Adriana Romanova

Unfortunately, a lot has changed since my last article on small, Greece-based drybulk shipping company EuroDry Ltd. (NASDAQ:EDRY).

Introducing EuroDry

For readers new to EuroDry, I will start with a short overview of the company:

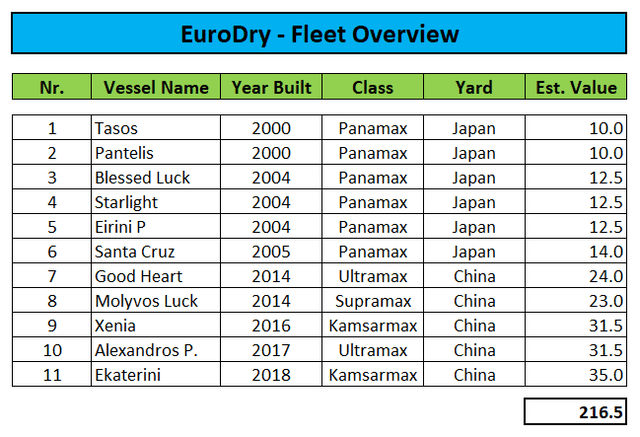

EuroDry operates a fleet of eleven drybulk carriers with an average age of 13.5 years which are mostly employed under short- to medium-term time charter contracts:

Company Press Releases, Author’s Estimates

Unlike peers Castor Maritime (CTRM) and Globus Maritime (GLBS), the company has avoided outsized dilution of common shareholders ever since its spin-off from Euroseas Ltd. (ESEA) in mid-2018 and recently redeemed all of its expensive Series B Preferred Stock.

That said, in FY2021 EuroDry raised approximately $10 million from issuing 0.34 million new common shares under its at-the-market offering program and sold some additional shares in Q2 as the stock price temporarily approached Net Asset Value (“NAV”) in April.

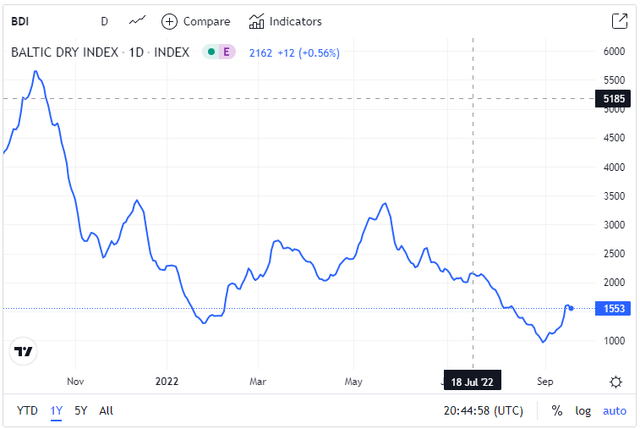

Weakness in Dry Bulk Charter Rates

As commodity demand from China has failed to pick up and with port congestion easing quite meaningfully, charter rates have remained under pressure with the Baltic Dry Bulk Index (“BDI”) now down more than 70% from multi-year highs reached in Q4/2021:

That said, charter rates for the mid-sized and smaller vessel classes have held up somewhat better than the Capesize segment thus benefiting companies like EuroDry.

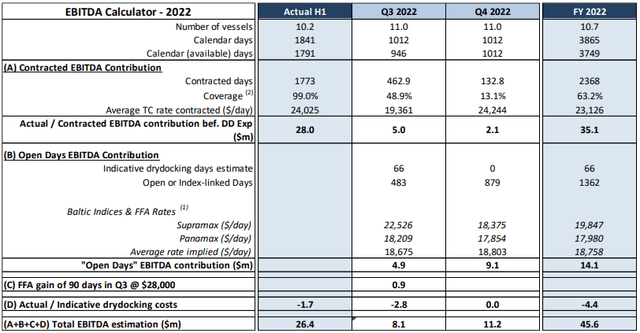

Strong First Half Results But H2 Will Be Weaker

Last month, the company reported reasonably good Q2 results but EBITDA for the second half will take a hit due to a mix of higher drydocking expense and lower charter rates. That said, the company is likely to remain solidly profitable.

$10 Million Share Repurchase Program

EuroDry also announced its first ever share buyback program:

Within this environment, we continue to look for ways to add value to our shareholders. With our stock trading at a very steep discount to our net asset value, our Board of Directors considers that buying our own stock represents a very attractive investment for us and has authorized a share repurchase program. At the same time, we are positioning ourselves liquidity-wise to capitalize on more traditional investment opportunities and acquire vessels consistent with our investment criteria should such opportunities appear.

On the Q2 conference call, management pointed to the ongoing strength of the second-hand vessel market which makes it difficult for the company to pursue additional growth at reasonable terms:

Tate Sullivan

And then can you just review, is this in your history with public shipping companies and shipping sector, I mean, is this the first repurchase plan and 15 years forever, can you just review the repurchase history?

Aristides Pittas

Yes, we had never done that in the past. But looking at how low our share price is, we felt compelled to do something to help support the price and make it a good return for our shareholders.

Tasos Aslidis

Yes, at this time to buy a new version is quite expensive as asset prices are extremely high compared to where we are trading. So it makes more sense to buy back our stock rather than to buy a new vessel.

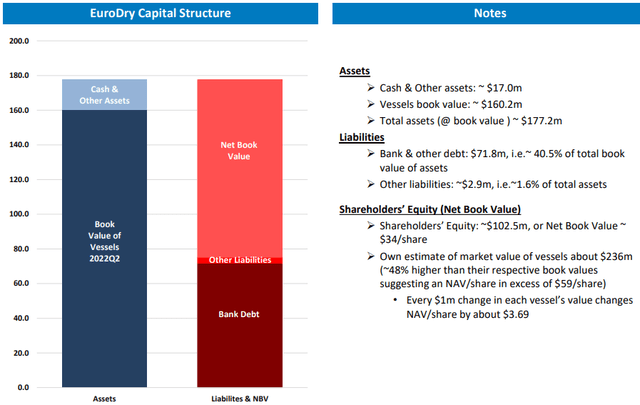

Net Asset Value Near All-Time High

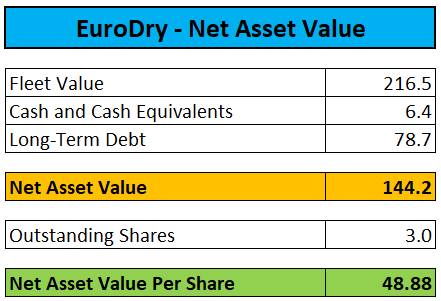

In its second quarter earnings presentation, the company stated the market value of its fleet at $236 million thus resulting in a NAV of almost $60 per share:

That said, I decided to apply an approximately 10% discount after the company announced the sale of the Panamax dry bulk carrier Pantelis for approximately $9.7 million which was well below my previous estimate.

Company Press Release / Compass Maritime / Author’s Estimates

But even at these conservative valuation levels, the company is currently trading at an almost 75% discount to NAV.

Vessel Sale Provides Liquidity for Share Buybacks

While I would have expected the sale of the Pantelis to result in up to $12 million in cash proceeds, the transaction will result in EuroDry recording a gain of approximately $3 million or $1.00 per share in the fourth quarter and provide the liquidity required for executing on the recently announced share repurchase program:

This sale is part of our effort to focus on more modern, eco-built, fuel-efficient vessels and is consistent with our overall ESG strategy. (…) The net proceeds of this sale will significantly increase our near-term liquidity and enable us to quickly capitalize on accretive investment opportunities in the market, when they arise, for the benefit of our shareholders.

Please note that the company’s market capitalization has dropped below $40 million so executing on the buyback program could result in a very sizeable reduction of the free float, particularly given the fact that CEO Aristides Pittas still controls approximately 45% of EuroDry’s shares.

Bottom Line

Even when considering the more muted outlook for dry bulk shipping, an almost 75% discount to NAV doesn’t seem justified for a profitable company that has largely abstained from pursuing growth at the expense of common shareholders like many of its Greek-based peers have done in recent years.

Once the sale of the Pantelis will be completed next month, I would expect the company’s share buyback program to kick into higher gear which should provide plenty of support for the stock price.

Assuming the discount to NAV narrowing to approximately 50%, upside potential for the shares would be close to 100% at current levels.

Given the potential near-term catalyst, speculative investors should consider establishing or adding to existing positions in EuroDry’s common shares.

That said, given the weaker charter rate environment and uncertain outlook, I am reducing my price target from $35 to $25.

Be the first to comment