David Hecker/Getty Images News

Excelerate Energy (NYSE:EE) has one of the world’s largest fleets of floating storage and regasifaction units (FSRUs). They take LNG off trans-ocean vessels and convert the LNG back into normal natural gas to go into a country’s pipeline infrastructure.

Until recently much of Europe’s natural gas was pumped in its natural state via pipelines directly from producing sources in Russia to customers in Germany and elsewhere, with Germany being the biggest customer by far.

Russia’s invasion of Ukraine stopped that so now those customers are scrambling to get EE’s hulls – and those of other FSRU operators – working for them. They add to demand from existing big buyers of LNG throughout Asia. That make those hulls a hell of a good investment!

I will take us around the oceans and expand on the worldwide scene later but first will say more about EE.

Excelerate Energy

Excelerate Energy, Inc. is a US based LNG company located in The Woodlands, Texas. It was founded in 2003 by George B. Kaiser but was only listed in April this year so – although its FSRUs are in great demand by customers – EE’s name remains below the surface for most investors.

Its main focus has been providing flexible LNG solutions to emerging markets around the world. EE operates a fleet of ten purpose built FSRUs with another on order. They have completed more than 2,300 ship-to-ship transfers of LNG for over 40 LNG operators and delivered more than 6,500 billion cubic feet (BCF) of natural gas through its 13 LNG terminals. That is more than any other company in the industry.

EE’s business spans the globe, with regional offices in eight countries and operations in the United States, Brazil, Argentina, Israel, United Arab Emirates, Pakistan and Bangladesh. It also leases an LNG terminal in Bahia, Brazil from Petroleo Brasileiro S.A. (Petrobras) (PBR).

European sanctions on Russian gas following Russia’s attack on Ukraine has added Germany and other European countries to that list.

Financial results are good showing healthy growth in both the top and bottom lines…

Second Quarter 2022 Financial Results

|

For the three months ended |

|||||||||||

|

June 30, |

March 31, |

June 30, |

|||||||||

|

(in millions) |

2022 |

2022 |

2021 |

||||||||

|

Revenues |

$ |

622.9 |

$ |

591.7 |

$ |

192.8 |

|||||

|

Operating Income |

$ |

39.3 |

$ |

39.1 |

$ |

27.8 |

|||||

|

Net Income/(Loss) |

$ |

(4.0 |

) |

$ |

12.8 |

$ |

3.6 |

||||

|

Adjusted Net Income (1) |

$ |

20.4 |

$ |

15.6 |

$ |

6.6 |

|||||

|

Adjusted EBITDA (1) |

$ |

66.1 |

$ |

62.3 |

$ |

58.4 |

|||||

|

Adjusted EBITDAR (1) |

$ |

75.2 |

$ |

71.4 |

$ |

65.5 |

|||||

The net loss reported for the quarter included a one-time charge of $21.8 million related to the early extinguishment of the Excellence lease as part of the IPO-related FSRU acquisition that was closed concurrently with the Company’s initial public offering in April 2022. The charge represents the difference between the amount paid for the Excellence compared to the lease liability at the time of the acquisition. Excluding the $21.8 million one-time charge and IPO-related restructuring expenses, Excelerate’s adjusted net income was $20.4 million.

Cash status is sound

As of June 30, 2022, Excelerate had $386 million in cash and cash equivalents. On April 18, 2022, the Company entered into a $350 million senior secured revolving credit facility. As of June 30, 2022, the Company had letters of credit issued of $40 million and no outstanding borrowings under its senior secured revolving credit facility.

Dividend

EE has just started paying a dividend. That is a very unexciting one of 0.42% but is a reflection of management’s confidence in the future and their looking after of shareholders’ interests. As a sign of where future dividend could go, FLEX LNG (FLNG) – a LNG carrier – now pays a dividend of over 10%.

