PM Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Eaton Vance Corp is one of the oldest investment companies in the United States, with a history dating back to 1924. Eaton Vance provides investment products to individuals, institutions and financial professionals in the US, including wealth management, defined contribution and sub-advisory services. In March 2021, Morgan Stanley completed its acquisition of Eaton Vance.

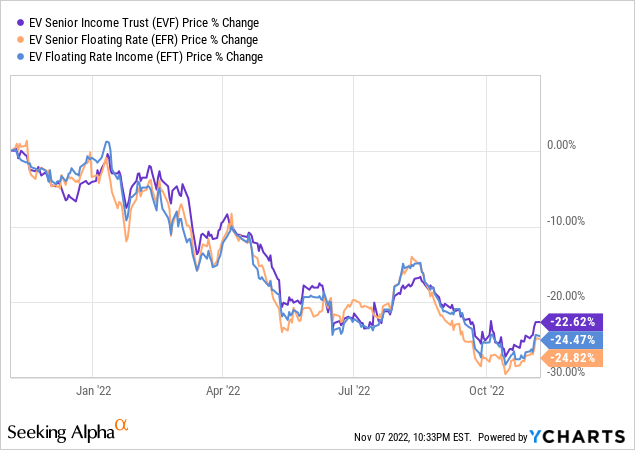

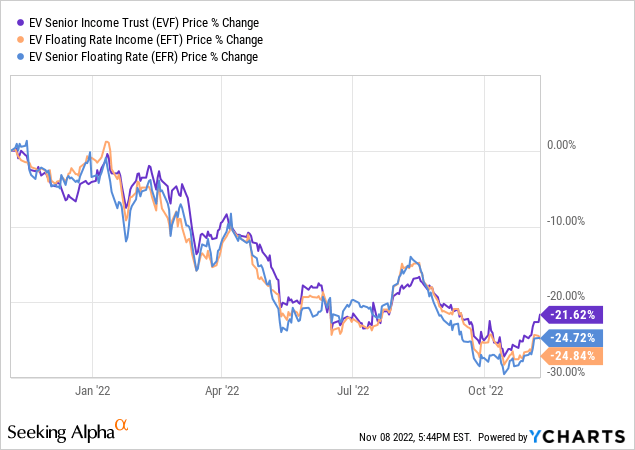

The Eaton Vance Senior Income Trust (NYSE:EVF) is one of five taxable CEFs offered by Eaton Vance. Despite its name, EVF invests similarly to both the Eaton Vance Senior Floating-Rate Trust (EFR) and the Eaton Vance Floating-Rate Income Trust (EFT), which I reviewed together here. Part of this review will compare the three portfolio structures. None have treated investor well since rate fears entered investors’ minds about a year ago.

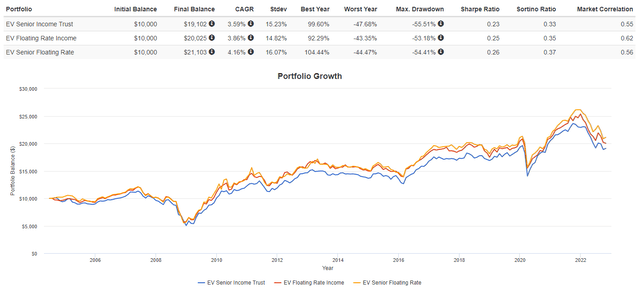

EVF is the best of the bad. The above doesn’t reflect payouts so the damage is about a 3rd less. With all three CEFs down and providing similar investment exposure, investors in any of the three EV funds, sitting on a loss, might consider swapping funds.

Eaton Vance Senior Income Trust review

Seeking Alpha describes this CEF as:

Eaton Vance Senior Income Trust is a closed-ended fixed income mutual fund that seeks a high level of current income consistent with preservation of capital. The Fund pursues its objective by investing at least 80% of its total assets in senior, floating rate loans by domestic or foreign borrowers, so long as foreign loans are U.S. dollar denominated and payments of interest and repayments are made in U.S. dollars. Investment in such floating rate instruments is expected to minimize changes in the underlying principal value of the Senior Loans resulting from changes in market interest rates. Benchmark: Morningstar LSTA US LL TR USD

Source: seekingalpha.com EVF

EVF has $104m in AUM and currently yields 7.76%. Fees are on the high side at 238bps, comprised of:

- Management fee: 103bps (scheduled to drop 18bps by 2026)

- Other expenses: 91bps

- Interest expense: 44bps (current leverage:37%)

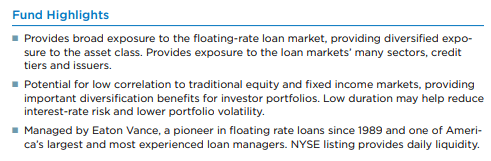

Eaton Vance states EVF’s investment objective is to provide a high level of current income, consistent with the preservation of capital. The fund’s Factsheet lists these as reasons investors should consider this CEF:

funds.eatonvance.com EVF

Index review

The Morningstar LSTA US Leveraged Loan Index is designed to deliver comprehensive, precise coverage of the US leveraged loan market. Underpinned by PitchBook and LCD data, the index brings transparency to the performance, activity, and key characteristics of the market.

Source: indexes.morningstar.com

Other important facts provided include:

- Loans from within the PitchBook and LCD database must meet the following criteria to be included in the index:

- Seniority: senior secured

- Minimum initial term: 1 year

- Currency: USD denominated

- Minimum initial spread: Base rate (LIBOR/SOFR) + 125 bps

- Minimum initial issue size: $50 million

- The index is market value-weighted with bid prices from LSTA/Refinitiv Mark-to-Market Pricing Service. The index is priced daily.

- The index is rebalanced weekly (every Friday). Loans are removed from the index when they are repaid, are no longer priced, or no longer meet the stated index eligibility criteria. Loans in default remain in the index unless they fail to meet the stated index eligibility criteria.

Holdings review

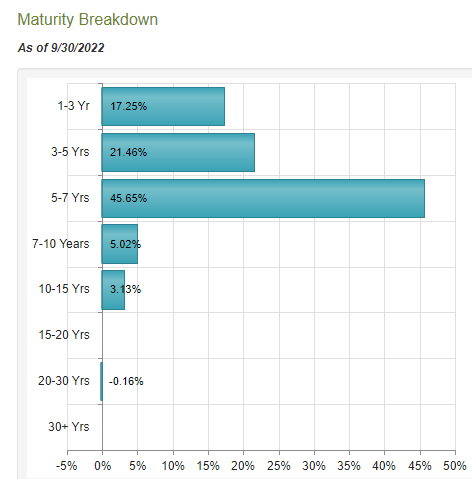

EVF hold about 400 securities with an average coupon of 7.46%. The WAM is 5.05 years, with this distribution:

CEFConnect.com

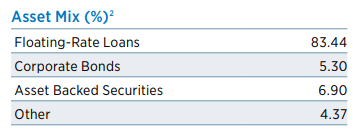

EVF has a very short duration of .33 years. Latest detailed sector allocation is from June:

funds.eatonvance.com

The average days to reset was 43. Morningstar rates the EVF portfolio as a “B”, where 63% of the weight is rated. About 23% is rated higher; 14% lower.

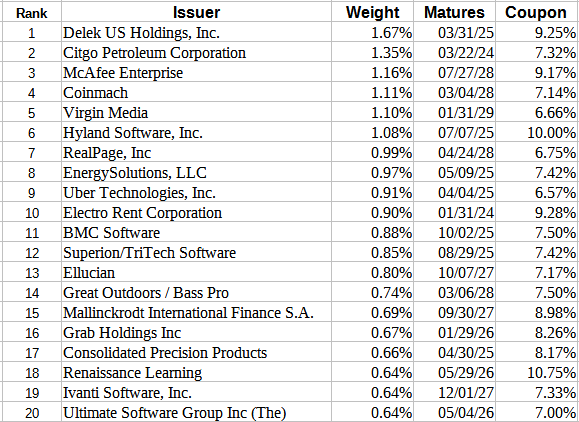

Top holdings as of the 3rd quarter were:

Morningstar.com; compiled by Author

The top 20 holdings represent 18.45% of the portfolio; with the first maturity amongst these not occurring until 2024.

