Marcus Lindstrom

The rise in long-term interest rates as the Federal Reserve has aggressively tightened policy to combat inflation has caused a significant sell-off in real estate stocks. While interest rates play a critical role in real estate valuations (as a significant portion of the purchase is typically debt financed), it is important to also remember that real estate can generate faster cash flow by raising rents, offsetting the headwind from higher rates. Shares of Equity Residential (NYSE:EQR) have been hammered in this sell-off, losing a quarter of their value over the past year, wiping out all of the gains registered over the past five years. Given strong rental market dynamics, I do think we are reaching an attractive entry point.

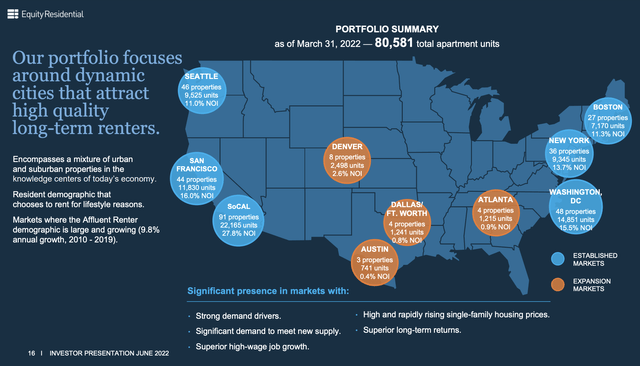

EQR is a large, diversified apartment real estate investment trust (REIT). The vast majority of its assets are in the Northeast and West Coast, though it is now growing in the sun belt. Ultimately, I do believe that the Sun Belt has better demographic trends, which is why Mid-America Apartments (MAA) is my favorite apartment REIT. Still, EQR runs high-quality assets that attract consumers who make about $166,000 on average, which has positioned itself well within these markets.

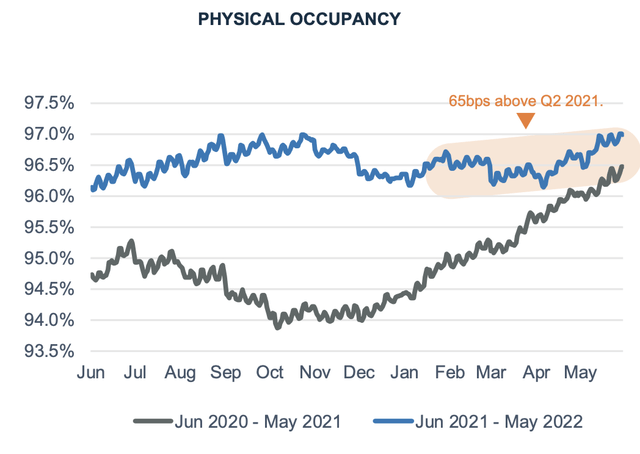

Indeed, as you can see, COVID lockdowns hit EQR’s portfolio hard, given its exposure to New York and San Francisco. Occupancy fell below 94% even as the company increased promotions and rental concession. However, occupancy recovered during 2021 and today sits very strong, at about 96.5%. Its geography is no longer the liability it once was.

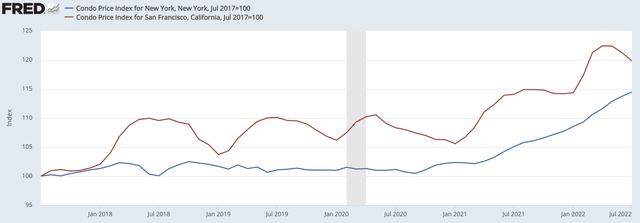

Even if one has concerns about its legacy-market exposure, it is interesting to note that New York and San Francisco condos have seen about 17% appreciation over the past five years. Conversely, EQR has lost its 5% of its value. Now, condos and apartments are not exactly the same asset, given one is bought and one is rented. But, this appears to be a meaningful dislocation, which I believe has been driven by equity investors rush to exit interest-rate sensitive company. The result is you can buy into EQR’s quality assets at a discount.

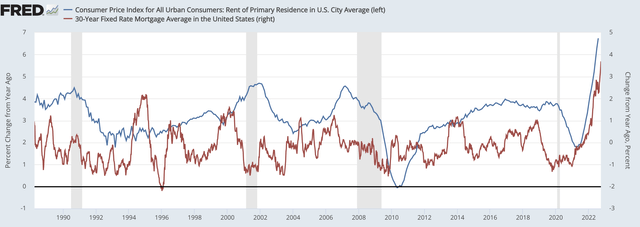

(Source: St. Louis Federal Reserve)

Beyond just asset valuation, it is important to emphasize EQR is performing well operationally and growing cash flow substantially. In the company’s second quarter, normalized funds from operations (FFO) rose by 24% to $0.89. FFO is critical to focus on as these funds are used to pay dividends.

During Q2, same-store revenue rose by 13.6% while expenses rose a much more modest 3.1%, creating significant margin expansion, which is why net operating income rose 19.1%. Occupancy remains very strong, holding at about 96.5%, and on new leases, EQR is getting 19.2% rental increases while renewals are posting 11.2% gains. We have seen a significant surge in rental rates, and this is flowing down to the bottom line.

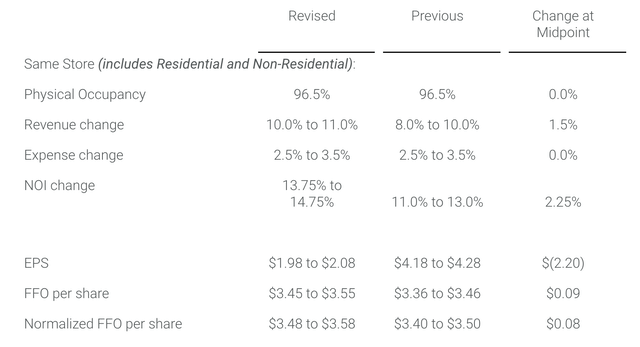

As a result, the company was able to raise guidance materially with revenue expected to increase by about 10.5% from 9% previously. This was due to an increase in management’s rental growth assumption while costs have held steady. Consequently, FFO per share could come in around $3.50.

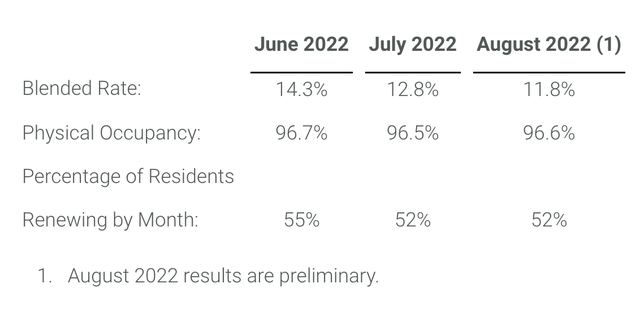

I see further upside to this guidance when EQR reports third quarter results. This is because of the company’s August operational update. Given August is the seasonal peak of the rental market, it was encouraging that the company said it expected same-store revenue growth to exceed the midpoint of guidance given just weeks earlier. Rental growth continues to run double-digits. While the August rate of 11.8% was slower than July’s 12.8%, it is important to remember that rents rose extremely sharply in mid-2021. As these prints fall out of the YoY comparison, there is a natural slowing that will occur.

EQR is seeing cash flow rise substantially as it passes on significant rental increase. One concern may be that these rental increases have already happen, but will they be sustained into the future? While double-digit rental growth cannot continue forever, the rental market dynamics are structurally quite favorable, leading to likely mid-single digit rental increases for several years.

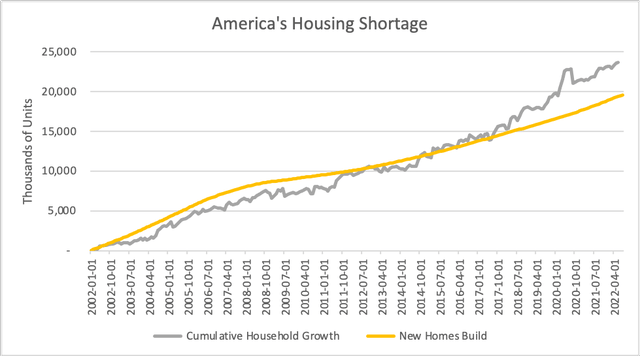

Ultimately, America just has too few housing units. Over the past 20 years, we have built about 20 million homes, but we have created about 23 million new households. Because everyone needs to live somewhere, this underbuilding has created significant upward pricing pressure, both in terms of home prices and rental rates. A shortage this large will take years to work through. Moreover, the extent to which Fed tightening causes construction activity to decline will only prolong this shortage. That just leaves landlords like EQR with more pricing power.

St. Louis Federal Reserve, my own calculation

We have also seen a significant rise in mortgage rates this year towards 7%. This will put homeownership out of reach for some, pushing them back into the rental market. Indeed, the mortgage rate increases in 1999, 2004, and 2021, foreshadowed subsequent increases in the pace of rental inflation.

St. Louis Federal Reserve

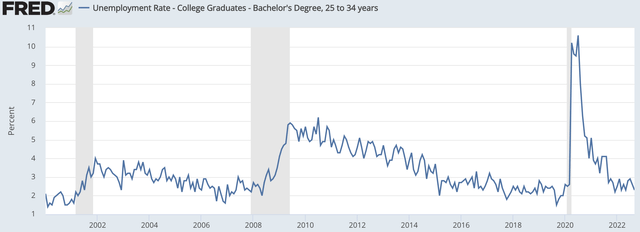

Finally, if you are worried about the economy rolling over more significantly, EQR is well positioned for this. Its average renter is 32 with a college degree and $166,000 income. Individuals in this cohort typically have more stable employment. During the financial crisis, their unemployment peak at 6% while the national rate reached 10%, and today it is a stellar 2%. It also rose less during the COVID crisis. They are not entirely immune to an economic downturn, but this is a relatively resilient consumer to target.

Today, shares yield nearly 4%, and over the past five years it has grown its dividend by about 4.2%. That dividend growth came even as the business faced its challenges from COVID. With rental rates remaining strong, I am looking for normalized FFO to come in at the high side of guidance or about $3.55 this year. That is about a 70% payout ratio, providing room for the dividend to rise alongside cash flow growth.

With mid-single digit rental growth likely to persist given the market dynamics, I am expecting EQR to grow FFO per share 6-9% over the next several years, given its ability to control expenses and largely fixed rate debt. That provides the opportunity to increase the pace of dividend growth and creates a total return potential of low double-digits over the next three years. Combining this cash flow outlook with the fact its shares have underperformed major-market condos by nearly 20%, I think the stock is a buy in the low $60s. I would be a buyer until at least a 3.5% yield or about $72, pointing to about 15% of upside.

Be the first to comment