JamesBrey

Introduction

Markets are in turmoil. Economic growth is slowing – inflation is not. The Fed is aggressively hiking to control the latter, pressuring economic growth even more. Mortgage rates are up while housing inventory is still low. As a result, affordability has gone down the drain. It’s an extremely tricky market environment, which is hurting even defensive investments. Among them is one of my all-time favorite REITs: Equity LifeStyle Properties (NYSE:ELS). While I am not a big fan of REITs, in general, due to my focus on dividend growth over a high yield, I love the company behind the ELS ticker.

While this sell-off isn’t fun, it is opening up new opportunities. ELS is now yielding close to 3%. That may not be a lot to people buying yields higher than 5%. However, it comes with high dividend growth backed by impressive financials. Especially now, ELS benefits from the fact that it offers affordable alternatives to potential homebuyers and renters.

Moreover, its balance sheet protects investors against the ongoing high-rate environment. This makes the valuation more attractive.

In this article, I will explain why ELS is on my watchlist, as I’m looking to make the company a part of my long-term dividend growth portfolio.

So, let’s get to it!

The Housing Market Is A Mess

On September 21, I wrote an article highlighting the issues of the US housing market.

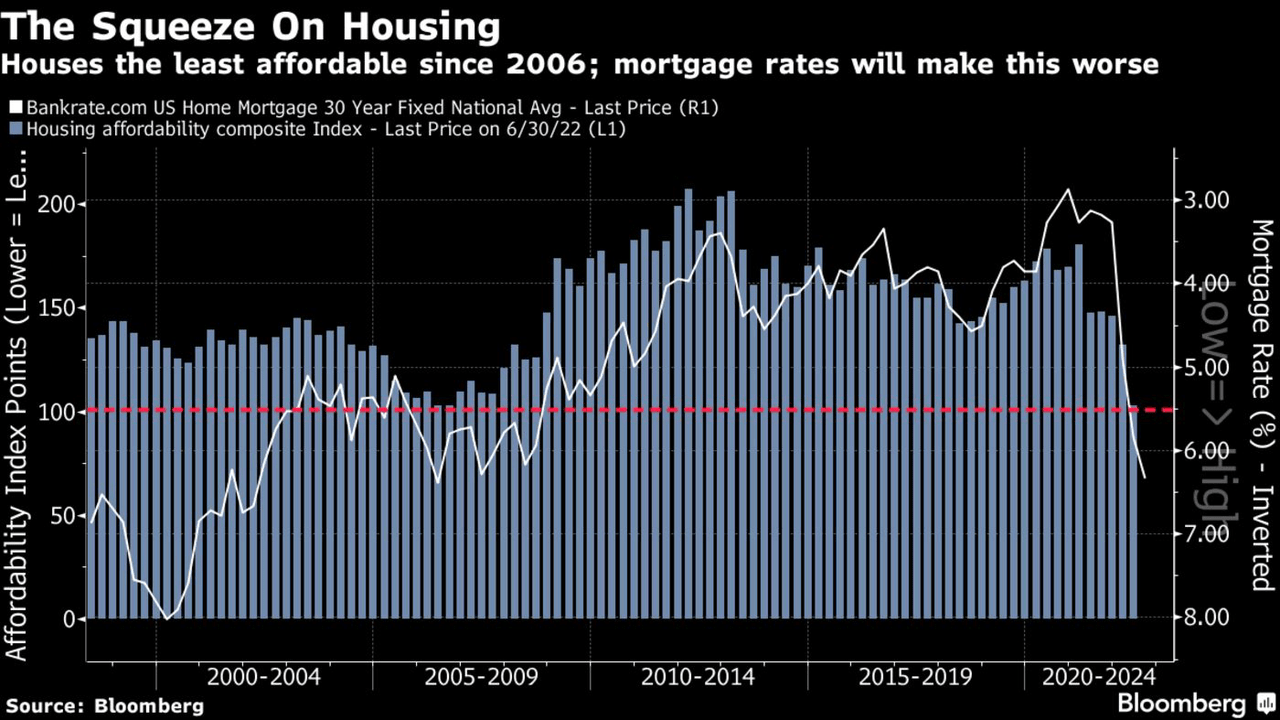

To give you a summary, rising rates are hurting demand. Homebuilder sentiment fell to its lowest level since 2013 when the housing recovery was still young. Rising mortgage rates have done a number on affordability.

Bloomberg

The worst part is that we’re now encountering financial risks.

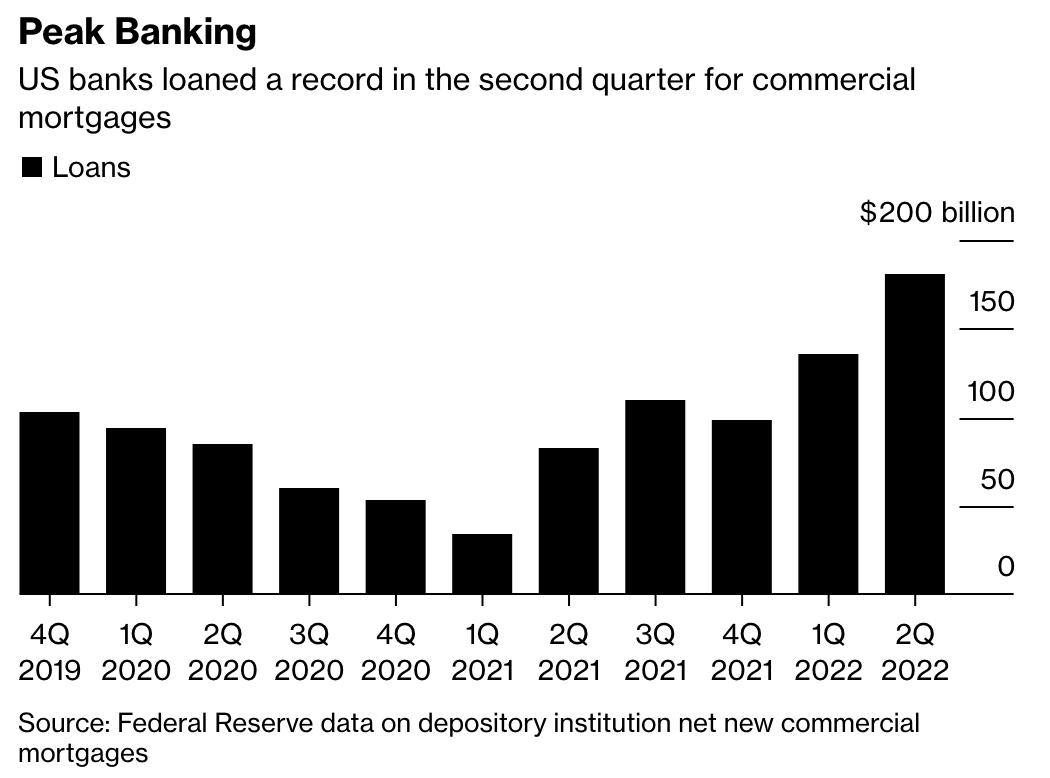

In the first six months through June, US-regulated banks financed a record $316 million of new commercial real estate loans. That’s a 172% increase versus the same period in 2021. Higher rates were the main driver behind this increase. The graph below shows this steep increase.

Bloomberg

Now, the tide is turning. According to Bloomberg, the biggest banks are now expected to reduce lending by 50% in the second half – compared to the first half.

That pullback is partially due to weaker client demand, as well as concerns about the surge in interest rates. In some cases, heightened regulatory oversight has played a role.

“A couple of the big money-center banks have been asked to pull back from their commercial real estate lending, specifically on office,” Brock Cannon, head of national loan sales for Newmark Group Inc., a commercial real estate brokerage. “The government is trying to get their arms around everything to see how impactful this is going to be; how severe will the losses be.”

Especially the last sentence is key. The government will need to see how severe the potential losses are. After all, hurting demand to pressure inflation comes with significant risks. Breaking the housing market will get inflation down, but at what cost?

The thing, however, is that this market is “weird“.

The problem is we’re in uncharted territory. Yes, mortgage rates have shot up, crimping affordability. But at the same time, unlike in the era prior to 2008 and the bursting of the subprime mortgage bubble, there are very few forced sellers and therefore very little inventory.

Homeowners looking to move aren’t selling because buying a new home would likely mean getting a new mortgage. At current rates, that’s just not attractive.

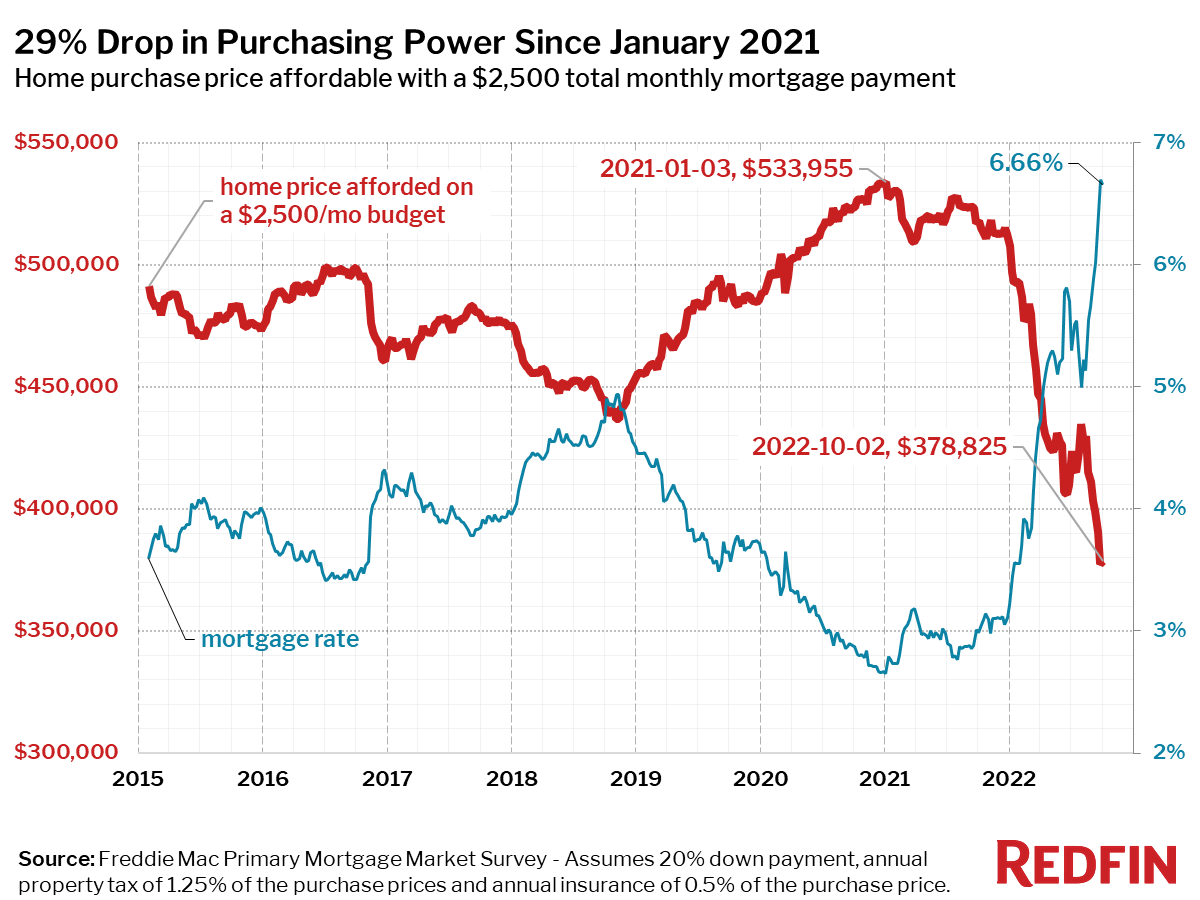

According to the latest Redfin numbers, the average mortgage with a rate of 6.66%, will allow purchasing a home priced close to $380 thousand. That’s a multi-decade low.

Redfin

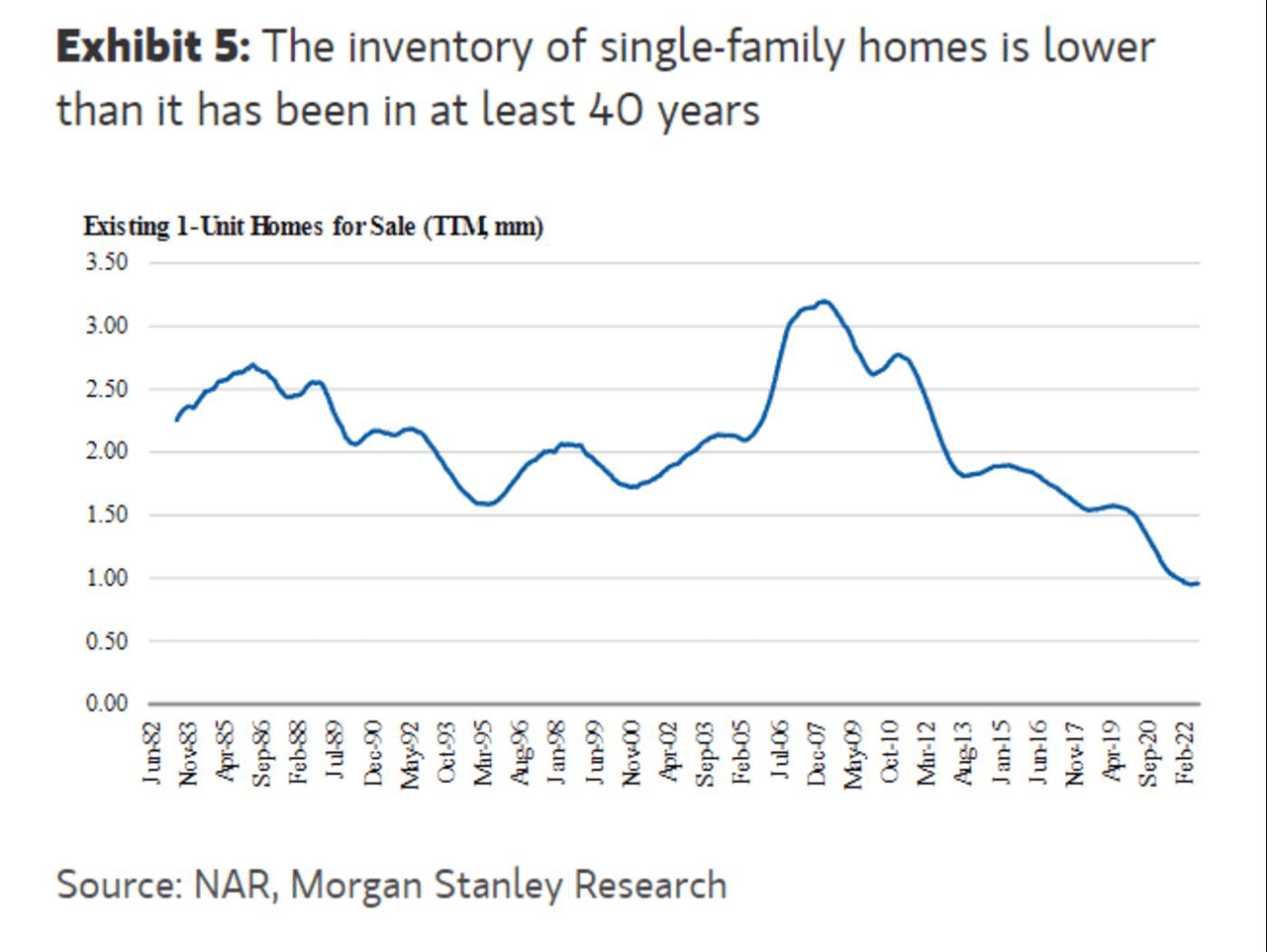

What this means is that the available inventory is still low. It’s the lowest in 40 years.

“They’re kind of locked in at their current homes at these lower rates,” Egan says. “So what we think we’re already seeing, what we anticipate continuing to see going forward, is that the inventory, the listings of existing homes available for sale, we have that data going back for single unit homes to the early 1980s, it was never lower than it was in earlier this year.”

Morgan Stanley

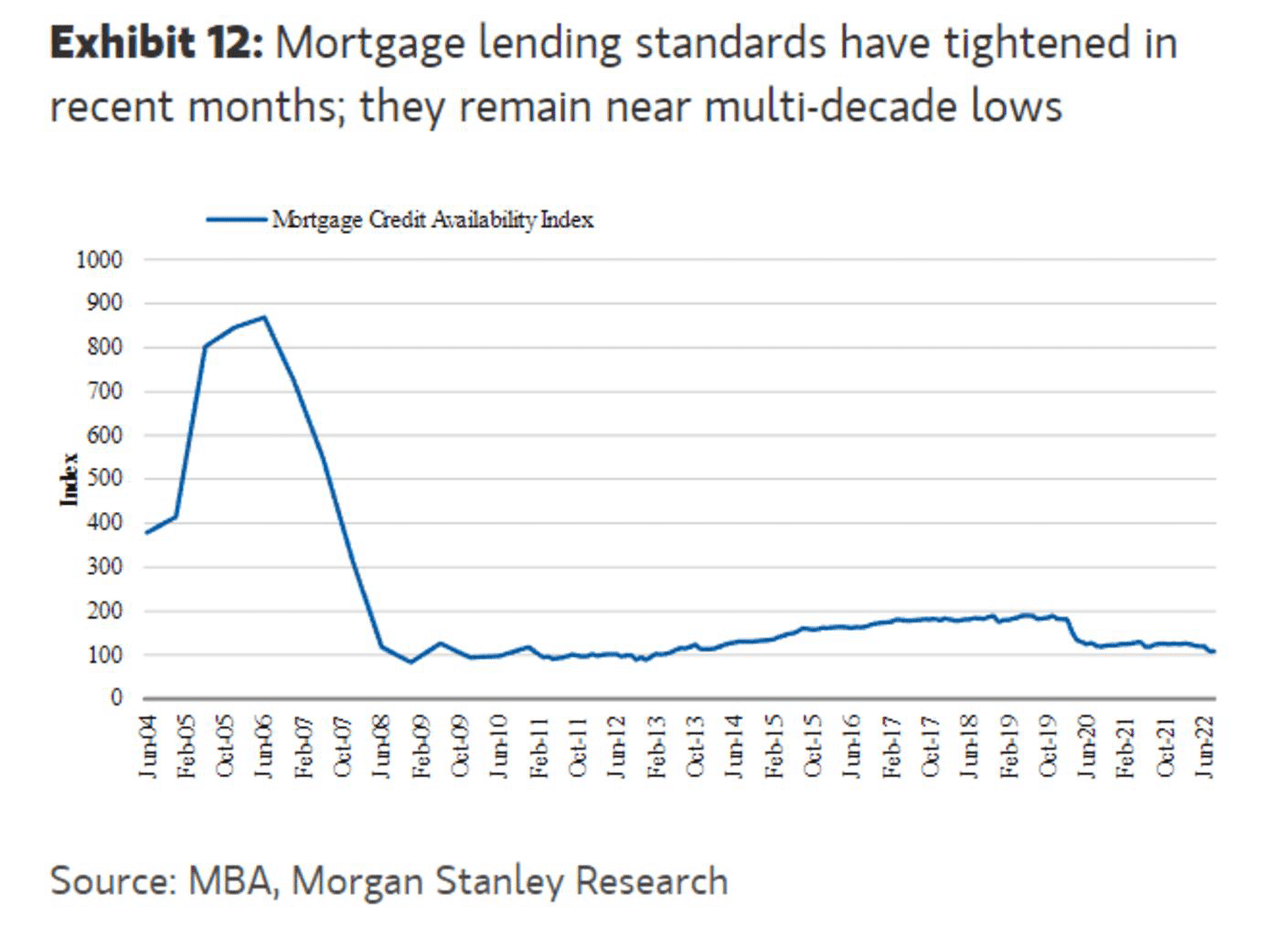

It also needs to be said that the market is stronger than it was during the Great Financial Crisis. Back then, lending standards were much looser. The mortgage credit availability index shows that lending has been stricter since 2006.

Morgan Stanley

If anything, availability has further declined after the pandemic. And if my outlook is right, it will become even worse as banks are reducing lending. While that won’t necessarily cause a home market implosion, it will make it likely that home sales drop further. People won’t buy new homes as fast.

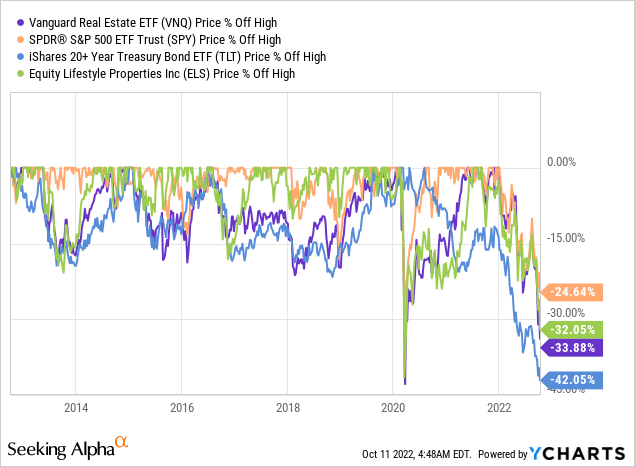

With all of that said, real estate investment trusts are in a tricky spot. Generally speaking, a lot of REITs are considered to be safe spaces. They invest in tangible assets with a purpose: residential, industrial, commercial, and related niches. However, they tend to get sold off pretty hard during certain conditions. Right now, the time for REITs isn’t very good. The Vanguard Real Estate ETF (VNQ) is outperforming the market by roughly 10 points as the chart below shows – excluding dividends. This is caused by the steep increase in yields.

The reason is that companies with a lot of leverage will face difficulties expanding their business. Moreover, with bond yields rising, investors don’t need to buy stocks to get income. There is now an alternative for stocks and it is adding to the problems certain “yield plays” like REITs, utilities, and related are facing.

For now, that’s an issue. However, it’s also an opportunity for long-term investors like myself.

That’s where ELS comes in.

The Many Things I Like About Equity LifeStyle Properties

I own one REIT, which is Public Storage (PSA). I am looking to add more, but it’s a slow process as I’m adding to existing positions and only slowly adding new ones.

When buying REITs, I don’t necessarily care about a high yield. What I care about is the business model of the REIT. I want assets it can easily expand without secular headwinds. Hence, I am not yet invested in commercial real estate. However, I do own self-storage because that industry benefits from secular tailwinds like smaller homes, last-mile logistics, and the ability of investors to buy assets in bulk.

In this case, we’re dealing with residential real estate. Manufactured housing (“MH”) and recreational vehicle (“RV”) communities, to be precise.

