SHansche

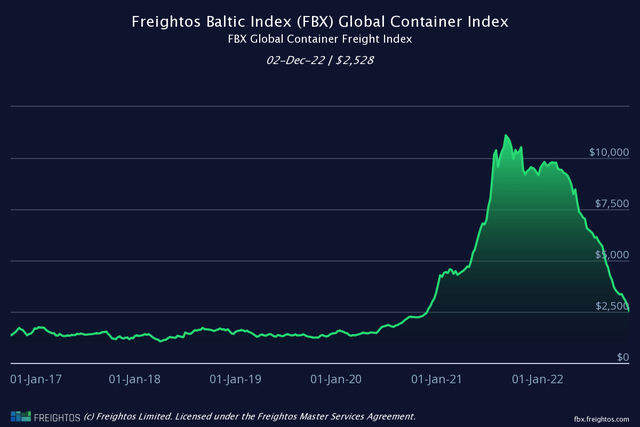

Containership rates continue to plummet at a troubling pace. With related parties such as retailers having accumulated above-average inventories and China’s zero-COVID policy, and declining demand for goods negatively impacting global trade volumes, containership rates are captaining below their pre-pandemic levels.

Freightos Baltic Index (FBX): Global Container Freight Index (fbx.freightos.com/)

As we have discussed in several of my past updates, some companies in the space are affected more than others. For instance, ZIM Integrated Shipping Services Ltd. (ZIM), whose performance is directly influenced by the underlying spot rates, has already started recording lower revenues, and by next year, its profits should plunge.

Containership lessors, on the other hand, such as Danaos Corporation (DAC) and Global Ship Lease, Inc. (GSL), have managed to mitigate much of this decline by signing multi-year leases at record rates, which should continue to generate robust cash flows moving forward.

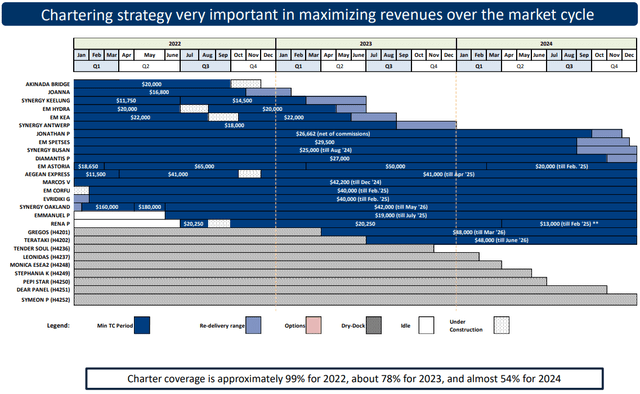

In this article, however, I want to revisit Euroseas Ltd. (NASDAQ:ESEA), whose chartering strategy should also provide strong coverage this year, next year, and to some extent in FY2024. Thus, the company should be able to navigate the ongoing decline in rates rather fine over the short to medium term. Combined with new vessels coming online at attractive rates in 2023, an improving balance sheet, the 10.3% yield, and the stock’s overall deep discount to NAV, Euroseas’ investment case comes with a deep margin of safety.

For future reference, here’s Euroseas’ current fleet employment:

Fleet employment (Investor Presentation)

Q3 vs. the upcoming Q4:

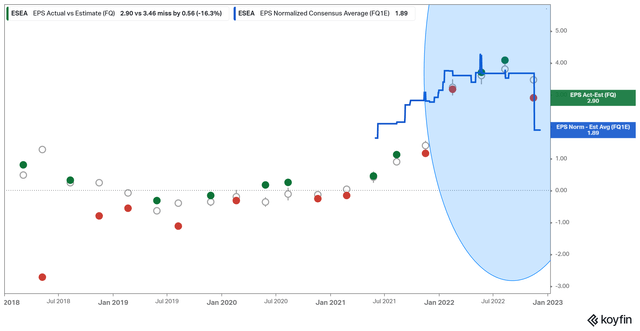

Euroseas earnings are set to decline sequentially. This is due to Joanna coming open in Q4 and Akinada Bridge and Aegean Express having both been in drydock since October 2022 and November 2022, respectively (the latter resuming employment in December). While Hydra, Kea, and Rena, are coming out of drydocks and will start contributing to earnings once again, analysts appear somewhat conservative, expecting Q4 EPS to land close to $1.89.

EPS Estimates: Actual vs. Expected (Koyfin)

Moving Toward FY2023

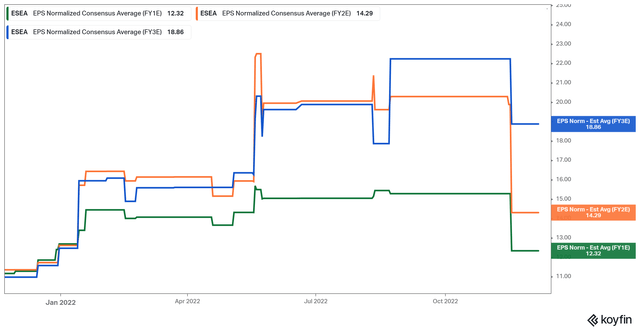

While Euroseas’ earnings potential indeed took a hit in the second half of the year amid drydocks, EPS for FY2022 is expected to land at $12.32, implying a 105% year-over-year increase. But most importantly, EPS is expected to grow by around 16% next year and by 32% in the year after.

Expected EPS growth (Koyfin)

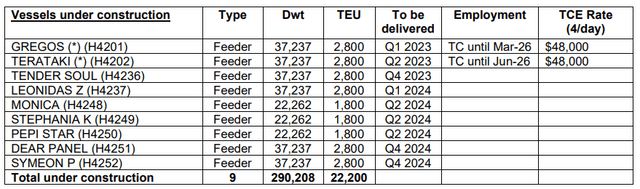

Coverage for 2023 and 2024 stands at 78% and 54%, respectively, which likely means that Euroseas will have to fix its remaining gaps at lower rates than those in 2022. However, the company will take delivery of Gregos and Terataki in 2023, which have already been fixed at very attractive rates. The two vessels should be highly accretive to EPS. The company will also take delivery of Tender Soul next year and another six vessels in 2024.

Vessels under construction (Q3 Earnings Report)

The problem here, of course, is that there is uncertainty regarding the rates at which these newbuilds will be fixed. Due to the containership market currently being in a shaky phase and a lack of interest toward long-term commitments by charterers, these newbuilds may not be fixed at as attractive rates as Gregos and Terataki. Nevertheless, rates still remain above their pre-pandemic levels, and the company should be able to fix these newbuilds at decent, profitable TCs. Euroseas breakeven/day is expected to be $14.1K over the next twelve months, lower than Q3’s $14.4K as well.

The 10.3%-Yielding Dividend & Buybacks

Ever since Euroseas reinstated its quarterly $0.50 dividend, the stock’s investment case has improved dramatically, as investors should now have a greater margin of safety. With the yield hovering in the double-digits, the stock should continue to see strong support close to $20.

When management was asked about the safety of the dividend moving forward if rates were to remain depressed in 2023 (which would have a major influence regarding the company starting fixing its newbuilds), Chairman, CEO & President Aristides Pittas had this to say:

…But the way we have thought about it is that the dividend is sustainable and will continue within the next few quarters at least. I remind you that $0.50 that we are currently paying is just 15% of the net income that we are currently making. So we do expect that throughout 2023, we will easily be able to be paying a dividend, but I won’t promise it, but I believe that, that will be the case.

As expected, the answer turned conservative toward the end, as it should, but clearly, management’s intention is to keep paying the dividend, and clearly, the dividend should remain well-covered in 2023 and 2024. After that, uncertainty kicks in as, again, we don’t know the rates at which the newbuilds will be fixed, but assuming they stop plummeting, the dividend should remain within coverage. For context, the company is currently spending just about $14.4 million in dividends per annum.

Regarding buybacks, as of Euroseas’ Q3 release (November 14th, 2022), the company had repurchased about $3.0 million worth of stock under its share repurchase plan of up to $20 million, announced in May 2022. Management could have arguably been more aggressive with buybacks, given the steep discount to NAV (and the potential savings on future dividends at current price levels?), but seeing them actually buying back stock is great. Repurchases should be highly accretive to EPS moving forward, in general.

The Discount To NAV

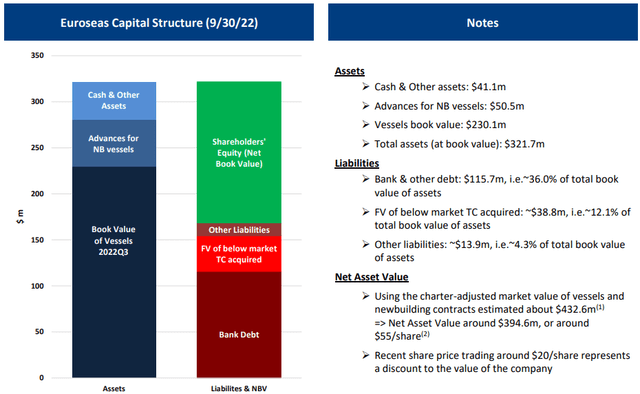

Speaking about Euroseas’ discount to NAV, this is where investors don’t just enjoy the prospects of a steep price appreciation in case the shares were to trade closer to NAV, but a relative margin of safety is ensured, as the discount is already too in-depth.

The market value of Euroseas’ fleet is much higher than that implied by its book value. Based on management’s own experience and using charter-adjusted values for its fleet and newbuilding contracts, the estimated value of its assets stood at about $432.6 million as of the end of September, which implies a net asset value of about $395 million or roughly $55 per share. With the stock currently trading at $19.35, this implies a massive 65% discount to NAV.

Balance Sheet Highlights (Koyfin)

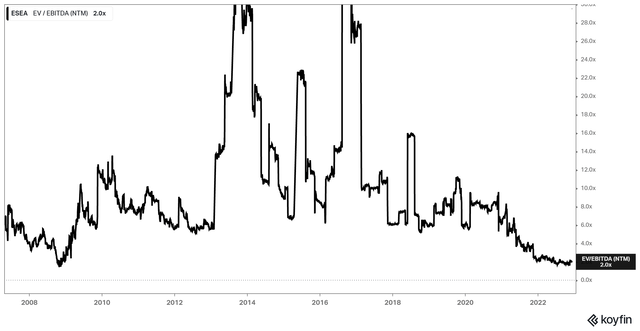

Considering the steep discount to NAV, the double-digit dividend yield, the active repurchases, the relatively strong earnings visibility, and secured funding for newbuilds, as well as the fact that Euroseas is currently at an all-time low forward EV/EBITDA of 2.0, investors should be subject to the best margin of safety the stock has probably ever come attached with.

Forward EV/EBITDA evolution (Koyfin)

Be the first to comment