Price agnostic

Natural gas prices are among the most volatile of all commodities but that volatility does not adversely affect EE’s results. They make this statement about that: “We are able to leverage the global demand for LNG, we’re price agnostic, we have predictable revenues from long-term contracts and our growth business has compelling upside.”

Growth

Part of that growth will come from the new demand in Europe. This SA article tells of Finland’s Hamina LNG Terminal Launch that will use EE’s Exemplar FSRU.

A five year contract was signed last month with Germany company Energie to deploy an FSRU at the port of Wilhelmshaven.

This month EE announced that it has signed a binding Shipbuilding Contract (SBC) with Hyundai Heavy Industries Co., Ltd. (HHI) for a new FSRU to be delivered in June 2026. The FSRU will have a storage capacity of 170,000 m3 and a maximum regasification capacity of one billion standard cubic feet per day (1,000 MMscf/d).

The state-of-the-art FSRU will be equipped with HHI’s proprietary LNG regasification system, dual fuel engines, selective catalytic reduction system, best-in-class boil-off gas management, and other innovative technologies which will drive improved performance and efficiency while lowering emissions.

Those who would like to know more about EE including its finances can find in on EE’s website.

Spare vessels are few

Out of a global fleet of about 50 FSRUs, Karl Fredrik Staubo, chief executive of Golar LNG, a Bermuda-based FSRU owner, estimates only five ships are available and three could be released from contracts this year. EE owns 10 FSRUs equalling 20% of that global fleet plus that new one on order.

That brings us onto the…

…Worldwide Scene

Supply countries

Australia is the world’s biggest exporter of LNG, exporting 81.2 million tonnes in 2021, according to government figures. Its biggest export markets are China, Japan, South Korea, India and Taiwan. Distance makes shipping LNG to Europe too costly but it can increase supplies to Asia countries to need to replace shipments diverted to Europe

Qatar is one of the world’s largest producers of natural gas. Last year its state owned producer placed an order valued at $20bn for new LNG carriers with South Korea’s big three shipyards: Hyundai Heavy Industries, Samsung Heavy Industries and Daewoo Shipbuilding & Marine Engineering. Qatar Petroleum said it had reserved production capacity with the companies through to 2027 as part of its plans to build more than 100 new carriers. Saad Al-Kaabi, the Gulf state’s energy minister and chief executive of Qatar Petroleum said: “With the conclusion of these milestone agreements, we have everything in place to commence the largest LNG shipbuilding programme in history.”

Those LNG carriers will need import terminals to deliver the LNG to and EE is well placed to supply the FSRU’s to handle some of that.

The US is another major producer of LNG and recently agreed to supply Europe with 50bn cubic metre of LNG per year by 2030 to help displace Russian gas. Europe has few onshore terminals to receive that so FSRUs will be needed.

Also the U.S. Ex-Im Bank has approved a plan that would support financing for U.S. energy ventures, including LNG. The programme would provide support across the entire lifecycle of a project, from capital investment to financing directed at securing demand.

Significant amounts of new LNG supply from any source are not expected to reach the market until midway through this decade while demand is growing in many parts now.

