gremlin

Welcome to the November 2022 edition of Electric Vehicle (“EV”) company news.

November saw October 2022 global plugin electric car sales achieve the second-best month ever. As usual, it was another very busy month for EV news.

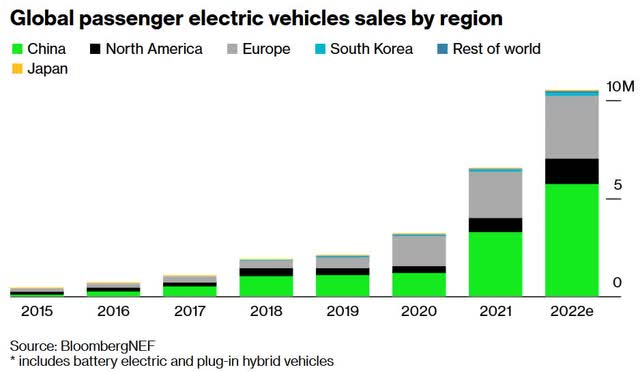

Global electric car sales as of end October 2022

Global plugin electric car sales finished October 2022 with 932,000 sales for the month (2nd best month ever), up 55% on October 2021, with market share of 16% for October 2022, and 13% YTD.

Note: ~72% (not updated recently) of electric car sales YTD are 100% battery electric vehicles (BEVs), the balance being hybrids.

China plugin electric car sales were 578,000 sales in October 2022 (second best month ever), up 75% on October 2021 sales. Electric car market share in China for October was 31%, and 29% YTD.

Europe plugin electric car sales were 211,000 in October 2022, up 14% YoY, reaching 23% market share and 21% YTD. Norway reached 86.4% share, Sweden 59.4%, Netherlands 34%, Germany 32%, France 23%, and UK 21.5% share in October 2022.

USA plugin electric car sales were reported by CleanTechnica stating: EVs reached 6.1% of US auto sales in Q3 2022.” That’s up from 5.1% in Q2 and 4.7% in Q1, 2022.

Note: The above sales include light commercial vehicles.

Note: An acknowledgement to Jose Pontes and the team at CleanTechnica Sales for their work compiling all the electric car sales quoted above and charts below.

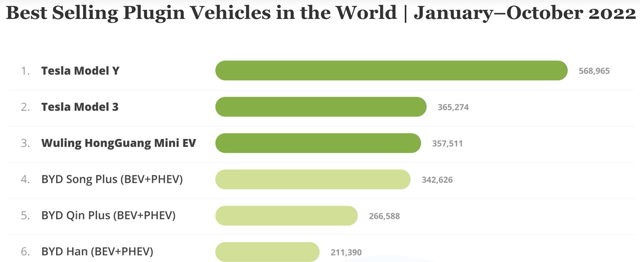

Global plugin electric car sales by model for January-October 2022 (source: CleanTechnica)

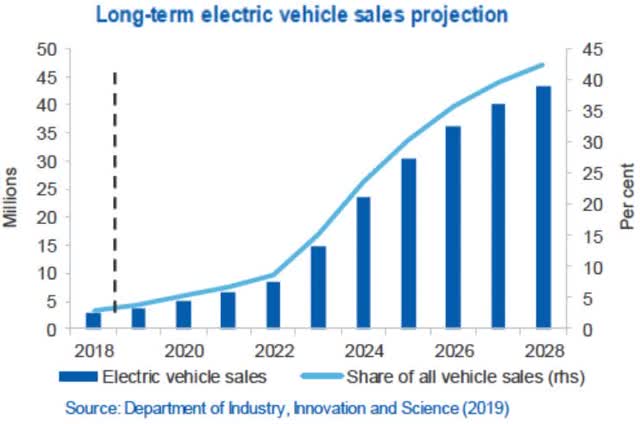

EV sales forecast to really take off from 2022 as affordability kicks in

The chart below aligns with our research that electric car sales will really take off after 2022.

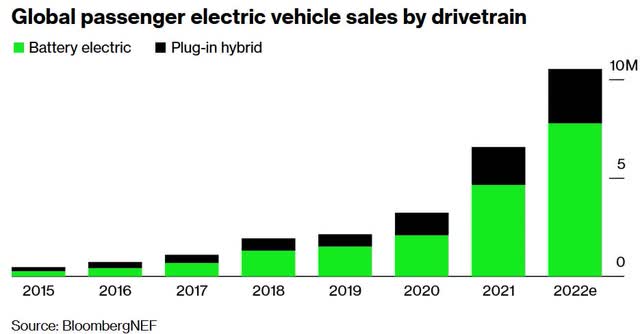

2022 – BloombergNEF forecasts for global electric car sales

BloombergNEF forecasts (as of mid 2022), “plug-in electric vehicles sales rise from 6.6 million in 2021 to 20.6 million in 2025” and “by 2025, plug-in electric vehicles represent 23% of new passenger vehicles sales globally, up from just under 10% in 2021.”

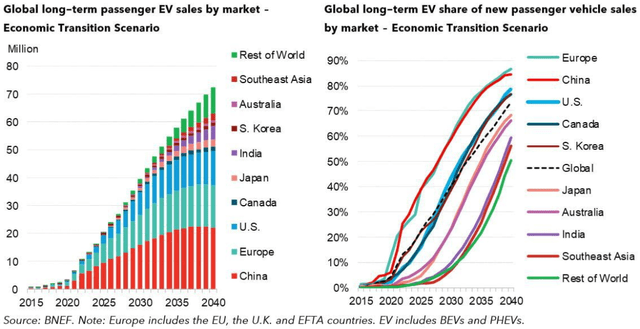

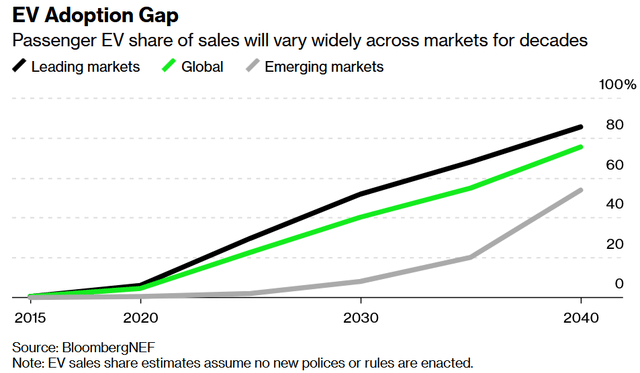

2022 – BloombergNEF long term EV forecast (global EV share to exceed 70% by 2040)

BloombergNEF forecasts ~40.4% global passenger EV market share in 2030 and 75.3% in 2040 (published June 2022)

EV market news

On November 4 TechCrunch reported:

iPhone maker Foxconn and Saudi Arabia are going into the EV business…..The new company, called Ceer, will design, manufacture and sell a portfolio of EVs using BMW’s component technology, according to Thursday’s announcement…The first EVs from the Ceer brand are expected come to market in 2025.

On November 11 CleanTechnica reported:

CATL to provide VinFast with complete EV skateboard chassis. CATL is expanding its services to automakers to included dedicated electric car platforms complete with batteries, motors, and more.

On November 12 Teslarati reported:

Electric plane manufacturer takes off, receives worldwide orders. Australian regional airline Northern Territory Air Service (NTAS) has ordered 20 electric planes from manufacturer Eviation, and they are far from the only customer…we know that Eviation will be supplying the Australian airline with 20 planes, which will be used in short, sub-300-mile journeys within Australia. But Eviation has been making deals with big names outside of Australia, including with DHL, Cape Air, Global Air, and Evia Air in Germany.

On November 16 the Business Times reported: “EV maker VinFast plans US IPO as soon as January: sources.”

On November 17 CleanTechnica reported: “Ford CEO: 40% less labor to build electric vehicles.”

On November 18 CleanTechnica reported:

Electric helicopter makes historic flight… The helicopter was a third-generation e-R44 fully electric conversion of the popular Robinson R44 helicopter. It was reportedly the first electric helicopter to go from one city to another or from one airport to another…. 24 miles (39 kilometers), which took 20 minutes to cover.

On November 19 Bloomberg reported:

VW and Mercedes’s electric-car ambitions run into trouble. VW plans to delay EV rollout, Mercedes cuts EQS price in China. German carmakers are under pressure to finally overtake Tesla…VW plans to delay a key project by at least two years after software fumbles, according to a person familiar with the situation, calling into question its ambitious €52 billion ($54 billion) EV rollout touted as the industry’s biggest. Also this week, Mercedes cut prices on its flagship EQS EV in China by about $33,000 after misjudging the market.

On November 23 Electrek reported: “Caterpillar advances sustainable mining with first battery electric 793 large truck…” You can watch Caterpillar’s demonstration here on YouTube.

EV company news

BYD Co. [SHE: 002594][HK:1211](OTCPK:BYDDY) (OTCPK:BYDDF)

BYD is currently ranked the number 1 globally with 17.3% (not updated this month) market share YTD. BYD is ranked number 1 in China with 29.9% market share YTD.

On November 1 Seeking Alpha reported:

BYD Company is a top electric vehicle stock at Citi…Analyst Jeff Chung called the 52% jump in NEV sales in Q3 a bright spot for the company and forecast that BYD will grow sales of new energy vehicles by 137% next year. Crucially, net profit per car is seen rising by 20% on a sales leveraging benefit… Citi assigned a price target of HKD 640 to BYD to rep more than 250% upside potential for shares.

On November 3 Seeking Alpha reported:

Warren Buffett-backed BYD reported record October sales growth of ~169% Y/Y…..

Of total sales, 217,518 units were passenger cars and 298 units were commercial vehicles.

On November 15 Seeking Alpha reported: “BYD abandons semiconductor segment spinoff.”

On November 17 CarExpert reported:

BYD passes 3 million ‘new energy vehicles’, discusses its next moves…..It took the Warren Buffett-backed EV and battery supplier 13 years to sell one million NEVs, one year to hit two million, and just six months to hit three million.

On November 18 Reuters reported: “China’s BYD expands electric vehicle operation in Brazil…..”

On November 21 Seeking Alpha reported:

BYD secures order for 64 electric buses from Nobina…BYD has won an order for 64 electric buses from Swedish bus operator Nobina, with delivery scheduled in the second quarter of 2023.

On November 22 Seeking Alpha reported: “Berkshire Hathaway continues to lighten stake in EV maker BYD.”

On November 23 Seeking Alpha reported:

Chinese EV maker BYD to raise prices from Jan 1 on higher raw material cost, subsidy end….it would raise official guide prices for models in the Dynasty and Ocean series, as well as those in the Denza brand, by 2,000 yuan – 6,000 yuan ($840)… Consumers currently gets a subsidy of RMB 4,800 for BYD’s plug-in hybrid models, or RMB 12,600 for pure electric models….

Tesla Inc. (TSLA)

Tesla is currently ranked the number 2 globally with 13.3% (not updated this month) global market share YTD. Tesla is number 3 in China with 7.3% market share YTD. Tesla is still the number 1 electric car seller in the US by far with 65% market share.

On November 1 Reuters reported:

Exclusive Tesla’s Cybertruck to start mass production at end of 2023…Tesla said last month it was working on readying its Austin, Texas, plant to build the new model with “early production” set to start in the middle of 2023.

On November 5 Business Insider reported:

Billionaire investor Ron Baron outlines how Tesla could soar 570% over the next decade to a $4.5 trillion valuation…”But that’s not including robots, that’s not including autonomous vehicles, that’s not including batteries,” Baron said… “I think in 2025 it [Tesla stock] will be $500 to $600. And in eight to ten years we ought to be somewhere around $4.5 trillion,” Baron said.

On November 11 CleanTechnica reported:

Tesla to boost Fremont production with help from Shanghai… Tesla is sending around 200 employees from Giga Shanghai to Fremont to help boost the California plant’s production, according to a report from Automotive News.

On November 22 Electrek reported: Exclusive: “Tesla Cybertruck reaches 1.5 million pre-orders – Can it live up to the hype?”

Note: Actually the Cybertruck tracker excel has net orders at ~1.63m.

On November 23 Reuters reported:

Elon Musk names S. Korea among top candidates for EV investment – Yoon’s office. Tesla chief executive Elon Musk said on Wednesday that South Korea was among its top candidate locations for a factory it plans to build in Asia for making electric vehicles (EVs), according to South Korea’s presidential office.

On November 25, The Guardian reported: “Tesla recalls more than 15,000 Australian electric vehicles over faulty tail lights.”

On November 27 Electrek reported:

Tesla Semi completes first 500-mile trip with a full load…Now Tesla is finally bringing its electric truck to market with deliveries expected to start this week, and it’s a 500-mile version of the electric truck…Five hundred miles with a full load between charges is the sweet spot for a commercial long-haul semi-truck, because after about eight hours of driving, a break for the driver is mandatory.

On December 2 Tesla held the Tesla Semi Event where they delivered the first Tesla Semi to PepsiCo. You can view the video here (starts at the 21 min mark in the video).

Investors can read our past Trend Investing article: “Tesla – A Look At The Positives And The Negatives“, where we rated the stock a buy. It was trading at USD 250 (post 5:1 stock split and 3:1 split is equivalent to USD 16.67). Investors can also read the latest Tesla Trend Investing article (discusses the potential of Tesla’s humanoid robot) here.

Volkswagen Group [Xetra:VOW](OTCPK:VWAGY) (OTCPK:VLKAF)/ Audi (OTC:AUDVF)/ Lamborghini/ Porsche (OTCPK:POAHF)/ Skoda/ Bentley

‘Volkswagen Group’ is currently ranked the number 3 top-selling global electric car manufacturer with 8.3% (not updated this month) market share YTD, and 1st in Europe with 20% market share YTD.

On November 1 Volkswagen Group reported: “Volkswagen enters partnership with MILES Mobility to accelerate expansion of car sharing portfolio.”

On November 14 Volkswagen Group reported: “ID. models crack the half-million mark: Volkswagen meets delivery target one year earlier than planned…” Highlights include:

- “Volkswagen is making rapid progress worldwide with electrification of its vehicle fleet despite strained supply situation.

- Order bank remains high: 135,000 (+65% vs. 2021) ordered vehicles being produced at fast pace.

- Electric roadmap is being accelerated: Production of ICE models in Europe to end by 2033. Ten new electric models to take to the road by 2026.”

On November 18 Reuters reported:

Volkswagen’s $2 bln Trinity electric vehicle plant in doubt. Volkswagen Chief Executive Oliver Blume is reviewing whether to stick to a plan to build a new plant to assemble its Trinity electric vehicles (EV) or to use its existing Wolfsburg factory, a source told Reuters on Thursday. Volkswagen, the world’s second-biggest carmaker, had planned to start building the 2-billion-euro ($2.06 billion) factory in 2023 and produce its flagship electric sedan there from 2026, with a view to accelerating the manufacturing process.

On November 20 InsideEVs reported:

Volkswagen’s Zwickau plant produced record number of electric cars. The plant appears to be running at maximum capacity right now…This alone indicates that the maximum output of 330,000 units annually.

On November 30 Bloomberg reported:

Volkswagen weighs Foxconn partnership to aid American EV push. VW said to be in talks with Taiwanese firm to make Scout cars. Alternatives include Magna cooperation, building own plant.

Wuling Automobile JV (SAIC 51%, GM 44%, Guangxi 5.9%), SAIC Motor Corporation Limited [SAIC] [CH:600104] (SAIC includes Roewe, MG, Baojun, Maxus)

SGMW (SAIC-GM-Wuling Automobile) is number 4 globally with 7.6% (not updated this month) market share YTD. SAIC/GM/Wuling JV (SGMW) plus SAIC is 2nd in China with 11.1% share YTD.

On November 3 Wuling Automobile JV reported: “SAIC-GM-Wuling launches 2023 KiWi EV Lotso Limited Edition.”

KiWi EV Lotso Limited Edition

Wuling Automobile JV

On November 7 Gasgoo reported: “SAIC Motor attains 32.19% YoY jump in Oct. 2022 NEV sales.”

On November 18 Wuling Automobile JV reported:

SAIC-GM-Wuling marks 20 years with new plant groundbreaking and new NEV. SAIC-GM-Wuling celebrated its 20th anniversary by breaking ground for its Smart & Lean BEV Factory in Liuzhou, Guangxi, and starting production of Wuling’s new global NEV model, the left-hand-drive version of the Air EV, at SGMW’s Baojun base. The Air EV has a range of 300 km on a single charge and is equipped with 30-kW and 50-kW drive motors in the two-seat and four-seat editions respectively. Forty-five minutes of DC fast charging is all it takes to achieve a charge from 30% to 80%…..

Geely Automobile Holdings Ltd (OTCPK:GELYY, HK:0175), Volvo Cars, Kandi Technologies Group (KNDI), Proton, Lotus, ZEEKR. (Note: Volvo Group is a separate company that makes e-trucks & e-buses)

Geely/Volvo is currently ranked number 5 in the global electric car manufacturer’s sales ranking with 5.7% (not updated this month) global market share YTD.

On October 31 Geely Automobile Holdings Ltd. reported:

Proposed spin-off of Zeekr Intelligent Technology Holding Limited. The board of directors (the “Board”) of Geely Automobile Holdings Limited (the “Company”) is pleased to announce that the Company has submitted a proposal to The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) pursuant to PN15 in relation to the proposed spin-off and separate listing of ZEEKR Intelligent Technology Holding Limited (“Zeekr”) (the “Proposed Spin-off”). Zeekr is a non-wholly-owned subsidiary of the Company, and is principally engaged in the research, development and sales of battery electric vehicles, batteries and other components of new energy vehicles, and related services under the “Zeekr” brand. The Stock Exchange has confirmed that the Company may proceed with the Proposed Spin-off.

On November 2 Volvo Cars reported:

Volvo Cars reports sales of 54,317 cars in October…..The company’s line of Recharge models represented 36.8 per cent of the sales last month, with fully electric vehicles accounting for 15 per cent of total sales.

On November 3 Volvo Cars reported:

Volvo Cars supports the future growth of Polestar. Volvo Cars is acting on its commitment to support the growth and development of Polestar by providing financial support in the form of an 18-month term loan, amounting to a total of USD 800M. The loan includes an option for Volvo Cars to convert to equity on a pro rata basis in a potential future equity raise by Polestar.

On November 8 Geely Automobile Holdings Ltd. reported:

Inside information framework agreement in respect of proposed formation of a joint venture company…..Zhejiang Geely Holding Group Company Limited*… entered into a framework agreement….pursuant to which the Parties proposed to set up a joint venture company….for the purpose of integrating each Party’s respective expertise and strengths in relation to internal combustion engine, hybrids and plug-in hybrids powertrains and transmissions activities and related technologies.

On November 8 Volvo Cars reported:

Volvo Cars executes on its strategic ambitions – divests its holding in Aurobay to Geely Holding. Volvo Cars has a strategic direction to become fully electric by 2030 and shape the future of mobility. In line with those strategic ambitions, Volvo Cars will divest its 33 percent holding in Aurobay to Geely Holding.

On November 9 Volvo Cars reported: “The new, fully electric Volvo EX90: the start of a new era for Volvo Cars.”

The new, fully electric Volvo EX90

On November 18 Reuters reported:

Poland chooses Geely Holding Group for EV platform. China’s Geely Holding Group will supply ElectroMobility Poland (EMP) with a modular electric vehicle platform that will form the basis of its Izera range, the companies said on Thursday.

Hyundai (OTCPK:HYMTF), Kia (OTCPK:KIMTF)

Hyundai-Kia Group is currently ranked number ~6 in the global electric car manufacturer’s sales ranking with 4.8% (not updated this month) market share YTD. Hyundai-Kia Group is ranked 3rd in Europe with 11.1% market share YTD.

On November 1 Kia reported: “Kia announces October 2022 global sales results.” Highlights include:

- “October global sales at 238,660 units, up 8.6% y/y….

- Year to date Kia global sales recorded 2,410,246 units, up 2.6% y/y.

- Kia to continue creating sales momentum and enhancing profitability through new models, such as the award-winning Kia EV6.”

On November 9 Kia reported: “Kia America announces 2023 EV6 pricing.”

2023 EV6 GT

Kia

On November 14 Hyundai reported:

Hyundai Motor Group signs MoU with Nusantara Capital City Authority to establish Ecosystem for advanced air mobility – A first step to open up AAM in ASEAN Market.

On November 16 Hyundai reported: “IONIQ 6 achieves five-star safety rating from Euro NCAP…..”

On November 25 Benzinga reported:

Hyundai Motor and SK On plan to build $1.9B JV plant in US…The facility is anticipated to produce 20 gigawatt hours [GWH], enough to power about 300,000 electric vehicles (EVs). The plant is expected to open in the first quarter of 2026. The battery unit is likely to be located in Georgia.

Stellantis N.V. (STLA) (merger Fiat Chrysler Group (FCA) and the Peugeot Group (OTCPK:PEUGF)) Ferrari (Jeep, Chrysler, Dodge, and RAM are all owned by FCA)

Stellantis Group is currently ranked the number ~7 in the global electric car manufacturer’s sales with 5.1% (not updated this month) global market share YTD. Stellantis is ranked 2nd in Europe with 15.6% market share YTD.

On October 31 Stellantis N.V. reported: “GAC-FCA Joint Venture to file for bankruptcy.”

On November 3 Stellantis N.V. reported: “Third quarter 2022 shipments and revenues.” Highlights include:

Stellantis Reports Strong Growth in Q3 2022 Net Revenues, Up 29% Full-Year Guidance Confirmed…..Global BEV sales increased 41% versus Q3 2021.

BMW (OTCPK:BMWYY), Mini, Rolls-Royce

BMW Group is currently ranked the number 8 global electric car manufacturer with 3.5% (not updated this month) global market share YTD. BMW Group is ranked 4th in Europe with 10.8% market share YTD.

On November 3 BMW Group reported:

BMW Group remains on track for success as transformation continues…..E-mobility ramp-up leads to bigger CO2 reductions.

On November 11 BMW Group reported:

Start of BMW iX1* production in Regensburg ups the pace: By 2024, one in three BMWs from Bavarian plants will be electric.

On November 25 BMW Group reported:

BMW Group to invest more than 2 billion euros in Hungarian Plant Debrecen by 2025…..The battery assembly will be located on the site of the Debrecen vehicle plant, which started construction about six months ago…..”In Debrecen, we are building the most advanced plant in the world. With our iFACTORY, we are setting new industry standards for vehicle production. Our investments underline our systematic approach to implementing e-mobility.”

Daimler-Mercedes (DDAIF, DDAIY) (Smart – 50% JV between Daimler & Geely) (NB: A proposal to rename Daimler to Mercedes Benz)

Daimler-Mercedes is ranked number 9 globally with 2.9% (not updated this month) market share. Mercedes Group is ranked 5th in Europe with 9.3% market share YTD.

On November 3 Mercedes Blog reported: “Mercedes-AMG EQE SUV: the first AMG all-electric performance SUV.”

Mercedes-AMG EQE SUV

Merdcedes Blog

On November 16 Financial Times reported:

Mercedes-Benz follows Tesla and cuts EV prices in China…The starter prices for the EQE model, the EQS model and its luxury edition – the AMG EQS 53 model – sold in China will be reduced by Rmb50,000 ($7,000), Rmb204,600 and Rmb198,600, respectively…..

On November 28 The Driven reported:

Mercedes trucks to use electric trucks only in its own supply chain. Mercedes-Benz Trucks, one of Daimler Truck’s biggest brands, has set a goal of electrifying all deliveries to its largest truck manufacturing plant in Wörth, Germany, by the end of 2026…..

On November 28 Electrek reported: “Mercedes’ $1,200 EV update cuts 0-60 times by a second, but only in one market…..”

GAC Group (Guangzhou Automobile Group Co. Ltd.)

GAC Group is ranked number 11 globally with 2.7% (not updated this month) market share YTD.

On November 3 Gasgoo reported: “GAC Group sells over 2.03 million vehicles in Jan.-Oct. 2022…..”

On November 24 Yahoo Finance reported: “HoloMatic raised $100 million new funding, led by GAC Group…..”

XPeng Inc. (Xiaopeng Motors) (XPEV) [HK:9868]

On November 1 XPeng reported: “XPeng G9 SUV obtains permit for autonomous driving public road tests…..”

On November 1 XPeng reported: “XPENG announces vehicle delivery results for October 2022.” Highlights include:

- “5,101 vehicles delivered in October 2022.

- 103,654 vehicles delivered cumulatively in the first ten months of 2022.”

On November 4 XPeng reported:

XPENG completes RMB964 million debut issuance of auto leasing carbon-neutral asset-backed securities on the Shanghai Stock Exchange.”

Great Wall Motor [HK:2333] (OTCPK:GWLLF) (OTCPK:GWLLY) [ORA]

On November 2 Bloomberg reported: “China’s electric carmakers eye Thailand in next sales push.” Highlights include:

- “Great Wall, Hozon, BYD are challenging the Japanese incumbents.

- Chinese investment in Thailand has doubled, mostly around EVs.”

Ford (F)

On November 2 Ford reported:

Ford strengthens position as America’s No. 2 EV brand; All-new super duty off to hot start – orders exceed 50,000 in five days; ’23MY retail orders up 134%; F-Series expands lead as No. 1 truck; Bronco sales climb 48%…..

On November 15 Ford reported: “Ford announces strategic partnership with Manufacture 2030 to enhance supply chain sustainability.”

On November 22 Ford reported: “Ford Pro reveals all-electric E-Tourneo custom multi-activity vehicle with superior space, performance and premium tech.” Highlights include:

- “…..All-electric powertrain offers up to 370 km range and 125 kW DC fast charging. Tourneo Custom line-up also includes PHEV and all-wheel drive diesel options…..

- All-new Tourneo Custom range produced by Ford Otosan in Kocaeli, Turkey, with deliveries to European customers from mid-2023.”

Ford Pro Reveals All-Electric E-Tourneo

Ford

Li-Auto (LI) [HK:2015]

On November 1 Li-Auto reported:

Li Auto Inc. October 2022 delivery update. Li Auto Inc…today announced that the Company delivered 10,052 vehicles in October 2022, up 31.4% year over year. The cumulative deliveries of Li Auto vehicles reached 221,067 as of the end of October…

NIO Inc. (NIO)

On November 1 NIO Inc. reported: “NIO Inc. provides October 2022 delivery update.” Highlights include:

- “NIO delivered 10,059 vehicles in October 2022, increasing by 174.3% year-over-year.

- NIO delivered 92,493 vehicles year-to-date 2022, increasing by 32.0% year-over-year.

- Cumulative deliveries of NIO vehicles reached 259,563 as of October 31, 2022.”

On November 10 NIO Inc. reported:

NIO Inc. reports unaudited third quarter 2022 financial results. Quarterly total revenues reached RMB13,002.1 million (US$1,827.8 million). Record-high quarterly vehicle deliveries were 31,607 units.

Renault [FR:RNO] (OTCPK:RNSDF)/ Nissan (OTCPK:NSANY)/ Mitsubishi (OTCPK:MSBHY, OTCPK:MMTOF)

On November 1 Mitsubishi reported: “Mitsubishi Motors starts sales of the all-new Outlander PHEV Model in North America…..”

On November 4 Car Expert reported:

Mitsubishi weighing stake in Renault electric vehicle spinoff. Mitsubishi has acknowledged it needs electric vehicles, and it could obtain some via an investment in Renault’s EV spin-off.

On November 5 Bloomberg reported: “Renault to target $10 billion valuation for its electric-vehicle business.” Highlights include:

- “French carmaker aims for Paris IPO sometime next year.

- Renault to elaborate on EV carveout plans at event next week.”

On November 8 Nissan reported: “Sakura wins Japan Automotive Hall of Fame Car of the Year.”

Nissan Sakura EV

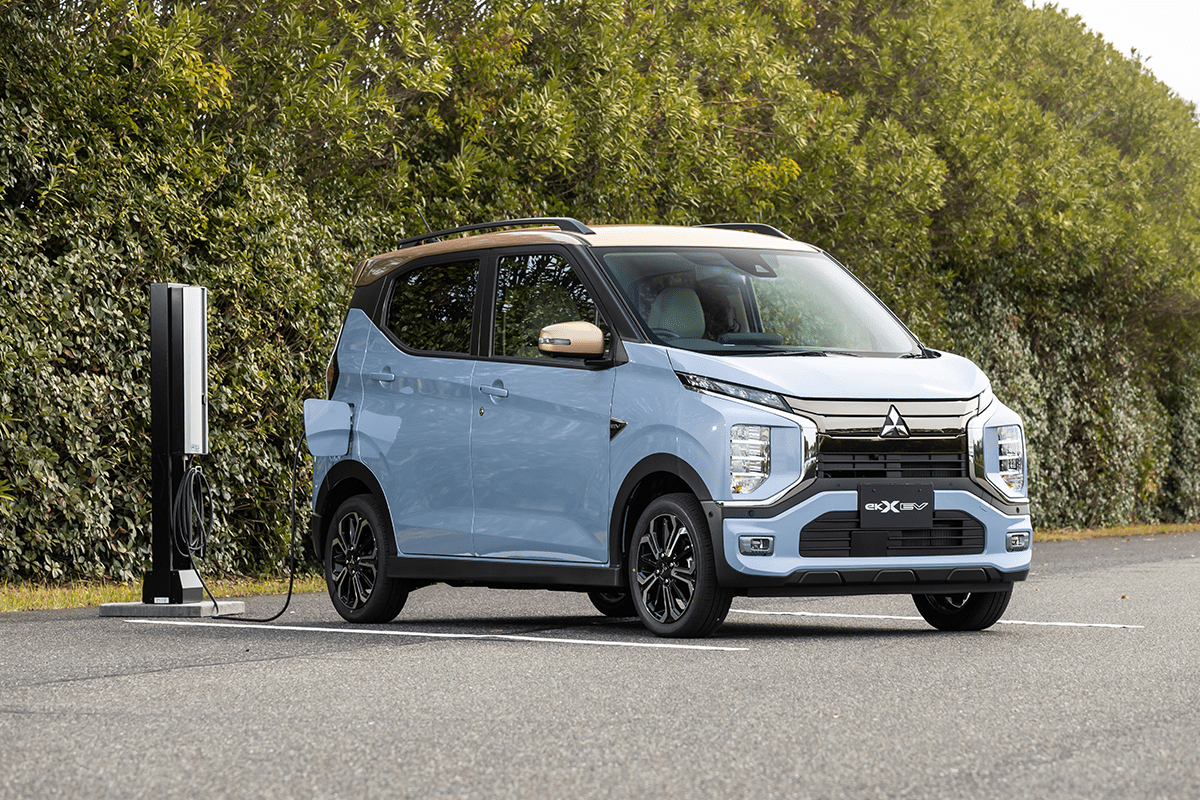

On November 8 Mitsubishi reported: “Mitsubishi Motors’ all-new eK X EV wins Japan Automotive Hall of Fame Car of the Year 2022-2023.”

Mitsubishi Motors’ All-New eK X EV

Mitsubishi

On November 10 Mitsubishi reported: “Mitsubishi Motors’ all-new eK X EV wins RJC Car of the Year and RJC Technology of the Year for 2023…..”

On November 13 GoAuto News Premium reported:

Renault to split business, link with Geely. Radical overhaul of Renault includes splitting off EVs, JV with Geely to make more ICE cars…..

On November 16 Electrek reported: “Nissan launches “EV Carefree+” to encourage ICE drivers to make the switch to electric…..”

General Motors (GM)/Chevrolet

On November 3 General Motors reported: “General Motors and Microvast to develop specialized EV battery separator.”

On November 17 CNBC reported:

GM expects EV profits to be comparable to gas vehicles by 2025, years ahead of schedule…..GM also boosted its 2022 cash flow guidance to between $10 billion and $11 billion and tightened its adjusted earnings range.

On November 24 Electrive reported:

GM to launch EV offensive in China by 2025. General Motors has announced the launch of more than 15 electric models based on its Ultium platform in China by 2025. Following the already available Cadillac Lyriq electric SUV, GM is planning a broad range of Ultium-based models across brands, segments and body styles for the Chinese market.

Polestar Automotive Holding UK Limited (PSNY)

On November 3 Polestar reported: “Polestar obtains USD 1.6bn financing support from major shareholders.”

On November 14 The Driven reported: “Polestar confirms launch of Polestar 4 in 2023 as EV sales double in current year.”

On November 22 Polestar reported:

Polestar 2 production hits 100,000. “It’s an amazing achievement – especially given we launched the Polestar 2 during the pandemic. Thank you to the team and all our customers who have joined us on this exciting journey,” says Thomas Ingenlath, Polestar CEO.

Beijing Automotive Group Co. (BAIC)(includes Arcfox) [HK:1958) (OTCPK:BCCMY)

On November 16 BAIC reported: “Another cutting-edge technology of BAIC wins the authoritative award…..”

Lucid Group (LCID)

On November 8 Lucid Group reported: “Lucid announces third quarter 2022 financial results, on track for annual production guidance of 6,000 to 7,000 vehicles.” Highlights include:

- “Record quarterly production of 2,282 vehicles, more than triple Q2.

- On track for annual production guidance of 6,000 to 7,000 vehicles.

- Q3 revenue of $195.5M driven by customer deliveries of 1,398 vehicles in the quarter.

- Strong demand with over 34,000 reservations, representing potential sales of over $3.2B.

- Announced plans to open Project Gravity SUV reservations in early 2023.”

On November 8 Lucid Group reported:

Lucid Group, Inc. announces $600 million ATM Program and additional investment of up to $915 million by an affiliate of PIF…..

On November 17 Lucid Group reported:

Lucid announces opening of first Swiss retail location in Geneva. The grand opening of Lucid Studio at Cours de Rive 10 to take place on 18th of November.

On November 18 Lucid Group reported: “Lucid Motors opens first retail studio location in Texas, the Dallas Studio at Legacy West.”

Toyota (TM)/ Lexus

On November 16 Toyota reported: “A nod to the near future: Toyota bZ compact SUV concept revealed in U.S…..”

Toyota bZ Compact SUV Concept

Toyota

On November 16 CNBC reported: “Toyota unveils new Prius hybrids amid skepticism of its EV strategy…..”

On November 25 The Driven reported: “Toyota Hilux and Ford Ranger utes to go electric as pricing revealed for mass EV conversions…..”

Tata Motors (TTM) group (Jaguar, Land Rover)

On November 7 Tata Motors reported: “Tata Motors celebrates its production milestone of 50,000 EVs…..”

On November 23 Tata Motors reported: “Tigor.ev, now with More Tech and More Lux Features.”

Tata Motors Tigor.ev

Tata Motors

GreenPower Motor Company Inc. [TSXV:GPV] (GP)

On November 15 GreenPower Motor Company Inc. reported:

GreenPower reports record revenue of $7.7 million and 57 vehicle deliveries for fiscal second quarter 2023…….

Workhorse Group Inc. (WKHS)

On November 8 Workhorse Group Inc. reported:

Workhorse Group reports third quarter 2022 results. “Our team is making steady progress, executing on our product roadmap, including beginning initial production and delivery of vehicles…..

Lion Electric (LEV)

On November 2 Lion Electric reported:

Lion Electric announces the production of its first made in America School Bus in its Joliet Illinois Factory.

On November 9 Lion Electric reported: “CDPQ and Finalta Capital support Lion Electric’s growth strategy with $30-million bespoke financing.”

On November 10 Lion Electric reported: “Lion Electric announces third quarter 2022 results.” Highlights include:

Q3 2022 Financial Highlights

- “Delivery of 156 vehicles, an increase of 116 vehicles, as compared to the 40 delivered in the same period last year.

- Revenue of $41.0 million, up $29.1 million, as compared to $11.9 million in Q3 2021.

- Gross loss of $3.8 million, as compared to gross loss of $1.2 million in Q3 2021.

- Net loss of $17.2 million, as compared to net earnings of $123.0 million in Q3 2021…”

Nikola Corporation (NKLA)

On October 31 Nikola Corporation reported: “Nikola and KeyState announce innovative hydrogen supply collaboration to support Nikola fuel cell electric vehicles…..”

On November 2 Nikola Corporation reported: “Zeem Solutions signs purchase order for 100 zero-emission Nikola Tre battery-electric trucks…..”

On November 3 Nikola Corporation reported: “Nikola Corporation reports third quarter 2022 results.” Highlights include:

- “Produced 75 Nikola Tre BEVs in Coolidge, AZ and delivered 63 to dealers.

- Reported revenues of $24.2 million, GAAP net loss per share of $0.54, and non-GAAP net loss per share of $0.28…..

- Raised $100.5 million in gross proceeds through ATM,

- Completed the acquisition of Romeo Power in October.”

On November 8 Nikola Corporation reported: “Nikola and ChargePoint partner to accelerate charging infrastructure solutions.”

Honda [TYO:7267] (HMC) (HNDAF)

On November 5 Honda reported: “Honda exhibits World Premiere of the “e:N2 Concept” indicating the direction of all-new EV models.”

Honda e:N2 Concept

Honda

On November 5 Asia Financial reported:

Honda ramps up EV push with new China-only model. The Japanese auto giant aims to roll out 30 EV models globally and produce 2 million EVs a year by 2030.

Lordstown Motors (RIDE)

On November 7 Lordstown Motors reported: “Lordstown Motors and Foxconn Broaden strategic partnership.” Highlights include:

- “Foxconn to invest up to $170 million in Lordstown Motors.

- Announce plans to pursue first joint EV program.”

On November 8 Lordstown Motors reported: “Lordstown Motors reports third quarter 2022 financial results.” Highlights include:

Third Quarter and Recent Business Highlights

- “Start of commercial production of EnduranceTM vehicles at the Foxconn Ohio assembly plant, at a very slow rate…

- Reported operating loss of $154.8 million….

- Adjusted operating loss1 excluding the above items of $33.8 million, 33% lower than adjusted operating loss in 2Q22 on the first full quarter without plant operating costs and other reductions…”

Mazda (OTCPK:MZDAY)

On November 22 BNN Bloomberg reported:

Mazda, suppliers to invest US$11B on electric vehicle push…..with the automaker forecasting they’ll account for 25 per cent-40 per cent of its global sales in 2030.

On November 22 Mazda reported:

New partnerships for the development and production of electric drive units. Mazda Motor Corporation is planning to complete the electrification of all vehicle models by 2030…

Near term potential EV producing companies

Arrival (ARVL)

On November 25 The Guardian reported:

Founder of troubled electric van maker Arrival steps aside as CEO. Russian billionaire Denis Sverdlov to swap roles with chair Peter Cuneo after chaotic strategy U-turn.

Fisker Inc. (FSR)

On November 2 Fisker Inc. reported: “Fisker Inc. announces third quarter 2022 financial results.” Highlights include:

- “Q3 2022 operating results consistent with company expectations; full-year total spending guidance at the low end of the $715 million to $790 million range.

- Magna to purchase a commercial fleet of 15 vehicles which we will deliver in December 2022.

- Consumer demand remains strong. Fisker Ocean reservations and orders totaled over 62,000 as of October 31, 2022. During the quarter, sold out of Fisker Ocean One’s globally and our 2023 US allotment of Fisker Ocean Sport and Fisker Ocean Ultra trim levels.

- Fisker confirms 42,400 Ocean unit production plan for 2023 predicated on detailed supplier and assembly ramp schedule.

- Fisker hosting journalists and analysts the week of November 7th ahead of Ocean SOP on November 17th; attendees will have an opportunity to test drive the Fisker Ocean.

- First drivable Fisker PEAR prototype to be completed ahead of plan, ready later this month.

- Ended quarter with a solid cash balance of over $824 million driven by ATM execution, disciplined spending and weak Euro.”

On November 17 Fisker Inc. reported: “Fisker Ocean: World’s most sustainable vehicle starts production on schedule.”

You can read a recent Trend Investing article on Fisker Inc. here.

Three wheel EV companies

Arcimoto Inc. (FUV)

On November 14 GlobeNewswire reported:

Arcimoto announces Board’s approval of reverse stock split ratio and effectiveness date…..The reverse split will reduce the number of shares of Common Stock issued and outstanding from approximately 51.2 million to approximately 2.6 million.

On November 14 GlobeNewswire reported: “Arcimoto announces third quarter 2022 financial results and provides corporate update.” Highlights include:

- “Produced 150 new FUVs, the highest vehicle production quarter in Arcimoto’s history, and a 47 percent increase over Arcimoto’s previous quarterly record.

- Delivered 74 customer vehicles, the highest quarter of customer deliveries in Arcimoto’s history, with an average sales price of $22,428…”

Electrameccanica Vehicles Corp. (SOLO)

On November 14 Electrameccanica Vehicles Corp. reported: ElectraMeccanica reports third quarter 2022 financial results.” Highlights include:

- “Company reported $1. 44 million in Q3 ’22 revenue, up over 12x from the year ago quarter.

- Contract manufactured SOLOs for Q3 ’22 total 103, reflecting temporary “Zero Covid” slowdown in China, while EMV maintains delivery pace at 64 vehicles for the quarter…

- Business maintains over $173 million of working capital as trailing twelve month revenues and deliveries improve 32% and 37% from Q2, respectively.”

EV & battery ETF

- The Amplify Lithium & Battery Technology ETF (BATT) is a broad based EV related fund worth considering. It is currently a trading on a P/E of 10.86. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles.”

Other EV or EV related companies

Other EV companies we are following include Envirotech Vehicles (EVTV) (formerly ADOMANI Inc., Atlis Motors, Ayro, Inc. (AYRO), Blue Bird Corporation (BLBD), Blink Charging (BLNK), Byton (private), Canoo Holdings (GOEV), China Evergrande New Energy Vehicle Group [HK:3333], Chery Automobile Co. Ltd. (private), Didi Chuxing, Dyson (private), Electric Last Mile Solutions Inc. (“ELMS”) (ELMS), Ferrari NV (RACE), Guangzhou Automobile Group Co., Hyliion Holdings (HYLN), Ideanomics Inc. (IDEX), Mahindra & Mahindra (OTCPK:MAHDY), Niu Technologies (NIU), Proterra (PTRA), Qiantu Motor, Sono Group N.V (SEV), Rivian Automotive (RIVN), Subaru (OTCPK:FUJHY), Suzuki Motor Corp. [TYO: 7269] (OTCPK:SZKMY) (OTCPK:SZKMF), Tata Motors (TTM) group (Jaguar, Land Rover), Vinfast, WM Motor, and Zhi Dou (private).

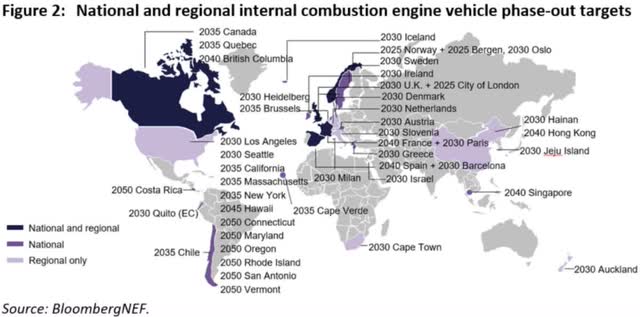

The list of countries and cities banning (or planning to ban) petrol and diesel vehicles include at least:

- Norway (2025); UK, Netherlands, Denmark, Sweden, Iceland, Greece, Ireland, Israel (2030); Scotland (2032); Hong Kong (2030-40); EU, Germany, Japan, Canada (2035); France, Spain, Egypt, Taiwan, Singapore, India, New Zealand and Poland (2040).

- Rome (2024); Athens, Paris, London, Stuttgart, Mexico City, Madrid (2025); Amsterdam, Brussels, Hainan (2030); California, New York, Quebec Province (2035); Sao Paolo, Seoul (2040).

Note: Wikipedia has an excellent list showing the phaseout of fossil fuels in various cities and countries.

ICE vehicle phase out target dates

Autonomous driving/ Connectivity/ Onboard entertainment/ Ride sharing [TaaS]/ EV leasing/ renting

On October 28 Drive.com.au reported:

Ford posts $1.28 billion loss following closure of autonomous driving tech company. Despite billions of dollars and promises of self-driving cars by 2021, Argo AI is shutting down.

On November 3 Inside EVs reported:

XPeng G9 approved for Robotaxi testing without any hardware changes. The EV only requires an OTA software upgrade to perform autonomous driving tests on designated public roads in Guangzhou, China.

On December 2 Seeking Alpha reported:

Autonomous trucks roll in Texas as Aurora and Uber test hauling goods during holiday peak season…..Aurora Innovation (AUR) and Uber Freight (UBER) announced the expansion of their autonomous pilot with a new commercial lane between Fort Worth and El Paso. The two autonomous transportation specialists said a 600-mile lane across Texas launched in October……

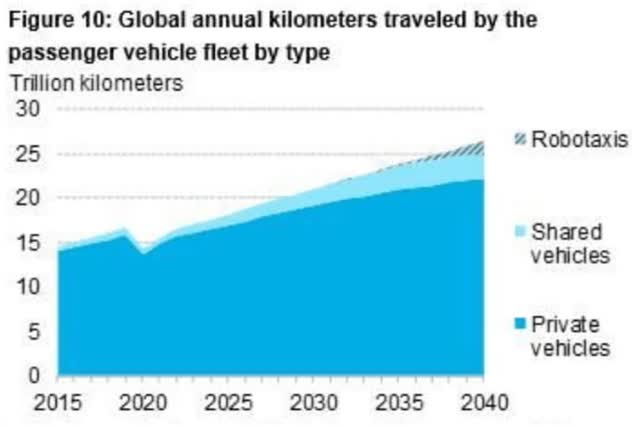

BNEF 2020 forecasts by fleet type

Conclusion

October 2022 global plugin electric car sales were up 55% YoY and reached 16% global market share; 31% share in China, 23% in Europe, and no data for October (May was 6.1%, Q3 was ~6%) for the USA.

Highlights for the month were:

- iPhone maker Foxconn and Saudi Arabia to form EV business called Ceer.

- Electric plane manufacturer takes off, receives worldwide orders.

- Electric helicopter makes historic flight.

- VW and Mercedes’s electric-car ambitions run into trouble.

- Caterpillar advances sustainable mining with first battery electric 793 large truck.

- BYD Co: Citi assigned a price target of HKD 640 to BYD (~250% upside). BYD sells 217,518 passenger NEVs in October. BYD secures order for 64 electric buses from Nobina in Sweden.

- Tesla’s Cybertruck to start mass production at end of 2023. Ron Baron thinks Tesla could soar 570% over the next decade to a $4.5T valuation. Tesla to boost Fremont production with help from Shanghai. Tesla Semi Event with the first Tesla Semi delivered to PepsiCo.

- Volkswagen’s Zwickau plant produced record number of electric cars, capacity is 330,000pa.

- SAIC Motor attains 32.19% YoY jump in Oct. 2022 NEV sales. SAIC-GM-Wuling marks 20 years with new plant groundbreaking and new Air NEV.

- Geely plans to spinoff Zeekr with a HKSE IPO.

- Hyundai Motor & SK On plan to build $1.9B JV 20GWh battery plant in US.

- BMW starts BMW iX1* production in Regensburg, by 2024, one in three BMWs from Bavarian plants will be electric. BMW Group to invest more than 2 billion euros in Hungarian Plant Debrecen by 2025.

- China’s electric carmakers eye Thailand in next sales push. Great Wall, Hozon, BYD are challenging the Japanese incumbents.

- Ford strengthens position as America’s No. 2 EV brand.

- Renault radical overhaul of Renault includes splitting off EVs….

- Mitsubishi weighing stake in Renault electric vehicle spinoff.

- GM expects EV profits to be comparable to gas vehicles by 2025, years ahead of schedule. GM to launch EV offensive in China by 2025.

- Polestar raises 1.6B. Confirms launch of Polestar 4 in 2023 as EV sales double in current year.

- Lion Electric announces the production of its first made in America School Bus in its Joliet Illinois Factory.

- Foxconn to invest up to $170 million in Lordstown Motors, plans to pursue first joint EV program.

- Mazda, suppliers to invest US$11B on electric vehicle push.

- Arrival founder steps aside as CEO for Russian billionaire Denis Sverdlov.

- Fisker Ocean begins production in Austria. Reservations and orders totaled over 62,000 as of October 31, 2022.

- Ford posts $1.28 billion loss following closure of autonomous driving tech company Argo AI.

- Autonomous trucks roll in Texas as Aurora and Uber test hauling goods during holiday peak season.

As usual, all comments are welcome.

Be the first to comment