onurdongel

(Note: This article was in the newsletter on August 28, 2022.)

When the current EQT (NYSE:EQT) management took over, there was a lot of things that were done quickly to rapidly turn things around before the challenges of fiscal year 2020 became apparent. One of the things about “good enough” management (that was there before the current management) is that the extra details that keep a company out of trouble when unexpected challenges appear, often remain undone. At that point “good enough” managements often state they did the best they could while shareholders pay the bill.

Here, EQT management has paid attention to a lot of details. The result is a much smoother ride though some very rough times for shareholders than might have been the case. Now, management is still focused upon some long-term issues that need to be resolved. But those issues will result in slower, more nuanced improvements. Over time, such improvements can result in material improved returns to shareholders.

Cash Flow

Cash flow is improving steadily. The challenge is to note the improvement while realizing that higher prices will demand the use of cash flow. That means that not all of the calculated free cash flow is available because working capital needs will use some of that free cash flow.

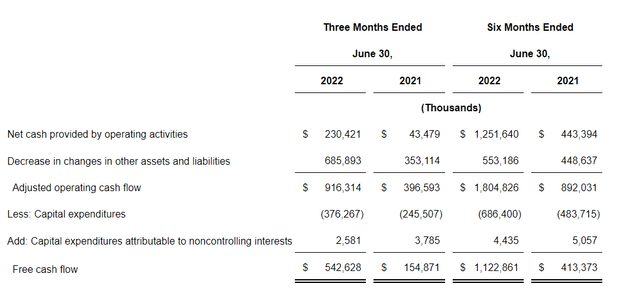

EQT Reconciliation Of Cash Flow From Operating Activities To Free Cash Flow (EQT Second Quarter 2022, Earnings Press Release)

The reason that “Net cash provided by operating activities” is a GAAP measure is because that is the cash generated by the business (from operations as defined by the statement) as tied into the checking account before the next few items adjust the total cash “in and out”.

Having free cash flow in excess of that GAAP number as many calculate is kind of an oxymoron because you cannot have more free cash than you have cash generated. This is also the reason that free cash flow is non-GAAP because it often, as shown above, gives a more favorable picture of the cash flow situation than is really the case.

The cash that ends up needed in working capital will often “be released” during the next cyclical downturn when commodity prices drop. Similarly, the cash generated by the business will often assert itself as the GAAP number because working capital only needs to finance higher commodity prices one time.

Debt

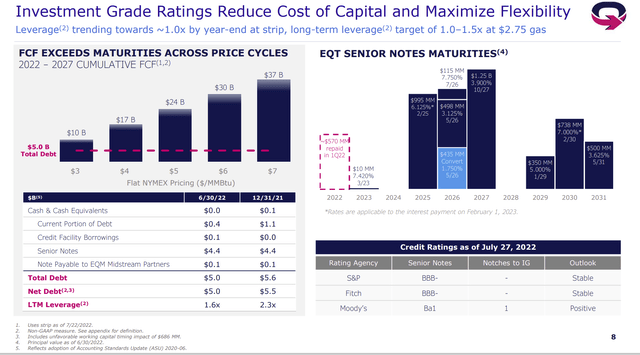

Therefore, it is important to know that the business can generate a certain amount of cash before working capital needs. That means that the long-term debt structure that the company has is very reasonable compared to the cash generating abilities of the company at the current time (with current commodity prices).

EQT Debt Due Structure And Leverage Calculation (EQT Second Quarter 2022, Earnings Conference Call Slides)

Despite the negative effects of the hedging program lowering revenue, management is making good progress towards lowering the financial leverage as shown above. As selling prices are likely to continue to improve, the debt due in the future appears to be in reasonable amounts. The credit line and the cash flow should be able to handle the whole situation shown above for the foreseeable future.

Similarly, a company with the financial ratings shown above will have access to the debt markets. The only worry would be the cost of that access whenever the company needs to either refinance debt or add to the debt shown above. Contrary to many opinions, the debt market never “shuts down”. But the cost of debt can escalate beyond the means to repay that debt in a given situation. The ratings shown above make that situation unlikely (but possible).

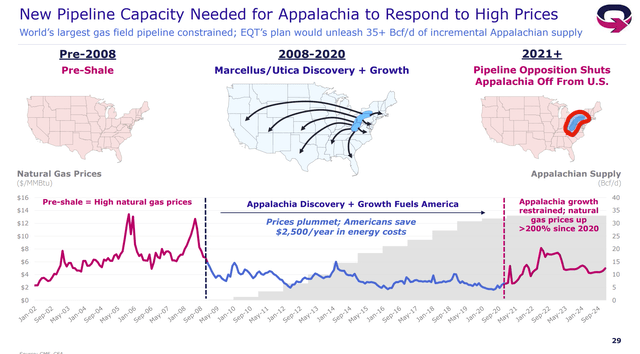

Appalachia Marketing Issues

The Marcellus is located in an area that is close to a lot of people. The “not in my backyard” syndrome stops a lot of development that would result in lower prices. The result is that the Northeast and up into Canada, pay some of the highest natural gas prices in both countries. A balance has not yet been found between the two (pro and anti) that would allow for a solution to lower prices.

Marcellus Pipeline Conundrum (EQT Second Quarter 2022, Earnings Conference Call Slides)

It turns out to be far easier to add pipeline capacity that goes West and South from the Marcellus because there are less people. So, the “not in my backyard” movement does not gain significant strength to stop progress. But heading North and East does run into population centers that do not want pipelines “in their backyards”.

This is slowing the progress of the basin receiving prices that are commensurate with other areas of the country. The result probably means a fair amount of natural gas heads down South to some of the main processing centers for basins like the Permian and the Haynesville because of the inability to get to markets that really could use additional supplies.

In the current industry situation, prices received are improving and profitability is adequate. But a cyclical downturn would punish producer prices received in the Marcellus more because a surplus would result in the basin that would lead to weaker pricing than is the case elsewhere. As a country, we probably need to think about the overall best interest rather than agreeing with whomever shouts the loudest.

The Future

This company acquired some great acreage at low costs during a time when there were few buyers even thinking about acquisitions. The resulting low location cost for each well should be demonstrated by a higher return on equity than is the case for many competitors as prices received continue to improve. Supposedly the company is near an agreement to acquire more acreage.

This company, like many, locked in prices through its hedging program to guarantee a minimum amount of cash flow because most management and industry observers never saw the currently strong prices on the horizon. In fact, many were far more worried about weak commodity prices for years to come. Now that the situation is clearly much better than anticipated, management has begun to adjust the hedging program accordingly.

Therefore, net prices received are likely to continue to improve for the foreseeable future. Less talked about is that some of the acreage is liquids rich acreage that provides management some flexibility that was not there in the past.

Overall, this company has now emerged as a growth situation. Even though production itself will probably not grow much until debt levels have decreased further, growth is likely to continue through periodic acquisitions and technology improvements. Another avenue of growth will be the gradual shifting of transportation agreements (as some come up for renewal) to increase the ability of the company to reach more profitable markets.

As a result, profitability is likely to continue to improve for some time to come regardless of progress made at the top line (revenue). The rapid improvements made by management initially are a thing of the past. But a long-term target returns in the low teens from the rapidly growing dividend and some appreciation are a good possibility.

This company achieved an investment grade rating on its debt. The management attention to a lot of details will lower the long-term risk of this investment. Those investors wanting to buy and hold knowing that this is a cyclical company may want to consider this as a potential portfolio position.

Be the first to comment