Muhammet Camdereli

The iShares MSCI United Kingdom ETF (NYSEARCA:EWU) doesn’t really reflect the economy of Britain. Maybe that’s for the best, since the British economy is exposed to a fair deal more uncertainty than maybe we’d like. What it is exposed to is quite good sectors working on a global stage, that should either benefit or be able to weather a recession. With yields being strong and multiples being quite low, it looks like quite a solid ETF.

EWU Breakdown

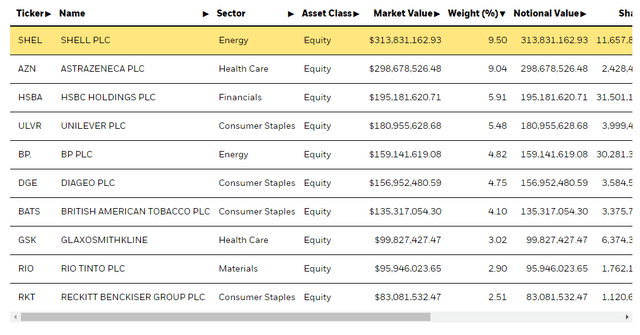

Let’s have a look at the EWU holdings.

The first thing we notice is that these aren’t businesses that are that focused on Britain. All of these are companies that operate on a very broad geographic scale. In fact, British consumption is unlikely to matter at all for many of them. There is some exposure in the financial companies, where some of the banks are more local Lloyds Banking Group (LYG), and here the potential tax cuts coming from the new Liz Truss government might matter more, but still the exposures tend to be very international.

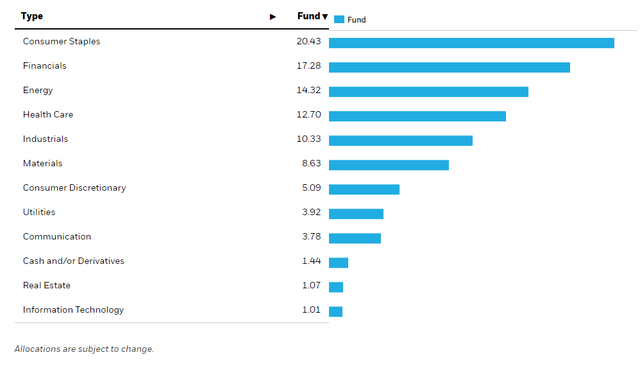

Sector Breakdown (iShares.com)

Sectoral exposures are what matter most. From that perspective, the ETF is quite well positioned. Consumer staples are recession resistant and a solid area to be in the markets, although perhaps in cases a little too exposed to inflation. Financials are great too, as there is a growing spread between savings rates and lending rates. What we don’t like is the 6% exposure to HSBC (HSBC), which remains a very risky prospect. Nonetheless, there is energy next which is of course well positioned in our current environment where energy security is of strategic importance and prices are being determined by a geopolitical conflict. Below is healthcare, helmed by AstraZeneca (AZN), providing yet another resilient specialty medicine exposure to withstand economic pressures.

Conclusions

These resilient sectors are attractive as we continue to monitor the state of markets. We are still concerned about how the employment market will look in three months’ time. Admittedly, we are for now seeing a pretty remarkable performance in the jobs report, with rate hikes coming along with a slight rise in unemployment. What’s even better is that this unemployment is coming from people once again seeking employment who weren’t prior, not people becoming unemployed after losing jobs. This latent workforce could be important in bringing parts of the economy back to full productive capacity. However, without firings, we still have inflation that is too high and will propagate. More rate hikes will be required, and increased job seeking might make those required rate increases greater than before. At least we are seeing a peaking in inflation for now, but mainly because of energy prices falling. Core inflation persists.

Overall, a resilient exposure like EWU where multiples lie below 13x in PE and the yield is just above 4% seems a well-placed value bet where uncertainty still pervades. EWU seems like a reasonable pick in the current market.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment