Laurence Dutton/iStock via Getty Images

It’s been a while since my last article about EPAM Systems (NYSE:EPAM), and I believe that it is the right moment to make some remarks about the recent results presented by the company and how the future may be for the company in the coming years.

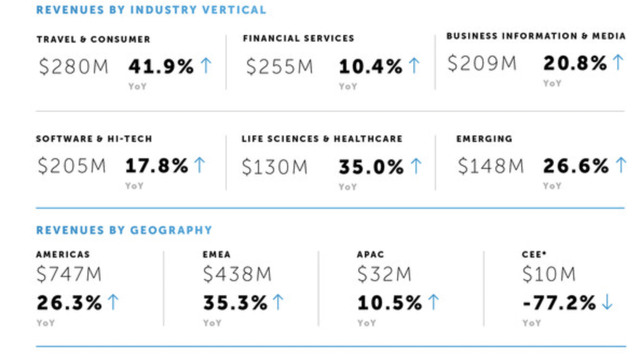

In the recent results presented by the company, revenue increased 24% compared to the same quarter of 2021. In addition, income from operations remains strong and growing at rates of 24% in the same period. The company continues to generate high amounts of cash from operations and has a solid financial position that has helped them to navigate over the turbulent times we are going through right now.

The business remains strong, and there are no signs of deceleration of demand in the long term. Digital transformation is still needed by all sort of businesses and EPAM continues to expand to different verticals and different geographies. A great part of EPAM’s revenues come from North America and Europe, but the company is growing its presence in less digitalized regions of the world, such as Asia. Growth potential is high there and EPAM is willing to make presence in a market which will definitely have strong momentum in the coming decade.

EPAM’s quarterly results in different verticals and geographies (EPAM investor relations)

EPAM is focused on providing high quality services at low prices to achieve a double goal: increase customer satisfaction and deliver more quality to the value added services that they provide. In the words of Arkadiy Dobkin:

[…] about our ability to continue moving higher in the value chain, something we started 10-years ago and what we’re very eager to continue doing now and in the future, proving to the market that we would be able to navigate the next transformation of EPAM to be able to offer to our clients something, which is rare in the market; strategy and implementation simultaneously and at scale and doing that better than most of our competitors can.

This business’ strategy, also known as shared scale economics, is focused on providing great quality services while the company keeps lower pricing than competitors in order to increase customer satisfaction. This, combined with the long term relationships they have with their clients make them well positioned to grow in the coming years.

The company remains focused on maintaining its human capital, which in my opinion is the main source of their moat in a highly fragmented and competitive market. EPAM’s focus on maintaining and retaining employees is admirable, and can be seen in the low churn rate and employee attrition they show, which averages around 10% in the last three years.

In addition to all the benefits of the business model, EPAM continues to maintain a solid balance sheet position that has allowed it to relatively easily solve all the difficulties arising from its operations in Eastern Europe. The company currently has net cash of more than $1 billion, although it remains to be seen whether part of that cash (denominated in rubles and other oriental currencies) may be recoverable. In any case, solid cash generation together with a good debt maturity schedule means that the risk of default is relatively low.

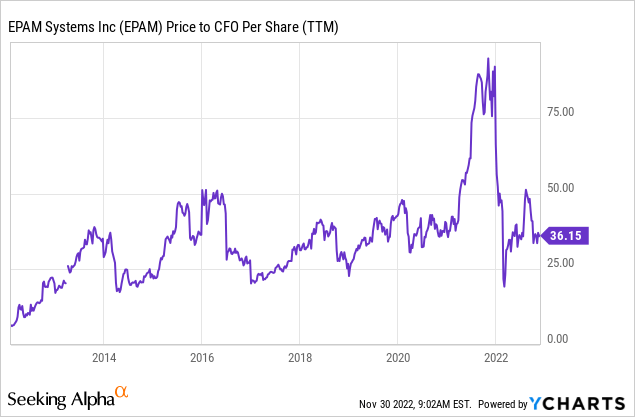

EPAM’s valuation remains high as the market is not unaware of tailwinds for the sector. It is currently trading at more than 30 times its operating cash flow, in line with the valuation levels of previous years. Valuation levels above 25 times cash flow would be interesting to restart a position in EPAM. The risk / benefit ratio (according to my profile) would be much more appealing at that time.

In conclusion, I believe that EPAM is a company located in a good sector with many tailwinds in the long term and with an extraordinary management team that will continue to drive the growth of the company and at the same time generate value for shareholders in the long term.

Be the first to comment