EUR/GBP News, Price and Analysis:

- Eurozone ministers still at loggerheads over crucial rescue package.

- EUR/GBP eyeing support as liquidity thins ahead of Easter break.

Recommended by Nick Cawley

Planning is Key When Trading

Tetchy Eurozone Rescue Talks Ongoing

Divisions within the Eurozone continue to thwart a critical coronavirus rescue plan putting the existence of the European Union at risk, according to some member states. The Spanish agriculture minister, Luis Planas, warned ‘ this is a crucial issue on which the European Union’s future is at stake’, while Italian Prime Minister Giuseppe Conte said in a BBC interview that the risks to the European Union ‘are real’. Italy are one of a group of member states, including France and Spain, seeking the issuance of coronavirus bonds to combat the virus, while Germany and the Netherlands are vetoing any kind of joint-issuance of bonds that leave them on the hook for other member states debt. Talks continue and the outcome will have a notable impact on the Euro.

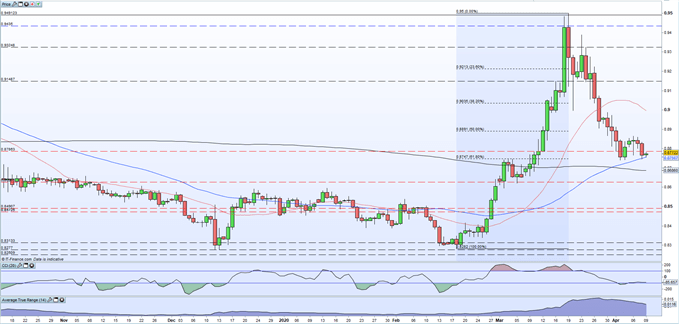

EUR/GBP recently bounced off a support zone between 0.8740 and 0.8747, made up of a double monthly low on April 2/3 and the 61.8% Fibonacci retracement level of the February 18-March 19 twelve point rally. The pair are also sitting on the 50-day moving average, an indicator that held firm when tested yesterday. Thin liquidity conditions are likely to keep the pair in check but a break lower cannot be discounted, especially if the EU leaders are unable to find a compromise or if any decision announced is seen as a short-term fudge. Volatility levels, using ATR, remain high.

The DailyFX Online Trading Universityhas 1000s of updated articles covering all aspects of trading.

EUR/GBP Daily Price Chart (October 2019 – April 9, 2020)

Recommended by Nick Cawley

How are Retail Traders Positioned in These Volatile Markets?

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EUR/GBP – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment