swissmediavision/E+ via Getty Images

As my followers likely already know, small-cap ($1.2 billion) Energy Recovery (NASDAQ:ERII) serves the global desalination market with its patented PX pressure-exchange devices. PX devices are used in SWRO (salt-water reverse osmosis) facilities to reduce power requirements to save costs and lower emissions. ERII dominates the global market and with the growing shortages of potable water, the company’s future looks bright. Revenues are growing, margins are high, the company has no debt, and bookings continue to be strong. ERII looks attractive here and investors should take advantage of current market volatility and accumulate shares on dips.

Investment Thesis

As I mentioned in the bullets, the American Southwest is in the grips of a multi-decade long megadrought. Lakes Powell & Mead, the two largest freshwater reservoirs in the United States, are both at historic lows.

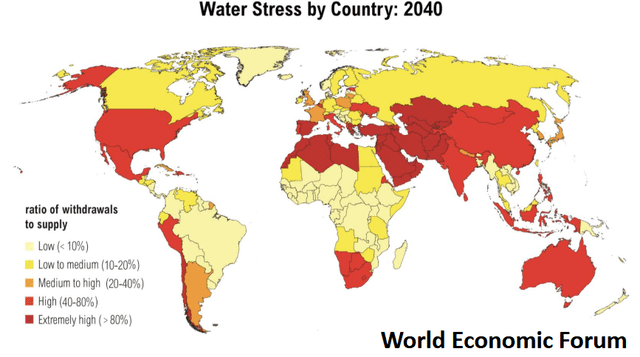

However, fresh water supplies are by no means confined to the United States. Global warming, population & economic growth, and pollution are all factors that are stressing-out potable water supplies across the planet. Indeed, the question isn’t so much as what country has or will have water supply problems, but what countries don’t. Indeed, the World Economic Forum’s forecast indicates that the majority of the world’s population will be under “High” or “Extremely High” risk of water stress by 2040:

Global Water Stress Map (World Economic Forum)

That being the case, investors should consider allocating some capital to those companies providing solutions. One way is through a diversified fund like the First Trust Water ETF (FIW). See my recent Seeking Alpha article FIW: Because Water Is More Essential Than Oil (or Data) on more information on that fund. The other way, of course, is by buying stock in individual companies – one like Energy Recovery. Today I’ll take a closer look at ERII and you can determine for yourself if the company deserves to be a position in your portfolio.

Portfolio

ERII has been trying to diversify its portfolio for years. Currently, the company is focusing on three primary business lines:

- Reverse Osmosis Desalination, or SWRO

- Industrial Wastewater Treatment

- CO2 Refrigeration

That said, the SWRO market has, still does, and will continue to dominant the company’s revenue stream. The Industrial Wastewater and CO2 refrigeration segments hold significant potential for growth, but are still in what I consider to be the “show me” stage.

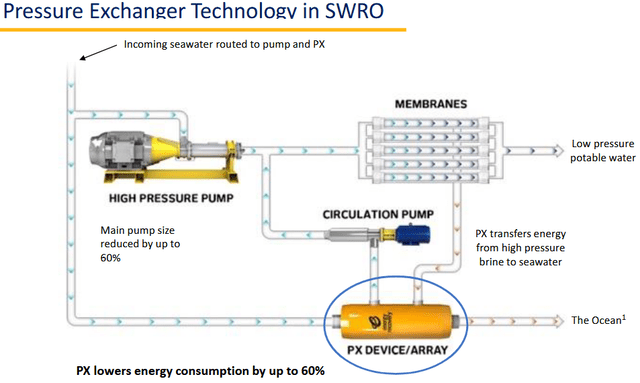

The block diagram below shows where and how ERII’s PX exchange devices fit in the SWRO process and reduce power consumption (by up to 60%) in a typical SWRO facility:

Salt-Water Reverse Osmosis (Energy Recovery)

It is that considerable reduction in power consumption – and the resulting reduction in emissions – that makes ERII a compelling investment proposition for its customers while at the same time polishing the company’s ESG credentials.

Earnings

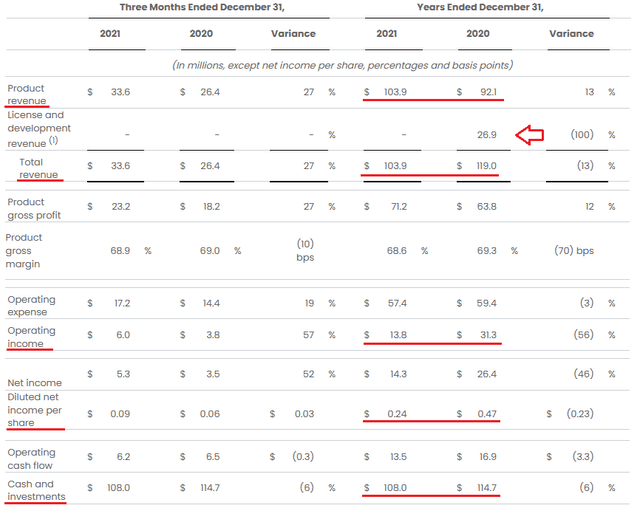

ERII 2021 Earnings (Energy Recovery)

As can be seen by the graphic above, despite the 13% yoy increase in product revenue, total revenue declined by 13% yoy due to the roll-off of ~$27 million in licensing revenue from the somewhat ill-fated Schlumberger (SLB) joint-venture exit. As I have been suggesting for many years now, that JV has yet to show any meaningful long-term follow thru in the shale fracking industry (I have covered that JV extensively in previous SA articles). And I doubt it ever will.

That being the case, FY21 EPS of only $0.24/share was ~50% lower on a yoy basis. Meantime, the company ended the year with $108 million in cash – $6.7 million lower from the end of FY20. However, note the cash balance would have been grown significantly higher had the company not bought back $23.35 million in shares during FY21.

Orders

As I have suggested for many years, despite all the various distractions to commercialize the Vor-Teq product in the fracking industry, SWRO continues to be ERII’s bread-n-butter. Orders keep rolling in, including these YTD contracts:

- In January, ~$25 million in contracts for SWRO Plants in Saudi Arabia. These orders are expected to ship by the end of Q1 FY22.

- In February, $885,000 in industrial wastewater contracts in Asia.

- In April, $20 million in SWRO contracts in the Middle East Gulf region.

In aggregate, the contract announcements YTD equate to ~$46 million, or ~44% of total product revenue last year.

While the two large contracts are “same old, same old” SWRO related revenue, the smaller one is much more interesting to me. This is a significant step in ERII’s goal to establish a new business vertical that has excellent growth potential going forward and, for the first time, offer shareholders true diversification away from what has been a one-trick pony (i.e. SWRO).

I say that because of the use-cases noted in the press release. The industrial wastewater operations include a lithium-carbonate based battery manufacturing facility in China and a textile wastewater treatment facility in India. Both of these use-cases show significant differentiation from the typical PX-device applications as compared in the SWRO global mega-product market. That said, both of these projects will utilize the PX-devices in the SWRO desalination portion of their industrial wastewater treatment operations.

Risks

Risks include all of the macro environment risks that most investors are already aware of: rising inflation, rising interest rates, Putin’s war-of-choice in Ukraine that has roiled global markets and resulted in strong economic sanctions on Russia by the U.S. and its Democratic allies. All of these factors could result in lower global economic growth and/or lower government spending on things like SWRO facilities.

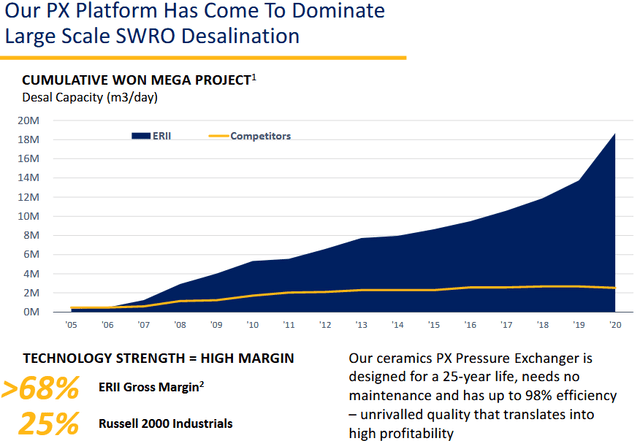

As always, a new company could come up with a better mouse trap. That said, ERII continues to dominant the SWRO market and I think this risk is relatively low:

Energy Recovery Market Share (Energy Recovery)

Note in the above graphic that ERII has been significantly stretching its lead in mega-project bookings over the last few years.

From a balance sheet perspective, ERII’s is pristine. The company has no debt and ended the year with $108 million in cash. That equates to an estimated $1.84/share based on the 58,723,000 fully diluted shares outstanding at the end of 2021 and bodes well for shareholders going forward.

Summary & Conclusion

Energy Recovery operates in a strategic and growing global market and – based on the macro environment of growing water stress – its prospects look very strong going forward. The company has no debt, plenty of cash, and checks all the relevant ESG boxes.

ERII is scheduled to report Q1 earnings on May the 4th. Year-over-year results are likely to look impressive. I say that because in Q1 of last year, total revenue was ~$21.5 million. That being the case, the January $25 million contract with Saudi Arabia reported above alone will out-strip last year’s results. The assumption here is that the company shipped all PX devices before the ended of the quarter (as the press release forecast) and received payment before quarter’s end. Note that a previous $21.9 million order placed last October may also contribute to Q1’s results.

Regardless, the prospects for ERII look bright considering YTD order flow and the potential for strong order growth through the remainder of the year. I rate ERII as an “Accumulate on Weakness”.

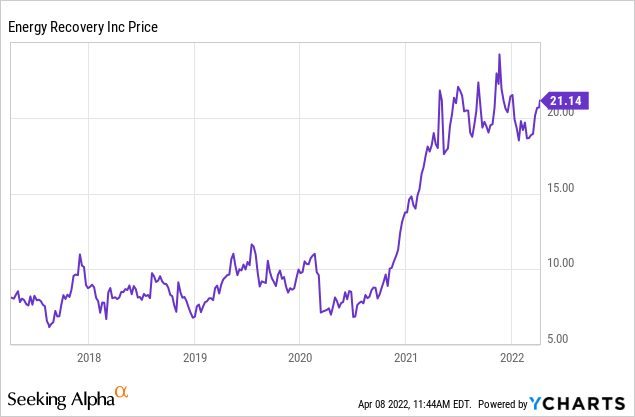

I’ll end with a 5-year price chart of the stock:

Be the first to comment