alengo/E+ via Getty Images

Investment Thesis

Evolv Technologies Holdings (NASDAQ:EVLV) is experiencing healthy demand in its core markets, and increasing awareness and adoption of its products. I expect this to continue for the next several years, benefiting revenue growth. However, EVLV is doing a hard pivot to a purely subscription-based model effective January 1, 2023, by only offering the subscription option to its customers. This should slow revenue growth in FY23. The good news is that the recurring subscription model is a high-quality business with good visibility and better margins, and this pivot should be a long-term positive. While I am optimistic about the company’s longer-term prospects, losses and cash burn is a big worry. The company posted ~$18.6 mn operating loss last quarter and burned through ~$24 mn. The company’s sales would have to ramp up significantly before we see it breaking even. I would prefer to be on the sidelines till its cash burn subsides and there is some visibility on when it can achieve a breakeven.

Business Basics

EVLV is a provider of AI-based weapons detection security screening systems. Unlike traditional walk-through metal detectors, EVLV’s touchless security screening solutions help detect dangerous weapons while significantly reducing nuisance alarms from harmless personal items. The company’s flagship product, the Evolv Express, is a touchless security screening system designed to detect firearms, improvised explosive devices, and tactical knives quickly in an unstructured flow of people. EVLV derives revenue from the sale of products, subscription arrangements, and professional services.

Revenue Outlook

In the third quarter of 2022, the company experienced strong demand in its core markets. The total revenue was up 96% Y/Y and 82% sequentially to $16.5 mn, driven by the rapid acceleration in subscriptions. The contracted subscriptions were up 198% Y/Y and 48% sequentially to 1692 at the end of the quarter. The company acquired 92 new customers in the quarter and installed 545 new subscriptions of Evolv Express.

The Remaining Performance Obligation (RPO) was up 220% Y/Y and 35% sequentially to $109 mn. RPO reflects the difference between contract value and revenue recognized to date for contracted units.

The company’s strong growth is reflective of the value its nuisance-free offering provides to its customers. In 2022, there have been approximately two mass shooting incidents every day in the U.S. including in weapons-free zones such as schools, hospitals, warehouses, and places of worship. Therefore, institutions are turning to Evolv products to reduce the threat of these mass casualty events at their venues with minimal nuisance to general people.

The company is experiencing a significant increase in its market exposure and awareness, pipeline build, transaction volume, and average deal sizes. This is evident from the company’s bookings, which increased 105% sequentially in the third quarter of 2022. EVLV had its first single transaction of greater than $5 mn and seven transactions of at least $1 mn in the quarter.

The company is also seeing an acceleration in its customer acquisitions and product deployments. There is also a good deal of momentum with the channel partners. The company is seeing broad activity across a dozen of its authorized channel partners, including Johnson Controls (JCI) and Motorola Solutions (MSI). Approximately 70% of EVLV’s sales activity comes from its channel partners.

The market for AI-based weapons detection is one of the largest and fastest-growing markets, and the company is well-positioned to take advantage of it. The Total Addressable Market (TAM) is $20 bn with ~700,000 entrances. The company has deployed ~1700 units till now, representing a penetration rate of ~0.25%. EVLV is expecting to deploy 2000 units by the end of 2022, 4000 units by 2023, and reach 10,000 units deployed in 2025.

Looking forward, the company should continue to see strong demand in education, healthcare, and professional sports. The education market is significantly large, with nearly 130,000 schools across the U.S., and approximately half of those schools are middle and high schools, where the threat of gun violence is the highest. Additionally, the company should also benefit from the Elementary and Secondary School Emergency Relief Fund (ESSER), which was initially held at the federal government level but was recently pushed to the states. This was a $175 bn budget designed to help schools in particular with COVID and safety, of which only $25 bn was used for COVID. Some of the schools are tapping the remaining $150 bn funding to improve the safety of their students and staff. Another major market for the company is healthcare. More than 6,000 hospitals in the U.S. are making investments to enhance patient and staff safety. Most workplace violence in the U.S. involves healthcare workers, and major healthcare unions have raised violence as a top issue. The company also has exposure in the professional sports market, and it is transforming the guest experience at stadiums and ballparks by eliminating long waits and entry lines.

EVLV plans to rapidly grow the pure subscription model that it is switching to effective January 1, 2023. This transition to a pure subscription model sets up the company for good revenue visibility looking forward, as the typical subscription term is for four years. The company plans to pivot hard to a pure subscription model by discontinuing the ability to buy its product outright and only allowing the purchase of its services through a subscription model. The management is expecting revenues of between $55 mn and $60 mn (or up 25% Y/Y at the midpoint). According to management, if the company would not have made the transition towards a subscription model in 2023, and the business model and purchases in 2023 have remained consistent as that of 2022, the revenue growth in 2023 would have been in the range of $85mn to $95 mn (or up ~100% Y/Y at midpoint).

In a subscription model, the company capitalizes its equipment as fixed assets, making its equipment move from inventory to fixed assets. The company is implementing a third-party financing program to support its subscription model. The third-party financing program is moving ahead well, and the company recently announced $75 mn in non-dilutive debt financing with Silicon Valley bank. The company will use the proceeds from this debt to fund hardware purchases from its contract manufacturer. One interesting thing is that despite having over $200 mn of cash on its balance sheet, the company has announced this additional debt financing. I believe the reason behind it might be the high cash burn that the company is witnessing. Last quarter, its cash burn was ~$24 mn. I believe this cash burn is likely to continue for a long time and with the way risk-taking appetite among investors has taken a hit recently, management might have thought it is prudent to take this additional financing.

I believe the company’s revenue growth should benefit from the healthy end market demand in Q4 FY22 and beyond. The revenue growth from the strong demand should be partially offset by the shift towards a pure subscription model in FY23. In the long term, this shift should benefit the company by generating predictable revenue growth.

Margin Outlook

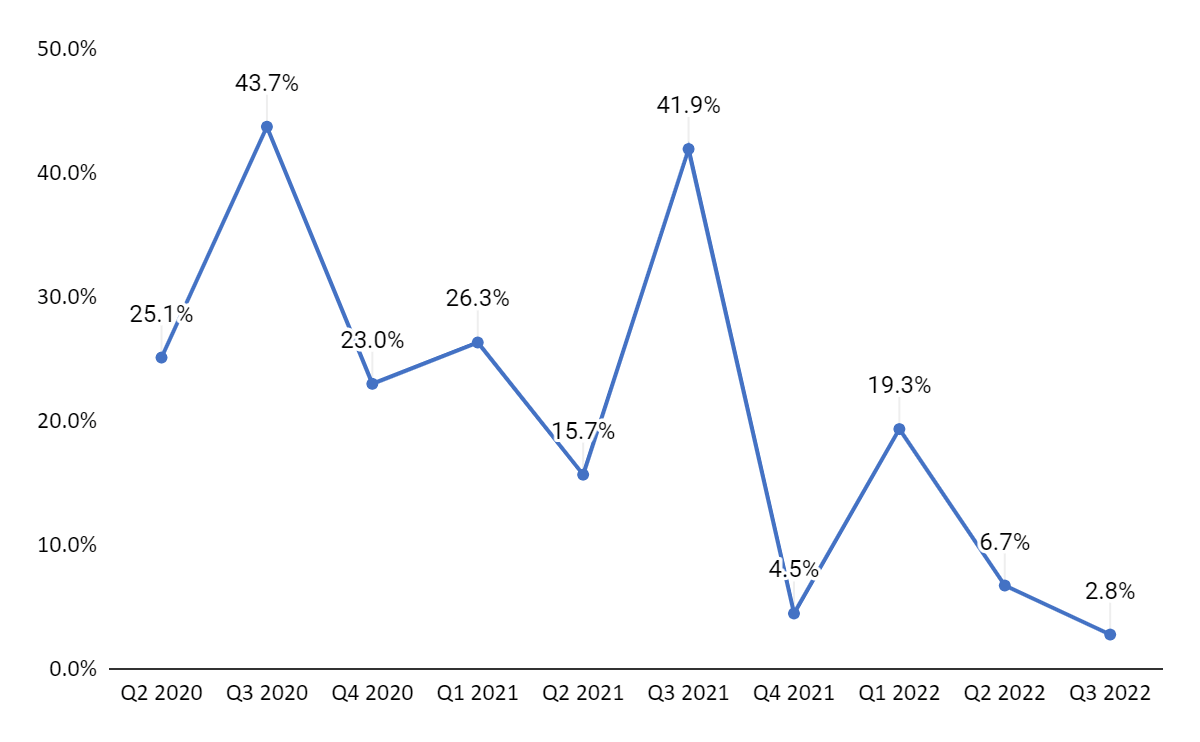

The adjusted gross margin in Q3 FY22 declined to 2.8% from 41.9% in Q3 FY21 due to higher product costs.

EVLV’s adjusted gross margin (Company data, GS Analytics Research)

Looking forward, I believe the company should be able to improve its gross margin given its transition towards the subscription model, which is a high-quality and high-margin business. Additionally, the company plans to implement a price hike in January 2023, due to inflationary cost pressures. EVLV also plans to moderate its expense growth and leverage the investments that it has made over the past two years. Management is expecting a gross margin of ~30% in FY23.

Financial Math and Takeaway

If we look at the gross margins of the company’s individual offerings, the subscription business has the highest margin.

|

For Q3 FY22, in USD thousands |

Product |

Subscription |

Service |

|

Revenue |

9839 |

5198 |

1493 |

|

Cost |

12960 |

2207 |

1138 |

|

Gross profit |

(3121) |

2991 |

355 |

|

Gross margin |

-31.7% |

57.5% |

23.77% |

For Q3 FY22, the subscription offering gross profit was ~$2.99 mn, while the product business had a gross loss of $3.1 mn and services had a modest $0.35 mn gross profit. If we compare this with the Q3 22 quarterly operating expense of $26.8 mn, it is clear that subscription revenue has to scale meaningfully before the company even nears a breakeven. Despite significant growth, the company will likely continue burning meaningful cash for the next several years to sustain its operations. This may lead to further dilution of the current shareholders. While I like the company’s offering and growth prospects, I would like its cash burn to moderate before becoming more positive on the stock. For now, I prefer to be on the sidelines and have a neutral rating on the stock.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment