SolStock

Thesis

Ethan Allen Interiors Inc. (NYSE:NYSE:ETD) is a retail stock that we believe is vastly undervalued by the market and is a stock that can provide dividend income growth for investors. The company is financially strong with a formidable brand moat. Based on dividend-based valuation model and historical/peer valuation comparisons, the company is undervalued and we believe there is at least a minimum of 60% upside once market conditions normalize. In addition, Ethan Allen’s management has proven to be capable of navigating the company through a deep economic shock like the COVID-19 pandemic and should be liquid enough to endure any further economic deterioration.

Company Overview

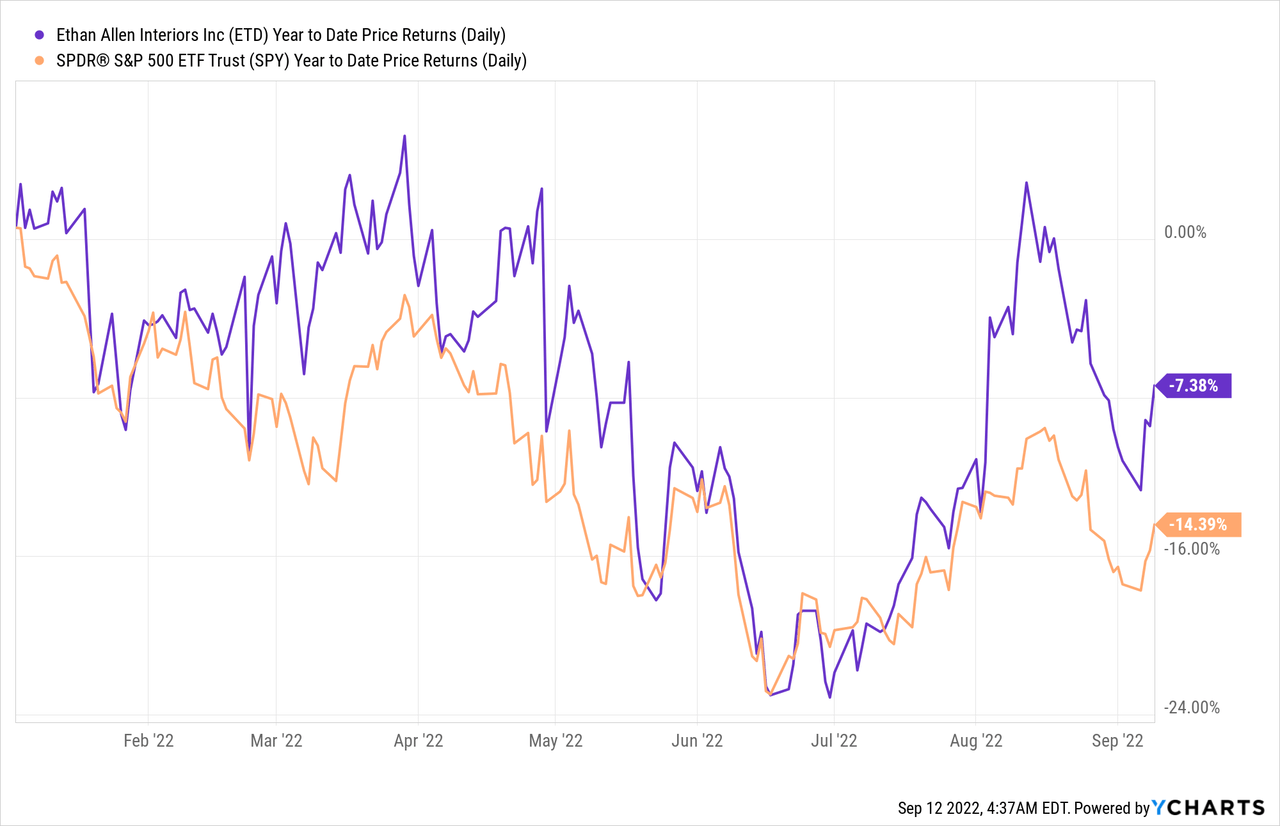

Ethan Allen Interiors Inc. is a U.S. interior design furniture company that manufactures and sells various interior design products, such as couches, beds, dining tables, and more. The company has more than 300 locations in the United States and abroad. Ethan Allen is well known for its timeless designs and the ability to customize its furnitures in its design centers. The company’s stock has outperformed the S&P 500 index so far this year, returning -7.38% compared to S&P 500’s return of -14.39% in the same time frame.

Strong Financial Performance

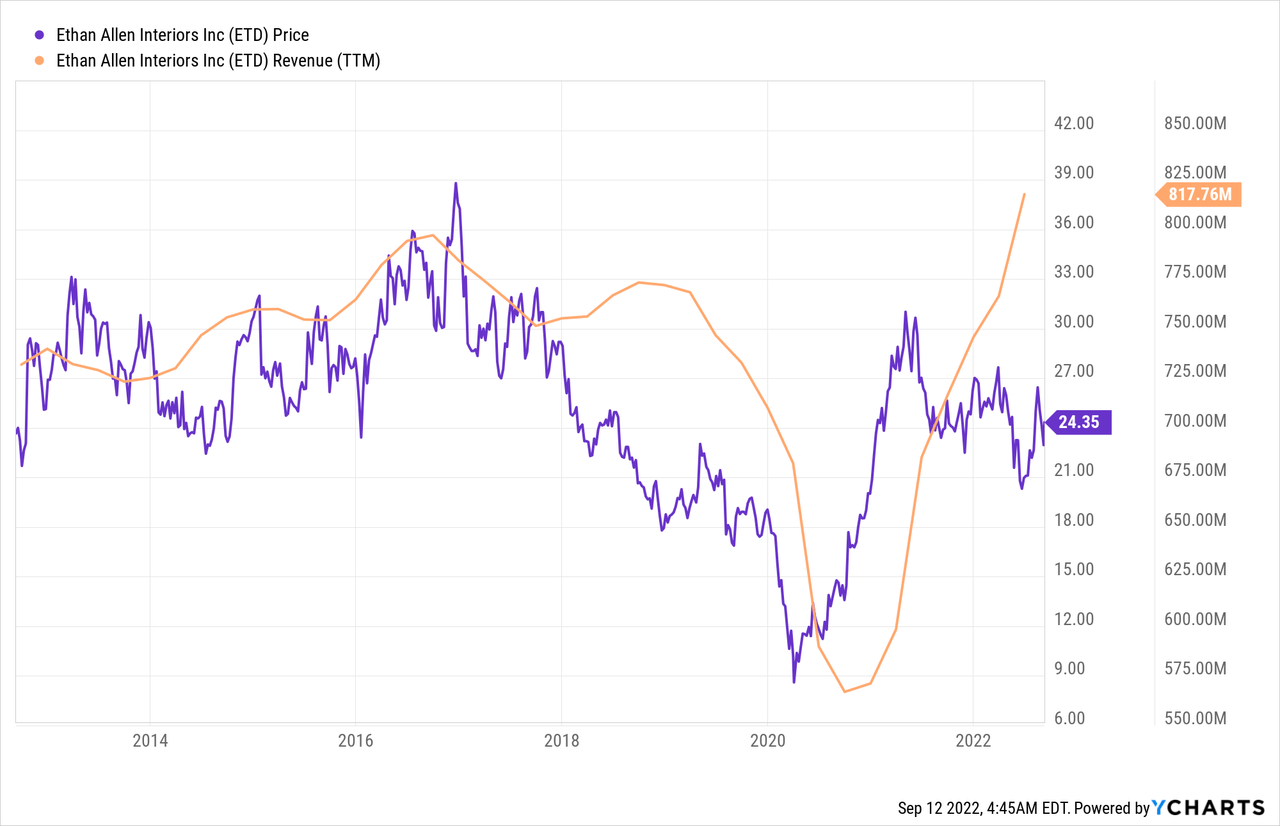

Ethan Allen is a widely known interior design brand and has won numerous awards to demonstrate its popularity and trust among consumers. For example, Lifestory Research declared Ethan Allen the “most trusted brand among people shopping furniture for their home” in 2022. Such titles put Ethan Allen well ahead of competitors, such as Williams-Sonoma (WSM), Restoration Hardware (RH), and IKEA. Recent quarter’s performance reflects Ethan Allen’s strong business moat as the company reported a quarterly sales YoY growth of 28.8% and a EPS YoY growth of 73.2%. Such strong quarterly performance has led management to declare an additional special cash dividend of $0.50 per share in addition to the regular quarterly cash dividend of $0.32 per share. Based on current levels, that translates to a dividend return of 3.3% just in the past quarter alone. We believe Ethan Allen’s 90-year brand history and consumer brand awareness serve as a strong moat that can continue to propel the company’s financial performance forward. As one can see below, except for pandemic-related years in which stores were shut down, the company’s revenue has generally trended upwards in the last 10 years, and Ethan Allen was able to exceed pre-pandemic revenues this year.

Valuation

We used a couple of valuation methods to determine whether the stock is undervalued or overvalued by the market. Based on either metric, we find that the company is considerably undervalued from an intrinsic valuation standpoint as well as based on historical valuation, and we believe that the current stock price presents an attractive opportunity for investors.

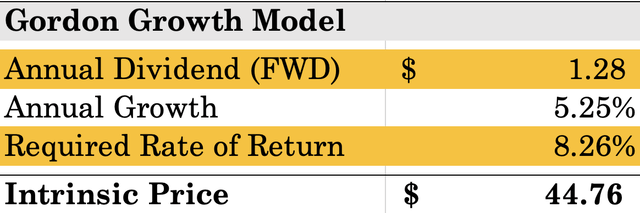

Gordon Growth Model

Excluding special cash dividends, the company current pays $0.32 per share in quarterly dividends. Annualized, the annual dividend amounts to $1.28 per share, which represents an annualized yield of 5.26%. That is more than 3 times S&P 500’s dividend yield of 1.69%. Using half of Ethan Allen’s 5 year dividend growth CAGR of 10.52% and a discount rate of 8.26%, the Gordon Growth Model has an intrinsic valuation at $44.76 per share, which represents a 83.8% upside from current levels. Given a low payout ratio of 29.26%, we believe that the dividend growth assumption is conservative and has the potential for higher dividend growth based on the company’s performance.

Sweet Minute Capital Valuation

Historical and Peer Valuation

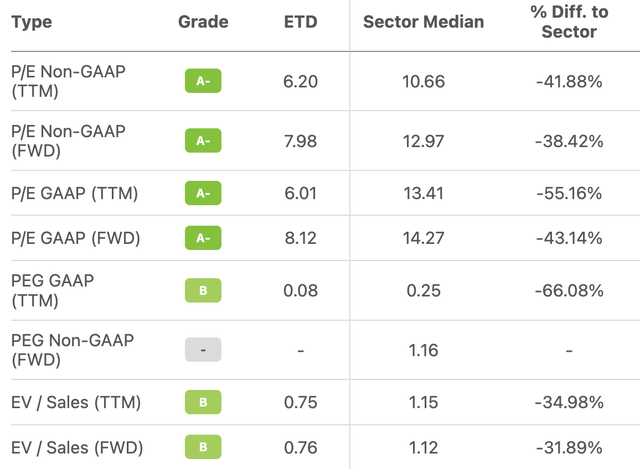

The company is currently valued well below the Sector median valuation multiples (i.e. P/E, PEG, EV/Sales, and etc.) as seen below. On certain metrics like PEG GAAP (TTM) valuation metric, Ethan Allen trades nearly -66.08% below current levels.

Seeking Alpha Valuation Metrics

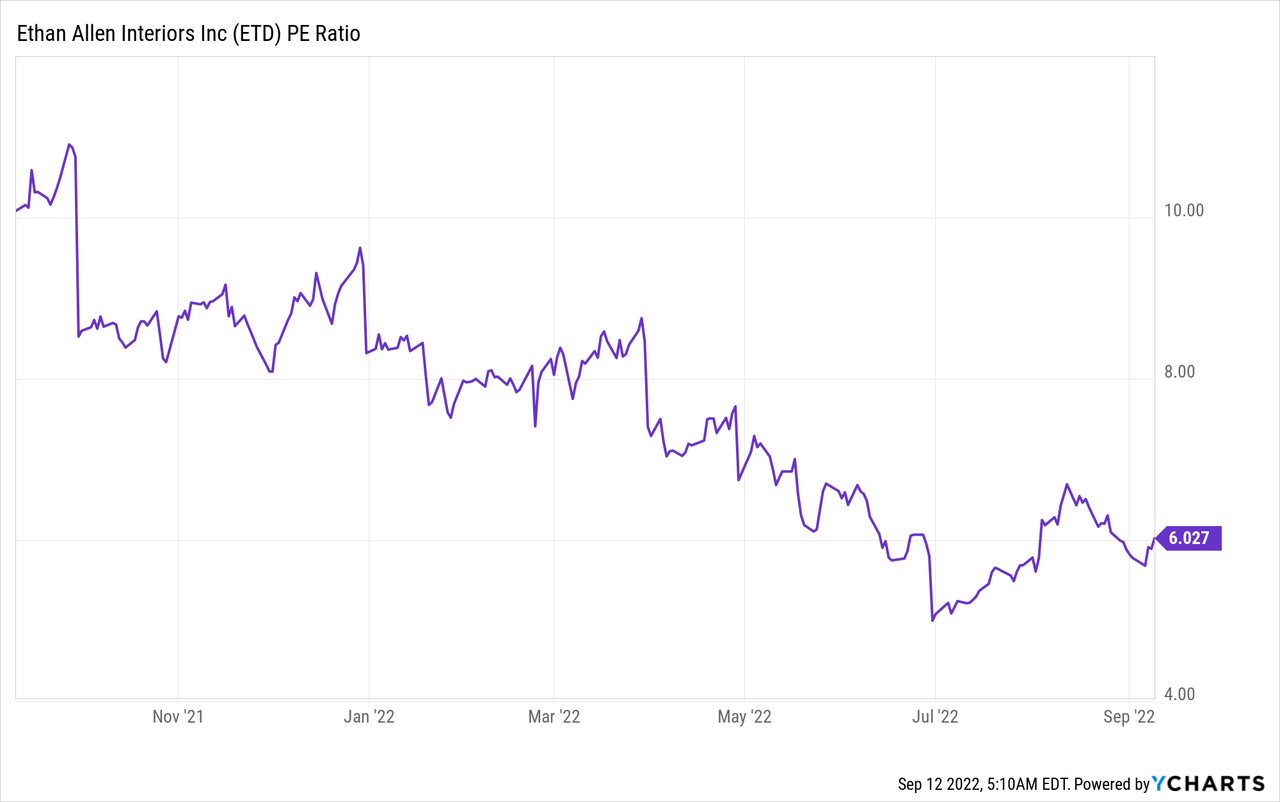

What is especially notable is that due to the market uncertainties, the company is trading at historical valuation lows. The company’s P/E ratio now hovers at ~6.0x though the company’s P/E ratio has ranged well in between ~10.0x to 20.0x in the last 10 years. Using the lower estimate of this range of 10.0x, based on the company’s TTM financial performance, we believe the company can well recover back to 10.0x P/E multiple, which presents a ~66% upside from current levels.

Risks

As a consumer discretionary company, the company is naturally exposed to the cyclical nature of the economy, especially among U.S. consumers. As the Federal Reserve raises rates and tightens monetary supply, there is an increased potential of a steep economic recession and decline in consumer spend. However, we believe Ethan Allen is well protected against these risks. First and foremost, Ethan Allen sells high priced interior design products with some furniture selling for more than $5,000. As a result, Ethan Allen caters more to high-income earners than other consumer discretionary brands such as IKEA. There are reports that compared to low-income households, higher-income households will fare better in an inflationary environment as they will have higher discretionary spend compared to low-income households. Furthermore, the pandemic-driven recession should provide some comfort to investors in Ethan Allen’s ability to navigate through unprecedented stoppage in consumer spending. Even as Ethan Allen’s revenue tanked in 2020 as a result of pandemic lockdowns, the company continued to pay out quarterly dividends, and the company has bounced back stronger in terms of financial performance. Furthermore, the company has nearly $110 million in cash (~16% of the market capitalization) as of last quarter, and we believe this should provide ample liquidity for the company to navigate through any steeper-than-expected recession.

Conclusion

Ethan Allen is an undervalued investment that we believe can provide ample dividend growth and value at the current price levels. The company presents a ~60% to ~80% upside based on intrinsic and historical valuation models, and the company has strong brand moats and balance sheet that can help the company navigate through potential economic turmoil. We believe Ethan Allen will make a great investment for long-term investors.

Be the first to comment