Tom Cooper

Investment Thesis

I have been a fan of EPR Properties (NYSE:EPR) for some time with my most recent article being published in May 2022. You may recall:

EPR’s price has been fairly flat over the past year, but its outlook and financial position are substantially better which makes this an even better time to get in. At a reasonable 16x multiple on FFO this stock should trade at $70/share within the next year for 40% upside and you get to collect the juicy ~6% dividend yield which will only get bigger in the coming months.

The management team has also proven they can steer this ship through any economic environment as it just did through the least conducive one possible which was COVID and came out the other side with the financial position intact.

Q2 results showed only positive signs and I am maintaining my $70/share price target for the reasons discussed throughout this article. I will also explain why the 9% Convertible Series E Preferred (NYSE:EPR.PE) shares are a viable alternative to the common that I have discussed in previous articles.

Deferral Collections on Track

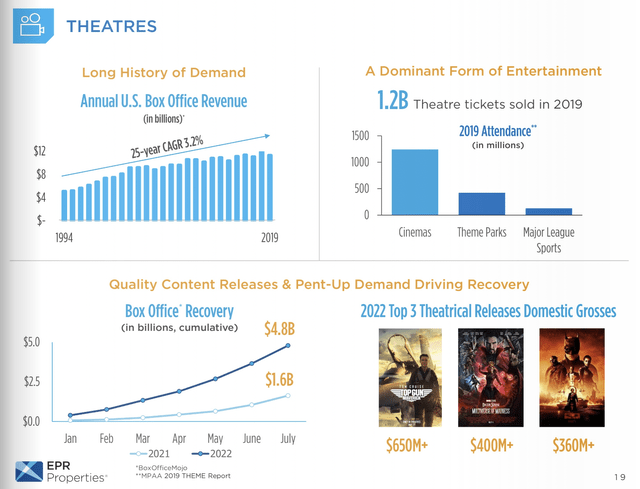

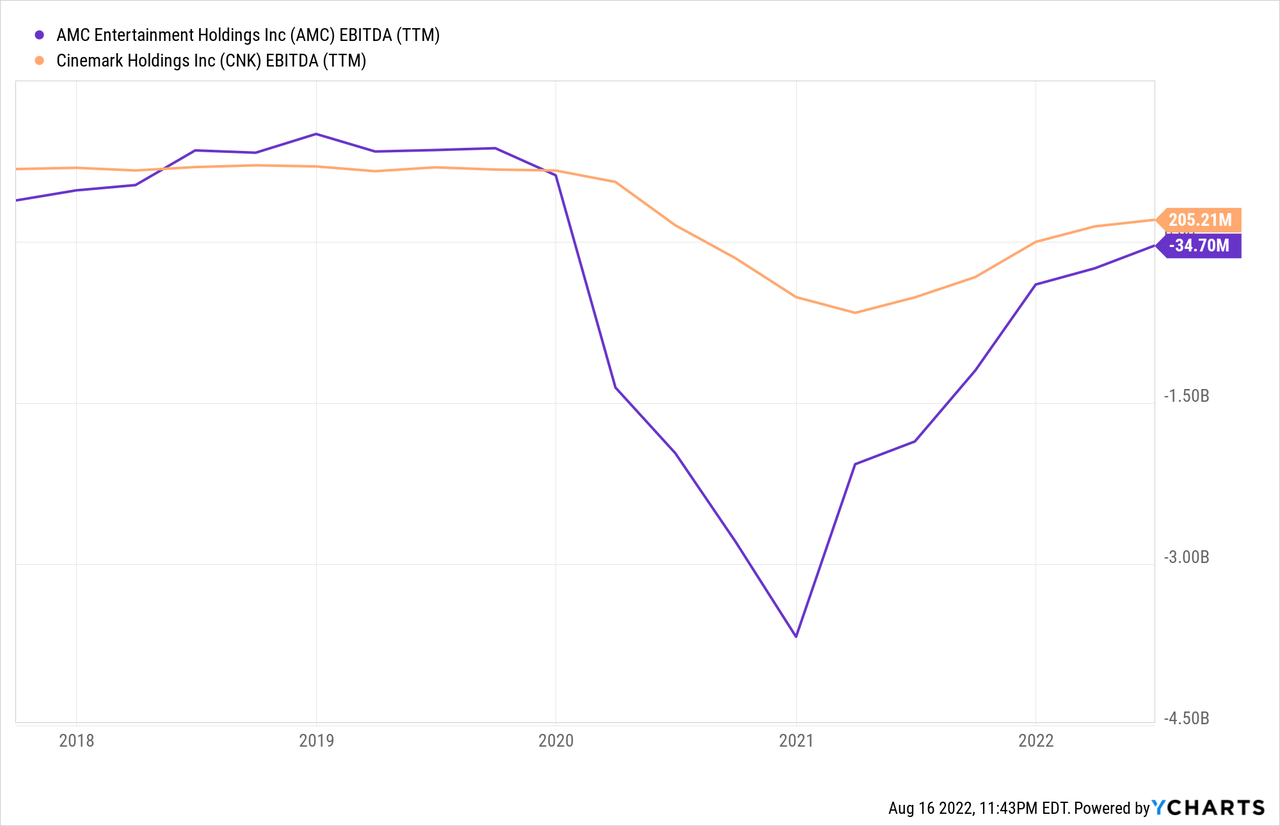

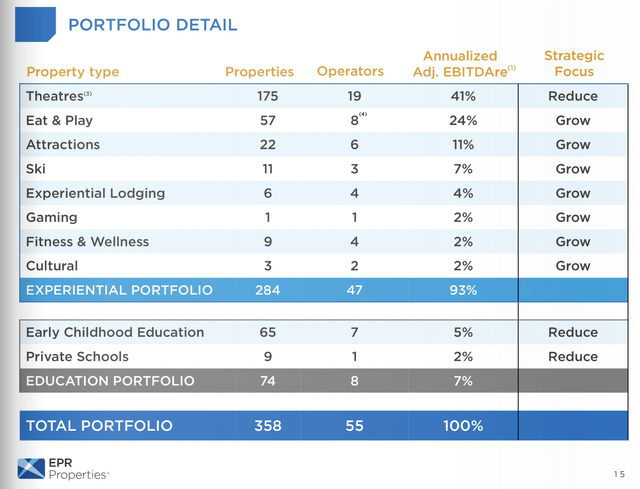

EPR’s largest asset class, which makes up 41% of EBITDAR, is Theatres. In my previous article, I discussed the astounding decline in box office sales between 2020-2021 which greatly impacted three of EPR’s largest tenants which include AMC Entertainment Holdings (AMC), Cinemark Entertainment (CNK) and Regal Cinemas. In fact, AMC was on the verge of bankruptcy in that timeframe.

We can see through 2022 that box office revenue is on pace to reach its pre-COVID levels. The three top blockbuster films already released this year which include Top Gun: Maverick ($650MM), Doctor Strange in the Multiverse of Madness ($400MM) and The Batman ($360MM) have combined brought in more revenue than all films did in the first half of 2021. As a result, CNK and AMC are starting to return to profitability (Regal is not publicly traded). Therefore, it would appear that COVID has not made the moviegoing experience a thing of the past.

Q2 2022 Investor Presentation (EPR Properties)

As of March 31, 2022, EPR had deferred amounts due from tenants of approximately $17.4MM that were booked as receivables. During Q2 EPR collected $4.9MM of deferred rent from accrual basis customers that reduced receivables and $4.7MM of deferred rent and $0.3MM of deferred interest from cash basis customers that were booked as additional revenue. EPR is well on track to fully collect by mid-2023.

Eat and Play

24% of EPR’s EBITDA comes from restaurateurs that also provide entertainment venues. This includes upscale bowling and bocce eateries to retro-themed gathering spots designed to appeal to socially-motivated Millennials. EPR’s largest tenant in the space is TopGolf.

