pp76

Investment Thesis: While Euronet Worldwide (NASDAQ:EEFT) is slightly expensive from an earnings standpoint, a further rebound in earnings growth could make the stock more attractive.

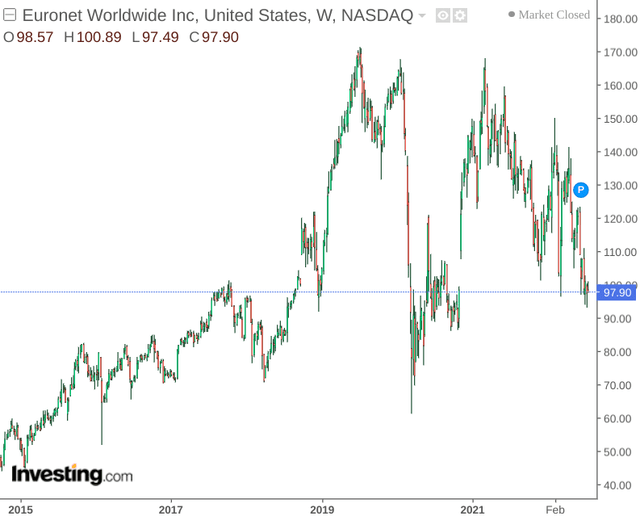

Euronet Worldwide has been seeing a steady decline in price over the past two years, after having rebounded strongly after the initial COVID-19 market decline in March 2020:

Investing.com

As a leading provider of global electronic payment services, the company was in a good position to expand its offerings during the emergency phase of COVID-19, when demand for electronic and online payments grew strongly.

However, there appear to be growing concerns on whether the business can sustain growth in an inflationary environment – when consumers may ultimately cut back on spending. The purpose of this article is to assess whether Euronet Worldwide can thrive in the current macroeconomic environment.

Performance

Given that Euronet Worldwide had reached almost the peak of its growth (in price terms) in the quarter of March 2020, I decided to compare the company’s cash position during this period to that of the most recent quarter.

| Balance Sheet Item | March 2020 | March 2022 |

| Cash and cash equivalents (in USD ‘000) | 709,521 | 986,534 |

| Total current liabilities (in USD ‘000) | 1,461,590 | 1,770,954 |

| Cash to current liabilities ratio | 48.54% | 55.7% |

Source: Figures sourced from March 2020 and March 2022 Form 10-Qs. Cash to current liabilities ratio calculated by author.

We can see that the company’s cash to current liabilities ratio has actually improved over this period, indicating that Euronet Worldwide is in a better position to meet its short-term debt obligations.

While diluted earnings per share came in at $0.16 in the most recent quarter, which is an improvement on the loss of -$0.16 seen in the same quarter last year, the company has yet to rebound to the prior earnings per share of $0.62 seen in March 2019.

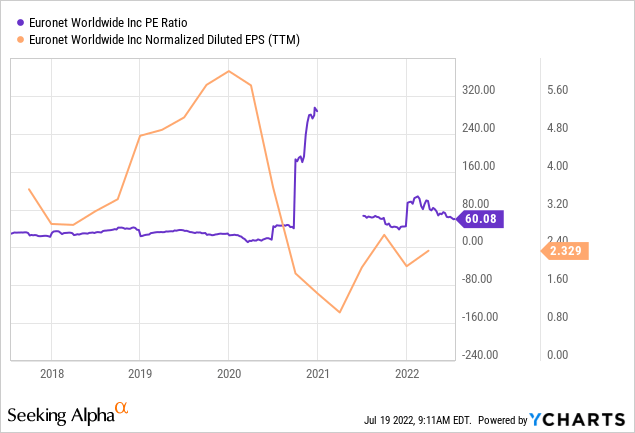

When looking at the company’s earnings on a five-year basis, we can see that earnings per share have yet to rebound to pre-2020 levels, while the P/E ratio itself is still above the ratio that we saw during that period.

YCharts

In this regard, I take the view that despite improving cash performance – investors are likely to want to see further evidence of an earnings rebound before considering investment in the stock.

Looking Forward

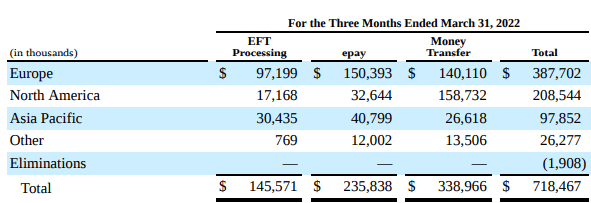

In terms of growth drivers and potential risks for Euronet Worldwide, almost 54% of the company’s revenue came from the European market in March 2022:

Euronet Worldwide Form 10-Q March 2022

As such, the company could be at risk of revenue loss resulting from a falling euro, as a weaker currency means that the company stands to earn less in commissions in dollar terms.

However, the fact that this segment raised 66% of its total revenues through branded payments (that is, prepaid payments through use of items such as prepaid debit cards, gift cards, vouchers, among others) means that the segment could see opportunity for growth in an inflationary environment given that rising costs of borrowing and fees from traditional financial institutions may increase demand for non-traditional payment methods.

With that being said, we can also see that across North America, the Money Transfer segment represented the largest segment, accounting for over 76% of overall revenue across this geographical market.

Moreover, with this segment earning revenue primarily through transaction fees as well as margin earned from buying foreign currency at wholesale exchange rates and then selling at retail rates, the company is in a good position to hedge itself from the effects of a falling euro.

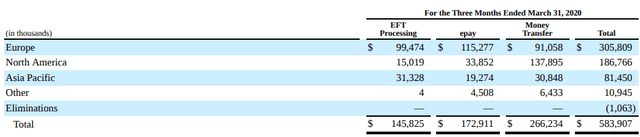

Euronet Worldwide Form 10-Q March 2020

Additionally, when looking at segment performance across March 2020, we can see that the European market has shown the most growth through to March 2022, with revenue up by 26% as compared to 11% for North America. With both epay and the Money Transfer segment having shown strong growth, further revenue gains across these segments could help to further drive overall earnings growth.

While inflation and a falling euro could be potential roadblocks, I take the view that if the company continues to show strong revenue growth in spite of these challenges, then earnings will grow accordingly and we could see the stock trade at a more reasonable value in this regard.

Conclusion

To conclude, Euronet Worldwide has shown strong growth across the European market, with epay and Money Transfer driving such growth. In this regard, while I take the view that the stock might be slightly overpriced at the present time, continued growth across these segments would make the stock more attractive from an earnings standpoint.

Be the first to comment