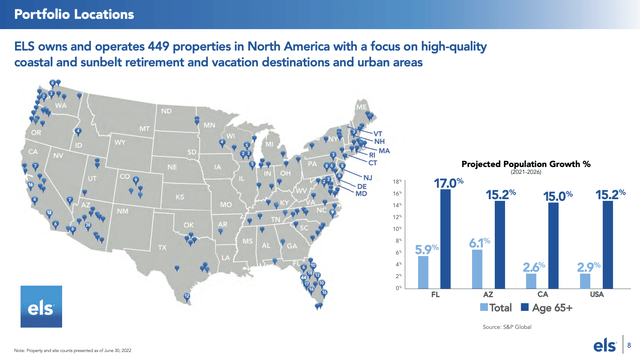

With a market cap of $11.7 billion, ELS is one of the largest companies in that space, owning 449 properties, in 35 states and one Canadian Province. These properties cover close to 171 thousand sites. 46% of its portfolio consists of MH communities. RV resorts account for 49% of the portfolio. Marinas fill the remaining 5% gap. Almost all marinas are located in Florida.

The company makes money from rent, as well as annual fees. Roughly 60% of annual revenues come from annual MH fees. Annual RV fees account for 20% of total revenues.

Roughly 95% of the company’s occupancy comes from homeowners. In other words, they pay the company fees. These people tend to stay longer than renters, which adds more safety to the company’s operations. The company uses empty spaces to make additional money from renting operations.

One of the things I’ve always liked about ELS is that it offers affordable housing. Manufactured housing has evolved a lot and is miles away from what people sometimes call “trailer parks”.

Especially in these times of high mortgage rates and imploding affordability, I believe that MH offers opportunities versus single-family housing (“SFH”). For example, the average home sales price is 76% lower for a MH. A $108,000 MH has an average monthly cost of $725. That’s 60% cheaper than SFH alternatives. That’s based on a 30-year loan and a 4.5% interest rate. Given the surge in mortgage rates, that benefit has shifted in favor of MHs.

As a result, ELS homeowners are in a fantastic position – financially speaking.

Through December 2021, the average upfront cost of purchasing a new MH in full was approximately 20% higher than putting 20% down on a new SFH, but the ongoing monthly rental payment for the MH was approximately 60% lower than the SFH monthly mortgage payment. At ELS most homeowners do not have debt on their homes and over the past three years, ELS has financed only 2% of new home sales.

Moreover, building new housing supply comes with advantages as it happens in controlled environments, resulting in no weather delays. Moreover, economies of scale make purchasing bulk materials attractive, hence lowering costs and allowing for much-needed supplies in times of shortages. Moreover, a standardized process makes the process quite efficient. The same goes for labor.

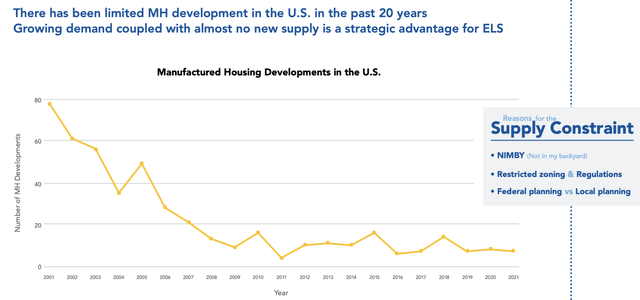

Additionally, while residential housing is an industry with low entry barriers, MHs are not seeing any major supply growth. According to ELS, zoning and regulations are an issue. Moreover, people don’t want MH communities close to their SFH communities.

With that said, the company is doing a great job turning secular tailwinds into growth. As of 2Q22, the company has an occupancy rate of 95.1%. This number has consistently been high as ELS has never expanded its business without the demand to back it up. The monthly base rent per site was $753. That’s up from $716 in the prior-year quarter. That’s an increase of 5.2%.

Now, before I continue to talk about numbers, let’s take a look at the ELS dividend.

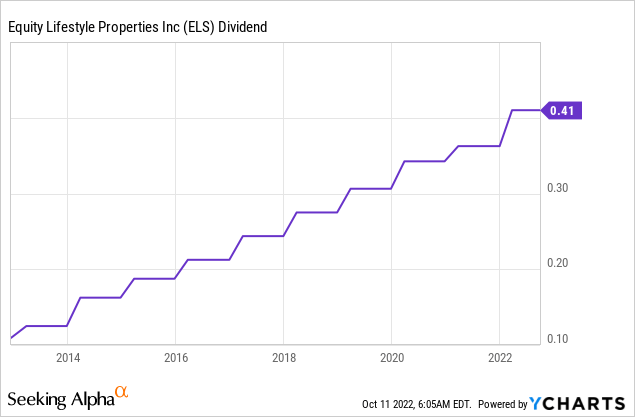

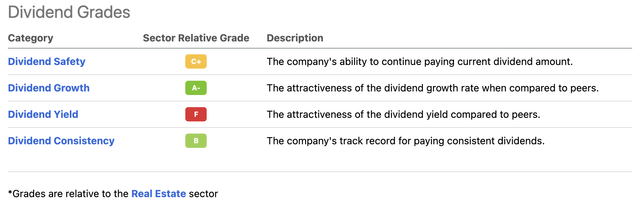

The company currently pays a $0.41 per share per quarter dividend. This implies a 2.7% yield. That’s decent in my book and because of the reasons I’m going to give you in this article. However, it means the company scores very low on its dividend yield as the sector median is at 5.1%.

Other than that, the company scores high on dividend growth and dividend consistency.

ELS’ average annual dividend growth of the past 10 years is 14.2%. The sector median is just 3.2%.

There is absolutely nothing wrong with buying a high yield. However, I prefer a 2.7% yield with double-digit growth over a 5.1% median yield with just 3.2% dividend growth any day.

These are the most “recent” hikes:

- March 2022: 13.1%

- March 2021: 5.8%

- February 2020: 11.8%

- February 2019: 11.4%

Just like the industry, ELS maintains a payout ratio of roughly 70% of AFFO (adjusted funds from operations). In other words, dividend growth is backed by strong AFFO growth.

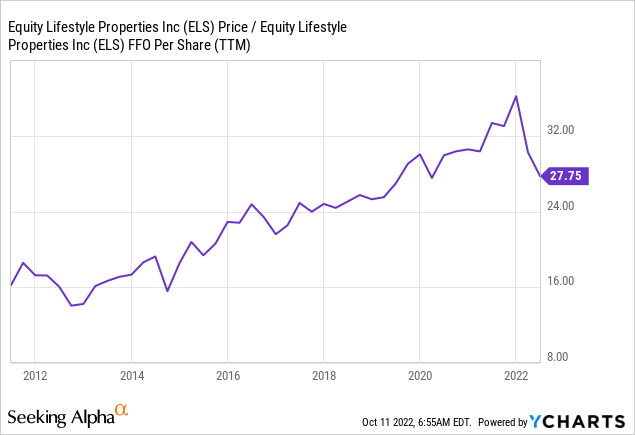

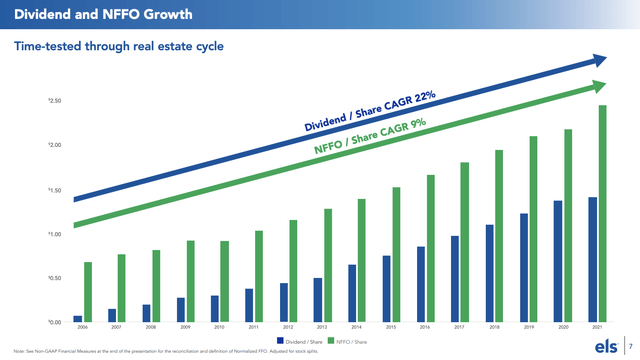

Normalized FFO has grown by 9% per share per year going back to 2006. Please note that “per share” means that it does account for share dilution. During this period, dividends have grown by 22% per year.

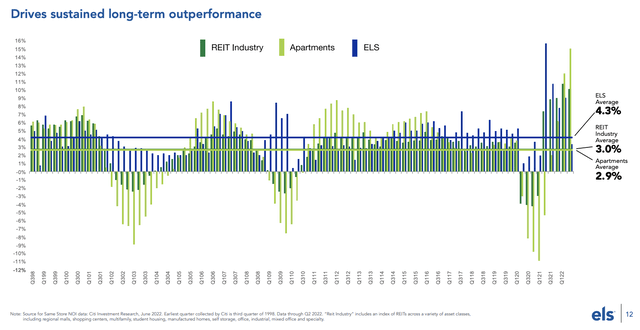

Net operating income has grown by 4.3% per year since 1998. This beats the REIT industry average by 130 basis points per year. The apartment average is 2.9%, which is still decent.

Even better is that these numbers have improved. Between 2013 and 2021, the average core revenue growth rate per year was 4.8%. The highest ever. Expenses also rose, but “only” by 4.5% per year. This allowed the company to grow NOI by 5.1% per year. That was 2.9% above average CPI during that period.

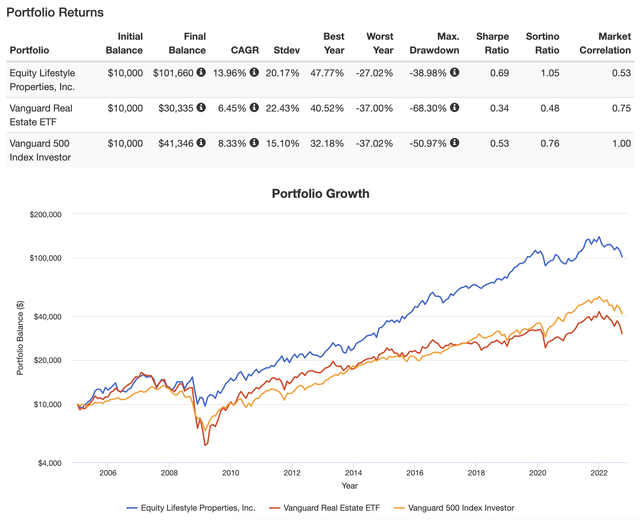

As a result of strong financial results, the company has returned 14.0% per year since 2005. This beats the Vanguard Real Estate by more than 600 basis points per year – with a lower standard deviation! In other words, that’s yet another argument against buying a “high” yield.

That said, there’s another important benefit. Especially in times of high rates: the company’s strong balance sheet.

Balance Sheet And Valuation

19.3% of the company’s enterprise value consists of debt. The company has $3.3 billion in total debt. $2.8 billion of this consists of secured debt.

$1.8 billion of its secured debt is maturing after 2031. The average weighted maturity is 11.7 years. ELS is not facing a maturity larger than $200 million until 2028. The average weighted interest rate is 3.5%.

The interest coverage ratio is 5.7x. Net debt is 5.3x adjusted EBITDA.

In other words, the company has a sustainable debt load, affordable rates, and long maturities. This buys the company time and allows it to withstand major macro headwinds.

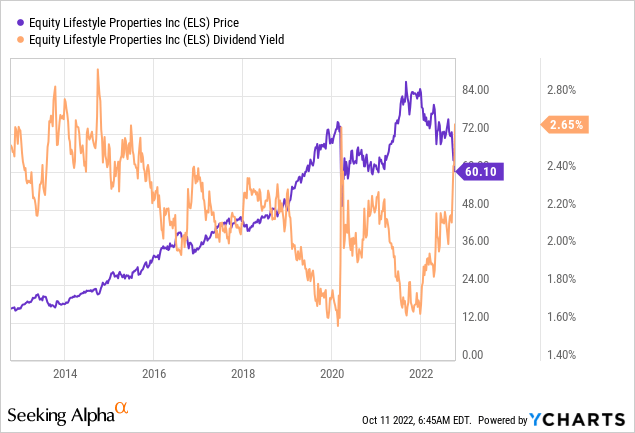

With regard to the valuation, the company is yielding 2.7% as I explained. That’s one of the highest numbers of the past 10 years. I believe that adds to the company’s attractive valuation. Bear in mind, this comes with above-average (expected) dividend growth.

That said, the company expects full-year FFO to come in between $2.65 and $2.75. This is based on at least 5.2% growth in MH rates, 6.4% growth in RV annual rates, and 0.2% outperforming growth in property operating revenue – versus operating expenses.

This implies a 21.8x to 22.6x price/FFO valuation. This would imply the lowest valuation in almost six years.

This valuation can come down even further, depending on how far the Fed is willing to go. However, I expect that we get close to a point where the Fed will have to prioritize financial stability over fighting inflation. At that point, I expect a big rush toward quality stocks like ELS.

Takeaway

We started this article with a discussion of the housing market. We’re dealing with one of the trickiest and weirdest markets in a very long time. Fundamentals are weak, but they are not weak enough to break the market. Homeowners are not selling due to high mortgage rates, which is also pressuring demand. As “theoretical” demand is high, the situation is made worse due to low supply. Add to this that banks are expected to significantly tighten lending requirements, and we’re dealing with a situation that won’t be solved until the Fed pivots.

In light of these developments, it’s important to focus on quality real estate investments.

I believe that Equity LifeStyle Properties is one of the best REITs money can buy. This diversified residential real estate company owns MH and RV communities. Its customers are financially stable, the company offers affordable alternatives in an expensive market, and its balance sheet protects investors against mayhem.

Moreover, because of strong earnings growth, the company offers high dividend growth and expected outperformance versus its peers, which I believe is very important for dividend growth investors.

It also helps that the market sell-off is providing investors with an attractive buying opportunity. The company’s yield is close to a 10-year high. Price/FFO is at an attractive 6-year low.

Long story short, if you’re looking for income and growth, look no further. I have little doubt that ELS will continue to deliver outperforming returns for decades to come.

(Dis)agree? Let me know in the comments!

Be the first to comment