jetcityimage/iStock via Getty Images

Here’s advice which may sound a little counterintuitive: even if inflation is peaking, it’s a great time to buy I Bonds. The Federal Reserve has embarked on an aggressive campaign to suppress inflation. They may or may not succeed immediately, but the odds are good that they will eventually get their way within a year or two. What seems most likely is that the Fed’s campaign will produce a softer economy if not outright recession. If that takes place, the weak economy may give an assist to the Fed’s work and help bring inflation down. Does that mean that you should stop buying I Bonds? Absolutely not. I Bonds have special characteristics which make them continue to be the best solution for short term yield and long term inflation protection. For the inflation-adjusted niche in your fixed income portfolio they continue to be much better than TIPS, which continue to trade at a negative real yield.

If you still haven’t heard about I Bonds (I have done my best to remedy that on this site) it’s because Registered Investment Advisors can’t make any money from them. They were introduced by the US Treasury in 1998 as a way to allow small investors to hedge against inflation risk. For the first few years individual investors could buy up to $30,000 per year with a large fixed rate, but the Treasury soon realized that this was way too generous and cut both the maximum amount and the fixed rates. The current rates are merely generous, $10,000 per year per Social Security Number and a fixed rate set for the moment at zero. That’s still the best deal there is.

I Bonds don’t trade. They remain in your account at TreasuryDirect until you cash them in or they reach maturity. Once upon a time you could buy them at certain banks and receive paper recording your holdings but now the only way to buy them is to go to TreasuryDirect. The site will walk you through what you need to do. There’s also a telephone number you can call for assistance. If you are new to the process I suggest starting to do this by around April 20 as TreasuryDirect is understaffed and they get really busy around the end of the month. If you are like me you are busy too and things always come up. Don’t let buying in April get away from you for those reasons.

There are two kinds of investors who may find I Bonds an ideal solution: (1) those who are seeking an outstanding parking place for cash and (2) those who are seeking a longer term instrument for longer term protection against inflation. The former will wish to compare the I Bond yield to instruments such as CDs or short term bond funds. The latter will wish to compare I Bonds to TIPS or other riskier inflation hedges such as commodities. Here’s how I Bonds can work for each type of investor:

- Buying in April assures you minimally a 14-month return of around 7% and likely higher. You will get the present 6 month rate of 3.56% (7.12% annualized) and the amount to be announced May 1 after the final monthly addition, for March, is added on April 12. That’s tomorrow as I write. The first five months already sum to 3.43% (6.86% annualized) so that the May 1 number is virtually certain to bring the annual amount to 7% and likely higher. That’s what you will get until May 1, 2023. If the numbers at that point are going to be less favorable, you may want to exit by July 1, 2023. You can cash in your I Bonds after one year, but there’s a three-month penalty so you will want to hold for fourteen months in all. April counts for a month. Buying at the end of a month, in this case April, earns you the entire month’s interest. You will have received at least 6% annualized for 14 months (12/14 of 7%). That’s an amount you can’t beat with any safe fixed income instrument. If it is clear in April 23 that the inflation number for the next six months is going to be fairly large you might prefer to continue parking your money in I Bonds.

- My own approach has been as a long term investor. I Bonds are an inflation hedge you can hold for up to 30 years if you wish or sell at no sacrifice any time after five years. I was lucky to start buying in 2000 when we were having a little inflation bump. I have the bonds I bought in 2000 and a couple of years after with real yields 3.6% and 3% as well as all the I Bonds I bought annually in subsequent years. They will get quite a little pop from the current inflation bump. Current buyers will have that too. Inflation may persist longer than many think or flare up again before my I Bonds start rolling off at 30 year maturity. Who knows? But what if inflation rates crash and sink into outright deflation. This has happened for a few months in the past decade. No worries on this either. When a six month period has outright deflation, your accumulated I Bond interest simply freezes. The fixed rate never goes negative (unlike TIPS), and when inflation resumes, as it always does, accumulated interest begins to compound again from its highest previous point. What this means is that I Bonds effectively provide protection against deflation as well as inflation. My personal expectation is that within a few years the normalized inflation rate will slide back to 2-3% with the possibility of a few brief swings in the deflationary direction. I Bonds are perfect for this scenario.

That’s the short version. You should buy I Bonds to the limit in April regardless of what you believe inflation may do. The section that follows gives the longer version. If you have not read my previous I Bond articles you will want to read it for an amplified version with details. If you have read it in earlier articles you could skip it but don’t neglect to read the subsequent sections which contain additional current data.

What Are I Bonds And How Do They Work?

Because each article on I Bonds attracts a number of new readers I feel an obligation with each successive article to restate a few basics about what I Bonds are and the slightly complicated way they work. Because I think I said it pretty well in two earlier articles I’m going to repeat a few paragraphs verbatim or nearly so. If this starts to feel tediously familiar feel free to skip and use it as a reference if at some point lower in the article you have a question. Bear in mind that many highly intelligent people have to hear about the workings of I Bonds a few times before they have a solid command of what I Bonds can accomplish and their many attractive features.

I Bonds are a form of US Treasury Savings Bond which is inflation-adjusted. Like ordinary EE Savings Bonds, I Bonds are backed by the United States Treasury. Savings bonds have been around since 1935. Under a temporary name change to War Bonds, US Savings Bonds helped fund World War II. I Bonds have been around since 1998.

I Bonds produce returns with two components. The first is a fixed rate which provides the “real” return – real meaning inflation-adjusted. For new purchases this rate resets semiannually on May 1 and November 1, or the next business day if the first day of the month happens to fall on a holiday. Once you purchase an I Bond the real rate in force at that time continues for 30 years until the bond matures or until the owner chooses to redeem it. The second component of I Bond return is the inflation rate as represented by the Urban Consumer Price Index (CPI-U). One can argue about the defects of the Urban CPI but it’s what is used for all important measures such as resets of Social Security payments. The inflation rate used for I Bonds is reset semiannually at the same time the fixed rate is reset, on May 1 and November 1, and the accrued value of your I Bond is updated so that the return compounds semiannually. I’ll repeat for the purpose of clarity that the fixed rate doesn’t change for bonds you already own. The inflation rate is updated every six months starting from the date of purchase. It is then updated every six months. If this seems complicated, TreasuryDirect was kind enough to provide this table:

| Issue month of your bond | New rates take effect |

|---|---|

| January | January 1 and July 1 |

| February | February 1 and August 1 |

| March | March 1 and September 1 |

| April | April 1 and October 1 |

| May | May 1 and November 1 |

| June | June 1 and December 1 |

| July | July 1 and January 1 |

| August | August 1 and February 1 |

| September | September 1 and March 1 |

| October | October 1 and April 1 |

| November | November 1 and May 1 |

| December | December 1 and June 1 |

You can currently buy up to $10,000 annually of electronic I Bonds in a TreasuryDirect account. That’s $10,000 per Social Security Number. You can buy the same amount for your spouse and each of your children. You can also request that up to $5000 of your Federal income tax refund be received in the form of a paper I Bond which will be mailed to you whenever the IRS gets around to sending refunds. If you want to do this you should over withhold for that amount.

Like all Treasury Bonds, I Bonds are not taxable by States and Municipalities. Another advantage of I Bonds is that you can choose to defer paying Federal taxes until maturity or redemption. This can be helpful if you or your heir (whom you designate with each purchase) expect to have lower taxable income at some point in the future. Under some circumstances I Bonds are tax free when used for educational purposes – read the fine print, though. All of the terms included in this paragraph are also true of EE Savings Bonds, by the way, which I discussed in an earlier article.

One of the most important but seldom noticed qualities of I Bonds is that they are not only an excellent inflation hedge, but a hedge against deflation as well. The reason is that the inflation component of the composite return never dips below zero. The fixed return earned for a six month period may dip for bonds with a positive fixed rate if inflation is negative for a full six months, but the current zero rate takes this off the board. With the current zero fixed rate, the combined value will never drop. In the event of a deflationary period the accrued value of the I Bond would simply freeze at its highest level. When inflation returns, as it always has, the total value of the account begins to compound again from the highest level it has reached.

I Bonds are probably the most flexible investment available. This is because their duration is any date you choose from one year to their maturity date of 30 years. You cannot redeem your I Bond during the first year, but after that you choose any moment you wish if for any reason you want to get out. You can use them as a place to park cash for the short to intermediate term or leave them in place and continue to have an assured long-term hedge against inflation. I have never redeemed an I Bond.

For the first five years the price paid for redeeming a bond is giving up one quarter (three months) of returns. After five years of owning an I Bond, the forfeiting of one quarter’s returns no longer applies. Beyond that there are no special rules or asterisks attached to cashing out until the final maturity at 30 years. There are, by the way, no commissions or other costs involved in buying or selling I Bonds. Paper bonds – now available only as part of your tax refund – can be bought at price intervals from $50 to $10,000 while electronic bonds may be bought in penny increments starting at $25. You could, for example, buy an I Bond with a face value $25.23.

Guesstimating Inflation And Gaming Purchases

Market savants are divided on how inflation will trend over the next few years. Cathie Wood for one thinks deflation is the natural tendency of our era, a point of view which may well be right notwithstanding the fact that she is hocking her book. Low inflation and low rates are of course friendly to her many high-priced fast-growing zero-current-profit investments with returns which must be discounted far into the future. On the other side of the argument many other high profile and highly qualified observers such as Mohamed El Erian, Larry Summers, Henry Kaufman, and Jeremy Siegel all of whom feel that the Fed is badly behind the curve and inflation is likely to be higher for longer than the Fed or anyone else thinks. It’s possible that both views will be proven right at different moments in the future.

Your guess may be as good as theirs. In any case your own estimate of future inflation will inevitably have an impact on whether you buy I Bonds for the short term or the long term. The very short term choice is already pretty clear and the very long term has the inherent uncertainty of distant events. Nobody can really be certain what will happen over time periods greater than six months because of the many variables. That being said, 5, 10, and 30-Year Treasuries and TIPS come with a forecast of sorts represented in this chart.

| Term | Treasury Yield | TIPS Yield | Inflation Assumption |

|---|---|---|---|

|

5 Year |

2.79 | -.58 | 3.37 |

|

10 Year |

2.74 | -.12 | 2.86 |

|

30 Year |

2.76 | .25 | 2.51 |

Bond investors express their views on future inflation with actual money in both Ordinary Treasuries and TIPS. As you can see in the above table the sum of their opinion is that inflation will recede fast enough to bring the five-year forward inflation rate to an average of 3.37% annually. That implies a fairly sharp decline in inflation from the present 7% rate. Over ten years the actions of Treasury investors predict a continuing but much more gradual decline. As for the 30- year rate, it’s a sort of baseline involving a best stab at the far less knowable long term future. All three periods project satisfactory returns for I Bonds. This is especially the case taking into account the fact that I Bonds held for 30 years provide an insurance policy against a policy mistake by the Fed or loss of reserve currency status for the U.S. dollar, two events which might lead to an unexpectedly high rate of inflation in the future. Even if ordinary Treasury rates rise quite a bit, I Bonds are likely to provide a competitive return as they have in recent years.

In a short term period like one year, I Bonds are pretty much a cinch to beat the daylights out of all other safe investments for real return. The first important break point to consider is the one-year return (actually, to take maximum advantage of current rates, 14 months if buying near the end of April). The next break point is the five-year return. Remember that after one year you may choose to bail out at any point with the sacrifice of three months of interest payments. If the inflation rate has dropped precipitously and you have a short term perspective you may wish to wait until you have held your I Bonds for 15 months (or as stated above closer to 14) and then cash in your I bond. After five years you may exit without sacrifice of any kind. There are, by the way, no commissions or expenses. Every dollar invested goes into the investment without friction.

The March CPI number announced on Wednesday April 12 will provide a definitive number for the variable (inflation) rate for the reset on May 1. The table below provides the numbers for five of the six months going into the May 1 reset and the second table describes the terms of the six-month rate still in force since last November 1, 2021. I have seen estimates of the March number which would produce a six-month rate around 0.60%, enough to lift the six month return starting May 1 to around 4% (8% annualized). I won’t speculate about this number personally although I think the probability of an upside surprise exceeds the probability of a downside surprise. It would be an enormous surprise if the month over month increase replacing the X in the table came in low enough to pull the one-year return below 7%. The March rate will come across the wire at 8:30 AM tomorrow, April 12. Unfortunately I will be in transit including appointments the greater part of the day. I will consult with the SA site as to the best way to provide an update.

| Oct2021 | Nov2021 | Dec2021 | Jan2022 |

Feb2022 |

Mar2022 | |

| Inflation Index | 276.859 | 277.948 | 278.802 | 281.148 | 283.716 | X |

| Monthly Pct Change | .83 | .49 | .31 | .84 | .91 |

Six Month Percentage Change (after 3 months): 3.43% (6.86% annualized)

| Apr2021 | May2021 | Jun2021 | Jul2021 |

Aug2021 |

Sep2021 | |

| Inflation Index | 267.054 | 269.195 | 271.696 | 273.003 | 273.567 | 274.310 |

| Monthly Pct Change | .82 | .80 | .93 | .48 | .21 | .27 |

Six Month Percentage Change: 3.56% (7.12% annualized)

(To get the 12-month yield of an I Bond purchased before May 1, wait for the additional number and simply add the present 6-month yield (3.56%) and the 6-month yield after adding the CPI report for March.)

You should in any case buy your 2022 annual allotment in April to capture the outgoing rate if you haven’t done so already. This is true whether you are making your initial I Bond purchase or followed the suggestion of my September and November 2021 articles and took advantage of the 3.56% (7.12% annualized) yield before the end of last year. It’s a new year and you can now double dip on that rate with your 2022 purchase, assuring that you enjoy 18 months of spectacular returns. You don’t have to wait for the new, possibly better, May 1 rate because you will get it anyway six months down the road starting on October 1, 2022. See the helpful chart in the previous section extracted from the TreasuryDirect web site.

It is highly unlikely, but not quite impossible, that the Treasury might increase the fixed rate for I Bonds by 0.1% or 0.2% on May 1. As desirable as a higher fixed rate would be over the long term, the chance of picking up an extra 0.1% or 0.2% doesn’t justify waiting. The odds strongly favor going ahead and buying now. The sooner you buy the sooner you will receive the full annual yield which may well prove to be the high point of the present burst of inflation. This is what the chart comparing ordinary Treasuries and TIPS implies.

What you should bear in mind is the long term power of receiving an outstanding yield on the front end. Your $10,000 investment stands to be worth something around $10,700 after a year and all future returns will compound from that base. If your view is short term, you can wait 14 months and see if inflation (the variable part of your return) has fallen far enough that you want to exit with a sacrifice of three months of income at that lower rate. If so, you can give yourself a pat on the back and then take your amazing one-year return and move on.

On the other hand you can decide that, with such a large head start, you might want to stick around until the second break point at five years when you don’t have to give up anything to exit. You could do a little arithmetic and see what the 5-year return would be like under various levels of inflation. My suggestion there is that the 10-year projection on the chart comparing Treasuries and TIPS suggests about 2.86% on average while the stated Fed goal is 2%. It’s possible that inflation might overshoot the average and go negative for a six month period or two, but remember that your highest total value will simply freeze and resume compounding when inflation returns. This is one of the reasons that I have always held my own I Bonds first purchased in 2000 with the intention of hanging on for 30 years. They now amount to a fairly large insurance policy against anything that could come along in the way of a major enduring inflation.

I Bonds Versus TIPS

TIPS are currently a mediocre investment with a hidden risk. There. I said it. I realize that many readers may own TIPS one way or another, perhaps on an advisor’s recommendation or because they are often part of model portfolios diversified between stocks and bonds. Some readers may have noticed the zero real yield on I Bonds and thought that was bad, but the truth is that it is absolutely wonderful compared to TIPS. Every TIPS from the shortest duration out 10 years has a negative – repeat, negative – real yield. After that the positive real yield is still very low and in my opinion does not outweigh the other advantages of I Bonds as the first inflation-protected $10 K of every portfolio. The table below gives the overall picture.

|

Term |

I Bond | TIPS | Difference |

|---|---|---|---|

|

5 Year |

0.00 | -.58% | -58 Basis Points |

|

10 Year |

0.00 | -.12% | -12 Basis Points |

|

30 Year |

0.00 | 25% | 25 Basis Points |

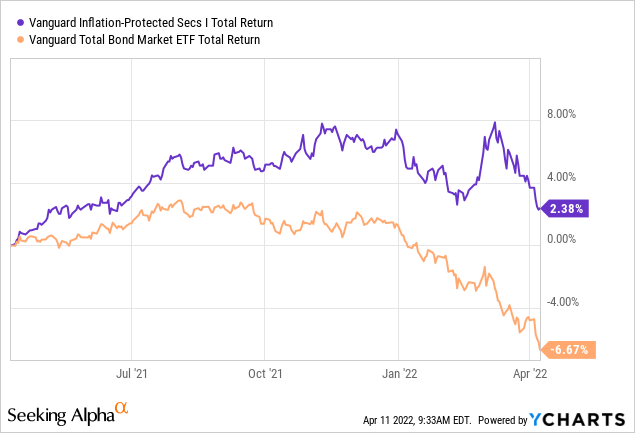

That’s only half the story of what’s wrong with TIPS. The other part of the story is that unlike I Bonds, TIPS trade every day the bond market is open. They are linked to other Treasuries of similar duration, and as a result when interest rates rise, TIPS fall in price along with other bonds. That’s exactly what has begun to happen over the past few months. The following chart provides an education in this phenomenon:

What you see in the above chart is that the TIPS price element falls along with the ordinary Treasury Bond ETF, just not quite as much. It’s a tug of war between two opposing forces, the downward tug as rising rates drag down all bond prices and the upward tug as the TIPS ETF is supported by monthly increases due to high and rising inflation. Even so, the TIPS chart produces only a 2.38% yield in a 7% inflation environment.

Now ask what happens if inflation begins to abate as the Fed raises rates three or more times in 2022. The bond element of the TIPS ETF will follow straight bonds and fall sharply while the monthly contribution of inflation will decline as the Fed’s rate increases produce their desired effect. At that point, the flat fixed return line of I Bonds will be a game saver and the inflation return, despite falling, will feel like a risk-free gift. Just to repeat, the short version of my advice on TIPS and I Bonds is to put your first $10K per Social Security Number into I Bonds and only then, if very very very worried about inflation take a calculated look at TIPS.

Safety, Flexibility, A Current 7%-Plus Yield, And A 30 Year Inflation Hedge

Just in case is one of the more underrated phrases in the language. Who’da thunk it is a phrase my mother used to apologize for being an English teacher. She used it for a set of unexpected events we would prefer to be able to accept with equanimity and a little humor. Bursts of very high inflation call to mind both expressions. Having some protection against high inflation should be a permanent “just in case” strategy. No one asset will totally solve the problem, but an I Bond portfolio will help. When the current inflation suddenly appeared, having some kind of hedge might have made the difference between who’d a thunk it and expressions I can’t write here.

In a famous 1977 Fortune article entitled “How Inflation Swindles The Average Investor” Buffett articulates with his usual eloquence how inflation is the one thing that quietly erodes value in every portfolio. It’s not just what it does to your personal dollars, but the ways it damages the performance of companies in which you may own shares. Buffett made the case in the 1970s that equity investments may not provide the defense against inflation that many investors expect. Over the decade leading up to the present burst inflation has actually been quite tame – an average of about 1.9% annually. That’s the lowest rate for any significant period since the 1930s (see this table). We should celebrate, right? Before becoming too cheerful, there’s this fact that you should think about: that tame 1.9% inflation rate still knocked about 21% off the purchasing power of a dollar over the past ten years.

Investors must ask themselves a basic question about investment portfolios: what are they designed to do? For many investors the portfolio is treated as though its goal is to build wealth. This is a valid goal but it may not be primary. The primary goal for many portfolios, whether recognized or not, is to serve as a store of value which will not lose ground in terms of purchasing power. Even at the current zero real rate of return, I Bonds achieve exactly that goal. The best part is that I Bonds do not trade or fluctuate in value and are an investment that does not require warnings or disclaimers. You don’t have to keep an eye on them.

Never lose site of your first goal: to preserve the purchasing power required to meet your future needs. It’s for this reason I Bonds can fill an important niche in your long term portfolio. They amount to an insurance policy you are being paid to own. My hope and expectation is that readers who decide to buy an I Bond for its one year 7%-plus yield will come to understand in the course of 12 months that I Bonds should occupy a niche in every long term portfolio. You can’t beat the combination of safety, flexibility, yield, and a 30-year hedge. I cherish my I Bonds acquired over 22 years and plan to hold them for the full 30. They go a long way toward avoiding that undesirable expression coulda, woulda, shoulda.

Conclusion

I Bonds continue to have spectacular yields which beat all safe fixed income investments with a likely 12-month forward return of 6% to 7% or more. You buy them at TreasuryDirect which is the same place where you buy all new Treasury issues. The site has detailed instructions and a number to call if you are unclear about anything. You have me for other details. I commit to reading all comments and doing my best to clarify and answer questions.

I Bonds are great for natural born nitpickers like myself. Many successful investors have a bit of nitpicker DNA and it’s a good idea to pull up as much of it as you can when offered a great deal just for paying close attention. Success in investing starts with doing the little things right, and I Bonds are one of those little things.

I strongly suggest that you first read the information on the TreasuryDirect site with patient attention and set April 25 as the get-it-done deadline for decision and action. That should give you enough time be assured your purchase will be processed in April. I will read comments and check SA messages to help readers who are having trouble with the TreasuryDirect site. The site admits to sometimes processing the following day and some commenters have said that it may be two or three days which could push your purchase into May. That’s a highly undesirable event. Remember: any I Bonds bought in April will receive interest for the full month. Don’t let it slip into May.

Be the first to comment