InfinitumProdux

With 11 dry bulk carriers in its fleet, EuroDry (NASDAQ:EDRY) transports major bulks such as iron ore, coal, and grains, as well as minor bulks including bauxite, phosphate, and fertilizers. EuroDry was spun-off from Euroseas (ESEA) in 2018 to become a pure dry bulk play, while Euroseas stayed a pure containership play. The two companies have retained the same management, with CEO Aristides J. Pittas and CFO Dr. Anastasios Aslidis responsible for the bulk of operations.

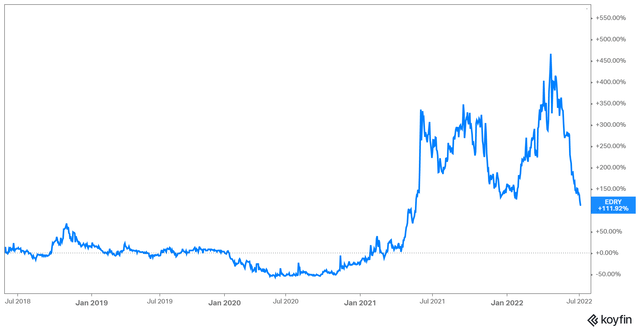

Shares of EuroDry went on the upsurge last year, following tailwinds in the dry bulk industry as a result of a tight availability of vessels against challenging supply chain bottlenecks. With dry bulk rates skyrocketing, EuroDry posted record profits over the past few quarters, igniting investors’ interest in the stock.

EuroDry Stock Price Performance (Koyfin)

However, shipping stocks, including shares of EuroDry, have plummeted lately. The underlying situation is rather weird, as we have seen shipping stocks trade similarly despite their qualities differing.

For example, in our latest piece going over Danaos (DAC) and ZIM Integrated Shipping Services (ZIM), we reminded investors of the former’s multi-year contracts which should provide predictable cash flows for at least the next few years. In the dry bulk space, chartering is quite different. Most charters are short-term, lasting a few quarters, while many have their rates linked to the underlying market index and not a fixed amount. As a result, investors should expect a fluctuating performance, and thus EuroDry’s investment case is by nature riskier. In fact, being a relatively tiny company in the space with a market cap of under $50 million, investors see EuroDry as one of the riskiest plays in the dry bulk space anyhow.

While there are further risks in EuroDry’s investment case, which we will discuss later, the potential reward appears equally, if not more massive.

This Year’s EPS To Be Higher Than The Stock Price…

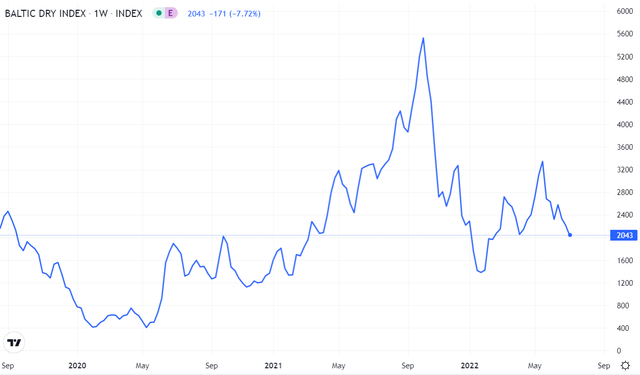

Dry bulk rates have normalized from last year’s record levels. In fact, considering the overall tough global economic and geopolitical environment, they remain at healthy levels.

Baltic Dry Index (Trading Economics)

With EuroDry’s vessels either linked to the underlying market index or chartered to considerably higher short-term rates than last year’s ones, the company’s performance has been very impressive recently.

In Q1, total net revenues came in at $18.3 million, suggesting a 113% increase year-over-year. As mentioned, the increase was due to higher time charter rates and the increased number of vessels owned and operated. With higher revenues expanding the company’s margins massively, net income for the period came in at $10.5 million against just $0.9 million last year. Accordingly, diluted EPS landed at $3.64 compared to last year’s $0.19.

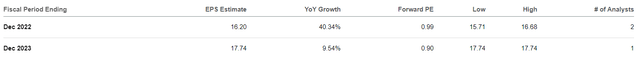

Over Q2, dry bulk rates hovered higher sequentially, while the recently acquired Molyvos Luck should have already started producing considerably higher cash flows by mid-quarter. Thus, I would expect the company’s results to be further improved compared to Q1. Yet, analysts expect Q2 EPS of $3.55. Still, the full-year consensus EPS estimate of $16.20 appears to be rather fair. This is because it implies earnings growth in the second half of the year, which is sensible since this is the busiest period in the industry, and thus rates are likely to advance in what is currently a tight, dry bulk market.

Consensus EPS Estimates (Seeking Alpha)

The $17.74 estimate for next year also makes sense, assuming rates remain healthy since the vessels acquired in early 2022 will start contributing to the bottom line earlier.

…Leading To Absurd Undervaluation

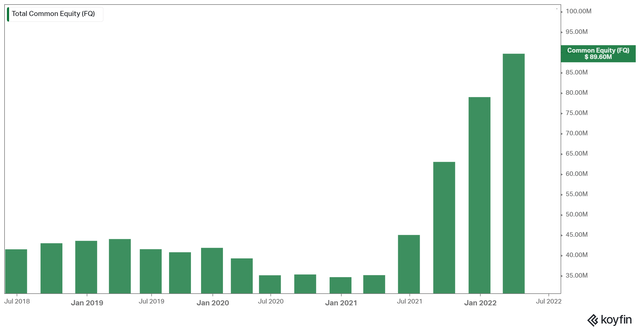

What’s striking about these numbers, if you haven’t already noticed, is that the company is basically expected to earn each year as much as the stock is currently worth. In other words, the company’s equity value should double next year from the underlying profitability alone ceteris paribus (all other factors constant). This may sound crazy, but that already occurred, with EuroDry’s common equity value nearly tripling over the past year.

EDRY’s Common Equity Value (Koyfin)

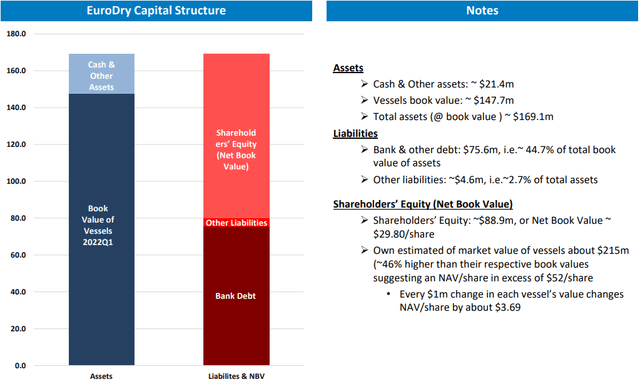

Also, notice that the current ~$90 million in common equity value is substantially higher than the company’s market cap of just under $50 million. In fact, the current market implies that the company is trading at around 56% of the book value. However, note that the company’s assets on the balance sheet represent historical values (i.e., the value of a ship when it was purchased). With vessels presently having the ability to earn more, they are worth more. The low order book against a tight market has also contributed to vessels increasing in value.

So while EuroDry’s book value per share may appear to be around $29.80 based on the balance sheet, based on management’s estimates which assume adjusted vessel values, the book value per share stands in excess of $52.

EDRY’s Book Value (Q1 Investor Presentation)

At the current stock price of ~$16.50, this implies that shares are currently trading at around 31.7% of their net book value (i.e., a discount of roughly 70%).

Is The Discount To NAV Justified?

This is a bit of a tricky question.

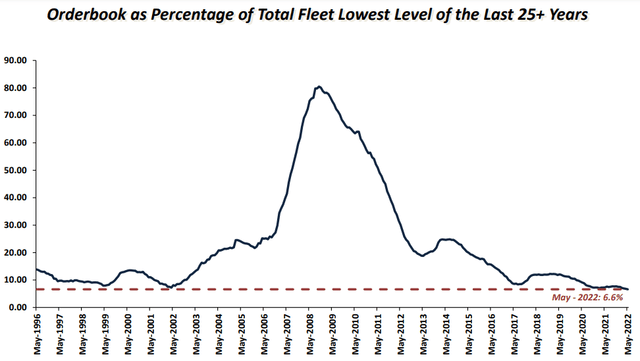

On the one hand, the discount to NAV is obscene, dry bulk rates remain healthy, and there are multiple catalysts to support higher rates in the industry moving forward. These include a 25+ year time low order book, supply bottlenecks persisting, and the ongoing Ukraine-Russia war adding to uncertainty and inflation (i.e., higher commodity prices).

