bloodua/iStock via Getty Images

Introduction

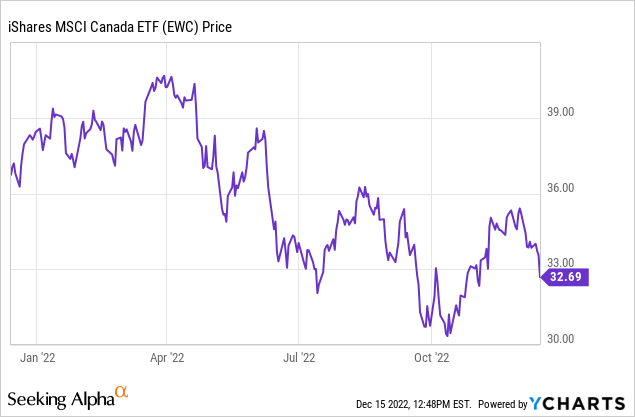

Many Americans may believe that because valuations have been sky-high for so long in the U.S. that the Canadian equity market may look more appealing. However, this is not the case as Canadian equities have their own idiosyncratic risks. Additionally, Canadian equities have exhibited weak relative historical performance with returns being heavily reliant on an overly aggressive financial sector. Lastly, Canada is currently exposed to political risk with the Liberal government proposing a 2% share buyback tax. Therefore, the iShares MSCI Canada ETF (NYSEARCA:EWC) is not a position that I think should be on Americans’ radar.

Empirical Analysis: Canadian Returns Have Been As Cold As Their Winter

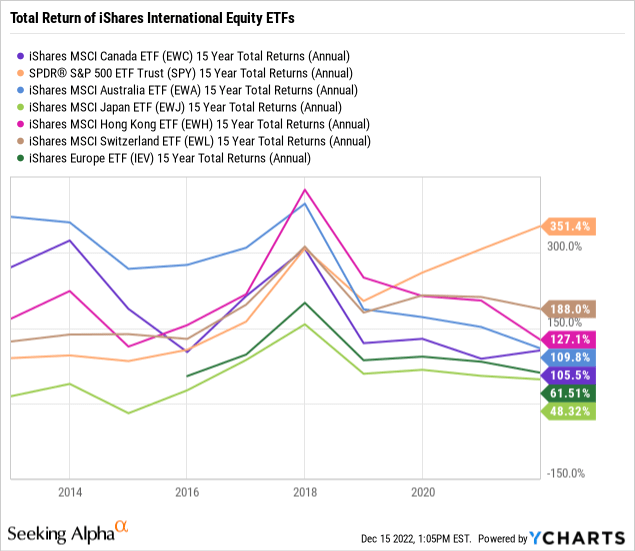

The first reason why I’m pessimistic about Canadian equities is because on a long-term basis their returns have been suboptimal at best. The following is a chart displaying the total returns of global equity ETFs compared to EWC.

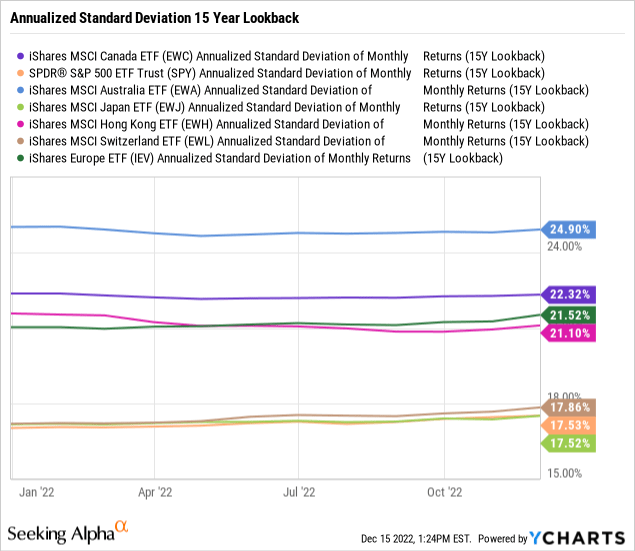

As you can see, over a 15-year basis, Canadian equities have performed on the lower end of their global counterparts. The picture gets worse when looking at the 15-year standard deviation of these funds, EWH has the second highest standard deviation out of all the funds listed above.

This provides further evidence that not only have Canadian equities been underperforming globally, but they’ve also exhibited higher amounts of volatility. Therefore, Canadian equities have been historically providing extremely low utility to investors.

Heavily Weighted Financial Sector Could Potentially Unravel

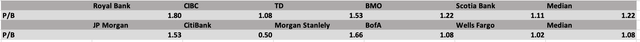

Canadian equities are heavily weighted in financials, which currently takes up around 36% in EWC’s fund. These financials are overvalued particularly when looking at the big 5 Canadian banks. The following display shows the big 5 bank’s price-to-book ratios compared with 5 large cap American banks.