Demand Regions

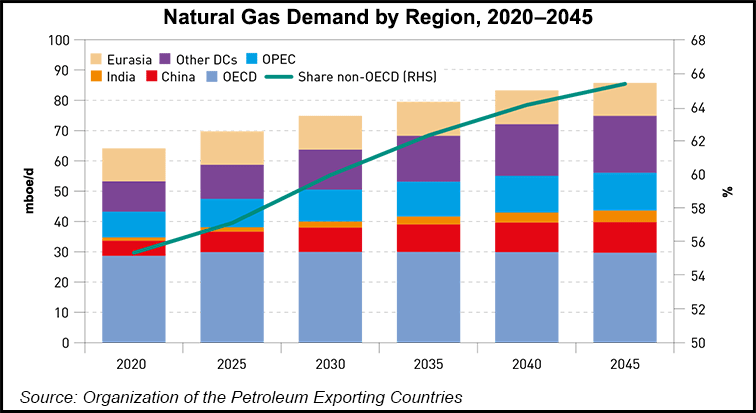

Demand growth is considerable as this chart shows…

OPEC

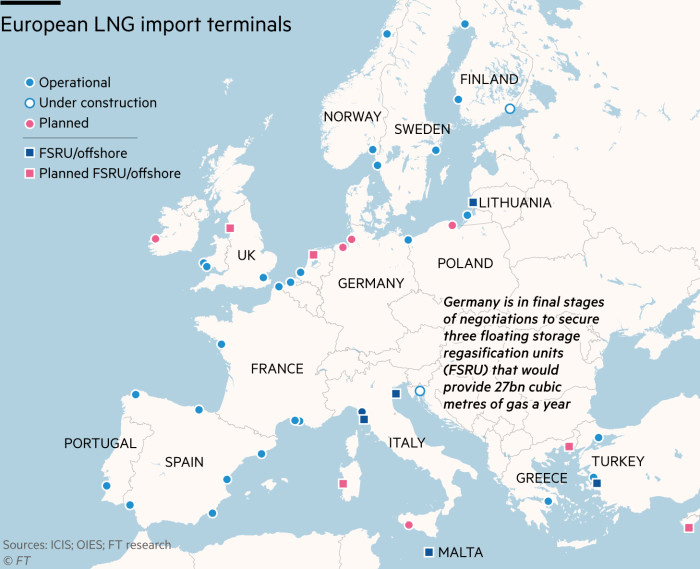

Europe currently gets around 30% of its gas from Russia. Europe is battling to get FRSUs! The German economic giant has no LNG import terminal and has been getting 55% of its via pipeline from Russia and has vowed to end that entirely by 2024. This weforum article tells more about that. Europe bought 74% of US LNG in the first 4 months of 2022, more than double last year’s share. That is continuing.

Europe has the infrastructure to regasify 170 bcm of LNG but most spare capacity is on the Iberian Peninsula, which does not have sufficient pipelines to move supplies further north.

Germany has no LNG import terminals and has selected locations on the North Sea and Baltic Sea for three FSRUs with an estimated capacity of 27 bcm.

This map shows the situation around Europe…

Financial Times

Developing countries. The huge demand from Europe for LNG to replace Russian pipeline exports is leaving developing countries starved of gas but their need is still growing.

Japan, South Korea, Taiwan and Thailand have constant LNG import demand increases. Together with Europe their demand is expected to increase by 46.6 million tonnes this year according to ICIS Analytics. Japan’s Economic and Trade Minister announced the government is considering using public funds to finance new US LNG export plants. The announcement follows Japan’s increasingly hawkish tone on replacing Russian energy imports

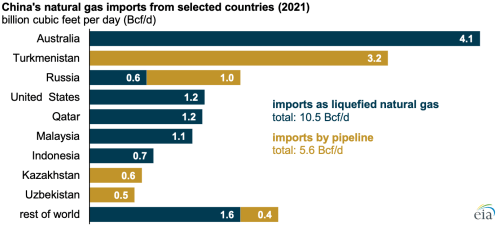

China surpassed Japan to become the world’s largest LNG importer in 2021.

The largest six suppliers-Australia, United States, Qatar, Malaysia, Indonesia, and Russia-provided 8.9 Bcf/d, or 85%, of China’s total LNG imports.

US IEA

Russia has tried to pivot to China to replace Europe but the existing pipeline capacity limits flows. Also we only hear of China’s economic slowdown due to the housing crisis and Covid Zero policies there but liquefied natural gas infrastructure work is booming in China, from expansions to new facilities, as the country prioritises transition away from coal. Beijing plans to build 34 coastal receiving terminals by 2035 more than doubling the country’s current capacity. China gets things built much faster than countries in the west that talk about doing something for longer than China takes to get that something built. Even so they will need FSRUs during the construction period.