Dry Bulk Order Book (Q1 Investor Presentation)

On the other, there are multiple reasons that keep shares trading on the cheap. The most significant one is that being a tiny company in the space, EuroDry needs to continue growing. The company has been using its own funds to acquire vessels in order to expand. It ended Q1 2021 with eight vessels, and it now has 11. In the current market environment, these acquisitions appear accretive, adding to profitability and supporting enough cash generation that allows the company to keep purchasing the next vessels.

But is this sustainable? What happens if, despite the favorable dry bulk dynamics, rates decline significantly over the next three to four years, leading to negative operating cash flows? EuroDry would likely expand the fleet through debt or equity. But then, using equity to fund acquisitions at such a discount to NAV would destroy shareholder value. Issuing debt is going to be very expensive in a rising rates environment for a cyclical company the size of EuroDry as well. Yet, the company needs to keep growing if it wants to be around in a couple of decades. Thus, what currently appears to be too cheap, may not be the case a few years forward, assuming, of course, rates were to significantly decline.

Can Dividends Or Buybacks Lift The Stock?

Investors could argue that by returning capital to shareholders, management could drive the stock price closer to its “fair value”. This is partly true, but there are some factors to consider.

First and foremost, the core need for EuroDry at this point is to grow. We mentioned it before, but it’s truly fundamental in order to assess the company’s investment case. With its fleet having an average age of 13.5 years, EuroDry needs to recycle its fleet to stay relevant in the coming decades. Thus, management is unlikely to start paying dividends as it prioritizes using its own funds to purchase additional carriers. Again, that can build shareholder value during the current environment but deteriorate shareholder value in an environment similar to that of mid-2020.

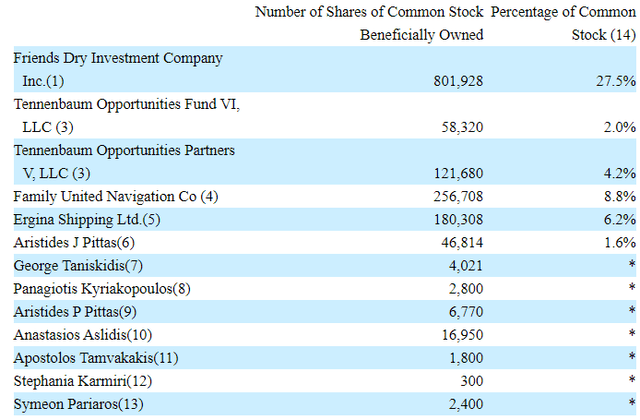

Buybacks could also help the stock advance. However, buybacks will reduce the balance sheet, and that goes against the company’s primary concern of growing the balance sheet. Further, it would reduce the stock’s liquidity, which is a foolish thing to do in case they may need to issue equity in the future, especially considering the low market capitalization. The liquidity situation is serious, as insiders, and specifically, the Pittas family, control the majority of shares. Friends Dry, Family United, and Ergina Shipping are mainly controlled and owned by the Pittas family. Thus, roughly half of the company’s outstanding shares are not included in the float.

Insider Ownership/Major Shareholders (20-F Filing)

Thus, buybacks may not be what the company necessarily needs at the moment.

Takeaway

EuroDry’s discount to net book value and common equity growth in the coming quarters driven by healthy rates and robust profitability make the stock look like a screaming buy. Still, risks remain regarding the company’s size and the need to grow consistently. If rates were to decline substantially in the medium-term, EuroDry could have capital allocation issues to execute its expansion plans, meaning that the current discount to net book value does not clearly present a must-buy opportunity. Still, if rates were to retain their current levels, let alone rise moving forward, shares could surge over the next couple of years. EuroDry’s investment case may have basically no margin of safety compared to the containership lessors on which we are bullish. It is a high-risk/high-reward one with the potential for massive upside, nonetheless.

Be the first to comment