Canadian banks are currently priced at an approximate 13% premium when looking at the comparable median price-to-book ratios of American banks. The picture looks uglier when bringing European banks into the equation.

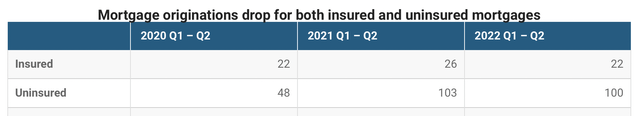

When factoring in the price-to-book ratios of European banks, Canadian banks are approximately 50% overvalued to their global peers. With the premium being put on Canadian banks, they carry significant mean reversion risks in the near term for two main reasons. The first reason is the bank’s aggressive loan book growth consisting of uninsured loans and refinancing. According to CMHC, uninsured mortgage originations have more than doubled from 2020-2022.

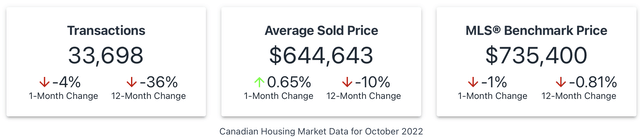

When you account for the fact that Canada’s housing market has been experiencing some weakness particularly outside of the Toronto and Vancouver area, the Canadian bank’s loan books run the risk of greater loan-to-value ratios and credit losses.

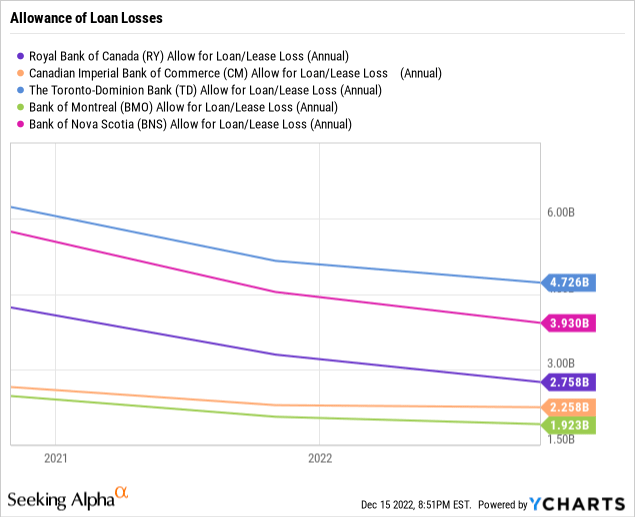

The second risk facing the banks is revision risks. One of the main drivers behind the Canadian financial sector’s performance the last two years has been a hot housing market which has allowed the big banks to reduce allowances for loan losses. This has been a critical driver for higher returns on equity and earnings growth. As you can see from the graph below, despite deteriorating economic conditions from inflation and interest rate hikes, the banks have been reluctant to reduce their loan loss provisions to shelter their profits.

With the Prime Rate sitting at 6.45%, combined with the negative economic implications of a hawkish BoC, we could see some negative 2023 revisions and guidance outlooks due to higher loan loss provisions needing to be in place. With that being said, exposure to broad Canadian equities looks less appealing.

Poor Economic Outlook

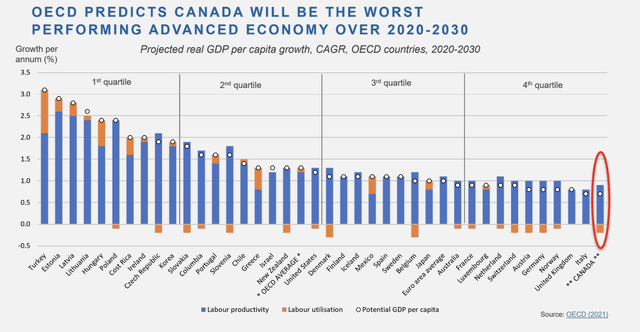

The next problem facing Canadian equity markets is that expected growth in the Canadian economy leaves a lot to be desired. The Economic co-operation and development currently predicts that Canada will be the worst performing economy on a GDP per capita basis.

