Bill Oxford/iStock via Getty Images

Amid elevated market volatility, the majority of investors have shifted to favoring safety over risk. And though I’ve focused a lot of my buying over the past several months on beaten-down small and mid-cap growth stocks, I’m not so keen on banking on highly uncertain plays that have seen massive shifts in their fundamental fortunes.

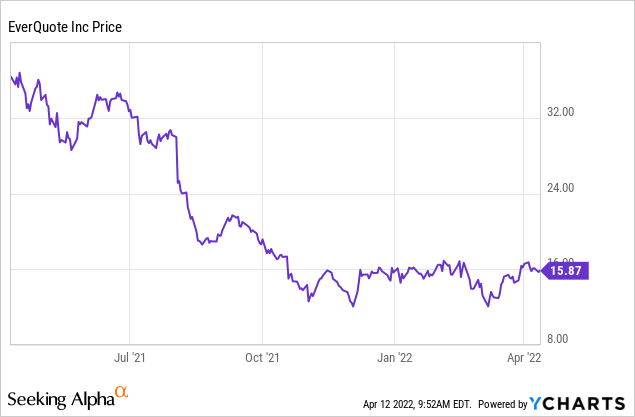

EverQuote (NASDAQ:EVER) falls into this bucket. This one-time market darling, which used to see tremendous revenue growth north of >50% y/y and inspired investors thanks to its diversification of revenue beyond its flagship auto insurance business, has seen losses pile up – both in its earnings and in its stock. Over the trailing twelve months, shares of EverQuote have been in a consistent downtrend and shed -55% of its value:

I remain neutral on this name. In my view, the only thing that EverQuote has going for it is value. Let’s level-set on that first: at current share prices near $16, EverQuote trades at a market cap of just $480 million. After we net off the relatively meager $34.9 million of cash on the company’s balance sheet, we arrive at an enterprise value of $445 million.

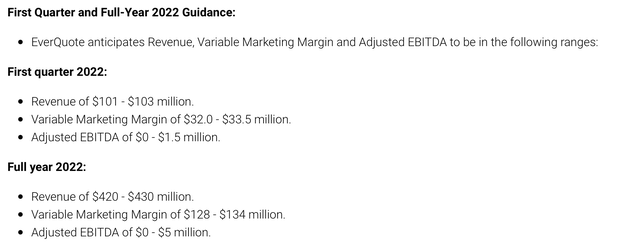

Meanwhile, for the upcoming fiscal year FY22, EverQuote has guided to $420-$430 million in revenue, essentially representing flat to +3% y/y growth, as well as roughly breakeven adjusted EBITDA of $0-$5 million:

EverQuote FY22 outlook (EverQuote Q4 earnings release)

This puts EverQuote’s valuation at just 1.0x EV/FY22 revenue – something that looks like quite a bargain.

In my view, however, EverQuote remains quite a bit of a value trap in light of the intensity of its fundamental risks. Here are the concerns that investors should be hyper-aware of:

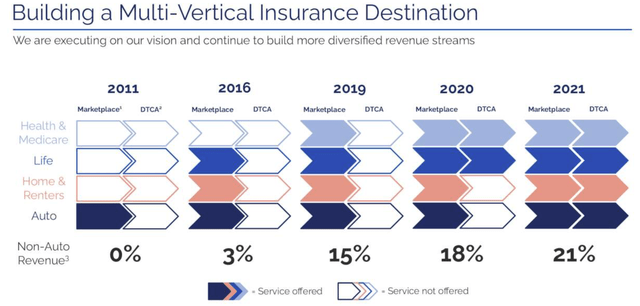

- Auto insurance industry weakness has persisted for several quarters and has no near-term end in sight. The quick backdrop behind this is that auto claim severity has spiked, while replacement costs/vehicle prices have also soared. This means that auto insurers are scrambling to bolster their profitability, which means in part paring down on more expensive marketing channels through middlemen like EverQuote. This dynamic has produced severe revenue declines in EverQuote’s business, and the company notes that it doesn’t expect recovery until auto insurers receive approval to raise premium rates (and even then, discretionary marketing spend on channels like EverQuote could remain permanently down). Though EverQuote has done a good job adding insurance categories like life, home and renters over the past several quarters (and healthcare, which at a small base grew revenue at a ~4x y/y pace in Q4), auto still represents ~80% of the company’s revenue.

EverQuote business diversification (EverQuote Q4 earnings deck)

- Very thin liquidity. As previously mentioned, EverQuote has only $35 million of cash on its most recent balance sheet. In FY21, operating cash flows were $7.2 million, and after accounting for a minor acquisition that the company made in the year, free cash flow burn was -$11.6 million. EverQuote’s liquidity profile may mean that further losses may force the company to raise additional capital. Needless to say, this isn’t optimal when A) the company’s share price is sitting underwater relative to prior highs, making equity financing overly dilutive, and B) interest rates are rising, which makes debt more expensive if EverQuote can manage to engage a lender in the first place.

