Casper1774Studio/iStock via Getty Images

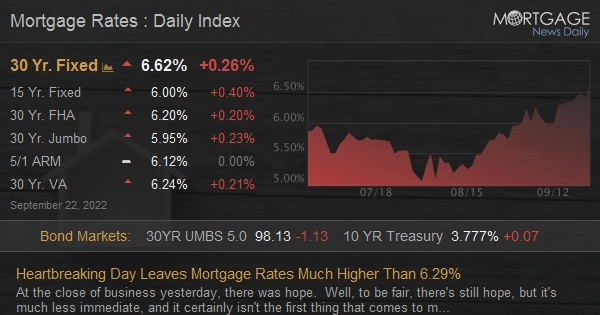

Mortgage rates have shot to their highest levels in more than 15 years, according to Mortgage News Daily.

Mortgage Rates Marching Toward 7%

Mortgage News Daily

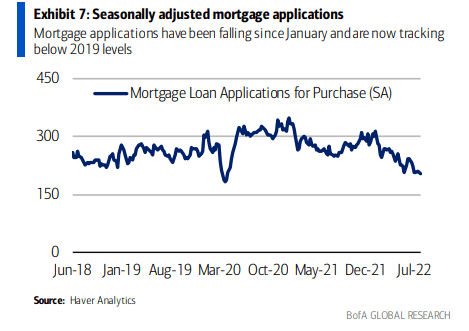

Moreover, mortgage loan applications for purchase, per Haver Analytics data, are below 2019 levels.

Mortgage Apps Headed South

BofA Global Research

This has bearish implications for credit reporting bureaus. One of the big three players in the space has an earnings date in less than a month and has endured a slew of negative news items. Is all that priced in? Let’s dig in.

According to Bank of America Global Research, Equifax (NYSE:EFX) provides credit and risk management solutions to businesses and consumers. The second largest US credit bureau (based on revenue), the company also operates in 23 other countries. Products and services include consumer reports, risk scoring and analytics, income and employment verification, fraud, and identity solutions, decisioning services, and marketing services.

The firm stands to benefit from secular tailwinds aiding tech and data evolution. Data privacy and security remain risks, though, as evidenced by the major breach at Equifax. There are downside risks, too, at a macro level with dropping mortgage applications and low unemployment claims.

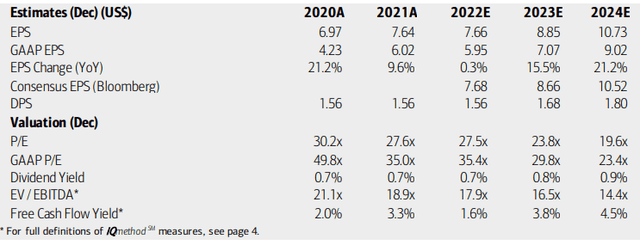

The Atlanta-based $21.6 billion market cap Professional Services industry company trades at a high 28.4 trailing 12-month price-to-earnings ratio and pays a paltry dividend yield of just 0.9%, according to The Wall Street Journal. Just this morning, the three major credit reporting agencies announced that free weekly credit reports will be available to U.S. consumers through 2023.

On valuation, BofA sees solid EPS growth next year and in 2024 after a weak 2022. I question that optimism given the major slowdown in the housing market and surging mortgage rates. The Bloomberg consensus EPS amounts are modestly lower vs BofA. Still, dividends are expected to climb as free cash flow inches higher. Unfortunately, the forecast P/E and EV/EBITDA multiples are exceedingly high. Equifax appears expensive right now.

EFX Earnings, Valuation, And Dividend Forecasts

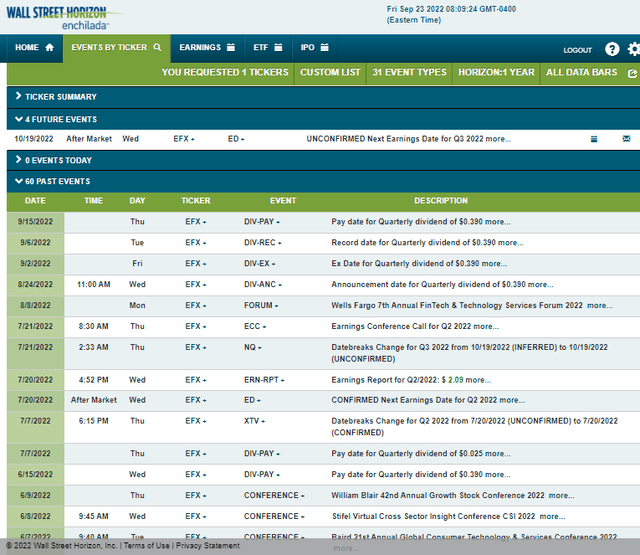

According to Wall Street Horizon’s corporate event calendar for Equifax, only the upcoming Q3 earnings date is expected to move shares over the next few months. Importantly, though, it is among the first handful of S&P 500 companies reporting results with its unconfirmed earnings date of Wednesday, Oct. 19, after the close.

Corporate Event Calendar

The Technical Take

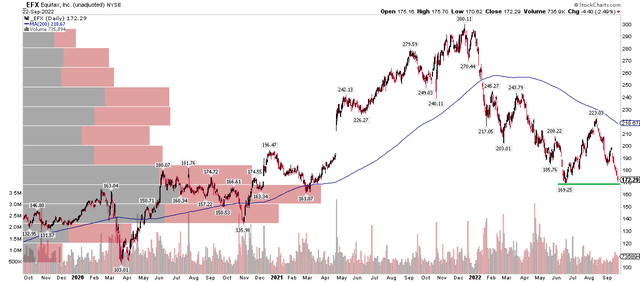

Equifax broke below its 200-day moving average at the turn of the year with a gap down on high volume back in January. It has been a struggle for the bulls ever since. After failing at resistance in the low $240s in a bearish double top pattern during Q1, the stock went on to make lower highs and lower lows throughout the first half. A strong bounce off the June low failed again to get EFX above the falling 200-day, and a big drop since then leaves the stock retesting the June low.

I see potential upside here though. Notice how many shares were traded in the $135 to $180 range. There should be buyers here based on that price history. If the stock falls under $169, perhaps a drop to $150 could be in play, but it looks like a decent buy there, technically.

The broader trend is lower, though. So it’s more of a ‘buy the dip, sell the rip’ mantra with EFX until it climbs back above the 200-day.

Equifax: Trending Lower, but a “Buy the Dip” Strategy Could Work

The Bottom Line

Equifax is due for a bounce soon. A short-term long swing trade here with a stop under $150 could make sense, but profits should be taken on an approach to the 200-day moving average. Long-term fundamental investors should avoid the stock, though, as its valuation is high and is exposed to cyclical areas of the economy that are turning south.

Be the first to comment