J. Michael Jones

EPR Properties (NYSE:EPR) has taken a bit longer than other net lease REIT peers to recover from the pandemic, largely due to its outsized exposure to the movie theater industry. Just as it appeared that movie theaters were out of the woods, one of the company’s tenants declared bankruptcy, sending the stock sharply lower. The stock trades at a notable discount to peers at 9x AFFO coupled with a high 7.9% dividend yield. The stock looks quite buyable here, although the same can be said about most of the net lease sector.

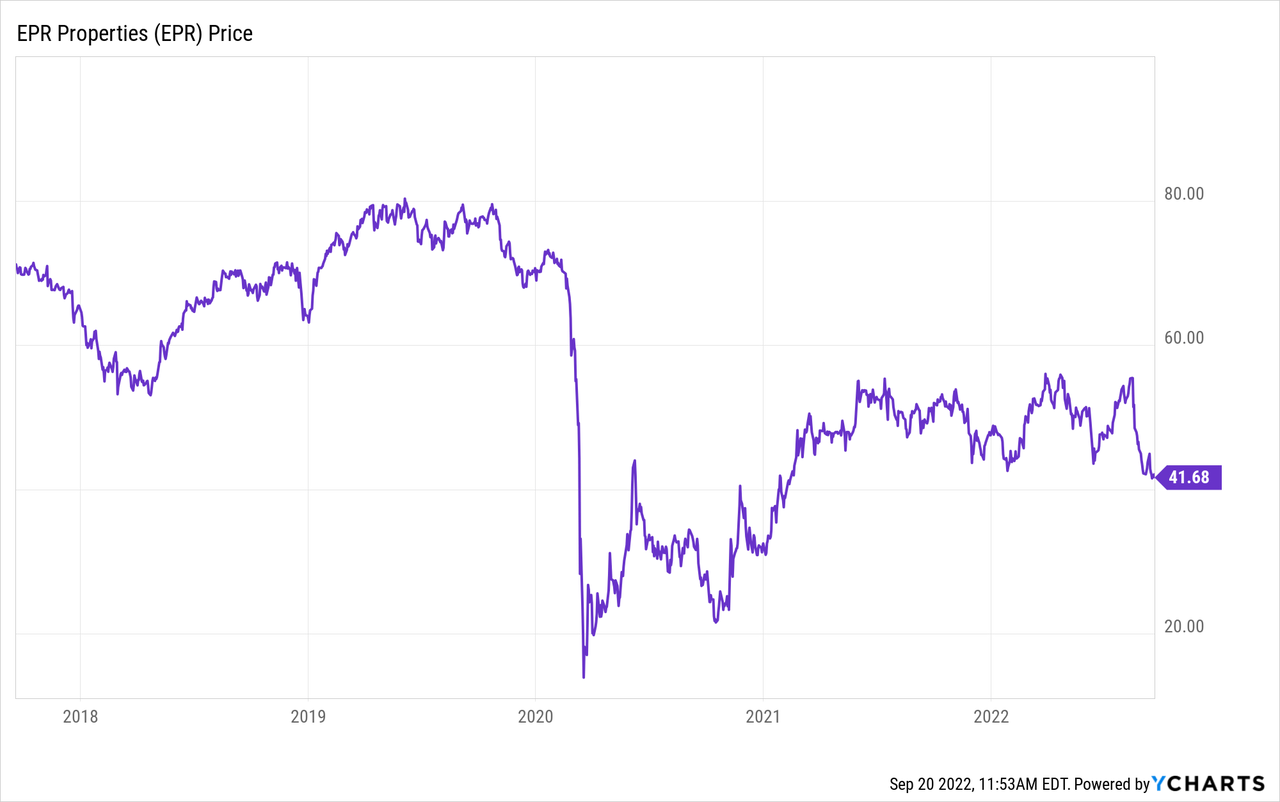

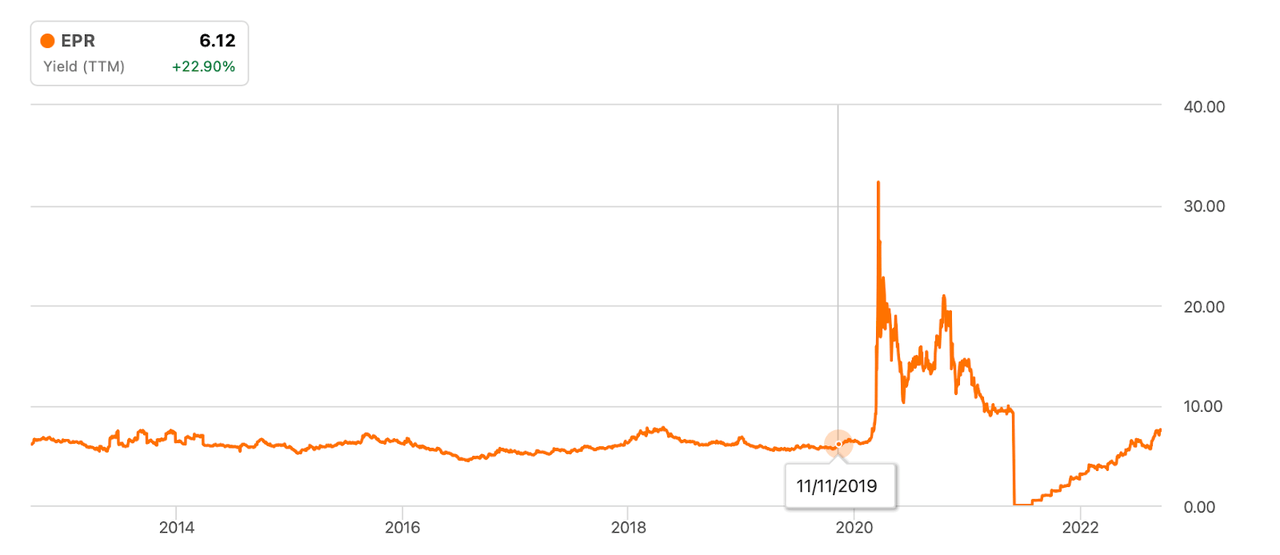

EPR Stock Price

EPR bottomed in the teens amidst the pandemic crash as its experiential portfolio suffered an existential crisis amidst pandemic lockdowns.

The stock has since recovered strongly from the lows but the stock remains 45% lower than pre-pandemic levels. I last covered EPR in April of 2021 where I called it a value trap on account of the movie theater exposure. The stock has since declined 15% (9% net of dividends) since then.