That brings us on to…

Onshore LNG Import Terminal Construction Obstacles

In many countries, such as Germany, it can take several years of fighting bureaucratic red tape before anything gets started then up to 5 years to build. This gti.energy paper tells more about that in detail.

Building an onshore regasification plant can cost $10bn compared with the roughly $500mn new-build cost for an FSRU.

Many poor countries have a growing need for LNG but cannot even contemplate building an onshore terminal due to those huge costs.

FRSUs have other advantages apart from cost. They are quick to set up and can later be repurposed for use as LNG tankers or for other types of commodities including hydrogen being carried as ammonia.

Also they present less of a threat of becoming stranded assets. FSRUs should have an economic life of roughly a decade compared to onshore LNG terminals which can have lives lasting decades. The latter is important too because within the next decade we shall see hydrogen replacing gas for many things meaning those terminals will be redundant long before the end of their usable lives.

From the foregoing it is obvious that EE has many opportunities but are there also…

Threats to EE

The most obvious one is a supply glut of FSRUs chasing a diminishing demand for LNG situation. Given the above forecast for LNG in many parts of the world and the time to get new builds into service I think it is safe to say it will not be until around 2027 before we see signs of that.

Political. In my opinion, it is Putin’s politics that have added to the need for LNG and to world threats. Provided confrontation between China and the US does not lead to war, and Russia does not go nuclear, demand for natural gas on all continents will continue to increase with much of that supplied in LNG form.

Tug of wars between politicians who want growth and central bankers who want to stop the world will be ended by macro events beyond both sides control. Basket case Britain’s inflation last month hit the headlines at 10.1% YOY but Month on Month it was 0.2%. 12 months of that or less will not make the real costs for underpaid people go away but it hopefully will make those overpaid central bankers “work” redundant.

Together with the above and a couple of other things I conclude that…

EE Is A Hull Of A Good Investment Opportunity

Or more precisely ten hulls plus one being built combine to make it that hell of a good opportunity.

Word play aside Institutional Investors think so too. They own 65.74% of the shares if the 29.92% owned by the founder’s George Kaiser Family Foundation is included among those.

Insider Buying. George Kaiser appears to be no longer part of the top team but they were big buyers at around the IPO time in April. The CEO, Steven M. Kobos, bought the huge amount of $6.37 million. Other bought hefty amounts too. The price today is about the same as then – around $24 – and I doubt they bought in for altruistic or PR reasons.

That leaves the question or guesstion of where the price will go.

CNBC says this:

CNBC

First Call expects 0.30 EPS for next quarter.

The current Price Target for EE is $31.29.

The Financial Times has this for the next 12 months : High $36.00. Med $30.00 Low $29.00

SA does not have a Quant rating on it yet.

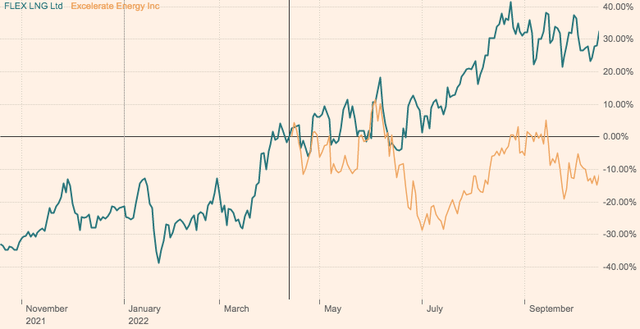

Since I used FLNG’s dividend payout above as a potential guide to the future I will use their relative stock market performance chart to show the possibilities.

That vast difference makes no sense to me and I shall pick the FT’s high price of $36 in 12 months as my target given the opportunities. That takes us up 50% from today. If anything near that happens then, in short, those EE hulls make EE a hell of a good investment opportunity!

Be the first to comment