ljubaphoto/E+ via Getty Images

Investing based on environmental, social and governance (ESG) criteria is a rapidly growing market among asset managers around the world. Notably, the acronym dates only to 2005. Its freshness on the scene has led to varying interpretations of this relatively new concept. This complicates investment decisions for those who want to implement values-based investing.

Problems with the Definition of ESG

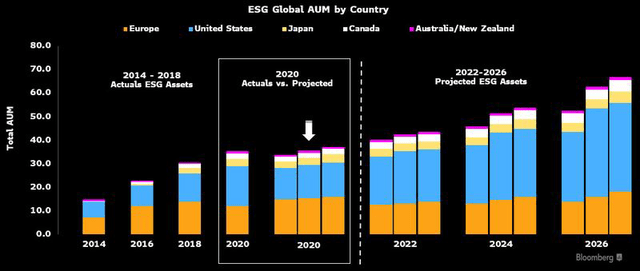

Estimating the scope of the ESG market remains difficult. Morningstar uses a rather stringent ESG definition and estimates ESG managed assets at about $2.7 trillion. Bloomberg Intelligence and GSIA both put the global ESG market for all ESG assets at around $40 trillion, and see it rising rapidly from here.

Despite its success in the marketplace, there is very little agreement on what constitutes “good” corporate behavior in the realm of sustainability, social justice, or governance. ESG itself is a slippery concept, without widely accepted definitions, criteria and metrics. The Wall Street Journal points out a simple example:

some might rank Shell highly on “E” because it has a plan to decarbonize its business, or poorly because it sells oil and plans to sell natural gas for years.

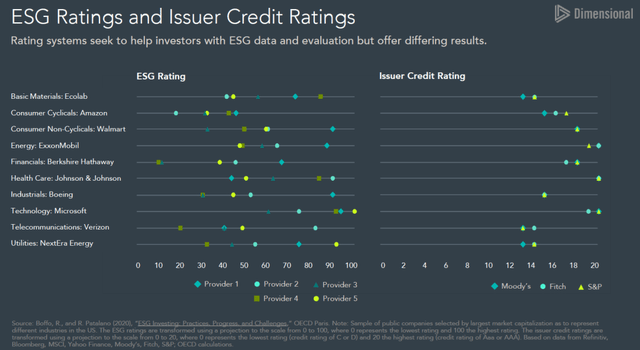

For now, venders have been allowed to define their own standards of ESG with predictable consequences. Even third party providers of ESG scores exhibit no concordance when evaluating the same companies. Dimensional Fund Advisors has surveyed bellwether companies across multiple industries and found that ESG ratings are all over the place. This discord stands in sharp contrast to the broad agreement among longer established credit rating systems. See the table below.

The randomness is not restricted to bellwether stocks. The Wall Street Journal reviewed pairwise correlations of the ESG ratings assigned by four different providers of ESG scores – MSCI, FTSE, Reuters, and Sustainalytics. For some context, a correlation of 0.0 would be a random scatter chart and ranking of 1.0 would equate to perfect correspondence. Pairwise correlations among credit rating agencies were around 0.8.

Pairwise correlations among the four ESG score providers more closely resemble a scatter chart as evidenced by consistently low correlations. Investors should keep this in mind before selecting a fund that relies on a 3rd party provider for insight.

| MSCI | Reuters | FTSE | Sustainalytics | |

| MSCI | 0.13 | 0.10 | 0.20 | |

| Reuters | 0.13 | 0.44 | 0.37 | |

| FTSE | 0.10 | 0.44 | 0.36 | |

| Sustainalytics | 0.20 | 0.37 | 0.36 |

The Rush to ESG

There’s money in ESG. Investors are willing to pay a premium for it. On an asset-weighted basis, investors in all active stock funds pay 0.67% for each dollar invested, and investors in ESG funds, 0.78%. The expense ratio for passive ESG funds, at 0.25%, is more than twice the average for all passive stock funds.

Indexed products have been capturing a rapidly growing market share. ESG is one of the few areas of active management that has witnessed inflows in the past few years. There was almost $70 billion in net inflows into sustainable US mutual funds and ETFs in 2021. That’s a 35% increase year-on-year.

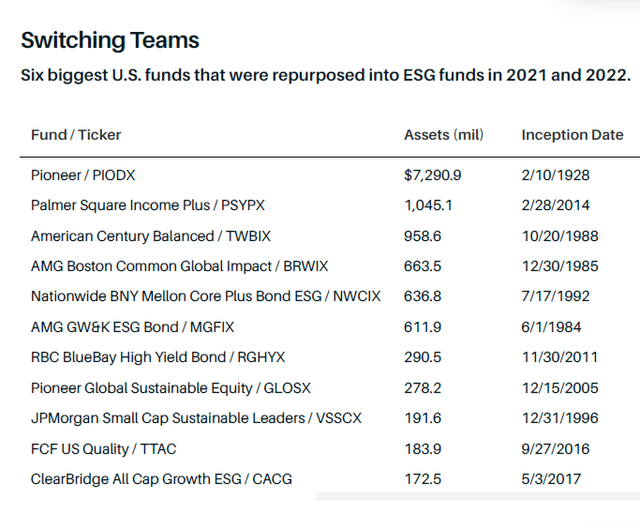

In fact, fund companies aren’t even investing in their own dedicated funds to carry the ESG banner. Why build from scratch? They are just renaming and repurposing existing product. As of March 31, there were 555 ESG open-end funds and ETFs, and since January 2019, 65 of those were repurposed from existing strategies, says Alyssa Stankiewicz, a research analyst at Morningstar. No surprise that most of the rebranded offerings were laggards. 40 of the 65 had experienced net outflows in the one year leading up to the strategy change.

Readers of my articles are probably aware that I’ve written a good deal about mutual fund companies closing or merging underperforming funds. It’s a subtle and clever marketing ploy to clean up the performance of a fund complex’s suite of offerings. A mutual fund company can run full page ads touting that 80% of their funds have beaten their 10-year Lipper averages … if they’ve closed or merged all their duds. Mutual fund “graveyards” are not merely anecdotal. Dimensional Fund Advisors estimates one half the equity mutual funds closed or merged in the 15 years ending in 2018.

It now appears that there is another marketing strategy available to fund venders. They can inject new life into their moribund product offerings by rebranding them as ESG investments.

Here’s a list of some of larger funds that have been rebranded in in the last 18 months. Note that the largest of the group, the Pioneer fund, has been operating since 1928. Who knew that it was investing sustainably all along?

Attempts to Standardize

Other players, not benefitting directly from ESG managing and licensing fees, are starting to take notice. Morningstar has begun to police its own ESG ratings. Earlier this year, the fund removed about 20% of the funds that had enjoyed an ESG tag within its database. That’s about 1200 listings.

Hortense Bioy, global head of sustainability research at Morningstar, told Bloomberg that sustainability tags were taken off “funds that say they consider ESG factors in the investment process, but that don’t integrate them in a determinative way for their investment selection.”

Bioy said funds that used “light or ambiguous ESG language” were targeted in the purge.

Governments are weighing in with regulations. The SEC has just issued a proposal on standardizing ESG funds. The proposal contemplates three types of ESG funds: integration, ESG-focused and impact investing and attaches parameters to each. So far, the SEC has left it to the individual funds to define their interpretation of ESG. Once defined, however, they will be held to account through disclosure requirements. Here are some examples from its 350-page proposal

- how an impact fund measures progress towards the specific impact, including KPIs (key performance indicators), the time horizon the fund uses to check for progress

- the fund must describe briefly how it engages with firms or votes its proxies on ESG issues.

- the fund should disclose the number or percentage of issuers with which the find held ESG engagement meetings and total number of ESG engagement meetings

- ESG focused funds that consider environmental factors have to disclose carbon footprints and weighted average carbon intensity (WACI) of their holdings.

Note that the SEC is still in the comment phase of this rule promulgation. It’s quite possible that the regulatory landscape will change in the following year. But don’t expect obvious clean choices when that happens.

American investors might draw a cautionary lesson from the European experience. They are a couple years ahead of the US in terms of standardization. In March 2021, regulators there began to implement the Sustainable Finance Disclosure Regulation (SFDR). The SFDR carves out two niches for ESG and subjects them to one of two governing rules, article 8 and 9. Article 8 funds can qualify with some handwaving. Hortense Bioy, director of sustainability research at Morningstar, said Article 8 funds ranged from climate-themed green to “very, very light green”, excluding just a few firms.

Morningstar analysis shows one in four Article 8 funds has exposure to companies involved in controversial weapons and one in five to tobacco. A third of Article 8 and 9 funds have more than a 5% exposure to fossil fuel firms.

Notably, the European market for sustainable investments contracted voluntarily by $2 trillion between 2018 and 2020 in anticipation of the implementation of these ESG rules. A massive amount of investment capital labelled as ESG didn’t even want to face a smell test.

Investment Takeaways

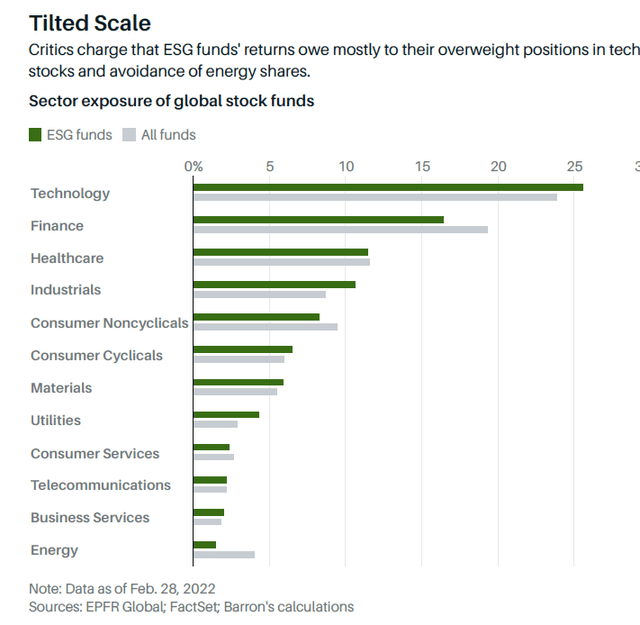

Most ESG funds have taken steps to reduce tracking error with broader established indicia. Stock inclusion criteria are typically structured so that the “best” actors among all industries are represented. There is typically a growth tilt to ESG portfolios as energy stocks are underrepresented while tech stocks are over weighted.

The larger ESG products tend to be little more than index funds. An analysis of the Vanguard ESG U.S. Stock ETF (ESGV) reveals a mild tech bias. About 20.8% of ESGV’s assets are invested in four tech stocks-Apple Inc., Microsoft Corp., Amazon.com Inc. and Alphabet Inc. By comparison, the S&P 500’s weighting in the four leading U.S. technology companies is 20.6%.

Here is some aggregated data.

There may be little tactical agreement on the ESG stock inclusion criteria but most of the larger fund offerings wind up with industry exposures pretty close to the Russell 3000 (RUA). It’s really hard to distinguish the merits of one fund’s selection criteria from another’s. In today’s market, investors can expect to pay more for funds labelled ESG with little expectation other than they will be somewhat biased to tech stocks.

The asset management industry is not transparent or consistent enough for an individual investor to make a strategic allocation to ESG. If someone wants to take a stand, the best option may be to do one’s own homework, at least until regulators impose some level of transparency and standardization in the industry.

Build from the bottom up. Find 3 to 5 individual stocks and make a small allocation to these names – perhaps allocate 1% to 2% of one’s portfolio to green companies. In time, regulators may create an environment where there is greater comfort in values-based investing.

Be the first to comment