vzphotos/iStock Editorial via Getty Images

Investment Thesis

Equinix (NASDAQ:EQIX) has grown rapidly as the demand for data centers and their related services has exploded as society has moved into a digital age. The company has a global footprint and assets in many of the biggest markets with high barriers to entry. It also has secular tailwinds and a moat that will likely prove to be stable without dramatic technological innovation. The valuation is a little rich for me right now. At 27.8x price/FFO, shares are expensive when growth is projected to be in the high single digits. The dividend yield is quite low, at 1.6%, but it makes up for it with a consistent track record of dividend growth. I don’t own shares, but I will certainly keep Equinix on my watchlist.

The Business

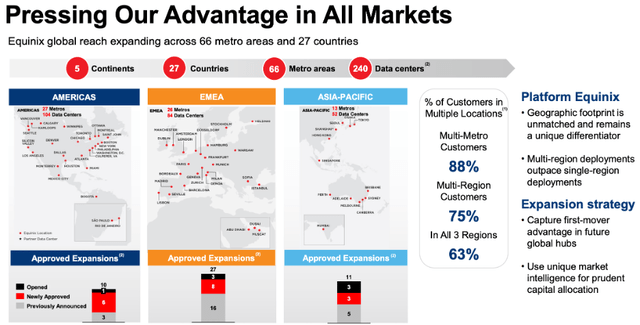

Equinix is the largest data center REIT in the world, with a market cap just under $70B. They focus on the largest markets across the globe and have expanded rapidly since their REIT conversion in 2015. If you can think of a major city around the world, Equinix probably has a data center there. The image below provides a good visual so investors can see how impressive the company’s international footprint is.

Equinix Locations (equinix.com)

They are also working to expand their footprint to new countries and even new continents. The company was in the news last week for acquiring MainOne for $320M. While this is a drop in the bucket for a company the size of Equinix, it opens up the African market and shows that they are pursuing external growth opportunities. A month earlier, Equinix announced the acquisition of four Entel data centers in Chile and Peru. This acquisition is expected to close in 2022 Q2 and will cost $705M. Again, this isn’t a massive boost for the company, but it shows that they are acquiring strategically located assets to open up new markets.

Equinix also has a solid balance sheet with plenty of cash and has shown the ability to borrow at low rates for decades. In case you haven’t noticed, inflation has been running wild and the ability to borrow at rates well below inflation is a plus for shareholders. The company has solid track record with their growth strategy and looks poised to continue to grow. Adding new countries is going to be key to their ability to grow from an already large base. However, the current valuation is the biggest thing keeping me on the sidelines.

Valuation

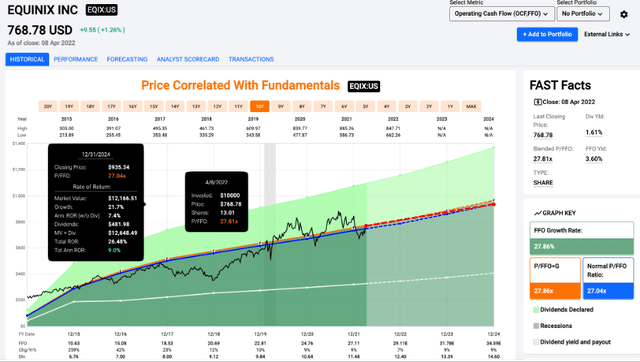

Equinix has a track record of consistent growth which is why the market has rewarded it with a premium multiple. Shares currently trade at a price/FFO of 27.8x, which is essentially in line with its average multiple. Since the REIT conversion in 2015, shares have had a normal price/FFO ratio just over 27x. Growth is projected to be in the high single digits for the next couple years, and I wouldn’t be in a rush to sell if you have held onto shares for a while, but there isn’t much in the way of margin of safety for new investors.

Looking at the chart above does show something that every investor likes to see: continued and consistent growth. That is one of the reasons that Equinix is on my watchlist. The other reason is the dividend growth record.

The Dividend

Equinix isn’t going to appeal to investors looking for current income. The dividend yield is 1.6%, but they have been able to grow that at an impressive rate in the last 5 years. I would expect the dividend to continue to grow at a high single digit rate for the foreseeable future as long as the company is able to execute on its continued expansion plans.

Conclusion

Equinix has one of the most impressive REIT asset bases in the world, perhaps only topped by American Tower (AMT). With their location in developed markets secured and growth on tap in developing markets, investors can consider Equinix to be a REIT with a moat. I like the recent acquisitions and I expect the company to continue to find ways to grow. However, the shares are just too rich to start a position here. The dividend yield, at 1.6%, isn’t enough to make up for it either. Equinix certainly belongs on a REIT investor’s watchlist, but I will stay patient to see if shares take a dive in the coming months. If they do, I will be excited to pick a couple shares up at a better price.

Be the first to comment