Paul Zimmerman/Getty Images Entertainment

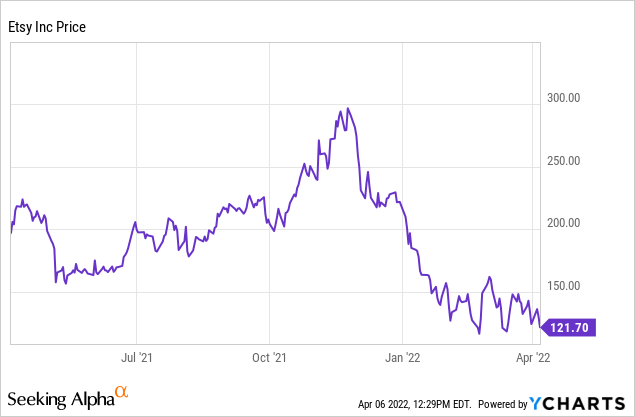

As markets continue to wobble at all-time highs, many tech and internet stocks have failed to make a full recovery after suffering a harrowing fall from heights. Some high-quality names, like Etsy (NASDAQ:ETSY), are still trading at a fraction of their former worth. And while I certainly agree that a correction was necessary, I think markets overreacted as usual and put Etsy in a very attractive buying position.

Since the start of the year, the arts-and-crafts site has lost 40% of its value, and relative to all-time highs above $300 notched last November, Etsy has seen its value drop by more than 60%. Another way of framing this is that Etsy has lost the lion’s share of the gains it has made since the pandemic began, even though the business has made tremendous structural improvements that have padded its growth and profitability.

Last December, when Etsy was trading north of $200, I issued a cautious neutral rating on the stock and advised investors to stay on the sidelines until prices cooled off more. Now, I truly do believe the valley has been reached and am bullish on the stock. It’s a great time to take advantage of the recent volatility to build a long-term position in this niche e-commerce play.

Among the more recent drivers of the bullish thesis for this stock are:

- Etsy is implementing a seller fee increase. In April, which will start impacting fiscal Q2 results, Etsy is planning on raising its seller fees from 5.0% to 6.5%. Note that even with this substantial hike, Etsy’s seller fees still are starkly lower than competitors like Amazon (AMZN) and eBay (EBAY). Fees vary by price level and category here, but a percentage fee in the low/mid-teens is not uncommon. So while Etsy fee increases have sparked seller ire in the past, it’s hard to complain when A) general inflation is pushing all prices higher, and B) competitor fees are still so much higher.

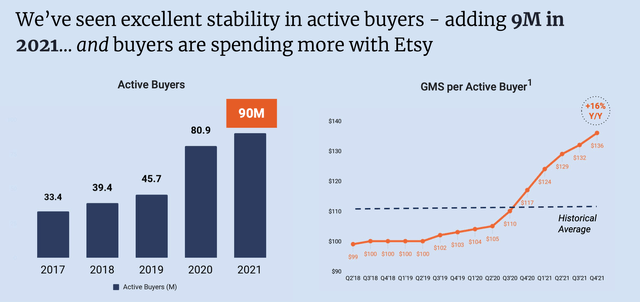

- Even after a banner period during the pandemic, Etsy continues to grow. Etsy added 9 million new buyers in 2021, and the average spend per buyer is also gliding upward. Even after exploding dramatically during the pandemic, Etsy is still finding ways to expand.

- Gradually expanding beyond the U.S. Etsy has made a strong push into Western Europe, and international GMS growth is indexing well above the total GMS growth rate for Etsy.

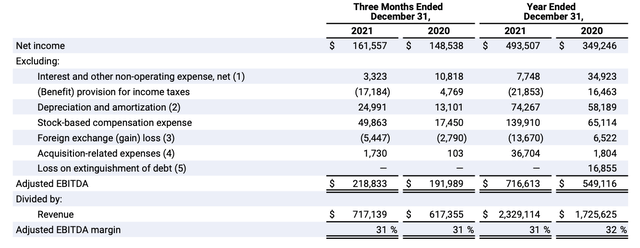

- Rich margin profile. Etsy has managed to produce adjusted EBITDA margins in the 30%+ range, which makes it quite a standout among tech stocks. Especially in the current “risk-off” environment in the markets, Etsy’s ability to generate such an enviable bottom line will give a floor to its sentiment and its stock price.

Etsy’s valuation, meanwhile, is at the most attractive levels seen in years. At current share prices near $122, Etsy trades at a market cap of $15.64 billion. After we net off the $1.04 billion of cash and $2.28 billion of debt on Etsy’s most recent balance sheet (a net debt position of $1.24 billion, which is reasonable against Etsy’s $0.7 billion annual adjusted EBITDA), the company’s resulting enterprise value is $16.89 billion.

Meanwhile, for the current fiscal year FY22, Wall Street analysts are expecting Etsy to generate $2.77 billion in revenue (data from Yahoo Finance), representing 20% y/y growth. I think there’s a good deal of conservatism in this forecast – if GMS continues to grow at a mid-teens pace while seller fees are being hiked 30%, a 20% y/y growth expectation is probably an easy target to beat.

Nevertheless, if we take Wall Street’s estimate at face value, the company’s resulting enterprise value is just 6.1x EV/FY22 revenue, versus a historical revenue multiple that usually clung to the 10-12x range.

To me, Etsy represents a perfect buying opportunity: appealing valuation, niche product that continues to draw in more buyers and GMS, revenue tailwinds from a fee increase, and a rich EBITDA profile. Take advantage of the dip as a well-timed buying opportunity.

Q4 download

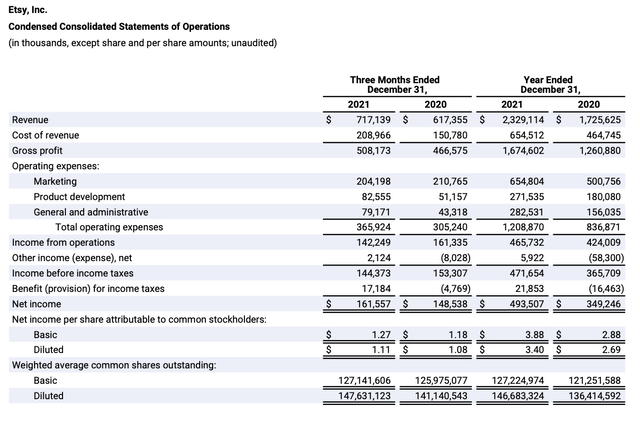

Let’s now go through the details of Etsy’s most recent Q4 results in greater detail. The Q4 earnings summary is shown below:

Etsy Q4 results (Etsy Q4 shareholder deck)

Etsy’s revenue in Q4 grew 16% y/y to $717.1 million, beating Wall Street’s expectations of $685.4 million (+11% y/y) by an impressive five-point margin. Revenue represented a two-point deceleration versus 18% y/y growth in Q3 – but never fear here, as fee increase revenue tailwinds should start kicking in Q2 of this year.

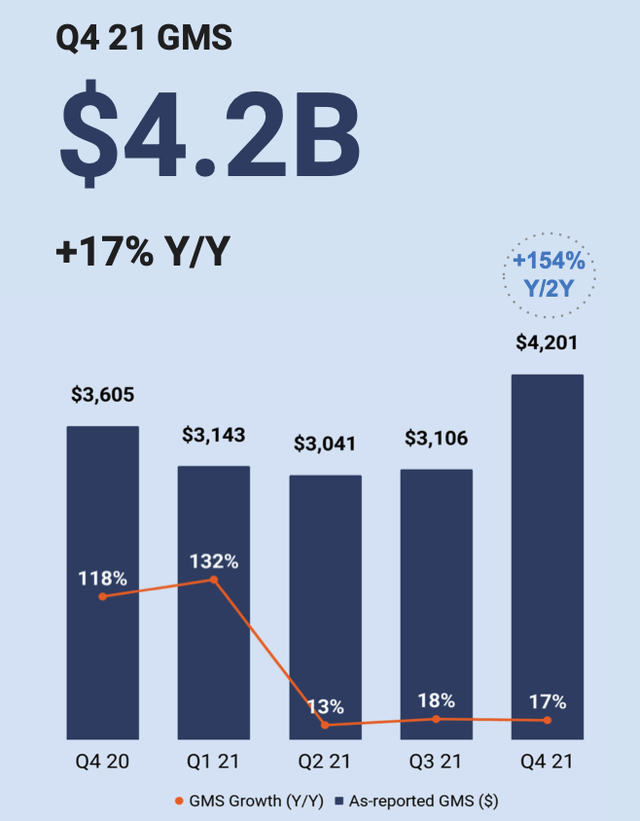

Etsy’s GMS (gross merchandise sales, which represents the dollar value of all the goods sold on the Etsy platform) also grew at a 17% y/y pace in the quarter, experiencing a nice holiday lift. Versus the pre-pandemic two-year ago compare, Etsy’s GMS is still up more than 2.5x. The company also reported strength during Black Friday, where average spend per buyer increased 8% y/y and the number of sellers participating in Black Friday grew 27% y/y.

Etsy GMS growth (Etsy Q4 shareholder deck)

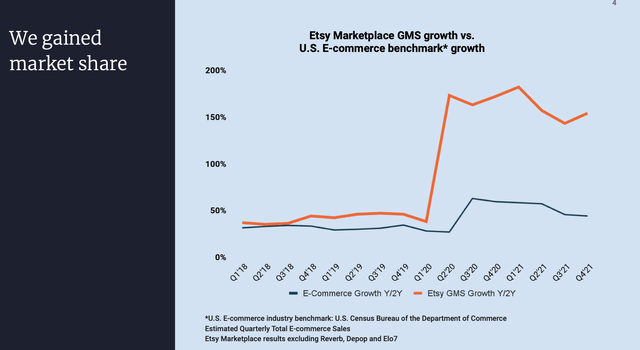

Another critical data point to recognize: Etsy has continued to see GMS growth far in excess of other e-commerce companies. The chart below shows two-year GMS growth: consistently since 2018, Etsy’s growth has towered over its competitors – indicating that even as a niche site, Etsy has managed to insert itself into a large and growing base.

Etsy market share gains, growth vs peers (Etsy Q4 shareholder deck)

Here’s some additional qualitative commentary on buyer trends from CEO Josh Silverman’s prepared remarks on the Q4 earnings call:

While 2021 was not the return to normalcy that many of us had hoped for, it did indeed offer greatly expanded options for consumers’ time and money compared with 2020, and many more places, online and off, where you could shop. Yet, Etsy continued to gain market share. In 2019, we laid out a long-term goal to outgrow e-commerce. And you can see that we have done that very substantially. And evidence is mounting through our cohort and brand data that these gains were not transitory. We believe that Etsy offers the world a true alternative to commoditize shopping, that buyers and sellers value this alternative, and we are in the early days of expanding our share of wallet. We grew that market share by bringing new buyers to the Etsy marketplace and encouraging our existing buyers to shop more frequently. […]

We reactivated nearly as many buyers in 2021 as we did in 2020, which is, in my view, simply remarkable. And while new buyer additions didn’t quite keep base with 2020’s spectacular level, new buyers still grew by 84% in 2021 when compared with the pre-pandemic level of 2019. And the pandemic cohort has been sticky. 53% of all active buyers who made a purchase on the Etsy marketplace in 2020 made another purchase in 2021, and 37% of new buyers in 2020 made a purchase in 2021.”

The chart of active buyers below also shows the robust growth in buyer counts in 2021, while average spend/GMS per buyer is also on an upward glidepath:

Etsy buyer trends (Etsy Q4 shareholder deck)

Lastly, Etsy has maintained its impressive profitability. In FY21, the company generated $716.6 million of adjusted EBITDA, up 31% y/y and representing a rich 31% adjusted EBITDA margin:

Etsy adjusted EBITDA (Etsy Q4 shareholder deck)

Key takeaways

Etsy continues to run a very popular marketplace which stands to see revenue growth accelerate next year, owing to an increase in seller fees (even though fees will still sit below industry benchmarks afterward). With ~20% y/y expected revenue growth and 30%+ adjusted EBITDA margins, Etsy’s current 6x forward revenue multiple is far undervalued – take advantage of the dip to buy.

Be the first to comment