dragana991/iStock via Getty Images

Note: I have covered Etsy previously, investors should see this as an update to my earlier articles on the company.

Etsy Inc. (NASDAQ:ETSY) reported its second-quarter results after the bell on Wednesday the 27th of July and to the market’s surprise, the e-commerce platform beat on both top and bottom lines.

The latest results have shown that the gains made since the onset of the pandemic are enduring – particularly concerning Etsy’s network where active buyers and seller figures remain at elevated levels. Considering the strong long-term tailwinds in e-commerce combined with the addition of Elo7 and Depop to Etsy’s House of Brands – Etsy’s Total Addressable Market is large and expanding. Etsy management and in particular CEO Josh Silverman have a history of unlocking significant value where others don’t see it – I believe that trend will continue moving forward. The long-term Etsy bull thesis is intact.

Digging into the numbers

Revenue for the second quarter was $585 million ($3.03B GMS), this was up 10.6% Year-on-Year (YoY) and up slightly sequentially. 2021 numbers didn’t include Depop and Elo7, excluding them from this quarter shows a decline in GMS of $440 million or 14.7%. Etsy is now lapping tough 2021 comps with considerable new headwinds as consumer spending tightens. Adjusted EBITDA was $162 million – a 1% margin improvement from Q1 and a 2% improvement YoY. This highlighted Etsy’s ability to adjust variable expenses quickly, the company reduced marketing investment which was the large driving force behind the margin improvement. The margins would’ve been even better when excluding Depop and Elo7 which provided a 4% drag – both of these acquisitions are long-term focused and give Etsy a stronger foothold in new markets.

Total active sellers remained solid at 7.4 million, only down slightly (3.6%) sequentially. Following on from the fee increase at the end of last quarter, it will be important to monitor active sellers to see if the Etsy strikes had much of an impact. Due to the fact active sellers are those who have sold one item in the last 12 months – it may take a while before any impact is seen and by then I believe most will return to the Etsy platform due to the superiority of the offering and the traction it provides sellers. Remember once you have built a large network of clients who purchase your items on Etsy, it is difficult to just shift those customers off of the platform, while sellers also wouldn’t be able to use tools such as Etsy ads to gain more customers.

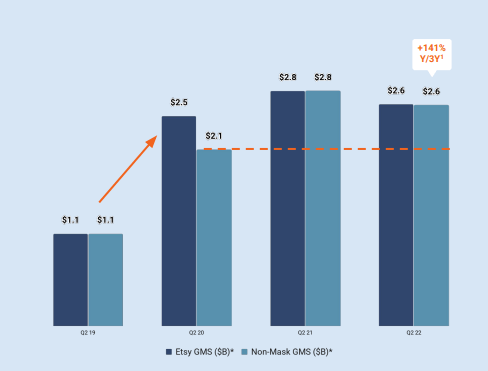

Not only was this figure impressive because it defied much of the market fears, but in combination with the other figures it also showed that even amidst headwinds, the gains Etsy has made during the pandemic are enduring. The high active seller count is a testament to Etsy’s strong offering and also infers that Etsy’s moat remains strong. Despite the frustration from sellers, the reputation built up by the platform over a long period of time and the network of buyers it has built has given the company the power and ability to make pricing adjustments while remaining sticky on both the buyer and seller side. The fee rise in an uncertain environment was a test and Etsy passed with flying colors. This, combined with higher spend per buyer has seen GMS explode since 2019:

Etsy GMS (Etsy IR)

Depop, Elo7 and the future of Ecommerce

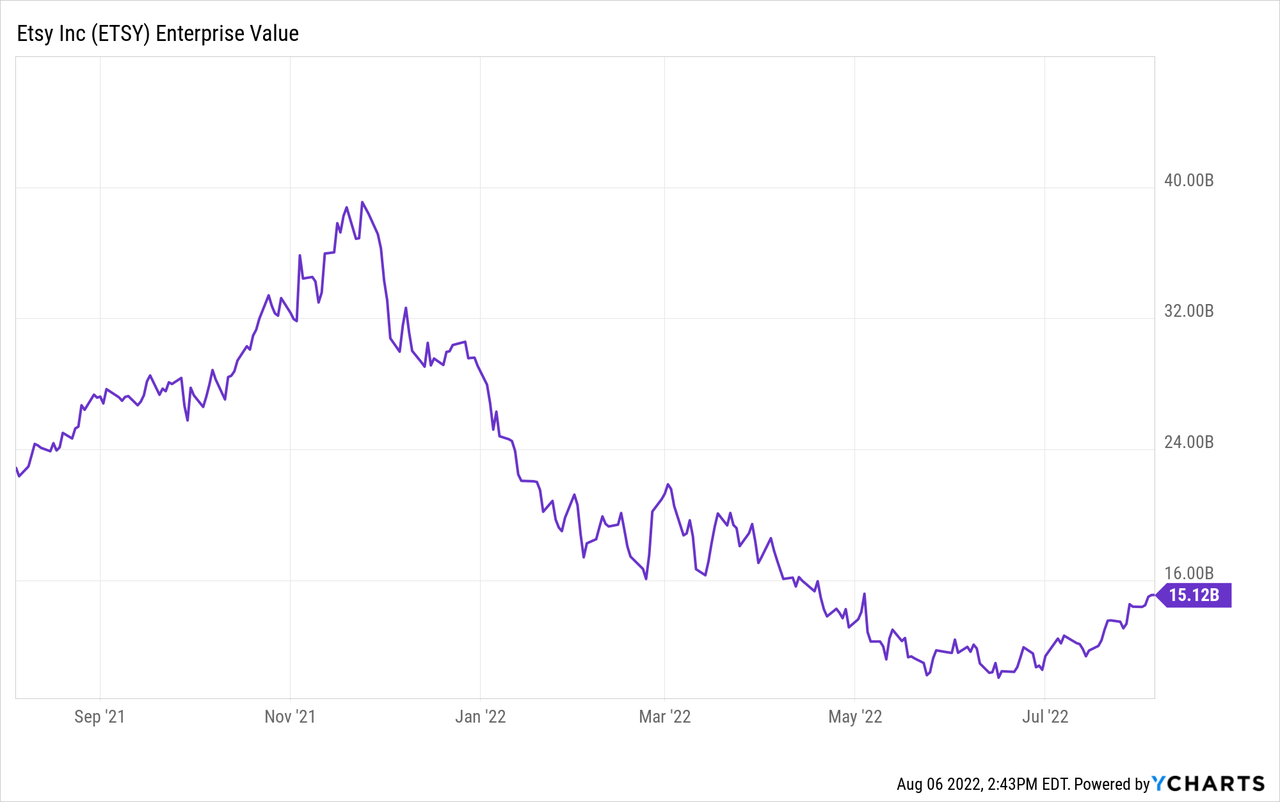

Etsy’s sharp decline in share price over the last year has significantly reduced the company’s Enterprise Value:

I not only believe that this steep decline deeply undervalues Etsy’s core marketplace but also the opportunity and potential for both Depop and Elo7 to create large value for Etsy shareholders. Both give Etsy footholds in new markets: ELO7 (South America) and Depop (Genz). The large tech collapse has taken no prisoners. Now it’s time to buy quality, through 2020 and 2021 investors didn’t necessarily need to do that to make money. Etsy is a high-quality business with a strong management team that has proven its ability to unlock value (introduction of Etsy ads, improving seller experiences, etc.).

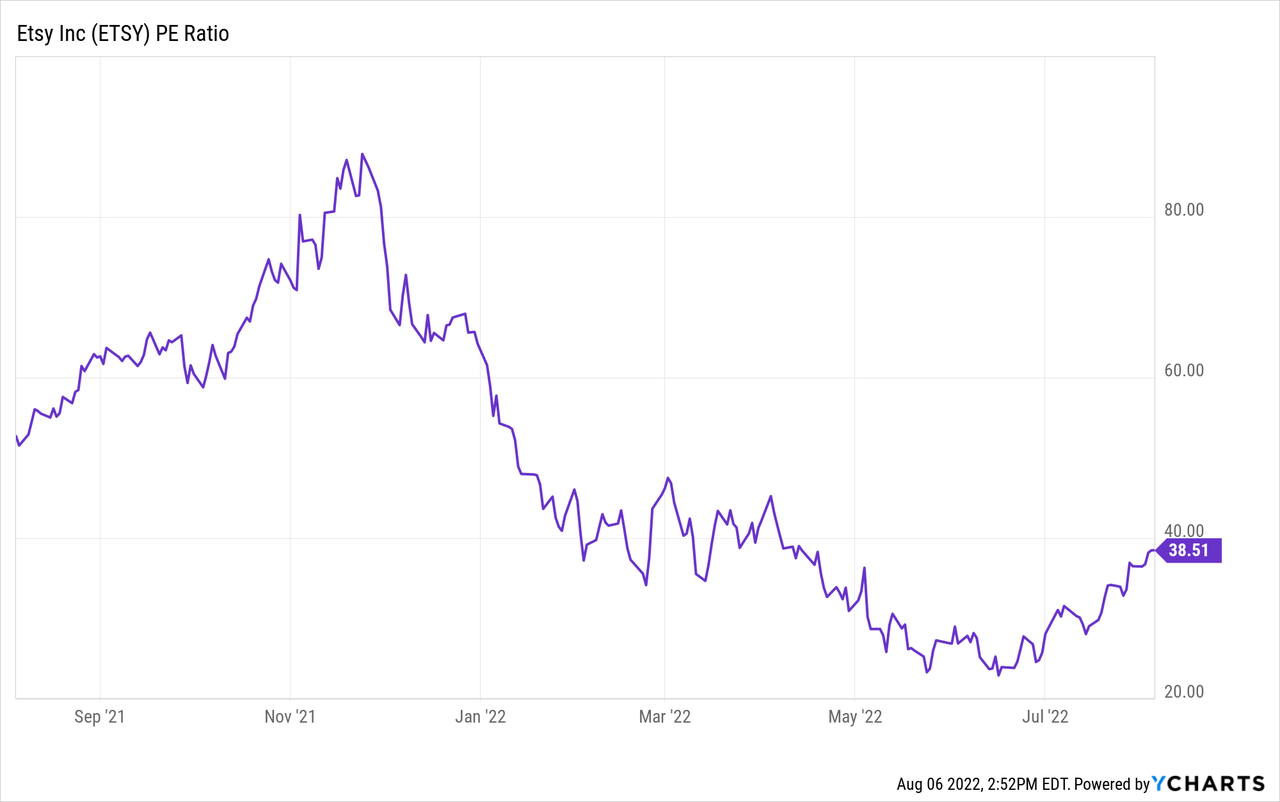

Etsy’s P/E is now trading just off three-year lows:

This is despite the gains Etsy has made as a result of the pandemic and the positive impact that has had on Etsy’s growth journey. Will Etsy continue to suffer through the current economic environment? Most likely yes. How the market will adjust prices to reflect that environment is anyone’s guess – the company is likely to trade in line with the rest of tech (this is what has occurred for the last few years). However, Etsy can and will get through this difficult period. Many of the enduring gains the company has made in building its brand – particularly over the last two years – will actually help the platform mitigate current and future turbulence. Etsy is well-diversified with over 40% of sales coming from non-US regions while habitual buyers (who make up 46% of sales) have continued to shop and support Etsy’s small sellers – the company has 8 million habitual buyers, only down 2% in comparison to the first quarter.

The Bottom Line

Etsy, like the rest of the e-commerce market, is suffering as it laps tough 2021 comps and battles through difficult economic circumstances. The share price has more than adjusted for this falling 65% from its peak, Etsy now trades near its lowest ever historical valuation. These conditions have provided a stern test for management who have reacted quickly to cut costs and raise fees, both actions could have had large repercussions, but in the end, actually demonstrated the strength of Etsy’s offering in this market. Etsy’s business has transformed throughout the pandemic, though the YTD share price performance would make it easy to forget that.

Etsy Marketplace Growth (Etsy IR )

Whilst short-term headwinds are still severe, the long-term growth potential of the e-commerce market is large and I believe Etsy, with its newfound strategy and differentiated e-commerce offering, is the best way to capture that growth in the long run.

Be the first to comment