EPR Properties Key Metrics

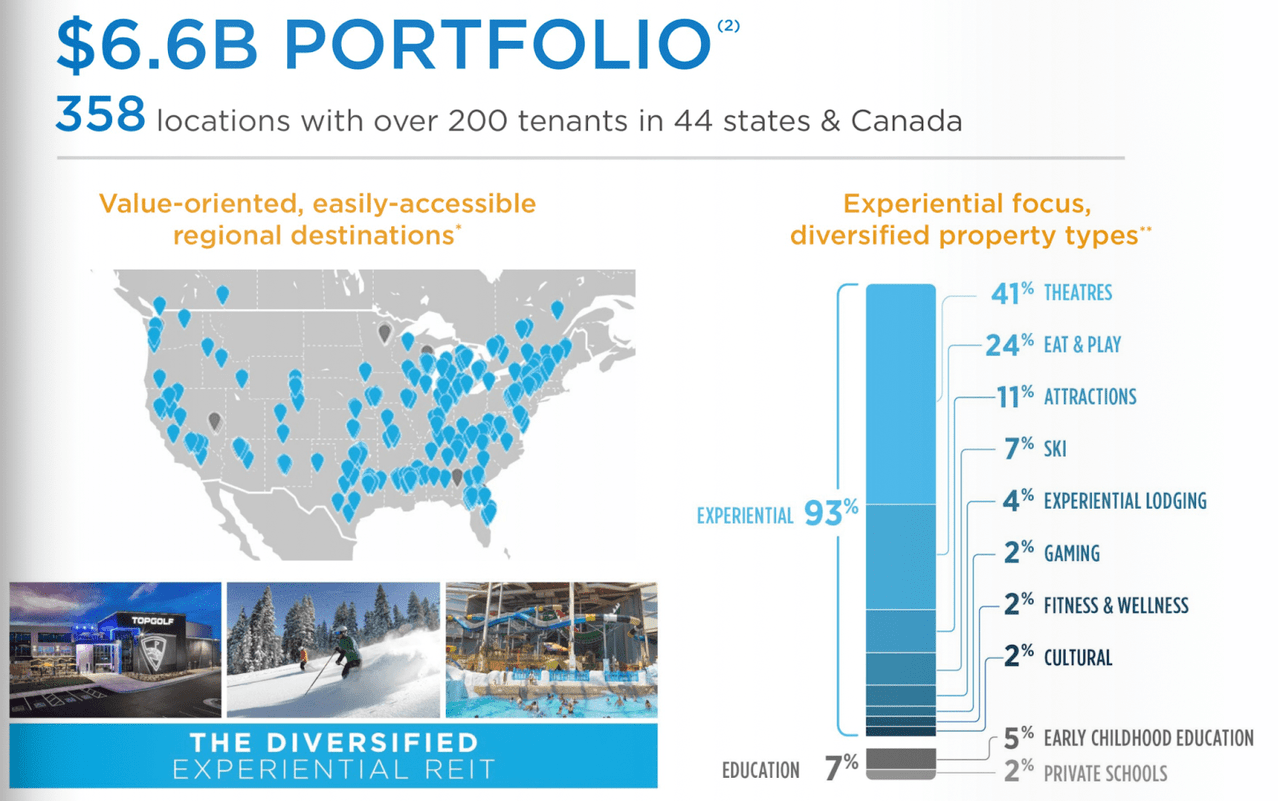

EPR owns a $6.6 billion real estate portfolio spread across 200 tenants in 44 states in Canada.

2022 Investor Presentation

These are triple net lease properties, meaning that the tenants are responsible for real estate taxes, insurance, and maintenance costs (the triple nets). NNN REITs typically deliver stronger free cash flow margins due to that lease structure.

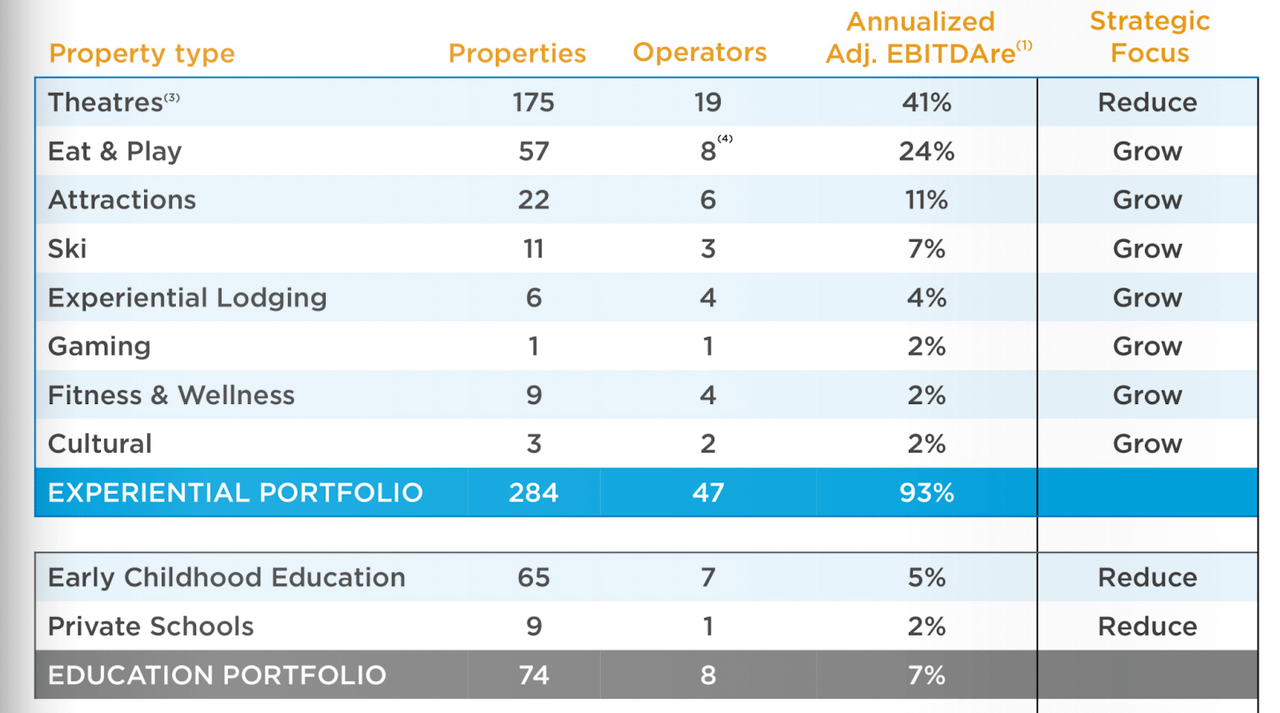

Unlike more well known NNN REITs like Realty Income (O) or Store Capital (STOR), EPR has focused exclusively on so-called “experiential properties.” We can see a breakdown of their various property types below – the company indicates that it seeks to reduce its exposure to theaters, early childhood education, and private schools.

2022 Investor Presentation

The latest quarter saw continued recovery from the pandemic, largely due to the theater tenants finally paying cash rents. EPR reported a staggering 73% increase in adjusted funds from operations per share (‘AFFO’) to $1.23 per share.

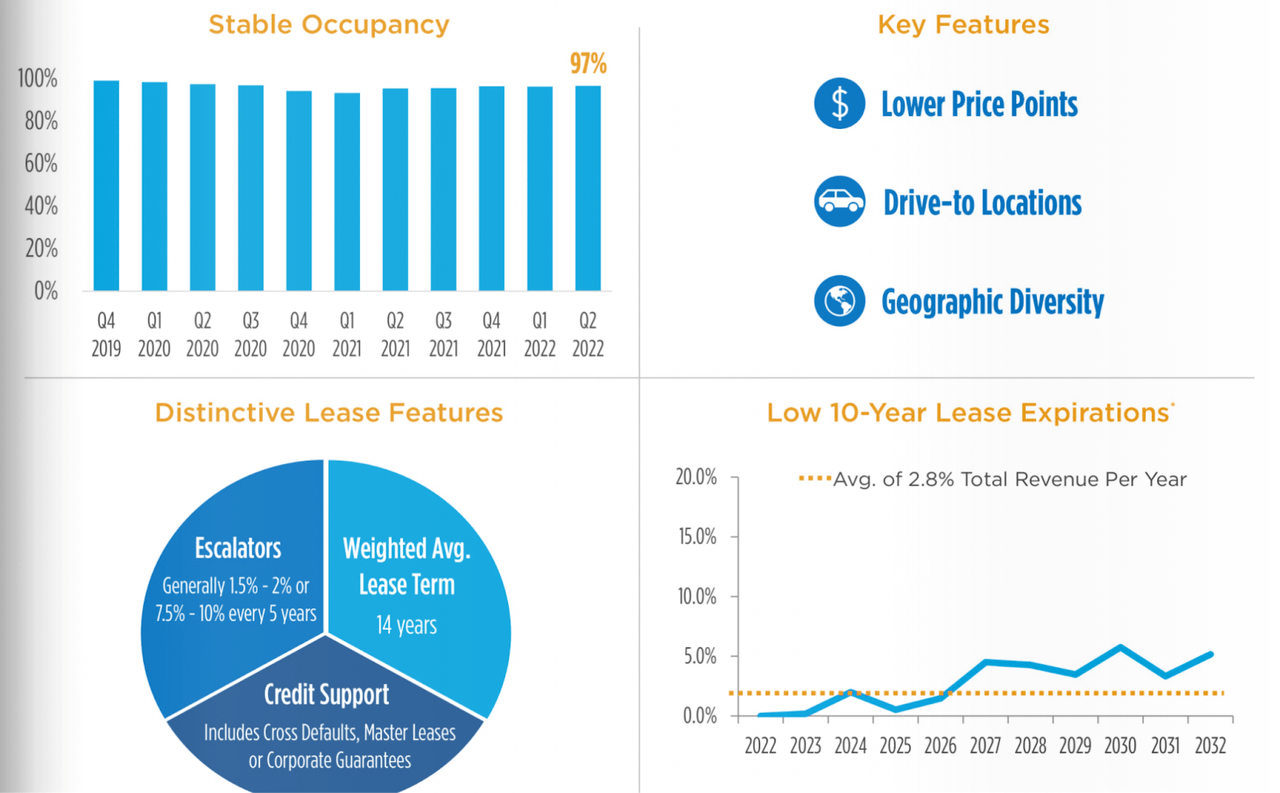

EPR ended the quarter with 97% occupancy and a weighted average lease term of 14 years. Its leases typically carry annual lease escalators of around 1.5% annually, providing a consistent source of internal growth.

2022 Investor Presentation

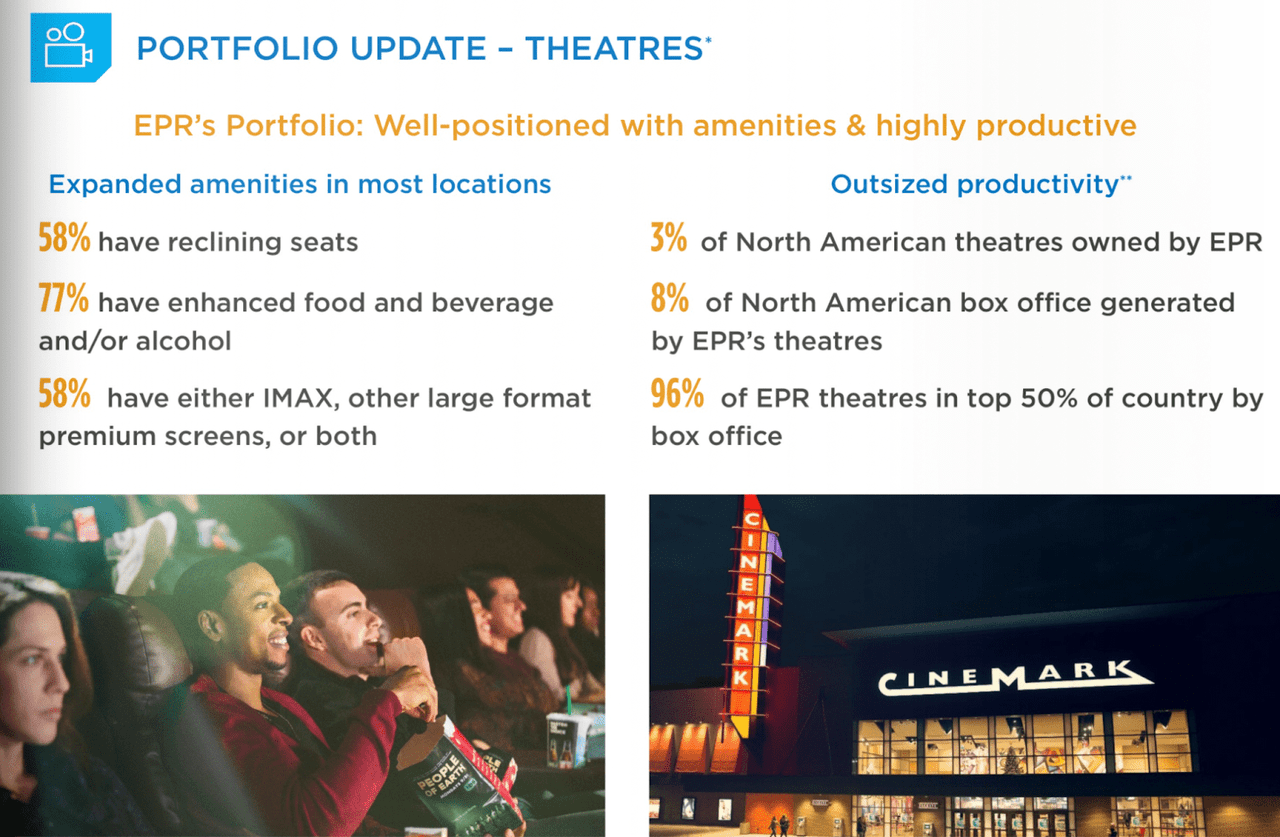

EPR has made great strides in diversifying its industry exposure since it came public in 1997 with 100% exposure to AMC Theaters (AMC). Exposure has since declined to 41% and EPR notes that the vast majority of its theaters are of a premium nature (as defined by reclining seats or enhanced experience) and can be considered to be the more strongly performing locations in the nation.

2022 Investor Presentation

That is difficult to confirm, however, and sentiment rules the day on Wall Street. As disclosed in the 10-Q filing, 15% of revenues come from AMC (AMC) and 14.4% from Regal. Cinemark (CNK) made up 8% of total revenue as of the end of last year. Regal’s parent Cineworld (OTCPK:CNWGQ) recently filed for bankruptcy. EPR had submitted a press release stating that Regal is current on all rent due and was not currently in any negotiations regarding their properties. It is however unclear if EPR will need to amend its lease terms with Regal or any other movie theater tenants. AMC was able to improve its balance sheet as a result of the Meme-stock craze and appears set to further improve its balance sheet on account of the new preferred stock (APE). That may be a highlight considering that AMC was arguably on the brink during the pandemic, but I expect negative sentiment to persist for EPR stock until there is resolution regarding Cineworld.

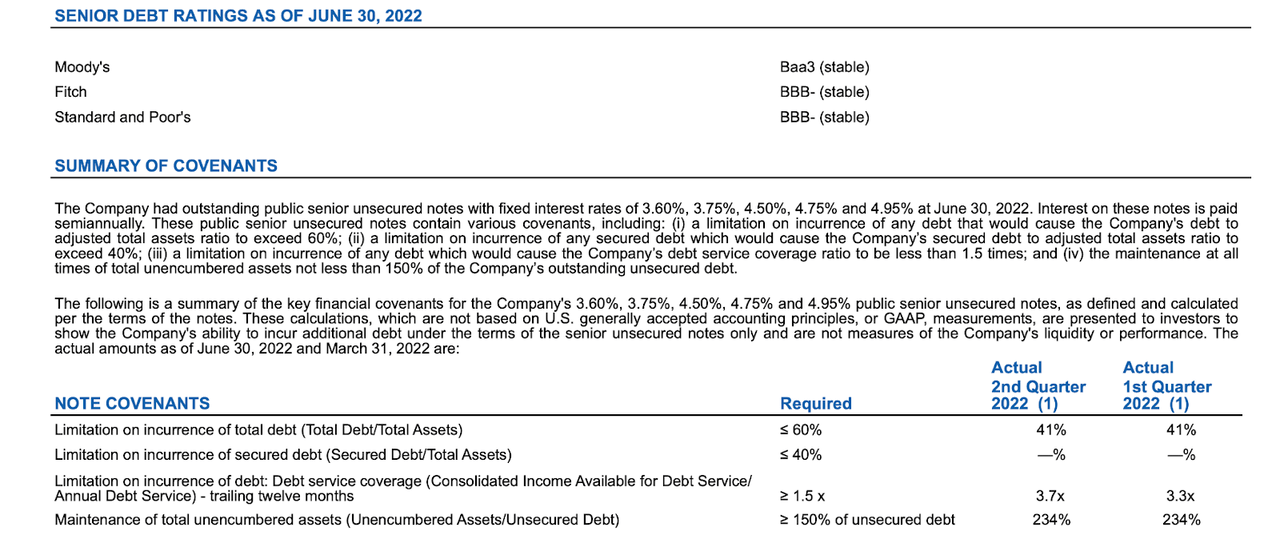

As of the end of the quarter, debt to EBITDA stood at 5.1x and the company was comfortably in compliance with debt covenants.

2022 Investor Presentation

Inclusive of $115 million of JV mortgage debt and $7.4 million of JV net operating income, debt to EBITDA stood at around 5.4x – a reasonable ratio.

