CHUNYIP WONG/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the iShares MSCI United Kingdom ETF (NYSEARCA:EWU) as an investment option at its current market price. The fund’s stated objective is “to track the investment results of an index composed of U.K. equities.” The fund offers exposure to large and mid-sized companies that are based in the United Kingdom.

This is a fund and a region on the globe that I keep a close focus on. I studied and lived in England for a short period and make certain to visit some parts of the U.K. on an annual basis. This helps keep me a bit more informed about the politics and economy there than most foreign countries I follow and invest in. Since the early stages of 2022, I elected to hold EWU for some British exposure for a few reasons. One, I was increasingly concerned about rising equity valuations domestically. Two, I saw the U.K.’s locale as a benefit compared to most of Europe, given its lack of proximity to the military conflict in Eastern Europe.

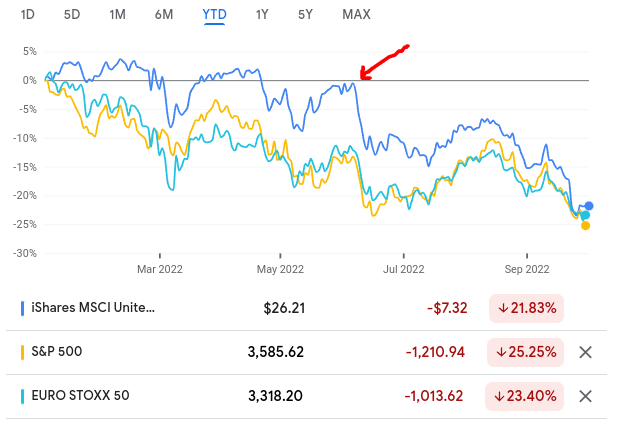

For a while, it looked like my thought process was reasonable, given EWU was beating the S&P 500 and a large-cap Euro index. However, the last two months turned the table on its head, with EWU still holding a slight edge over these other indices, but not by much:

YTD Performance (Google Finance)

Certainly, none of these returns look pretty. But while returns appear similar, EWU speaks to me as a bit of a contrarian play right now given the speed in which its decline has accelerated in the second half of the year. While the S&P 500 and Euro-based large caps have been on a consistent decline since January, EWU has only recently seen a free fall. This has piqued my interest, along with the fact that market sentiment in Britain is overwhelmingly negative. For me, this recipe is ripe for a contrarian buy, and I will explain the reasons behind my decision to add to my position in detail below.

Mostly Large Cap Make-up Preferable

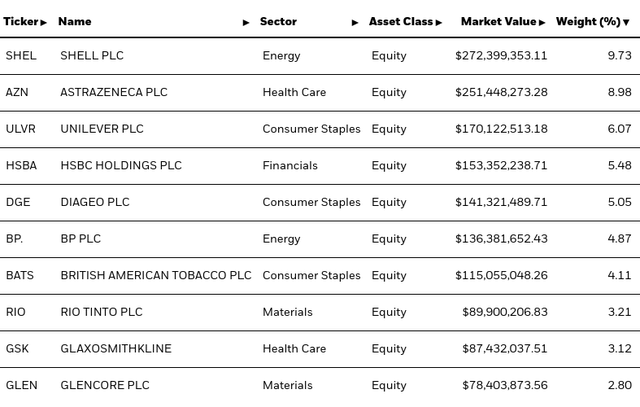

To start, I want to touch on EWU’s make-up, in terms of its holdings. This fund does offer exposure to both large and mid-sized companies in the UK. But the fact this is skewed towards the larger companies. For example, top holdings include some very recognizable names, among some of the largest companies in the globe from a range of sectors:

Given that this ETF is reasonably top-heavy, the inclusion of the larger names at the top of the list gives me some confidence.

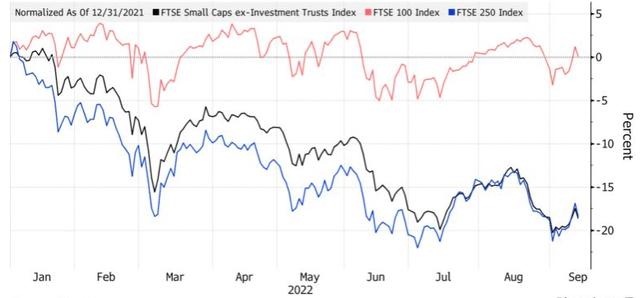

To understand why, there are multiple facets. One, in particular, is that large-cap British names tend to be more insulated away from the ongoings of the continent. They generate more of the revenues and profits internationally, limiting the exposure to currency and political fluctuations on the island. Until very recently, this was a major tailwind for the large-cap names. For example, through mid-September, large-cap British stocks were dominating their small- and mid-cap peers this calendar year:

Relative YTD Performance (British indices) (Bloomberg)

There are a number of reasons for this. Two key points, in particular, are that the exporter-heavy FTSE 100 index (large cap) has benefited from a slump in the pound and buoyant commodities prices. As they make sales in international markets, the value of those sales can increase on a relative basis when those figures are converted back into British pounds. Mid-cap and small-cap companies that do less exporting are at a relative disadvantage in this climate. Another reason is the large-cap benchmark also has a slant toward value stocks – such as Consumer Staples, Health Care, and Energy. These are areas that have been performing well as worries about economic growth dominate headlines around the globe.

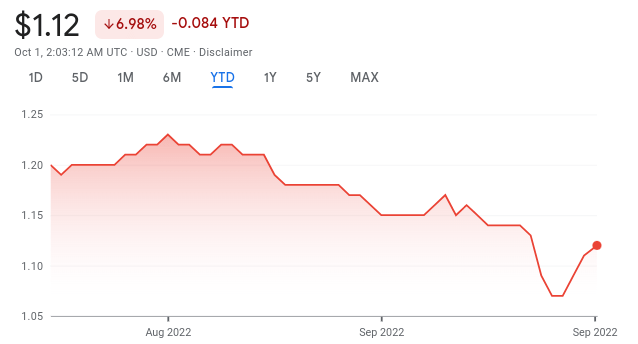

The takeaway for me is that both of these factors remain in place. The British pound has continued to decline since mid-September, resting near $1.11 after falling as low as $1.07 last week:

British Pound Value (in dollars) (Google Finance)

Similarly, tech-heavy indices (like the S&P 500) and other growth-oriented themes remain under pressure as recession fears mount. This will continue to benefit value stocks that trade at lower multiples already and are seen as less cyclical – and therefore less at risk of a slowdown.

The takeaway for me is that EWU is actually poised for relative outperformance as long as those conditions remain in place. And I expect they will. The recent sell-off is primarily due to macro-events within Britain, which I will get to in this review. Therefore, I see this as a buying opportunity due to some irrational selling, and not that the pressure makes EWU an “avoid”.

Inflation Remains High, Energy and Staples Less Exposed

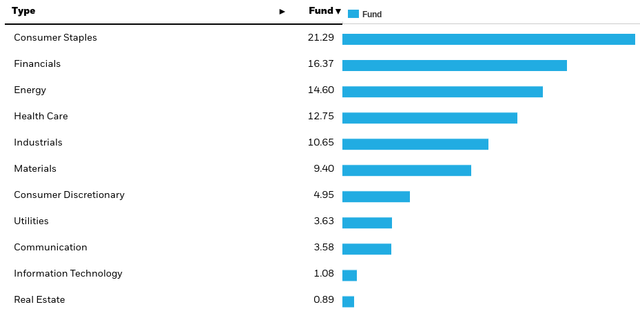

Digging into EWU’s holdings more broadly, readers should note that this fund relies heavily on performance primarily from six sectors, the top three of which make up roughly half overall exposure:

EWU’s Sector Weightings (iShares)

This is again critical to my assessment that I want this exposure. Compared to more cyclical areas like Tech, Consumer Discretionary, and Industrials, sectors such as Consumer Staples, Health Care, and Energy are more resilient to rate hikes. This is through a combination of offering goods and services consumers need (not just want) and also by being able to pass through inflationary impacts to end users.

In addition, the Financials sector, the second largest by weighting, has a tendency to benefit from a rising rate environment by passing on higher borrowing costs to customers. This improves net margins, assuming that rates do not rise so high that the economy slows and/or borrowers stop paying their obligations. In that instance, higher rates are negated by the corresponding losses that would hit the balance sheet.

This again is a factor why I like EWU. The reason being inflation remains high and that probably isn’t going to change in Q4. The good news is there is a sign inflation may be peaking, given that August’s CPI figure in the U.K. came in slightly lower than in July, as shown below:

UK Inflation Figures (Office for National Statistics (UK))

This suggests a reasonable backdrop for EWU. On the one hand, inflation remains high so the idea of playing this through a more defensive ETF makes sense. In addition, the fact that inflation may have peaked is positive for equities as a whole. It will limit the pain to consumers and could act as a factor for the Bank of England to be less aggressive with rate hikes.

To manage expectations, however, we must recognize that such a high level of inflation can pressure all equities. This means that regardless of the defensive nature of EWU if inflation remains sustained at this level, we may see further losses. Sectors like Financials and Energy may benefit from inflation, but even for those areas, too much can be a bad thing. Readers need to factor this into their risk analysis on whether or not this fund is right for them. If inflation remains at these levels or spikes higher, outperformance on EWU could mean less of a loss, but a loss, nonetheless.

Let’s Examine Some Of The Headwinds

I mentioned I think the inflationary environment and the declining pound offer some relative advantages to EWU. But we also need to put this in perspective. These factors have been in place for a while and EWU has not exactly been a shining star. There is relative advantage to EWU over some of Britain’s mid- and small-cap peers, but that in no way guarantees a positive return. Similarly, there is a lot of negative sentiment in the market right now, for the U.K. and other developed nations. This can mean a contrarian play is opening up, which is the case I am trying to make. But, again, this is just a prediction. It can also mean a lot more pain is on the way.

This is not meant to be double-speak or to claim I will be right regardless of what scenario occurs. My followers know I am not an endless cheerleader for any stock or fund, even the ones I own. I propose a balanced viewpoint of EWU, and everything else I cover. Do I stand by my prediction EWU is going to perform well in the next few quarters? Yes. But I am suggesting there are not any flaws or count-points to this thesis? Of course not.

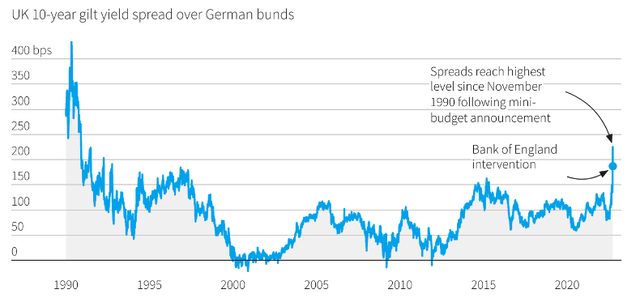

One such headwind is that institutional investors are rapidly losing confidence in the British investment landscape. This is a key reason why a contrarian play is available – major investors are suggesting more pain is yet to come. This reality has been amplified in the past few weeks, as the Tory-led government has announced a massive stimulus program with new spending and the postponement of tax increases that were set to go into effect next year (referred to as the “Growth Plan”). The end result has been that borrowing costs have skyrocketed, with 10-year gilts (British version of U.S. treasuries) shooting up to trade at a premium to its German counterparts:

UK 10-Year Spread (versus German bunds) (UK Government)

This has exemplified the challenge facing Britain right now. On the one hand, the country is facing soaring energy costs and high inflation. This has prompted the Bank of England to start an interest rate hike cycle. Yet, on the other hand, the current majority government has begun a campaign of economic stimulus, designed to jump-start growth. Seem contradictory? Well, it is, and is similar to some of the same challenges we faced here on the other side of the Atlantic earlier this year.

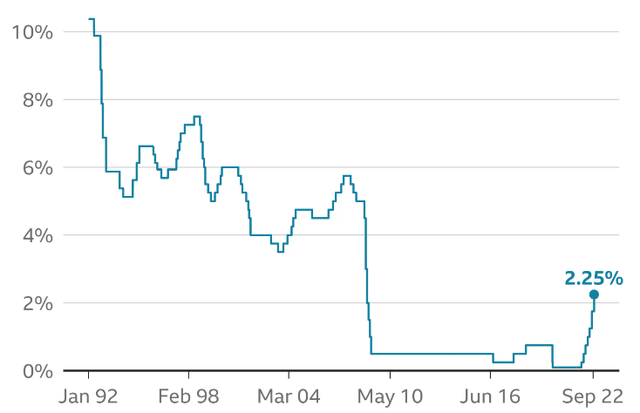

Why is this a problem? For one, it gives investors a mixed message – which partly explains the weakness in the British pound. The pound’s depreciation is occurring alongside sharply higher bond yields. That is typically a signal that markets are worried about policy credibility because this is not a scenario that should be occurring in sync. Further, the government is going to be placing a difficult strain on the country’s finances as more borrowing is coinciding with higher rates. With the Bank of England sending rates markedly higher this calendar year, more government revenue is going to have to go to servicing this debt. That is a tough spot to be in:

Britain’s Benchmark Rate (Bank of England)

The bottom line is this is a challenging investment climate. The good news is the market has recognized this and sent equity prices tumbling already. That presents some opportunity. But that opportunity could be limited if rates keep rising, fiscal prudence is thrown out the window, and institutional investors remain on the sidelines. These are important risks to consider.

Consumer Is Getting Help With Respect To Energy

One positive that has come out of the new Prime Minister Liz Truss’ initiatives is that consumers are going to get some energy-cost relief. This is critical for the consumer picture and should help free up discretionary spending on the island that will help corporate revenues and the investment outlook.

What I am referring to is the “Energy Price Guarantee”, announced on September 8th. Key points include:

- Limits on the price suppliers can charge customers for units of gas

- Temporarily removing “green levies” (around £150) from household bills

- Lift the moratorium on UK shale gas production

- A new Energy Supply Taskforce to negotiate with domestic and international suppliers to agree long-term contracts that reduce the price they charge for energy and increase the security of its supply

Source: UK Government

I view this as particularly timely. For one, it should give consumers some relief and ease anxiety going into the winter months. Two, it comes at a time when the British pound has lost a lot of value – which is going to increase imported energy costs. With consumers and companies getting support from the British government, the impact of that increase should be mitigated. Given EWU’s 26% exposure to both the Consumer Staples and Consumer Discretionary sectors, I view this as a win for the fund.

Government Showing A Willingness To Help

On a more macro-level, I also like EWU due to the British government’s willingness to step up to calm markets. While this hasn’t really “worked” in the short term, it signals to me that more action could be on the way. Simply, the government and central bank have the ability and desire to take action, and that could stave off the worst of an impending recession if done properly.

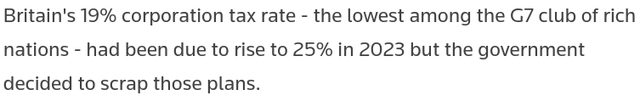

Two examples come immediately to mind. One, the Bank of England is now suspending the planned start of its gilt selling (again, similar to treasury bond selling by the Fed) that was set to begin next week. As reported by CNBC, the central bank is going to begin temporarily buying long-dated bonds, rather than sell them. This was done in an effort to calm the market and support lowering borrowing costs that have surged since the stimulus announcement rattled markets. Two, part of the stimulus means Britain is going to remain a competitive tax jurisdiction compared to its Western European counterparts:

Whether or not these proposals will work remain to be seen. But my takeaway is the government is taking bold action – justifiably so. This gives me confidence more help will be on the way if necessary, making the climate here more investable than many market participants seem to suggest.

Bottom-line

I think EWU is set up for a nice contrarian play here. Sentiment on the U.K. has soured and equities have sold off to a level that I see a lot of value. Risks definitely remain, as with all contrarian ideas. Most of these stem from the challenging consumer, business, and political climate within Britain.

But one must remember that investing in EWU is more than just investing in Britain. Yes, these are British companies in terms of where they are headquartered. But businesses in Britain that generate revenue around the globe will earn more when that money is converted back into pounds given the sharp decline in the value of that currency. And EWU is comprised almost wholly of large and mid-cap British companies that do generate a substantial portion of their revenue outside the island. The FTSE 100 (large caps) has a very strong international focus, with over 75% of revenue coming from overseas, according to a recent report by Forbes, while the FTSE 250 (mid-caps) generates roughly 50% of revenue earned overseas. This means these companies could very well benefit from strong economic performance globally, especially as the pound weakens.

As a result, I see the sell-off in EWU as an opportunistic contrarian play and will be adding to my position in the coming weeks. I suggest readers and my followers to give the idea some consideration at this time.

Be the first to comment