The bottom line here: while I have argued and continue to argue that beaten-down growth stocks remain the best place to focus during the current correction, EverQuote’s declining fundamental health makes it too speculative a play for my comfort. Stay on the sidelines here as the company continues to struggle through the macro issues plaguing its business.

Q4 download

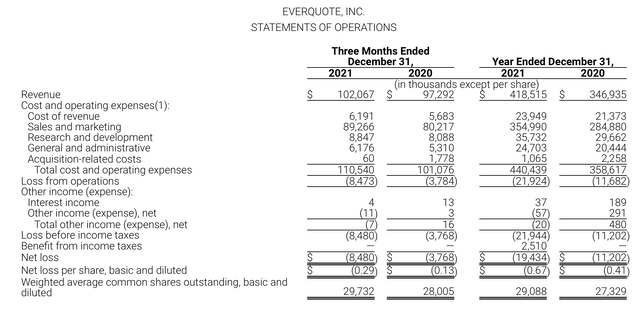

Let’s now go through EverQuote’s latest Q4 results in greater detail to highlight all the issues we have pinpointed. The Q4 earnings summary is shown below:

EverQuote Q4 results (EverQuote Q4 earnings release)

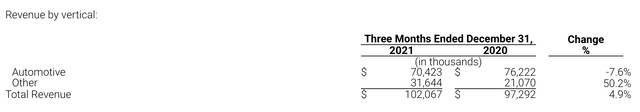

In Q4, EverQuote’s revenue grew at a meager 5% y/y pace to $102.1 million. The “good news” here is that EverQuote had already prepared investors and Wall Street in advance for the deterioration in its business, so EverQuote did come in above Wall Street’s expectations of $96.3 million (-1% y/y). The bad news is that EverQuote’s revenue growth decelerated fifteen points versus 20% y/y growth in Q3.

The big drag here, which should come as no surprise to any investor who has been following this story over the past two quarters, is the core auto business, which saw revenue decline by -8% y/y, offset by 50% y/y growth in the company’s non-auto businesses. In particular healthcare revenue, though small at $15.4 million in the quarter, grew 281% y/y.

EverQuote Q4 revenue by category (EverQuote Q4 earnings release)

Here’s some commentary from CEO Jayme Mendal’s prepared remarks on the Q4 earnings call that shed more light on the auto insurance issues the company is facing:

While we’ve seen modest recovery from Q4 lows, we remain 30% to 40% below August 2021 levels of carrier online revenue per quote request or RPQR. Each week carriers continue making large changes to campaigns, including pausing or reactivating entire states or segments, which is highly unusual during more stable times.

These changes result from ongoing profitability analysis being done by the carriers, as both rates and loss environments continue shifting dynamically. Given this uncertainty, our full year forecast is based on conservative assumptions about the recovery and auto carrier monetization which has two implications. First, it negatively affects revenue, particularly in the first three quarters of the year as our 2022 forecast anticipates minimal growth in the audio business as expected gains with local agents and in DTCA are offset by an extended period of lower year-over-year carrier demand. And second, it has a relatively larger negative impact on adjusted EBITDA.

Ultimately, the recovery in audio carrier monetization will be driven by the pace at which carriers receive approval to increase rates, enabling them to restore broader underwriting appetite and higher willingness to pay.”

It’s important to note that EverQuote is banking on two factors to happen in order to resuscitate the auto business. First, auto insurers must have their applications to raise premiums approved by regulators in 2022, and second, they must also reinvest that increased revenue on customer acquisition again through channels like EverQuote.

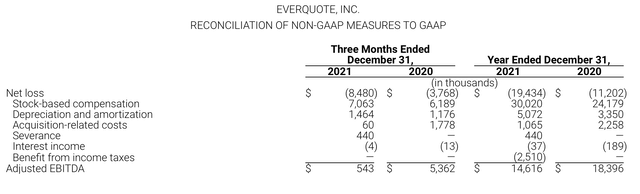

In the meantime, EverQuote’s profitability is flailing. Adjusted EBITDA in Q4 declined -90% y/y to $0.5 million in the quarter, while full-year adjusted EBITDA lost -21% y/y to $14.6 million, representing a 3.5% adjusted EBITDA margin for the full year – down 180bps from 5.3% in the year-ago quarter.

EverQuote Q4 adjusted EBITDA (EverQuote Q4 earnings release)

Recall as well that EverQuote isn’t guiding to any recovery in profitability in FY22, with $0-$5 million as the adjusted EBITDA outlook (representing further margin decay to basically breakeven). Again, with the very tight $35 million left on EverQuote’s balance sheet, the company may be forced to find a way to raise very expensive capital to stay afloat.

Key takeaways

Most investors have lost patience with EverQuote’s multi-quarter recovery story, and I’d recommend not falling into this value trap only to be disappointed with the pace of EverQuote’s supposed auto industry course-correction in 2022. Remain on the sidelines here: there are plenty of other tech stocks to invest in that have seen sharp stock price drops without major corresponding declines in fundamentals.

Be the first to comment