Eamonn M. McCormack/Getty Images Entertainment

Market downturns can be a welcomed sight for income-focused value investors, given that they produce high dividend opportunities. This is considering that the S&P 500 (SPY) still yields a paltry 1.6% despite falling into a bear market. As such, investors can easily find opportunities in individual stocks in today’s market to boost their income.

This brings me to EPR Properties (NYSE:EPR), which still appears to be reasonably cheap despite a slight uptick in recent weeks. In this article, I highlight what makes EPR an attractive high yield buy at the current price, so let’s get started.

Why EPR?

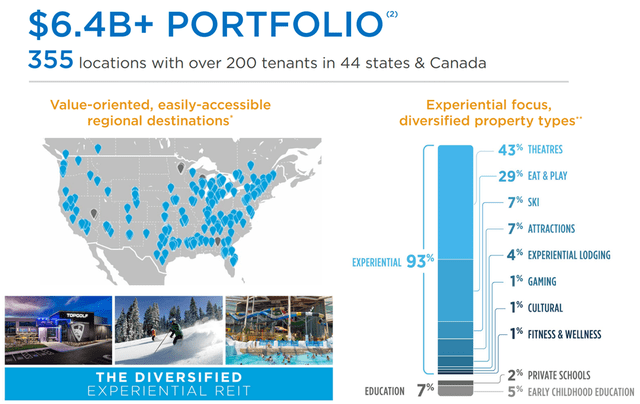

EPR Properties is the largest pure-play REIT in the U.S. that’s dedicated to experiential net lease real estate, with $6.4 billion in total investments spread across 44 states and Canada. This includes 281 properties in service across 42 operators. It also enjoys long-weighted average lease term of 14 years, sitting above the ~10 years for most net lease REITs.

While some investors may mistake EPR Properties as being primarily dedicated to movie theaters, that simply isn’t the case. That’s because management has been actively diversifying away from this segment. As shown below, movie theaters now make up just 43% of the property portfolio based on contractual cash rents, with the remainder stemming from restaurants, family attractions, resorts, and education.

EPR Portfolio Mix (Investor Presentation)

Moreover, 93% of EPR’s rents are based on experiential tenants, with the remaining 7% dedicated to private schools and early childhood education, thereby making EPR Properties ultimately e-commerce resistant.

Meanwhile, EPR’s portfolio has posted an impressive recovery, with AFFO per share more than doubling YoY, from $0.52 to $1.16 in the first quarter. The portfolio also appears to be healthy, with a 96% leased rate, and management recently upped its full year AFFO per share guidance to $4.47 at the midpoint, from $4.40 previously. Furthermore, EPR’s strong showing (pun intended) helped it to gain an upgrade to an investment grade credit rating of BBB- with stable outlook from Fitch, up from BB+ previously.

Looking forward, EPRT maintains strong liquidity to pursue external growth, with an impressive $323.8 million in cash on hand and full availability on its $1.0 billion unsecured revolving credit facility at the end of March. This appears to have been put to use recently, as this month, EPR acquired a resort and water park in Canada for $142 million.

In addition, management is set to pursue additional opportunities as it noted a $100+ billion addressable market opportunity, with several underpenetrated segments in experiential real estate. This was noted by management during the recent conference call:

We are also excited to be executing on our investment pipeline on transactions with solid economics. In 2022, we are uniquely well positioned to execute on a defined set of opportunities armed with a strong balance sheet. We are confident in the acceleration of our investments spinning based upon the substantial progress we have made on a number of transactions that we expect to close in the second half of the year.

Risks to EPR including higher interest rates, which may raise its cost of debt to fund new acquisitions. In addition, EPR’s 43% exposure to movie theaters could come under pressure from streaming. This is, however, nothing new for EPR, and movie theaters have proven more resilient than what many naysayers have prognosticated.

This is considering the recent success of Top Gun: Maverick, which has topped over half a billion in movie ticket sales domestically. In addition, streaming has shown cracks in recent months and management has noted a future in which streaming and theaters coexist rather than a winner take all, as highlighted during the recent conference call:

We believe the debate around the impact of streaming will continue to moderate. It is becoming increasingly clear that theater exhibition has regained its distinction as the platform which maximizes revenues for studios. With the recent Netflix news, the streaming environment appears to be entering a period of rationalization.

A recent study from Deloitte highlighted the intense competitive challenge faced by streaming services, and noted that social media has become a direct competitor for at home viewing time. We continue to believe that in the end, theater exhibition and at home streaming services should and will successfully coexist, as they have for many years.

Meanwhile, I find EPR’s 7% dividend yield to be attractive. The dividend is paid monthly and is well-covered by a 74% payout ratio, based on management’s current year AFFO per share guidance of $4.47 at the midpoint.

EPR also trades rather cheaply at the current price of $47.85, with a forward P/AFFO of 10.7, sitting well below that of most net lease peers. Sell side analysts have an average price target of $57.38. This implies a potential one-year 27% total return including dividends.

Investor Takeaway

EPR Properties is a quality net lease REIT that owns a diversified portfolio of experiential real estate assets. Its portfolio has posted a solid recovery since the depths of the pandemic. Looking forward, EPRT maintains strong liquidity to pursue external growth, with an impressive cash pile and credit facility. Lastly, EPR appears to be cheaply priced and sports a high 6.9% dividend yield. As such, EPR appears to be a good buy at present for income and growth.

Be the first to comment