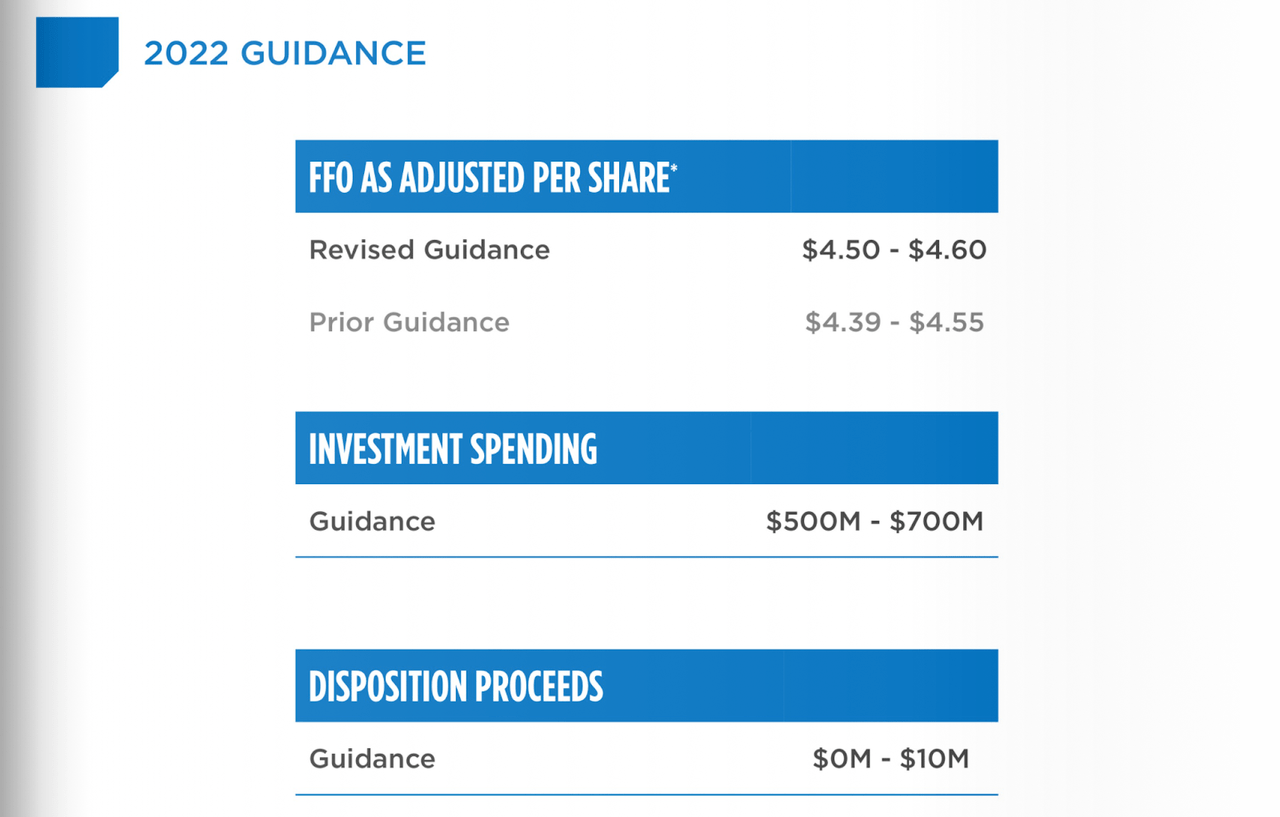

Looking ahead, EPR upgraded AFFO guidance to up to $4.60 per share mainly due to the strong investment pipeline.

2022 Investor Presentation

For reference, adjusted FFO stood at $5.44 per share prior to the pandemic. I typically like to see high acquisition spending versus low disposition proceeds, but in this case I am hopeful that EPR can aggressively sell off some theater assets in order to reduce its exposure to that industry. That may unfortunately prove to be a pipe dream as it isn’t clear if there are many willing buyers of theater real estate assets.

Is EPR Stock A Buy, Sell, Or Hold?

