ipopba

Thesis

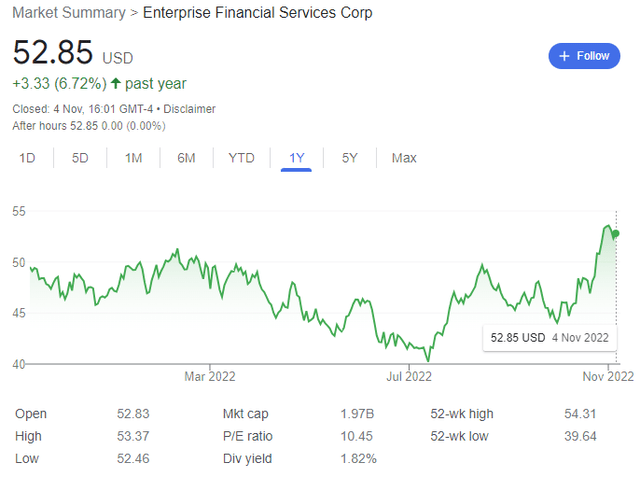

Enterprise Financial Services Corp (NASDAQ:EFSC) has been performing well on a quarterly basis, and gradually improving its top line, asset quality, and return on capital. However, there is no indication that they are currently undervalued, nor overvalued, so expect a continued gradual increase in share price as the company continue to benefit from the high-rate environment.

Intro

EFSC is a banking and wealth management provider, offering savings accounts as well as loans such as real estate loans or consumer loans (among other products). The company is based in Missouri but operates across a number of branches in the US.

The share price has not moved much over the past year, hovering around $50 dollars, and has only recently experienced an uptick in price movement over the past 30 days, resulting in the stock being up over 6% in the past 52 weeks. The share price currently sits at around $52-53.

Financial Analysis

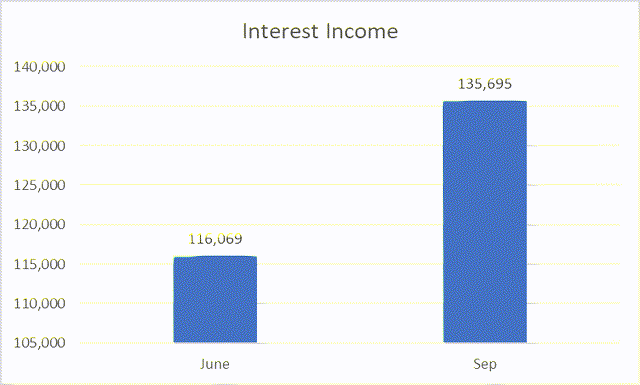

EFSC has been having recent success growing both its top and bottom line due to a solid and robust loan book. On a quarterly basis, interest income has grown 17% between Jun-22 and Sep-22 to reach $135m.

(Source: SEC)

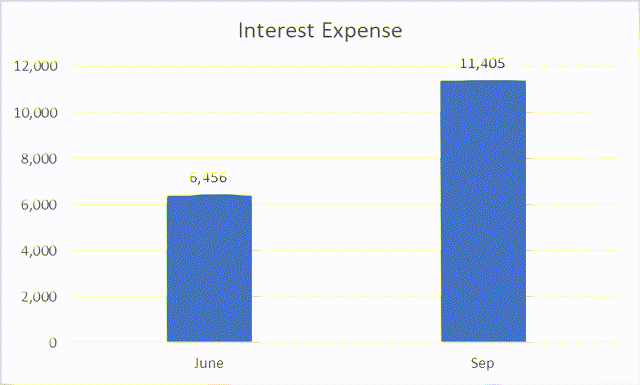

While this is strong growth quarter to quarter in an unfavorable macro environment, interest expense also increased, from $6.5m in June to $11.5m in Sep, a 75% increase on the quarter, which is no doubt due to the higher interest rate environment, leading to higher borrowing costs.

(Source: SEC)

But as the company’s interest margin is so high, the increase in the top line has resulted in strong growth in Net Interest Income, from $109m in June to almost $125m in September, 13% growth, leading to a Net interest margin achieving 4.1% compared to 3.55% for the linked quarter.

These improvements in the top line have resulted in net income (after non-interest income and expenditure) reaching $50m in Sep, growing 11% from June’s figure of $45m. Unfortunately, however, this has resulted in a decreased Net Income Margin from 39% in June to 37%. On the other hand, this is still a very strong result, and the decrease is marginal.

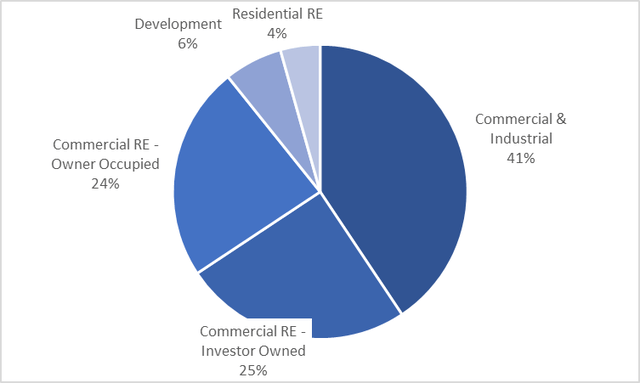

These improvements are due to a well-diversified loan portfolio (see below) backed by strong collateral.

(Source: SEC)

Benefits also came from expanding yields on earning assets and an increase in market rates that are higher than deposit costs. Loan and investment portfolios are growing strongly (the recent FCBP acquisition has also helped).

EFSC has improved their credit quality and shifted the risk composition of its loan portfolio in order to improve its asset quality. CET1 reached 12.2% last quarter, which is 7% higher than the minimum ratio with CCB (and NPL to total loans decreased from 0.21% to 0.19%).

The company’s EPS has grown 11% compared to the previous quarter, from $1.19 to $1.32. Return on average assets grew 17 bps from 1.34% to 1.51%, and the ROE has grown 110 bps from 12.64% to 13.74%.

On the other hand, these bottom-line improvements haven’t necessarily resulted in an improvement in the company’s valuation, as their P/E is around 10x and P/B is around 1.5x.

Valuation

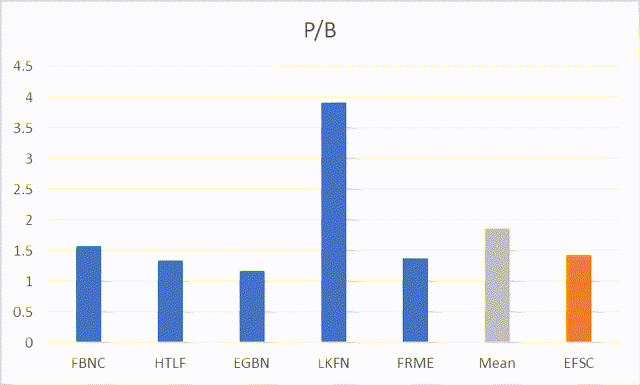

Compared to a set of peers, EFSC is slightly undervalued as their 1.5x P/B is lower than the average P/B of peers, which sits at around 1.8-1.9x. While this does imply that they are cheaper than their peers, it does not imply that they are undervalued, as the P/B is still higher than what would be preferable.

Risks

- One risk is a devaluation of the company’s assets and collateral. For example, almost 50% of the company’s assets are mortgage-backed securities, and more than 50% of its loans are linked to real estate. As rates continue to increase, the housing market may have potentially peaked, indicating that as mortgage demand falls and house prices fall, then we could see a devaluation of the company’s balance sheet.

- Secondly, EFSC’s expenses have been growing faster than income. For example, interest expenses grew by almost 80% between June and September 2022. And the FCBP acquisition led to around $20m in noninterest expense year to date. These expenses could continue growing, which puts increasing pressure on the company’s profit margins and potentially devalues the company.

Conclusion

In conclusion, EFSC has been growing their loan and investment portfolios, resulting in an increase in the top line by over 15% compared to the previous quarter (September compared to June), their net interest margin has also improved, reaching above 4%, and their return on assets and capital have also increased. The company is benefiting from the higher rate environment, and with a solid loan portfolio, expects to perform well over the next 12 months and continue improving its top line. While their profits and margins are currently strong, they are at risk of decreasing as expenses are on the up, but margins are high and these expense increases are marginal, so don’t expect any real change to margins in the near term.

Overall, the company is not undervalued nor overvalued in my opinion. While improvements have been made, the company sits with peers on a valuation basis, and there is no indication that the share price is currently cheap. On the other hand, there is also no major apparent risk to the company that would lead to a significant decline in the share price, so I think we can expect a steady increase in the stock over the next 12-24 months as they continue to benefit from a higher rate environment and continue to expand their loan portfolio.

Be the first to comment