EUR/USD ANALYSIS TALKING POINTS

- EZ fundamentals have remained largely unchanged leaving the euro exposed to additional weakness.

- 0.9601 key for EUR/USD.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EURO FUNDAMENTAL BACKDROP

The euro found some support this Tuesday after a poor performance against the greenback yesterday. The euro remains vulnerable to downside risk as fundamental headwinds significantly outweigh any sort of positivity at the moment as the eurozone heads into the winter months. From my perspective, markets are looking for a change in the Fed’s current stance (hawkish) or a marked reduction in inflationary pressures to change the tide for EUR/USD. Until then, I expect the euro to stay depressed.

The economic calendar is fairly light from European perspective although central bank speakers from both the U.S. and ECB will be under the spotlight throughout the day. High impact economic data events will come from U.S. durable goods orders and consumer confidence for August and September respectively.

Introduction to Technical Analysis

Trade the News

Recommended by Warren Venketas

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

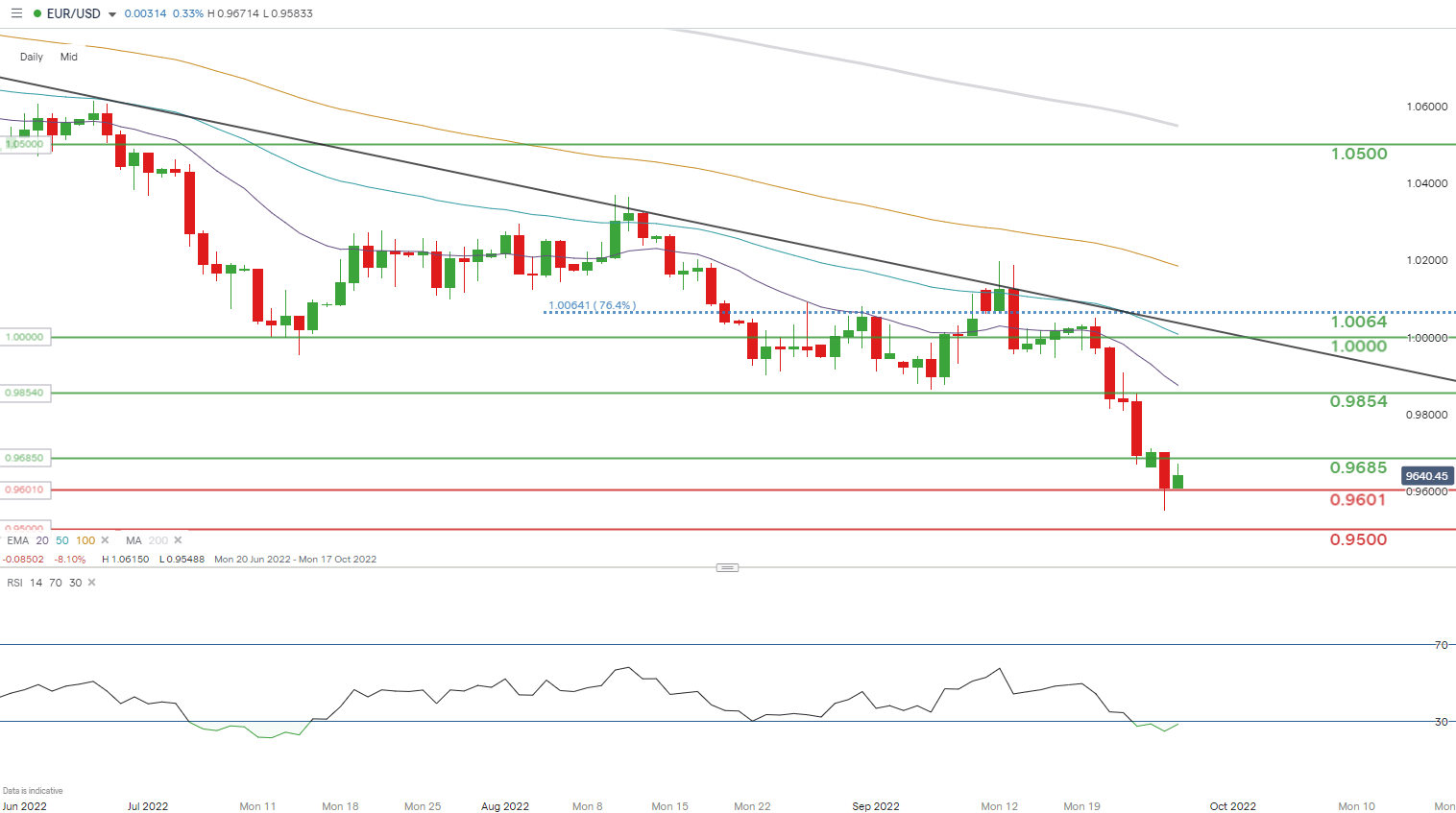

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily EUR/USD price action shows bears unable to close below the September 2002 swing low at 0.9601 which is key to opening up the 0.9500 psychological support zone. Should euro bulls defend this swing low, we may see a pullback towards 0.9800 in the interim. Coupled with an oversold Relative Strength Index (RSI), some euro reprieve seems likely short-term.

Resistance levels:

- 0.9854

- 0.9685

Support levels:

- 0.9601 (September 2002 swing low)

- 0.9500

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on EUR/USD, with 75% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we favor a short-term cautious disposition.

| Change in | Longs | Shorts | OI |

| Daily | 8% | 3% | 6% |

| Weekly | 20% | -47% | -9% |

Contact and followWarrenon Twitter:@WVenketas

Be the first to comment