fotoVoyager/iStock Unreleased via Getty Images

The iShares MSCI South Korea Capped ETF (NYSEARCA:EWY) is an exchange-traded fund designed to provide investors with exposure to South Korean equities. South Korea is generally considered to be a developed, advanced and sophisticated economy, although its equity market is less developed than other major equity markets such as the United States.

Nevertheless, EWY is reasonably popular, with assets under management of $2.94 billion as of August 26, 2022. The fund is useful for getting indirect exposure to both emerging markets and Asia-Pacific more broadly, but via a developed economy. Per data as of 2020, from OEC, South Korea’s major export destinations are China (24.7%), the United States (14.1%), Vietnam (9.04%), Hong Kong (5.82%), and Japan (4.72%).

EWY also has idiosyncratic features to consider. One principal concern is the currency, which I will cover first, given the strong correlation between EWY and the strength of the South Korean won.

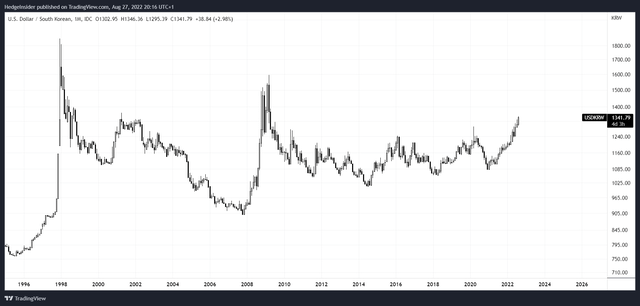

While EWY shares are denominated in U.S. dollars, the underlying holdings are denominated locally in South Korean won. Therefore, an appreciating won is supportive for EWY, while a declining won usually produces EWY share price weakness. I usually look at a few key factors to determine FX risk, which are: (1) a currency’s fair value based on Purchasing Power Parity; (2) a currency’s associated “yield” or interest rates; (3) a currency’s national current account and/or “terms of trade”; and possibly other unique features, including a country’s current positioning in its prevailing business cycle.

To recap: at the moment, The Economist‘s crude but useful PPP model, which adjusts for GDP per capita, indicates that the South Korean won is 24.9% undervalued relative to the U.S. dollar as of July 2022. This provides us with a natural tailwind potentially, and essentially suggests that products and services in South Korea are cheap in USD terms (i.e., the won is cheap). Meanwhile, the South Korean two-year yield of 3.55%, while the U.S. two-year yield is 3.38%. So, while the spread is not wide, there is a positive or neutral spread. That is not a tailwind (for carry trades, etc.), but it means that there is unlikely to be any negative drag on the won from a funding perspective.

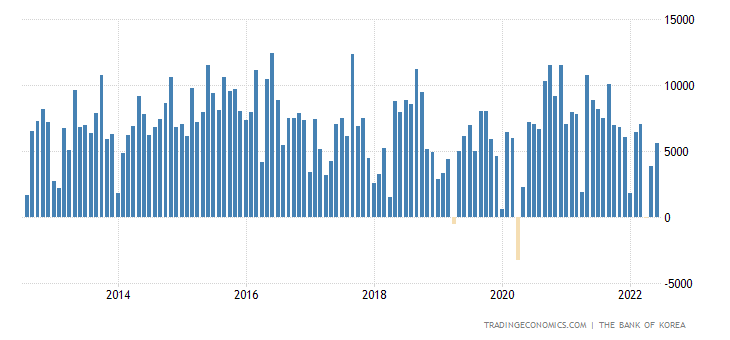

South Korea’s current account is positive. It has been consistently positive in fact, for many years.

Trading Economics

This is a natural indicator of an undervalued currency; a current account surplus would suggest that a stronger currency would be required to bring the currency back into balance. This is constructive for the won.

In summary, I would be comfortable having a South Korean won exposure. USD/KRW has been appreciating for months, and this has lately been supported by risk-off activity (capital flows into the U.S. dollar) and probably recessionary concerns (South Korea tends to do well during global economic upswings via exports).

For reference, right now I would imagine it would take appreciation of at least 5% and at most 10% to get back into a “fair value” range for USD/KRW, speaking conservatively. More upside than 10% would also be possible (taking the exchange rate back to its 2010 to 2022 long-term trading range).

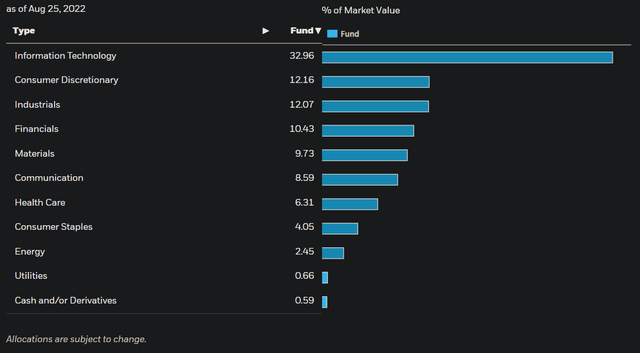

Besides the currency, EWY is exposed largely to the technology sector, with technology representing 33% of the portfolio as of recent. That is followed by Consumer Discretionary, at 12%, and then Industrials, at another 12%. All considered, EWY might represent a kind of “pro-cyclical beta” on the broader, global economy. Tech and Consumer Discretionary are generally considered to be economically sensitive, so you can expect under-performance as the world heads toward recession.