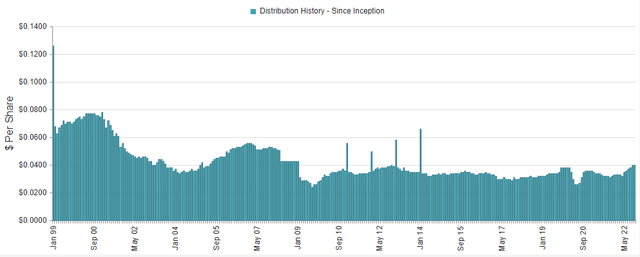

Distribution review

Since bottoming in April, 2022 has seen five of six months having a higher payout than the prior month: October was the exception. The November payout is up another penny. This Eaton Vance CEF does not use a Managed Distribution Plan.

Price and NAV review

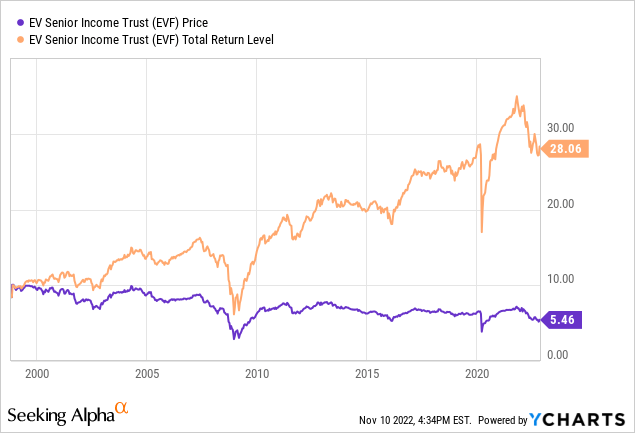

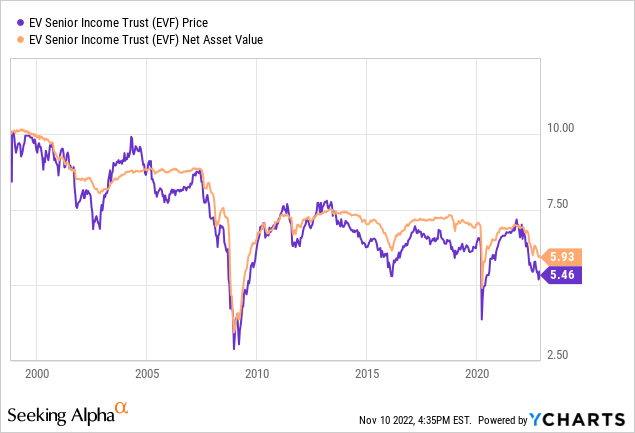

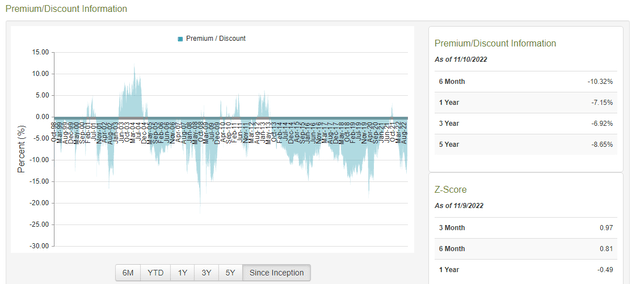

Unlike most of my recent CEF reviews, EVF has not spent a most of its life selling at a discount, as it is now: 9.1%. The next chart shows what the premium/discount relationship has been since inception.

The recent low was over 13%, so the gap has closed, but it is still at the deep end of its premium/discount trading range, which was actually in premium territory last fall (briefly), so there is that bonus return potential. A negative Z-score is a good indicator.

Comparing CEFs

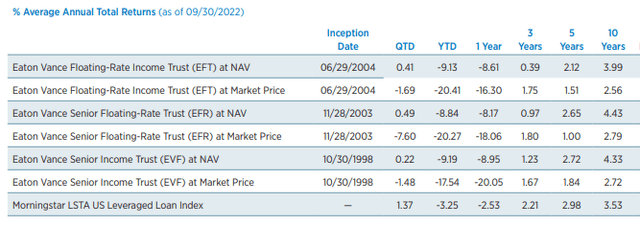

Based on 10-year price returns, EVF trails the best EV floating-rate fund by 7bps and is ahead of the 3rd one by 16bps.

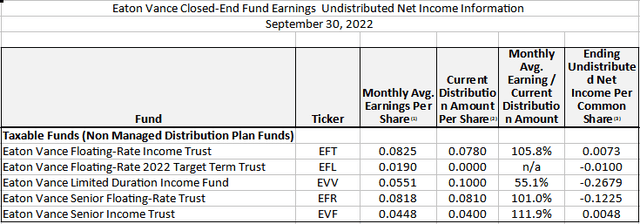

The next chart shows the UNII for all five taxable EV funds: EVF has the best numbers; ones that should allow for more increases in its payout level.

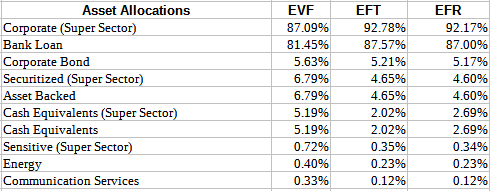

Based on sector allocations, there is not enough differences between the three to matter much.

CEFConnect.com; compiled by Author

Again, key factors are close across the funds, except for fees and floating-rate owned, both which favor EFR.

| Factor | EVF | EFT | EFR |

| Fees | 238bps | 217bps | 179bps |

| Premium/Discount | -9.1% | -10.0% | -8.95% |

| Yield | 9.1% | 8.2% | 8.6% |

| Weighted-average coupon | 7.46% | 7.24% | 7.24% |

| Weighted-average maturity | 5.1yrs | 4.8yrs | 4.4yrs |

| Floating-rate assets | 83.44% | 83.44% | 88.37% |

| Duration | .33yrs | .12yrs | .12yrs |

| Portfolio rating | B | B+ | B+ |

While those two factors favor EFR, two months ago it reduced its payout slightly, whereas the other two have seen increases. EFR does show the lowest coverage ratio, though that might not be the case with the recent adjustments. EVF provides the best yield.

Using data back to 2004 when EFT started, we see these results.

Above, we see EFR has the best values for most of the variables shown.

Portfolio strategy

The question facing investors at this point in time is, with known FOMC rate increases almost certain before 2023, do I buy now or wait? Over the past year, there are several times investors might have thought they were buying at the bottom, with October being the most recent. Even with extreme short durations and high WACs, most floating-rate funds are down in 2022. The last time the FOMC ended inflation of this magnitude, the FOMC rate topped out at 20%; 600bps above the peak inflation rate at that time.

My exposure to this asset class is the Fidelity Advisor Floating Rate High Income Fund (FFRHX). While it is doing much better than any of the Eaton Vance CEFs over the past year, long-term it is in the middle of the pack, but with a much smoother ride for investors.

Final thought

Eaton Vance offers three floating-rate CEFs, with none overwhelming the others. Based on that, investors in any of the three EV funds, sitting on a loss, might consider swapping funds. That said, and not being a tax expert, it is not clear to me if the IRS would consider swapping funds within the same family as an allowed trade for its “wash sale” rule.

Be the first to comment