guvendemir

It’s been a brutal two years for the Gold Miners Index (GDX), with investors that bought the index near its highs suffering through a 40% plus decline. However, few producers have been hit as hard as Equinox (NYSE:EQX), which chose to make an acquisition shortly after the peak in the gold market (Q4 2020) and is staring down considerable margin compression on a two-year basis despite the gold price holding up relatively well. At a share price of US$4.15, Equinox is very reasonably valued. Still, with no expected free cash flow generation in 2022/2023 in a capital-intensive period and some uncertainty related to Greenstone capex, I continue to see more attractive ways to play the sector.

All figures are in United States Dollars unless otherwise noted.

Just over two months ago, I wrote on Equinox Gold, noting that much of the negativity was beginning to look priced into the stock, suggesting a pullback below US$5.76 could present a buying opportunity. While the stock did find support below the US$5.70 level, which was a major support area dating back to Q4 2019, it put together a relatively weak bounce and then immediately undercut support again, leaving behind another low high. This was not a positive development, and the stock has since plunged more than 25% below support. With the stock now staring down a more than 70% decline from its Q3 2020 highs, let’s take a look at whether this is a falling knife worth catching.

Q2 & Full-Year Outlook

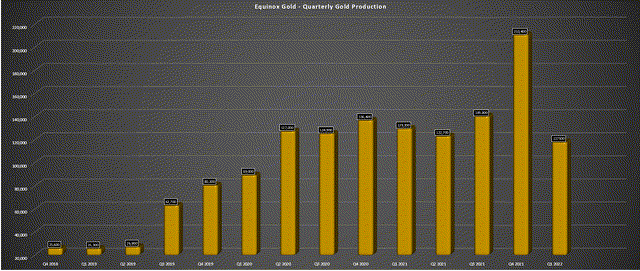

Equinox’s Q1 results were not great, with quarterly production below estimates at ~118,000 ounces of gold, while costs came in slightly above my estimates at $1,578/oz. This wasn’t overly surprising, given that capital expenditures were elevated, and production was anticipated to come in at its lowest levels of the year. The result was a decline in Equinox’s all-in sustaining cost [AISC] contribution margin in Q1 2022, which came in at just $34.9 million (Q1 2021: $39.1 million). However, with the company guiding for higher production in the back half of 2022, there was reason to be optimistic about cash flow generation and improved AISC margin as the year progressed. Unfortunately, gold and energy prices appear to have other plans for Equinox.

Equinox Gold – Quarterly Production (Company Filings, Author’s Chart)

Beginning with diesel prices, they have come in above levels that most miners were forecasting when they provided FY2022 guidance, and judging from Q1 commentary, the inflationary pressures felt industry-wide haven’t improved much at all. This involves higher contractor costs, higher materials costs, and higher consumables costs, which, combined with higher energy prices, were already likely to push Equinox’s costs well above its stated guidance mid-point ($1,372/oz). However, given that Brazil continues to see elevated inflation (Equinox has three operating assets here), and the fact that Equinox is sensitive to energy prices (two relatively low-grade mines and waste stripping programs at Los Filos), I would not be surprised to see costs come in above $1,400/oz.

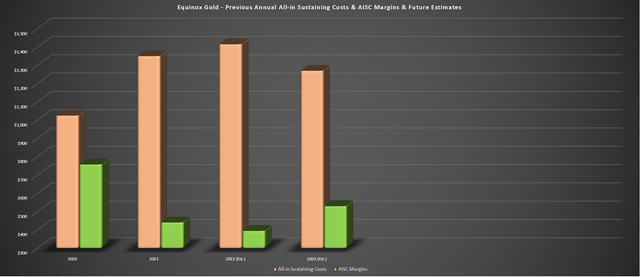

Equinox Gold – All-in Sustaining Costs, AISC Margins & Forward Estimates (Company Filings, Author’s Chart)

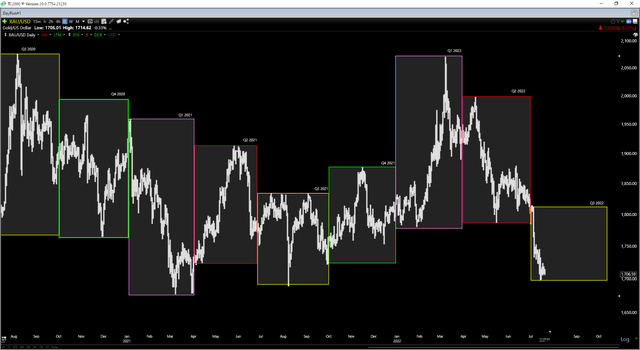

Assuming Equinox’s all-in sustaining costs came in at $1,415/oz, and its realized gold price averaged $1,940/oz, we would have seen some margin compression vs. 2020 levels, but nothing catastrophic. That was how the year appeared to be shaping up as of Q1, with the gold price briefly spiking above $2,000/oz. This is because AISC margins would have come in near $525/oz, down ~30% from FY2020 levels but up from 2021 levels ($441/oz). However, with a similar cost profile and a more conservative gold price assumption of $1,810/oz for FY2022, we could see AISC margins come in near $395/oz, down more than 45% from FY2020 levels and representing another year of meaningful margin compression.

Some investors might be scratching their heads given the poor share price performance of Equinox, with a company that has grown production from 2020 levels seeing its share price decline by over 60% in a flat gold price environment. However, it’s important to note that there was meaningful dilution from its Premier acquisition, and AISC margins will fall off a cliff on a two-year basis if the gold price can’t recover sharply by year-end. So, while production may be on track to increase more than 20% on a two-year basis, this has been more than overshadowed by what could be a ~48% decline in AISC margins.

Gold Futures Price (TC2000.com)

The good news is that AISC margins should bounce back sharply in FY2023, given that we should see a decline in sustaining capital, assuming the company can complete its major capital spending this year. However, if we assume a flat gold price assumption of $1,800/oz and all-in sustaining costs of $1,270/oz, this will still represent industry-lagging margins, and these margins would be well below FY2020 levels ($530/oz vs. $758/oz). So, while this will represent an improvement, I don’t see any reason that Equinox would head back to $10.00 per share, let alone $13.00 per share where it traded in Q3 2020, at least not until Greenstone construction is complete, or without a much higher gold price.

I have not forecasted past 2023, given that there’s too much uncertainty related to the timing of project completions, energy prices, and inflationary pressures.

Overall, this less appealing cost profile looks mostly priced into the stock, and sentiment for Equinox is the most negative it’s been in years. This is because the stock was over-owned in 2020 and was being hailed as the best growth story sector wide. Fast-forward to 2022, the company can’t catch a break. Not only did it have to suspend its RDM Mine temporarily, but investors are now aware of the challenges operating in Guerrero State (Los Filos), and there are worries about a capex blowout at Greenstone. Still, with the stock trading at less than 4x FY2023 cash flow estimates ($1.10 per share) and with a decent-sized contingency baked into capex at Greenstone ($177 million), a lot of negativity looks priced into the stock already.

Valuation & Risks

Based on ~355 million fully diluted shares and a share price of US$4.15, Equinox trades at a market cap of $1.47 billion. If we compare this market cap figure with an estimated net asset value of ~$2.65 billion, Equinox trades at approximately 0.55x P/NAV. This is a very reasonable valuation for one of the few growth stories in the gold space (Equinox hopes to grow production above 1.0 million ounces later this decade). Based on what I believe to be a fair multiple of 0.90x P/NAV, I see a conservative fair value for the stock of US$6.70, or 61% upside from current levels.

While this meets my buying criteria of a 30% discount to fair value (US$4.70 or lower), Equinox is in a less favorable position than some of its peers. This is because it’s building a massive development project in a province where we’ve seen two capex blowouts. It’s sensitive to energy prices due to having several low-grade mines, and most of its operations are in non-Tier-1 jurisdictions (Brazil, Mexico). The inferior jurisdictional profile isn’t a huge issue and will improve once Greenstone is online. However, Mexico has proven to be a more difficult operating jurisdiction for some producers recently (permitting delays). So, for investors looking for sleep-well-at-night miners, if there is such a thing, I believe it’s best to focus on Tier-1 jurisdiction producers.

In recent discussions, Equinox appears confident that it will not see a capex blowout and that it will be able to contain costs to the upfront capital estimate of $1.23 billion. There’s a considerable contingency on the project (14%), and I would argue that Equinox has a stronger team than Iamgold (IAG) and Argonaut (OTCPK:ARNGF), which have a long history of under-delivering. Still, even with a larger contingency, I would be surprised to see the company come in on budget, which could continue to be a slight overhang on the stock until the project is at least 50% complete and we’re closer to the finish line (first pour targeted H1 2024).

