Joe Raedle/Getty Images News

Equity Residential (NYSE:EQR) is a REIT and S&P 500 component that is focused on the rental of high-quality residential properties located in dynamic cities that attract affluent long-term renters. The company has interests in over 300 properties consisting of approximately 80K apartment units, with an established presence in key markets, such as Boston and New York, as well as an expanding presence in growth markets, such as Denver and Atlanta.

Exposure to some of the largest cities in the U.S. provides EQR with a pool of large and diverse industries and businesses that attract and create high-quality jobs that are often focused on the knowledge-based economy. These jobs result in a significant presence of renters that work in the highest-earning sectors of the economy and who are not overly burdened by their rental payments. This enables EQR to consistently increase rents with little pushback.

Another draw to EQR’s properties is their proximity to entertainment venues, universities, cultural and outdoor amenities, and public transit or highway access. These conveniences are of particular draw to younger populations, such as Millennials. Furthermore, this group tends to remain renters longer due to various societal trends, such as delays in marriage and having children, in addition to lower capacity for home ownership. These trends have been and will continue to be favorable tailwinds for EQR.

EQR’s success has rewarded long-time shareholders with market-beating returns, in addition to a growing dividend, which has grown at a CAGR of 6.4% from 2011-2022 and is currently yielding over 3.5% at current pricing. Supported by respectable rental growth and a solid balance sheet, EQR offers upside of approximately 15%. With shares down about 25% YTD, the stock offers an attractive entry point for long-term focused investors.

Earnings Review and Other Reportable Events

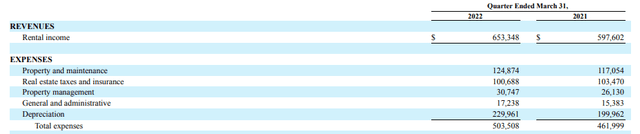

In the most recent filing period ended March 31, 2022, EQR reported total rental revenues of +$653M, which was up about 9% from the same period last year but about +$4.5M short of expectations, due primarily to higher than expected delinquencies in Southern California.

Still, the company reported strong same-store revenue growth of 7.8% due to strong occupancy and pricing power on leasing rates. Additionally, same-store turnover came in at the lowest level in the company’s history at 8.7%. These strengths contributed to a 26.7% increase in EPS and a 13.2% increase in normalized FFO/share during the quarter.

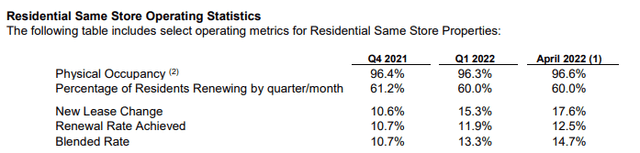

For the quarter, occupancy stood at 96.3%, which was up about 140 basis points from 2021. That rose to 96.6% on the day of release and even further to 96.9% in May. The increasing trend reaffirms the desirability of EQR’s properties to a population that is increasingly being priced out of home ownership. Further evidence is reflected in the company’s renewal activity, which came in at 11.9% for the quarter and continued strong into record levels in April of 12.5%.

Q1FY22 Earnings Release – Same Store Operating Statistics

In individual markets, New York continues to be the best performing market for EQR, with same-store revenue growth of 13.6% and 96.9% occupancy for the quarter. Robust demand is resulting in 60% of their residents renewing. While it is about 5% lower than renewal rates at the beginning of the year, the company is still able to re-lease the space to new residents at even higher rates. Looking ahead for the remainder of the year, the market is expected to be the best performer among the company’s operating regions.

EQR is also benefitting from favorable return-to-work trends and increased job postings, especially in the West Coast. The hybrid arrangements being adopted by many companies are forcing most employees to maintain some presence in the region, despite their desire to live elsewhere. Given the trade-offs, the preferences of many of these employees are rentals as opposed to outright purchases.

One drag on the current period’s results was higher than expected delinquencies in Southern California due to some tenants declining to pay rent and applying for state rental relief funds instead. In prior quarters, these same tenants were good payers and never had issues. With the relief period lapsing at the end of March, the company isn’t expecting additional issues moving forward, and they intend on working with the affected residents, numbering about 300, to resolve their concerns.

Aside from the delinquencies, the market environment in Southern California appears favorable, with home prices out of reach for many residents, forcing many into rentals. Additionally, occupancy in Los Angeles stood at 97%, with demand soaring from the entertainment content industry. Strong demand in the region is in turn resulting in some of the highest renewal rates in the company’s history.

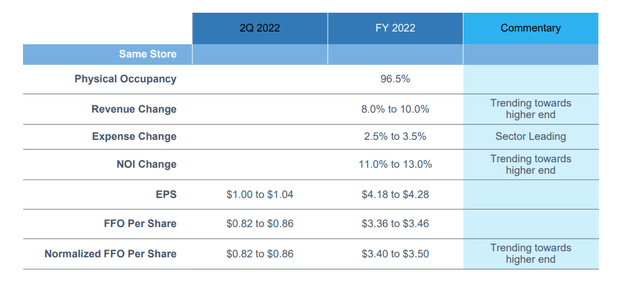

Looking ahead, EQR largely maintained guidance for the remainder of the year, which disappointed some investors, given the hikes provided by two of their peers. Still, results appear on track for a strong finish, with revenues, NOI, and normalized FFO trending towards the high end and expenses on track for sector-leading performance.

June 2022 Investor Presentation – Full-Year Guidance Update

The Fundamentals

As of March 31, 2022, EQR had total assets of +$20.8B, consisting principally of net investments in real estate of +$19.9B, and total liabilities of +$9.3B, which included net mortgages of +$2.2B and net notes of +$5.8B. As a multiple of EBITDAre, net debt was most recently 5.38x, which is a modest improvement from the 5.61x reported at the end of December.

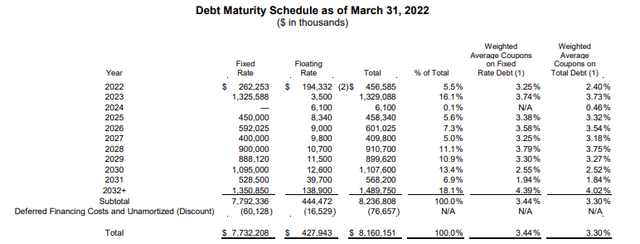

At a weighted average maturity of 8.1 years, most of EQR’s debt is due in later periods and has the benefit of being primarily fixed-rate, which insulates the company from the current environment of rising rates. The company does, however, have +$1.3B due in 2023.

Q1FY22 Earnings Supplement – Summary of Debt Maturities

A low degree of leverage and readily available access to debt markets affords EQR with viable options for refinancing the debt due in 2023. With just 5% floating rate debt on the books at present, EQR would benefit from the hedge of refinancing at floating rates upon maturity. Additionally, the company also has +$2.2B in readily available liquidity. Given the longer-term nature of their remaining debt, there is minimal repayment risk at present or for the foreseeable future.

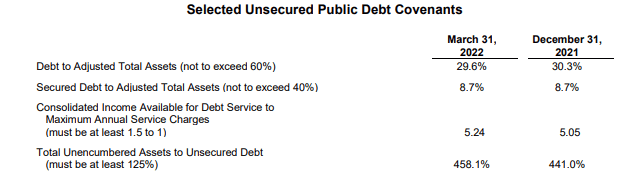

Further support of EQR’s adequate debt coverage is evidenced by their strong compliance with their existing debt covenants. Consolidated income available for debt service, for example, is 5.24x, which is more than the amount reported at the end of December and significantly greater than the requirement of 1-1.5x. Continued strength in this metric will ensure EQR is able to readily meet their servicing requirements prior to debt maturity.

Q1FY22 Earnings Supplement – Summary of Debt Covenant Compliance

In the current period, excluding depreciation, total expenses were up about 4.4%, but revenues were up 9.3% due to strong demand in their markets and strong pricing power. Continued strength in leasing spreads and occupancy paired with declining delinquencies will support further revenue growth in subsequent periods. A capable management team with an ability to navigate through an unfavorable cost environment further increases confidence of continued earnings growth.

Q1FY22 Form 10-Q – Partial Income Statement

Solid cash flow generation provides additional support to the company’s fundamentals. In Q1, EQR generated +$368M in operating cash flows and had +$171M left over after accounting for their investing activities. For income-focused investors, EQR provides an annual dividend of $2.50/share that is fully covered by operating cash flows and is about 81% of normalized FFO. With a long history of growth, the payout has proved durable to investors who depend on the income.

Conclusion

EQR is a leading owner and operator of residential properties in key urban environments around the U.S. Their exposure to high-income residents with jobs offering continued wage growth provides the company with the power to raise rents without significant pushback. In the current period, for example, rent as a percentage of total resident income stood at about 20%, despite double-digit rent growth.

Expanding loss-to-lease figures also puts the company in a great position to capture additional growth through 2022 and beyond. In May, the net effective loss-to-lease was approximately 13.5%, up from 11.1% in April. While this is lower than peers, AvalonBay Communities, Inc. (AVB) and Essex Property Trust, Inc. (ESS), the double-digit rate was still better than company expectations.

At present, EQR is trading at 20x forward FFO and near their 52-week lows. Robust demand, strong pricing power, and industry resilience are a few catalysts that are likely to propel the stock higher in the months ahead. Utilization of a standard dividend growth model with a 4.5% dividend growth rate and a discount rate of about 7.6% yields an approximate share value of $80.

In addition to an upside of approximately 15%, an investment in EQR provides a steady stream of reliable dividend payments, which have grown at a CAGR of 6.4% since 2011 and appear safe for the foreseeable future, supported by the company’s strong balance sheet and earnings potential. For long-term focused investors seeking rental exposure to quality urban markets, EQR is one REIT poised to deliver a sustainable rate of return on any diversified portfolio.

Be the first to comment