Falcor

It’s been a rough Q2 Earnings Season for the Gold Miners Index (GDX), and while operational results have been satisfactory, cost pressures have led to several guidance revisions. It looked like New Gold (NGD) might take the lead among the mid-tier producers for the worst Q2 report, but Equinox (NYSE:EQX) has emerged as a major contender. This is because EQX’s production could come in 12% below previous guidance (mid-point) at costs more than 9% above its previous outlook (mid-point). At a fully-diluted market cap of ~$1.53 billion, there’s no question there’s value here, but I see the stock as a swing-trading vehicle only (buy point at US$3.44) given the poor execution to date and weak margin profile.

Equinox Gold Operations (Company Presentation)

Just five months ago, I warned on Equinox Gold, noting that its attractive growth profile was more than offset by elevated costs, and there was no reason to be paying above US$8.00 for the stock. I specifically stated that while it’s a favorite among investors for its growth, I continued to see it as inferior relative to peers, with an increased risk of owning the high-cost producers. Since then, the worries about inflationary pressures have been confirmed, and the company has seen a massive blowout in cost guidance. Not surprisingly, this has led to a sharp decline in the stock, which is now testing multi-year lows near US$4.00. Let’s take a closer look below.

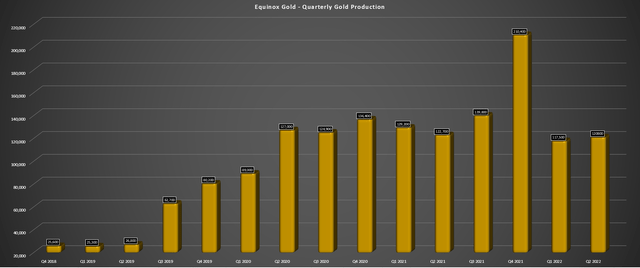

Q2 Production

Equinox released its Q2 results this week, reporting quarterly production of ~120,800 ounces, a 3% decline from the year-ago period. This decline was related to the sale of the Mercedes mine, a temporary suspension at RDM, the slower than planned ramp-up at Santa Luz, and a much weaker quarter at its Aurizona Mine (heavy rainfall delayed access to higher-grade in Piaba pit). Even if this was expected to be a softer portion of the year, Q2 was a disappointment, with Santa Luz expected to pick up some slack from the Mercedes Mine sale. Meanwhile, production was up at Los Filos year-over-year, but costs soared to $2,141/oz, reflecting higher waste tonnes and lower than expected ore grades, resulting in an $11.1 million write down.

Equinox Gold – Quarterly Production (Company Filings, Author’s Chart)

The only real bright spot in the quarter from a performance standpoint was Mesquite, which saw a sharp increase in production though this was partially due to being up against easy year-over-year comps. Production at the California mine came in at ~34,500 ounces at all-in sustaining costs of $1,202/oz, a meaningful improvement from the year-ago period. The increase in production at lower costs was related to a lower strip ratio and higher grades from the main part of the Brownie ore body. On a full-year basis, costs have been revised, reflecting lower sustaining capital expenditures ($38 million vs. $52 million) for 2022.

Given that production is sitting at just ~238,300 ounces year-to-date (down 6% year-over-year), it’s no surprise that Equinox has reeled in its full-year guidance from a mid-point of ~668,000 ounces to a new mid-point of ~583,000 ounces – a nearly 13% decline. Although some of this is related to the unplanned temporary suspension at RDM due to the federal legislation change in Brazil (minimum freeboard guidelines for all TSFs), some blame lies on Equinox for a sub-par ramp-up at Santa Luz to date. The company noted that it was primarily due to modifications to handle resin-in-leach processing at an industrial scale and rectification of some piping and leach tank issues. Let’s take a look at costs.

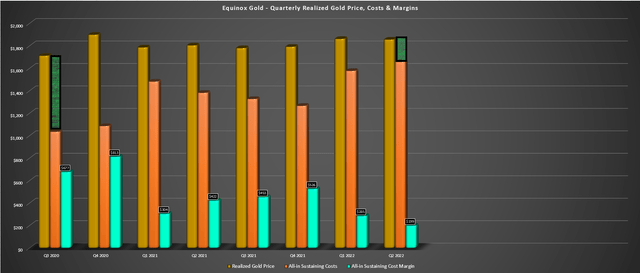

Costs & Margins

While production came in much softer than estimates, even if this year was set to be back-end weighted, operating costs were the major disappointment. This is because Equinox came into the year guiding for costs well above the industry average and setting the bar low (~$1,373/oz mid-point), and has now raised cost guidance to $1,500/oz despite slashing sustaining capital expenditures by $24 million. The company noted that this was related to further inflation of approximately 6% (diesel, cyanide, grinding media) and the slower ramp-up at Santa Luz. Now, investors must hope that Equinox has at least got this guidance estimate right, or we could see costs come in above $1,500/oz in 2022.

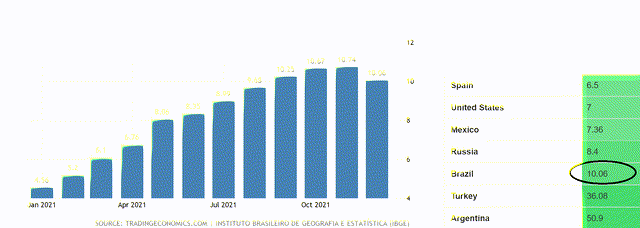

Brazil Inflation Rate – December 2021 (TradingEconomics.com, IBGE)

As I pointed out earlier this year, Equinox had an increased risk of missing guidance, which is why I favored other producers. The reason was that the company operates several low-grade mines, leading to a more significant impact from a fuel standpoint if diesel prices remain elevated, given that it was moving considerably more volume of rock per ounce produced. This is the opposite of a company like Yamana (AUY), which operates relatively high-grade underground mines and was much more insulated from continued inflationary pressures.

In addition, Equinox has four operations in Brazil, and the country had some of the highest inflation rates globally heading into 2022 (shown above). Six months later, inflation rates have hardly cooled off in Brazil (June: 11.9%), and the strength of the Brazilian Real in H1 and the United States Dollar has been a further headwind. While this already has made things more difficult for Equinox, it hasn’t helped that performance has been sub-par, and now the gold price is going in the wrong direction. Given this double whammy (rising costs, weakening gold prices), all-in sustaining cost margins plunged in Q2 and are likely to come in below $325/oz this year (FY2021: $441/oz).

Equinox Gold – Quarterly Gold Price, Costs & Margins (Company Filings, Author’s Chart)

Some investors will cry of manipulation with EQX down 70% from its Q3 2020 highs vs. a less than 20% decline in the gold price. However, this stock move has closely tracked AISC margins, which plunged from $677/oz in Q3 2020 to $199/oz in Q2 2022 (a 70% decline). This decline has been further exacerbated by the share dilution related to the acquisition of Premier and the weakening balance sheet, with Equinox now sitting on ~$470 million in net debt in its heavy capex phase building Greenstone. It’s worth noting that AISC margins could improve in H2, but I would still expect to see meaningful margin compression year-over-year (~$300/oz vs. $441/oz).

Financial Results

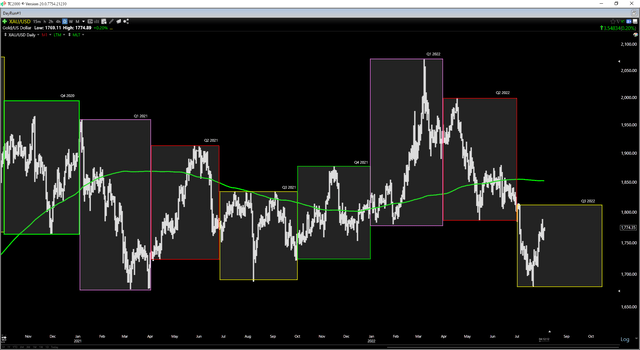

The poor operational performance and rising costs made it a brutal quarter from a financial standpoint. Equinox reported a 1% decline in revenue despite benefiting from a higher gold price and reported mine-site free cash flow of (-) ~$13 million vs. (+) ~$14 million in the year-ago period, with operating cash flow declining to $16.4 million. Fortunately, the second half will be better (I don’t know if it’s possible it could get much worse). Still, Equinox is now coming up against a weaker gold price, the downfall of performing poorly and producing considerably less gold than planned in a period when sales would have been at a much higher price in H1 2022.

Gold Futures Price (Company Filings, Author’s Chart)

So, is there any good news?

Fortunately, the resin-in-leach circuit is performing well, and Greenstone miraculously remains on schedule and budget, on track to have the majority of buildings enclosed by year-end, allowing for strong productivity during the Canadian winter. To date, 56% of capital costs have been contracted, which lowers the risk of a capex blowout like Magino and Cote have seen, and 26% of the total budget has been spent. The company also added a $100 million accordion feature to give it more flexible financial flexibility.

So, while there was lots to dislike about Q2, at least the company is still in a position to afford to build its growth project, unlike Iamgold (IAG), which is scrambling to find additional capital by year-end and may need to divest an asset. That said, the Greenstone operating cost estimates continue to look too ambitious at sub $650/oz, dampening the margin outlook post-Greenstone construction. Hence, while Greenstone will certainly pull down consolidated costs significantly, I don’t see it having anywhere near the desired effect that some investors might be assuming under the belief that ~20% of production will be at $625/oz AISC.

Greenstone Construction (Company Presentation)

Valuation

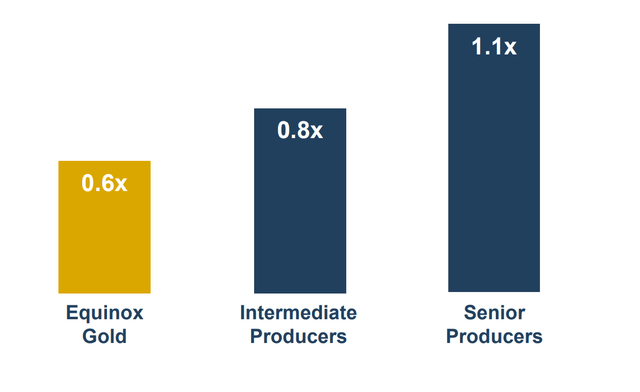

Equinox currently has ~355 million fully diluted shares, translating to a fully diluted market cap of ~$1.53 billion at a share price of US$4.30. If we compare this figure with an updated estimated net asset value of ~$2.32 billion (reflecting stickier inflation), the stock trades at approximately 0.65x net asset value. This is a huge discount to million-ounce producers; a league Equinox eventually hopes to join if it can execute its growth plans successfully. Equinox regularly points out this valuation discrepancy in its presentations. However, in doing so, it does not point out its weaknesses and negative differentiators vs. the average million-ounce producer.

Equinox Gold – Valuation vs. Peers (Company Presentation)

For starters, the company has not done a great job meeting its promises to date, and 2022 is another example of a massive miss vs. guidance. Secondly, one of its larger operations is in a jurisdiction that commands depressed multiples, Guerrero State, Mexico, suggesting a lower multiple should be applied from a consolidated basis (Los Filos waters down P/NAV multiple). Third, its cost profile is well above that of its peer group, and it lacks production from Tier-1 ranked jurisdictions (below 30% even with Greenstone). Finally, it has a much weaker balance sheet than its peers, with nearly $500 million in net debt and limited free cash flow generation until Greenstone is online.

So, while this multiple may seem on the low end vs. peers like Newmont (NEM) and Gold Fields (GFI), I believe the discount to be more than justified. As I pointed out in my previous article, a more conservative multiple for the stock would be 0.90x P/NAV, translating to a fair value of US$5.88 per share based on ~355 million fully-diluted shares (including convertible notes). From a share price of US$4.30, this points to meaningful upside. That said, investors aren’t getting paid to wait; the execution here to date has been poor, and other producers are returning significant capital to shareholders with much better track records and better upside cases, like Agnico Eagle (AEM) – [75% upside to fair value].

Summary

Equinox released a terrible Q2 report, and while costs will improve in H2, they are still well above the industry average until Greenstone comes online. The only good news in the report is that Greenstone appears to be tracking on budget and schedule, which will be a game-changer for the company once online. That said, I strongly believe that the only producers worth owning are those with strong track records meeting their promises, and Equinox Gold fails miserably in this category, at least based on its 2-year track record. So, while I believe pullbacks below US$3.45 would provide swing-trading opportunities, I see far more attractive ways to play the sector.

Be the first to comment