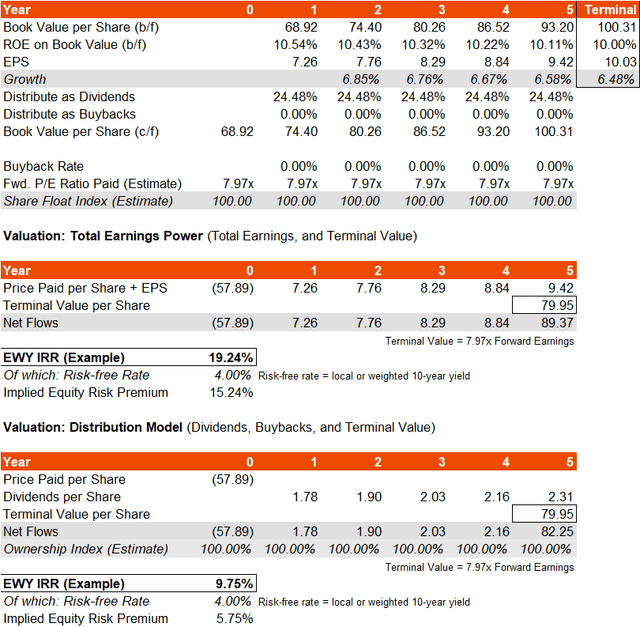

EWY’s portfolio reflects its chosen benchmark index, the MSCI Korea 25/50 Index. This is a capped index, which is important given the fund’s massive exposure to Samsung Electronics (OTCPK:SSNLF), at 20.69% as of August 25, 2022. The capping methodology ensures that no single stock breaches the 25% mark (rebalancings occur to avoid this). Using data from Morningstar, as of August 25, 2022, EWY’s forward price/earnings ratio is circa 7.97x across the portfolio, with a price/book ratio of 0.84x and a trailing dividend yield of 3.20%. The implied forward return on equity is therefore about 10.5% (quite modest as compared to other regions), and a dividend distribution rate of circa 25%.

Assuming a stable return on equity of about 10% and a stable rate of dividend distributions, with no buybacks, a fairly hefty equity risk premium is implied, even if we used a safe risk-free rate of 4% (which is more than the current South Korean 10-year yield).

That places the nominal IRR in the region of 10-20%, which is clearly implicative of under-valuation for an advanced economy’s equity market. Of course, we could see a near-term recession that hits earnings hard; in this case, if we saw a drop of 10% in earnings the first year, then 0% growth, then a climb back to 5%, the IRR range would drop to between 4% and 13% by my calculations (over the next five or so years). The lower estimates are based on dividend distributions and terminal value only, rather than total earnings. I think the total earnings model makes more sense, as this is how one would value a single company; EWY, being an equity ETF, is simply a collection of single-name stocks.

Another way to look at it, would be to value current forward earnings by an appropriate “terminal multiple”. The current forward price/earnings multiple, cited earlier, is presented by Morningstar as being 7.97x. The inverse of this figure, the forward earnings yield, is 12.55%. If we assume a risk-free rate of about 4%, and an equity risk premium of 5% plus 1.23x beta (in accord with history), the balance comes to 2.4% of additional equity risk premium applied to forward earnings. In a way, this implies a negative earnings growth rate to perpetuity, which is surely unfair to apply to EWY’s portfolio. Really, it suggests that the market is under-valuing EWY’s portfolio for other reasons, perhaps its proximity to China (surrounding political risk).

It is also worth mentioning that the broader equity market (globally) has sold off in recent times, so equity risk premiums are probably more elevated than usual in any case. And Professor Damodaran also started the year with a suggestion for South Korea’s country risk premium (as of January 2022) of about 50 basis points, so that would explain some of the additional risk priced into South Korean equity valuations.

I think holding EWY over the longer term at present prices is safe, however I would not rule out some further negative variance given macroeconomic uncertainty (most importantly inflationary pressures), U.S. equity market valuations, and major central bank measures to contain inflation (that being, most importantly in my opinion, higher interest rates).

Given EWY’s economically sensitive sector exposures, it is not a safe haven market to be invested in during these sorts of times. But a bounce-back will already be overdue from a valuation perspective when it comes around, and the South Korean won (as discussed earlier) offers upside potential in the medium term. My only true reservation is that South Korean’s balanced return on equity of circa 10% is not impressive, and so long-term out-performance relative to other major equity markets such as the United States is simply not likely. EWY is a case of a cheap equity market that is unlikely to out-perform long term and is currently cyclically “out of favor”. I would nevertheless keep a bullish stance as while further downside would be unsurprising, I do think South Korean equities are inexpensive.

Be the first to comment