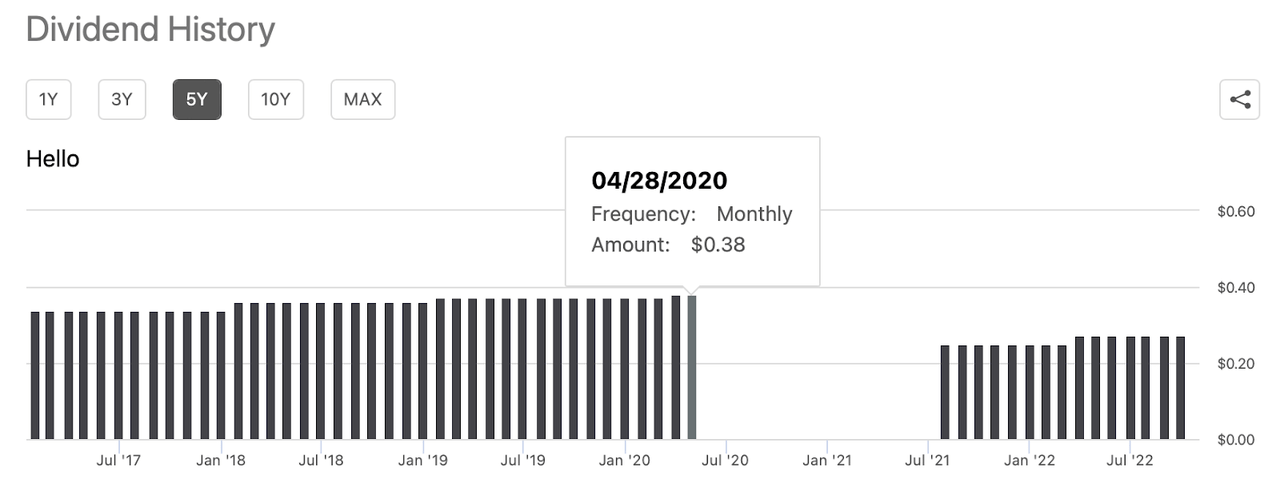

EPR currently pays a $0.275 per share monthly dividend, still far below the $0.38 monthly payout prior to the pandemic.

Seeking Alpha

Whereas the stock used to yield around 6% prior to the pandemic, the stock is currently yielding nearly 8% based on the reduced dividend payout.

Seeking Alpha

The stock is trading at around 9x 2022e AFFO, meaning that it has a 72% AFFO payout ratio. While I am skeptical of using payout ratios for many REITs, I am comfortably doing so with NNN REITs due to the high free cash flow generation.

The low payout ratio is a positive for shareholders because it means that more cash is available to fund acquisitions. As stated on the conference call, EPR expects to generate over $150 million in cash flow from operations after the dividend this year. In all fairness, that might not sound like a lot as compared to the $3.1 billion market cap (and perhaps more critically, the $5.8 billion asset base), but remember that growth expectations for NNN REITs tend to be muted anyways. Even without assuming debt issuance, that retained cash flow can represent up to 3% of growth from external acquisitions.

How long could EPR keep its payout ratio low if it wanted to? Based on the latest quarter’s $41.4 million in taxable income, $6 million of preferred stock dividends, and 75 million shares outstanding, I estimate EPR’s minimum dividend payout (REITs are required to pay out at least 90% of taxable income to shareholders through dividends) to be $0.14 per share monthly – far below the current payout. This means that unless the company decides to aggressively raise its dividend, it could theoretically continue retaining cash flows to fund acquisitions. I am hopeful that it chooses the latter path as multiple expansion (likely derived from reducing movie theater exposure) may be a significant driver of long term returns.

At recent prices, EPR trades at a discount to the 11.7x multiple of Spirit Realty (SRC) and 16x multiple of Realty Income (O). While the discount relative to SRC appears somewhat consistent with historical levels, a clear argument can be made that both names are too cheap relative to O. I can see O eventually re-rating to around 18x AFFO, SRC re-rating to 15x AFFO, and EPR re-rating to 12x AFFO. That implies a stock price of $55 per share – or 40% total return potential inclusive of the 8% dividend yield.

What are the key risks here? I have a nagging feeling that EPR’s portfolio appears ready to show weakness at any moment, particularly from the theater sector. The Cineworld bankruptcy may lead to a larger than expected number of vacancies and may be only the first shoe to drop in the sector. That overhang may keep EPR stock trading at low multiples until it is resolved, keeping the return potential limited to the dividend yield. I rate EPR a buy but caution that one should pay great attention to how the Cineworld bankruptcy unfolds.

Be the first to comment