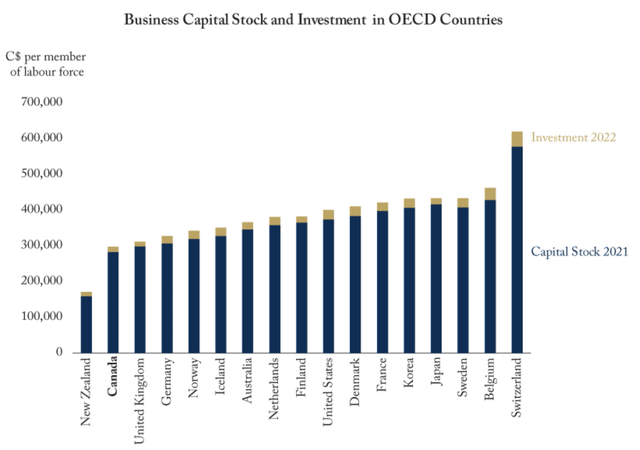

Business Council of British Colombia

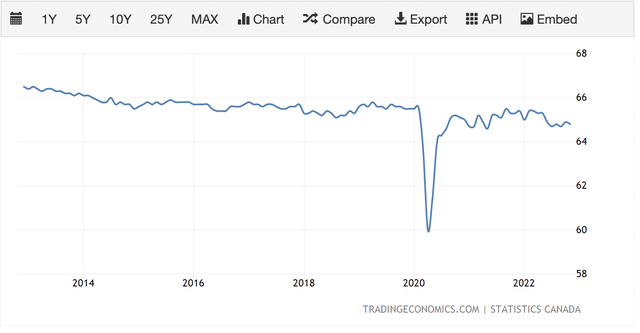

When further diving into the Canadian economy’s statistics it becomes more evident as to why there is such a gloomy outlook for Canada’s economic growth. Looking at Canada’s labour force participation rate, you’ll see that after discounting 2020 as an outlier year, Canada’s labour force participation rate has been declining steadily the last decade.

Comparably, the U.S. has had a declining labour force participation rate for decades, however American businesses also invest double the amount of capital per worker than Canadian businesses do.

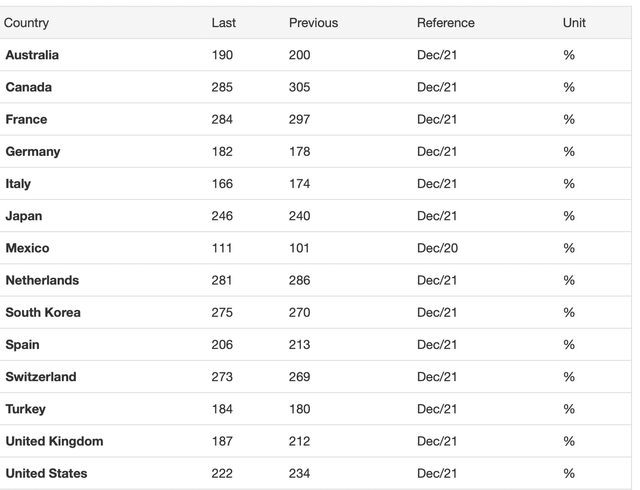

Simply put, the more capital stock per worker the more he/she is equipped to earn and maximize output for their economy. As seen in the chart above, Canada’s capital stock per worker leaves a lot to be desired. Therefore, unlike Canada, the U.S. and other advanced economies will likely offset all or most of the decline in productivity from a reduced labour force, with investments in business and technology. Finally, Canada’s debt burden is worrisome from an investor’s perspective. At 285%, Canada currently has the highest private debt-to-total GDP out of all the countries in the G20.

The high debt burden Canada’s private sector currently carries could sedate opportunities for further investment, dividends, and also pose risk to their hot real estate market. Therefore, because Canada’s debt burden and lack of investment into their work force, the Canadian economy leaves a lot of downside risk with limited upside.

Political Risks: Possible Buyback Tax

While the U.S. recently imposed a 1% share buyback tax in its Inflation reduction act, Canada plans to impose a 2% buyback tax on Canadian corporations. Although this would not be effective until 2024, the tax on buybacks not only reduces shareholder rewards, but mature companies will not be incentivized to buy back stock from investors who could utilize that cash to invest in younger businesses with better growth prospects. Therefore, the tax could have negative implications on their capital markets by encouraging less efficient investment. This presents an additional non-quantifiable risk factor for Canadian equity markets.

Risk to Thesis: Immigration Policy and Housing Market

The risk to my bear thesis is that Canada’s immigration plan to bring in 1.45 million immigrants over the years of 2023-2025 ends up being the boost of labour force needed to improve the country’s productivity and economic growth. Moreover, Canada has a very hot housing market and if in the long-term the housing boom continues it will bolster additional consumption and corporate profits. However, I must say that these two events are not mutually exclusive. If the housing market weakness persists and even falls further, the financial contagion could lead to a prolonged recession which may drive lower immigration than is desired by policy makers. Therefore, you might need one of these events to obtain the other, and rolling a pair of sixes is a lot less likely than merely rolling a six by itself.

Conclusion: Discount is Justified

The Canadian economy is questionable at best and I’d say that the Canadian equity market is even less appealing. The market’s heavyweights could see significant downside in 2023 with the financial sector recording higher loan loss provisions to undo their aggressive accounting policies. Secondly, Canada’s economic data from labour force to deficits indicate that the economy has little to nothing to look forward to in terms of growth. Lastly, the country has political risk with the Liberal party’s share buyback tax expected to provide negative implications for the economy. Therefore, I think Americans should avoid Canadian equities.

Be the first to comment