Iurii Garmash/iStock via Getty Images

Investment Thesis

EQT Corp. (NYSE:EQT) sells gas and natural gas liquids (”NGL”). Hence, with prices of natural gas in the US steadily creeping up, EQT should be set up very well to benefit from this dynamic.

Here’s the bull thesis in a nutshell, with natural gas prices in Europe jumping higher since the start of 2022, demand for NGL is going to increase.

EQT is 65% hedged, so it won’t fully sell-off if, for whatever reason, gas prices in the US were to take a breather.

However, management clearly is very confident in EQT’s near-term outlook having recently announced a $1 billion share buyback program.

I make the case that the risk-reward here is appealing.

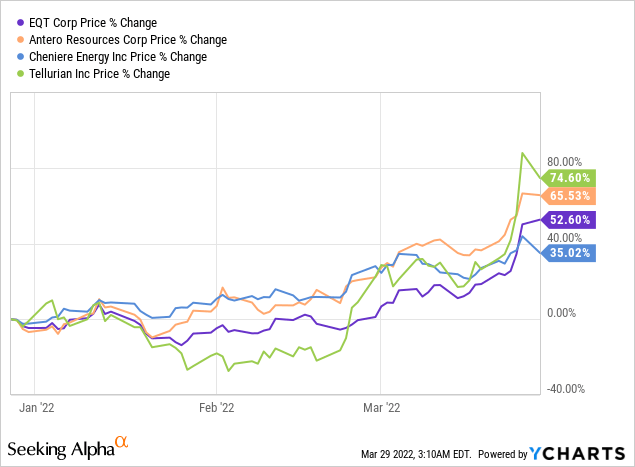

Investor Sentiment Moving Higher

For the past three months, this whole space has been on fire. The question now is whether or not this space will continue to remain compelling or is the market due for a breather?

I believe that we are not even getting started on the ”real” moves to the upside. Even though commodities are seriously cyclical, I believe that the cycle here is going to be longer than many predict.

Why EQT? Why Now?

EQT is the largest producer of natural gas in the US. Its revenues are derived from the sale of natural gas and NGLs.

As you know, Europe right now finds itself in an energy crisis. Meaning that the demand for natural gas in Europe is very high. Furthermore, Russian sanctions further restrict supply, in what is already a tight gas market.

As a reminder, natural gas is used for heating, transport, heavy industry, and agriculture, to name just a few uses.

What this all means in practical terms is that Europe is at a severe economic disadvantage when it comes to the production of various commodities and fertilizers compared to the U.S. What’s more, as of right now, getting natural gas liquids (”NGL”) to Europe is seriously challenging.

This further compounds issues for companies that use natural gas, as many of these compound products are commoditized. That means that with inflation driving commodity end-products higher, the incentives to produce more of these products are high.

But for European producers that use natural gas as their input resource, these companies are not able to capitalize on high demand, because their input costs, namely natural gas, are high relative to the U.S.

Consequently, President Biden is facilitating up to 15 billion cubic meters (”bcm”) exports to Europe, to displace up to 10% of what Europe gets from Russia. This is then expected to ramp up further after 2022.

However, irrespective of the intent, there’s simply no practical way to ramp up LNG exports to Europe. This will take around three to four years to meaningfully increase.

So, this is a logistics nightmare. All this being said, it’s clearly extremely good news for any company that has any exposure to LNG sales, such as EQT.

Cash Flows Could Increase, Meaningfully

Right now, EQT guides investors towards $1.4 to $1.7 billion of free cash flow this year. However, for 2022, EQT is 65% hedged. What this means is that even if the prices of natural gas go up meaningfully, EQT won’t be in a position to benefit hugely. Yes, it will benefit, but not fully. At least not in 2022.

On the other side of the equation, if things were to cool off in the gas market, then similarly, EQT would be largely hedged with its free cash flows for 2022 to a large extent known.

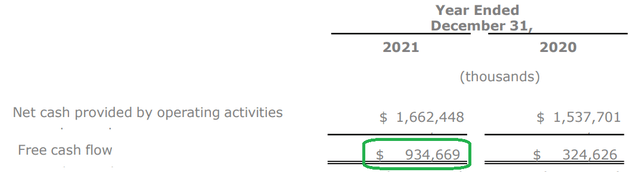

EQT Q4 2021 results

As you can see above, in 2021, EQT’s free cash flows were $935 million. However, despite being meaningfully hedged, EQT’s free cash flow guidance for 2022 is about 50% higher than 2021.

However, keep in mind that this guidance was given at the start of February.

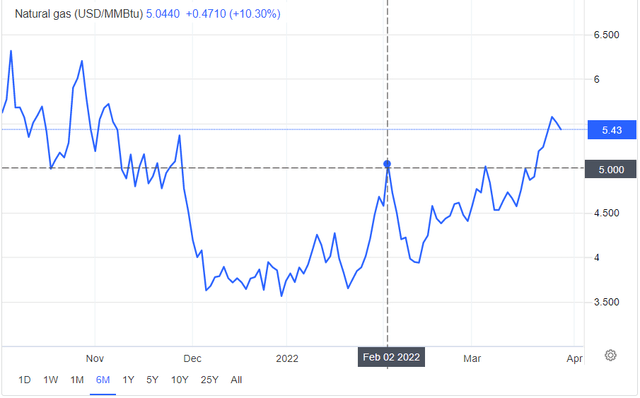

Trading economics, natural gas prices

As you can see above, at that time, EQT simply had no visibility into the price of natural gas we have now.

However, since early February, prices for natural gas have gone up. And more importantly, prices appear to be poised to go even higher, with analysts pointing to 20% higher prices in 2022.

EQT Stock Valuation — Difficult to Quantify the Upside Potential

It’s so difficult to make a conclusive argument that EQT is cheap on key metrics, such as free cash flows because it all depends on whether or not natural gas prices stabilize around $5.

Clearly, as it stands right now, EQT is priced at approximately 10x free cash flows, and this appears on the surface to be a reasonably fair entry point for new investors.

Indeed, for their part, management believes that the stock is cheap enough, that they announced an open-ended $1 billion share repurchase program in February.

What’s more, management clearly believes that they have more cash than they need to invest, because they’ve recently reinstated a dividend of $0.50 per share.

The Bottom Line

To say that the LNG space is very fluid would be an understatement. There’s a serious energy crisis in Europe. Europe had embarked on the green agenda without truly understanding what they were getting into.

It now appears that just to make things interesting, Western governments have imposed sanctions and mandates to cut their reliance on Russian gas exports.

This has led to gas prices soaring more than 80% in 90 days. All in all, the demand for natural gas is going up globally. And even though there’s demand for more LNG in Europe, ultimately, there are physical restrictions in place in terms of how you actually get LNG into Europe.

Altogether, this appears to indirectly raise the demand for natural gas in the US. Even if right now, some investors are doubtful as to whether or not this is indeed going to lead to a massive amount of investment in this space, the fact remains, all excess LNG exports are going to take several years to ramp up.

That being said, when the transport problem finally gets solved, EQT, the largest producer of natural gas in the US is very well positioned to benefit on the upside.

To preempt your question, I don’t have shares in this name. But I have shares in a peer. Whatever you decide, good luck and happy investing.

Be the first to comment