Greenstone Construction Progress (Company Presentation)

It certainly helps that Equinox is splitting capex with Orion vs. Argonaut having to absorb the cost on its own with its Magino blowout and Iamgold being a majority owner at Cote. That said, there’s no disputing that Equinox has a couple of different areas of uncertainty, which the market tends to dislike, that could be delaying its re-rating given its growth profile. For these reasons, while I do see considerable upside from current levels for Equinox, I prefer companies exploring lower capex options for growth and leveraging off existing infrastructure vs. a completely new build that could be more difficult to keep on budget (Greenstone, Magino, Cote).

For those unfamiliar, Magino’s capex has increased to more than $720 million, up from $321 million initially and an updated figure of $370 million (Q4 2020). Meanwhile, Iamgold’s share of Cote was estimated at ~$900 million in Q3 2020, and more than 18 months later, attributable costs to completion have been estimated at more than $1.0 billion despite considerable spending. Equinox updated its costs more recently than in Q3 2020 and Q4 2020 (Magino, Iamgold) and has a large contingency. Still, given the magnitude of these blowouts, it will be a herculean task to bring this project in on budget.

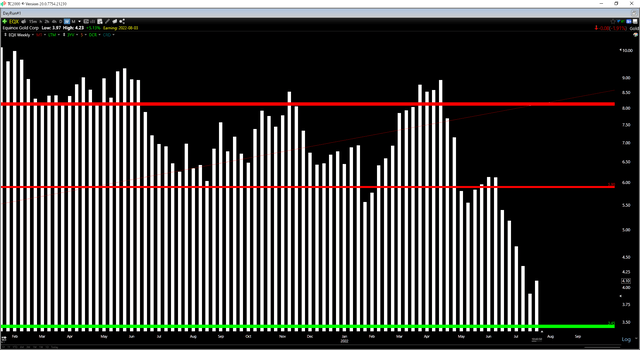

Technical Picture

While Equinox has dipped into a buy zone from a valuation standpoint, the technical picture has weakened considerably. In fact, the stock broke below a major support level at US$5.90, a support level that dated back to Q4 2019. In the case of major support breakdowns, these levels often become new ceilings for a stock temporarily. This is because investors that have accumulated along this support line could become anxious to exit at breakeven or a small loss on any retracement to this level. Meanwhile, with this support area giving way where EQX’s stock was defended at the 2020 lows, the next strong support level doesn’t come in until $3.45.

When it comes to small-cap names, I prefer a minimum 6.0 to 1.0 reward/risk ratio to justify entering new positions to account for the risk. At a current share price of US$4.15, Equinox trades at a reward/risk ratio of 2.50 to 1.0, which is based on $1.75 in potential upside to resistance and $0.70 in potential downside to support. So, while the stock may be in a buy zone from a valuation standpoint, I don’t see the stock as in a low-risk position from a technical standpoint. For this reason, and when factoring in the added uncertainty of sensitivity to energy prices, a weaker gold price hurting its already industry-lagging margins, and a potential upward capex revision at Greenstone, I see more attractive ways to play the sector.

Summary

Equinox is one of the better growth stories sector-wide, but the company has seen considerable dilution from last year’s acquisition, and it’s a relatively high-cost producer in a period of softening gold prices. After a 70% share price decline, the stock is much more reasonably valued and much of the negativity is baked into the stock. This is especially true given that the company is focused on growing production to 1.0+ million ounces per annum later this decade.

However, while some investors might believe this is the best avenue to get exposure to production growth, I think there are more attractive options, with Agnico Eagle (AEM) being one example. This is because AEM is leveraging existing infrastructure to grow production with modest capex relative to annual cash flow, allowing it to pay an attractive dividend yield and buy back shares (something Equinox cannot afford until at least 2024). Meanwhile, Agnico is much more protected from weakness in the gold price with sub $1,000/oz margins in FY2023. So, while I see EQX as a Speculative Buy at US$3.65, I see more attractive bets elsewhere in the sector, hence my Neutral rating.

Be the first to comment