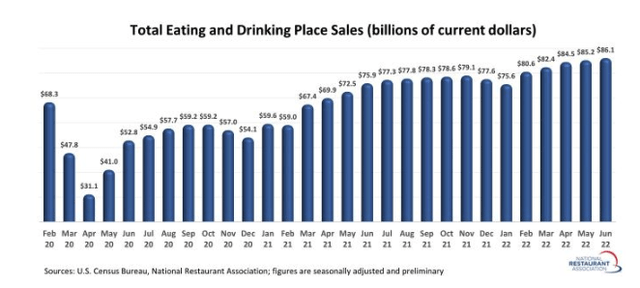

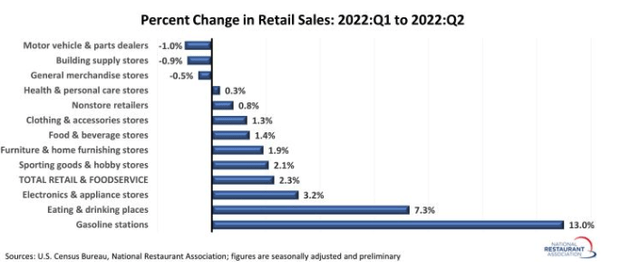

Eating and drinking places registered total sales of $86.1B on a seasonally adjusted basis in June, according to the National Restaurant Association. That was up 1.0% from May’s volume of $85.2B, and represented the fifth consecutive strong monthly gain.

Eating and drinking places ranked second among the major categories tracked by the National Restaurant Association, with total sales rising 7.3% between the first and second quarters of 2022. Factoring in menu-price inflation, real eating and drinking place sales rose 5.5% in the second quarter.

This is while the national average price of gasoline has been at $5/gallon; just imagine what spending would have been in the absence of high gas prices.

Total restaurant industry sales (National Restaurant Association)

Total restaurant industry sales (National Restaurant Association)

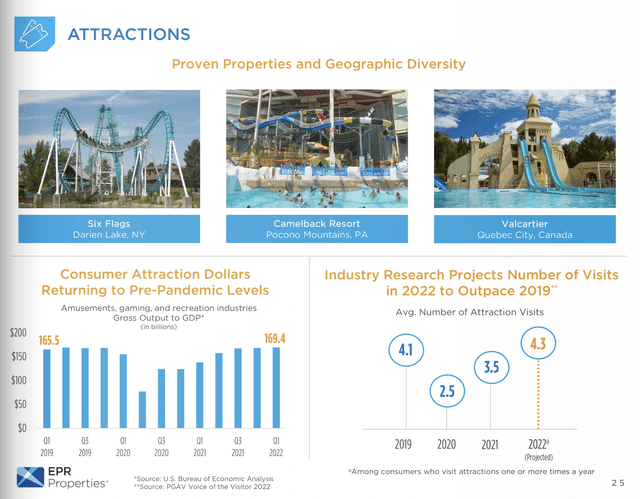

Attractions

The share of EBITDAR attributable to the attractions segment has increased to its highest level in EPR’s history. Visits to its properties that theme park operators occupy such as Six Flags Entertainment (SIX) and Camelback Resort now are on pace to exceed the levels seen in 2019.

Q2 2022 Investor Presentation (EPR Properties)

EPR’s investment spending during Q2 of 2022 totalled $215MM, bringing the total CAPEX spending for the year to $239MM and included the acquisition of an 85% interest in an experiential lodging property for $50.6MM as well as the acquisition of two attraction properties in Canada for $142.8MM. One of which includes the Calypso Waterpark in Ottawa, ON, which is the largest theme park in Canada, and the other is Valcartier in Quebec City, QC. As a result, this segment should grow substantially as a proportion of EBITDAR in future quarters.

Q2 2022 Investor Presentation (EPR Properties)

Guidance

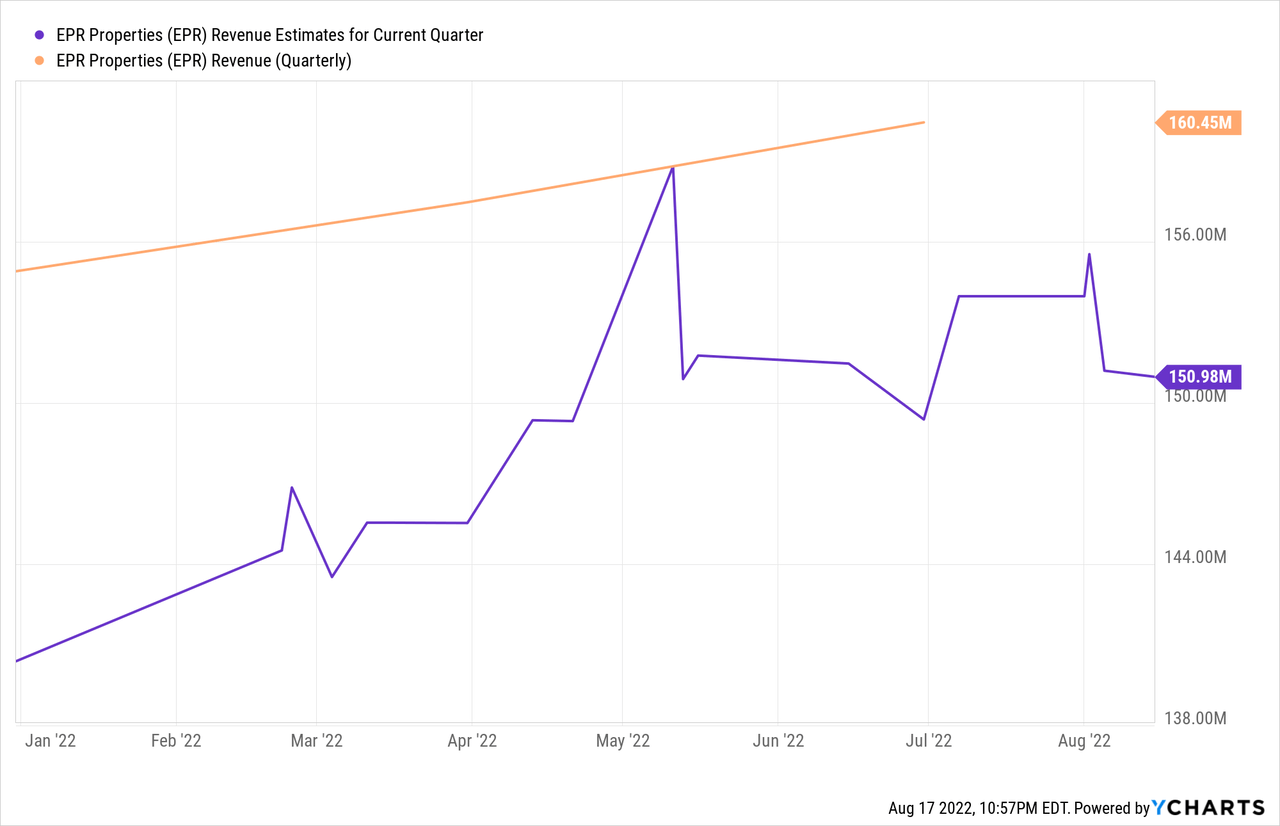

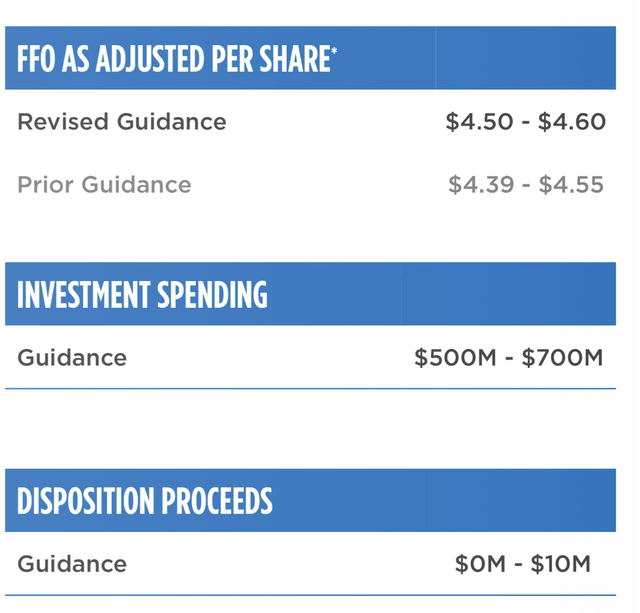

Things have improved much quicker than expected for EPR coming out of its pandemic lows for the reasons mentioned above, which is why it exceeded analyst revenue and FFO estimates for Q2 2022. Management has also raised guidance for fiscal 2022 and its FFO estimates do not even include the deferred collections.

Q2 2022 Investor Presentation (EPR Properties)

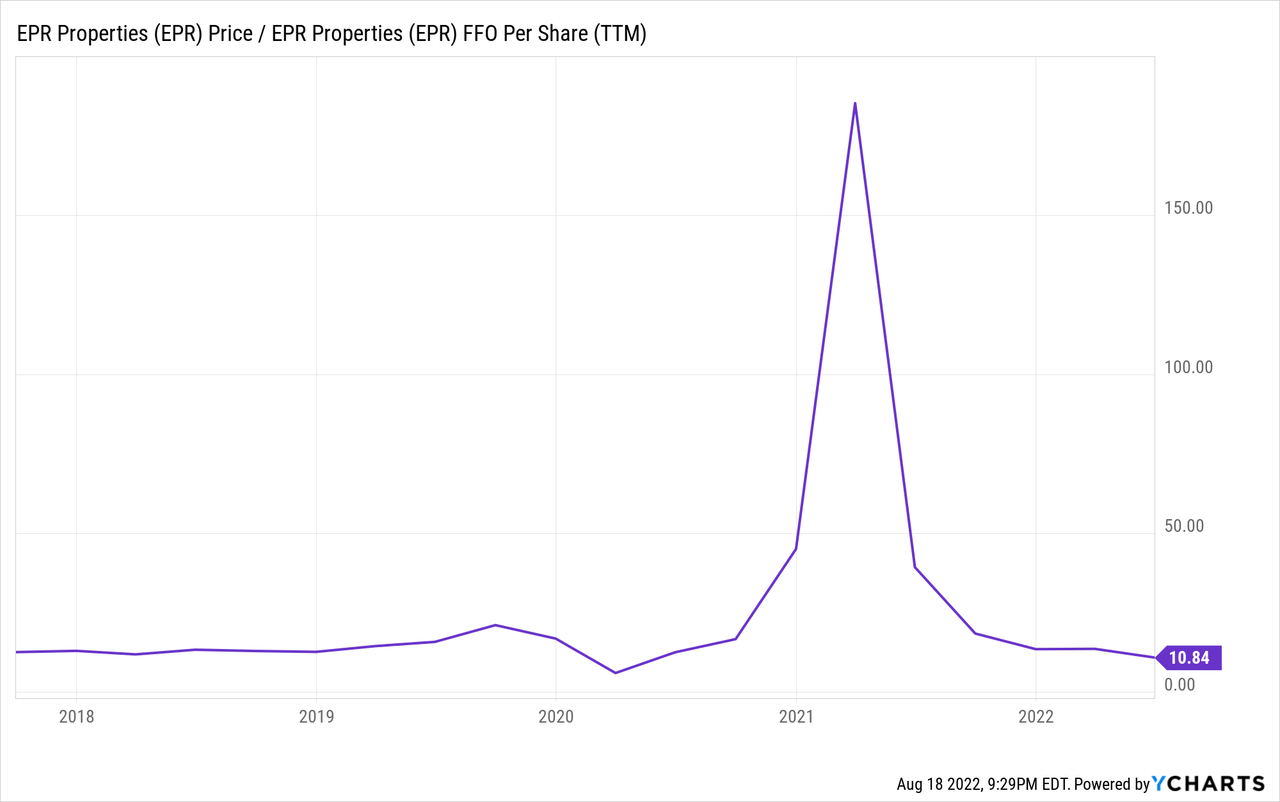

As mentioned previously, EPR has spent $268MM in CAPEX to date, but plans to spend as much as $700MM before 2022 YE. Management suggested in the Q2 2022 earnings call that it intends to spend the bulk of the CAPEX budget on non-theatre properties as cap rates have started increasing. Previously, cap rates were at 7-8; the management now expects to be able to invest at over 8%. Although the Theatres segment accounts for a historic low as a proportion of EBITDA, with greater CAPEX spending on Attractions, Eat & Play, Experiential Lodging and Gaming, we should see even greater tenant diversification by year-end. Given EPR’s current situation, it seems absurd that it trades at almost a historic low valuation at ~11x FFO.

Q2 2022 Investor Presentation (EPR Properties)

The payout ratio is only at 73% of the low end of guidance for fiscal 2022. Historically, the payout ratio has been at least 80% of FFO. Therefore, I would not be surprised to see the monthly dividend increase to at least $0.30/share before year-end. This would mean a forward looking payout ratio of at least 7% at the current price of $51/share.

The Preferred Shares

I have previously only discussed the common shares but I am also bullish on the preferred shares or at least the Series E and C. EPR’s preferred shares are summarized below:

- EPR-C 5.75% Series C Cumulative Convertible Preferred Shares (EPR.PC)

- EPR-E 9.00% Series E Cumulative Convertible Preferred Shares (EPR.PE)

- EPR-G 5.75% Series G Cumulative Redeemable Preferred Shares (EPR.PG)

| Series | C | E | G |

| Coupon Rate | 5.75% | 9.00% | 5.75% |

| Convertible | Y | Y | N |

| Price/share | $23.98 | $31.08 | $23.62 |

| Yield | ~6.4% | ~7.2% | ~6.1% |

The Series G offers the lowest yield and shares are callable as of November 30, 2022, which is likely why it trades at a 6% discount to the $25/share liquidation (par) value. It also offers no conversion option like the other two series.

Both E and C Series are callable but not at a specified price or date and are at 150% of the conversion price, which based on EPR’s current price would be at ~$78/share and ~$81/share respectively and will unlikely be much of a factor in the near term.

Series E and C preferred shares offer somewhat favourable conversion options to realize upside. Series C shares have a conversion ratio of 0.4163 common shares per $25.00 liquidation preference at June 30, 2022 (equivalent to a conversion price of approximately $60.05 per common share). Series E shares have a conversion ratio of 0.4826 common shares per $25.00 liquidation preference at June 30, 2022 (equivalent to a conversion price of approximately $51.80 per common share). EPR’s share price as of June 30, 2022 was ~$45/share relative to ~$51/share today which would have little impact on the conversion ratio today.

As Series E shares trade at a 24% premium to par, you are essentially spending an extra $6 for every $25 of liquidation preference and therefore the effective conversion price is really ~$64/share. The Series C shares offer slightly more upside if one were to convert as it would only be profitable to convert the Series E if the share price exceeded ~$64/share versus $60/share for the Series C. Either way, I do see it being profitable to convert either issuance in the near term as I have a minimum $70/share price target for EPR common shares.

Personally, I would go with the Series E to collect the higher yield while waiting for EPR’s common stock to rally.

Conclusion

EPR common stock is cheap in its own rights and there is absolutely nothing wrong owning these securities long-term. However, the Series E and C preferred shares provide a comparable yield with much more downside protection as they are senior in the capital structure to EPR common stock. In addition, the shares offer capital appreciation potential as the undervalued common stock gets more respect from the market.

Be the first to comment