EUR/USD Price, Chart, and Analysis

- German ZEW highlights a more optimistic outlook.

- EUR/USD remains stuck in a range and at the greenback’s mercy.

Keep up to date with all market-moving data releases and events by using the DailyFX Calendar

The latest German ZEW data suggest that while current conditions are difficult, there may be better times ahead for the Eurozone’s largest member state and the block as a whole. According to the ZEW report, experts expect growth to resume and inflation to reduce in both the Eurozone and Germany over the next six months.

Ahead, traders should monitor ECB President Christine Lagarde’s speech at 13:00 for any commentary about inflation and the market’s current rate hike pricing.

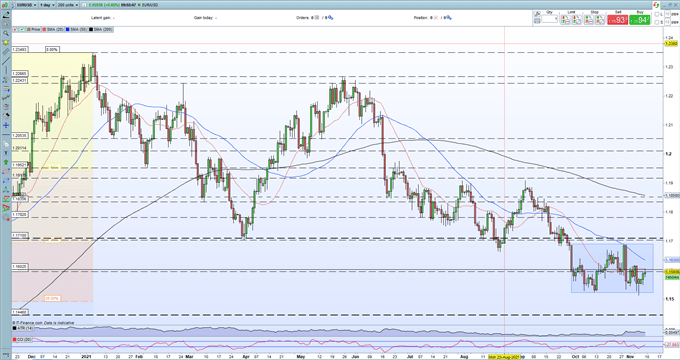

The recent weakness in the US dollar has helped push EUR/USD higher but it may now take a more fundamental move to nudge the pair back above the 1.1690/1.1700 zone. Last Friday’s break below 1.1514, a 16- month low, was quickly bought back and suggests that a range between 1.1515 and 1.1700 will likely hold over the short term. We identified this box structure last week and suggested that support may be tested, and this view hasn’t changed.

EUR/USD Testing Support Ahead of the Latest US Jobs Report

Euro (EUR/USD) Daily Price Chart November 9, 2021

Retail trader data show 57.72% of traders are net-long with the ratio of traders long to short at 1.37 to 1.The number of traders net-long is 2.81% lower than yesterday and 3.43% higher from last week, while the number of traders net-short is 8.09% higher than yesterday and 0.53% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment