pandemin

Thesis

Fully-integrated midstream MLP Enterprise Products Partners (NYSE:EPD) stock has recovered remarkably from its September lows. In an early August article, we cautioned investors to avoid chasing the rally then.

EPD has consolidated sideways over the past two months as the underlying energy markets weakened further. Notwithstanding, EPD’s operating model shields it from significant volatility in the underlying markets with its contractual agreements on its volume.

As such, it has helped EPD maintain robust profitability margins through economic cycles, lifting its distribution over time for investors. Consequently, EPD trades at a higher valuation multiple on average than its downstream/upstream peers in the oil & gas value chain. However, it trades at a discernible discount against the S&P 500 oil & gas storage and transportation industry.

We assess that EPD’s diversified growth drivers should help mitigate potential weakness from a particular segment. Notwithstanding, EPD is not immune to a broad-based normalization in the underlying markets, which could slow the growth in its distributable cash flow (DCF).

As such, we postulate that it could impact the buying upside from the current levels, as Wall Street’s estimates remain optimistic about the industry’s prospects. Hence, we believe that EPD could be hit by potential risks of earnings compression if the market anticipates further weakness in the underlying markets.

EPS last traded at an NTM dividend yield of 8.1%, well above its 10Y mean of 6.5%. Therefore, it’s arguable that EPD’s valuation doesn’t seem aggressive as we enter a potential recession.

Still, we gleaned that EPD’s price action indicates that buyers’ momentum has continued to weaken even as it consolidates. Therefore, we urge investors to remain patient, as we postulate a material re-rating is unlikely in the near term.

Revise from Sell to Hold for now.

EPD: Valuation Remains Relatively Well-Balanced

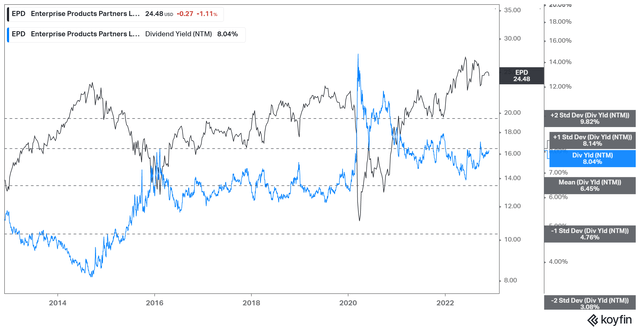

EPD NTM Dividend yields % valuation trend (koyfin)

EPD last traded at an NTM dividend yield of 8.1%, close to the one standard deviation zone over its 10Y mean. However, we noted that the market rejected further buying upside as its yield moved closer to its 10Y average at EPD’s June highs.

Hence, we assess that the market has likely de-rated EPD, expecting potential earnings compression moving ahead.

Therefore, we urge investors to avoid adding exposure in EPS close to its mean to improve their reward/risk in anticipation of further weakness in the energy markets.

Underlying Energy Markets Have Weakened Considerably

Recessionary headwinds have continued to build up, worsened by the recent COVID flare-ups in China, as oil bulls continued to feel intense pressure from sellers. Furthermore, the market appeared to have “disregarded” OPEC+’s previous announcement of production cuts, as the market focused on risks of demand destruction.

However, we also gleaned that WTI crude oil price action appears to be oversold after the recent steep selloff. As such, it should find support if oil bulls return vigorously to defend against further selling.

NYMEX natural gas futures have also recovered remarkably from their October lows. However, we assess that further spikes akin to what we saw in August/September are unlikely as Europe works out its plans to cap gas prices moving forward. Notwithstanding, it remains work-in-progress for now.

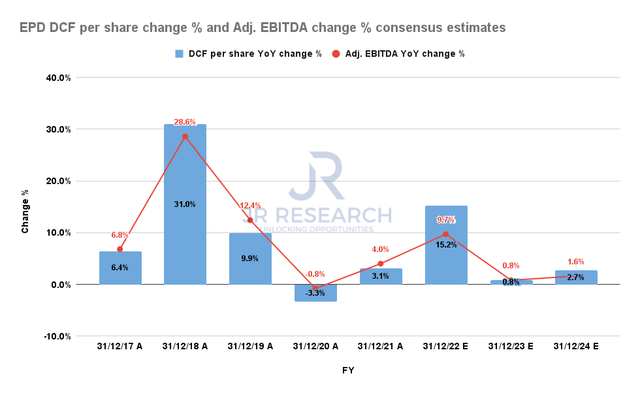

EPD DCF per share change % and Adj. EBITDA change % consensus estimates (S&P Cap IQ)

Accordingly, we deduce that the consensus estimates are credible, modeling for a steep normalization in its adjusted EBITDA growth through FY24. As a corollary, it’s also expected to impact its DCF growth.

Hence, buyers’ sentiments could be affected unless the market presents a highly attractive valuation to capitalize on.

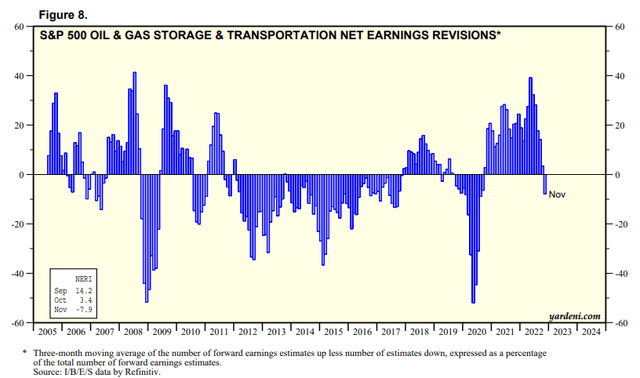

S&P 500 oil & gas storage and transportation industry net earnings revisions % (Yardeni Research, Refinitiv)

Moreover, oil and gas analysts remain optimistic about EPD and its peers’ prospects through the recession. Despite that, we gleaned that analysts have started writing down their industry earnings estimates. Therefore, the downward revisions could accelerate if the underlying markets weaken further.

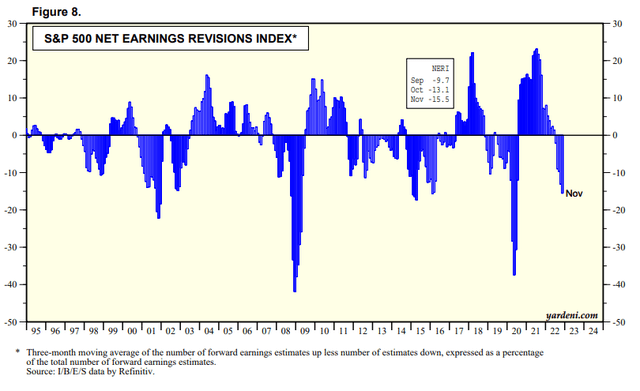

S&P 500 net earnings revisions % (Yardeni Research, Refinitiv)

Moreover, the bifurcation between the industry and the broad market couldn’t have been more different. As seen above, analysts have written down earnings estimates for the market significantly through November.

But, oil and gas analysts don’t expect the hit from the potential recession to stymie the earnings growth of EPD and its peers as much.

However, the message from the energy markets suggests that these analysts could have been too optimistic, as seen in the recent downward earnings revision in November.

Therefore, we urge investors to be cautious in expecting EPD and its peers to withstand the recession much better than the market if the price action in the underlying markets deteriorates further.

Is EPD Stock A Buy, Sell, Or Hold?

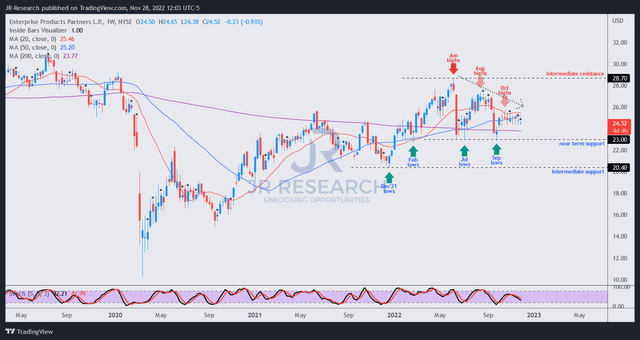

EPD price chart (weekly) (TradingView)

Since June, EPD has been forming lower highs as buyers failed to regain significant upward momentum.

However, buyers managed to stake the defense of its September lows robustly, in line with the support seen in February and July.

Coupled with our concerns about potential earnings compression, we don’t find the current levels attractive despite its 8% yields. Hence, we urge investors to remain patient, as EPD could continue to consolidate, with reward/risk skewed toward the downside from here, potentially revisiting its September lows.

Revising from Sell to Hold for now.

Be the first to comment