ArtistGNDphotography

Entergy Corporation (NYSE:NYSE:ETR) is a regulated electric utility that operates in four states in America’s Deep South. This makes the company one of the larger utilities in the nation, as many of them are confined to only a single state. Entergy’s $31.38 billion market capitalization certainly reinforces this conclusion as this is one of the highest figures in the utility sector. As might be expected then, Entergy has most of the characteristics that investors in utility companies appreciate. This includes things such as stable cash flows that tend to grow over time. This characteristic was certainly showcased in the company’s second quarter 2022 earnings results as Entergy managed to post substantially higher year-over-year revenues and net income. This is unlikely to be a limited-time occurrence either, as the company is well-positioned for continued forward growth. Entergy also boasts a high dividend yield that is frequently characteristic of utilities, which at 3.37% is substantially above the broader market. When we combine this with a very attractive current valuation, Entergy appears to have a lot to offer an investor.

About Entergy Corporation

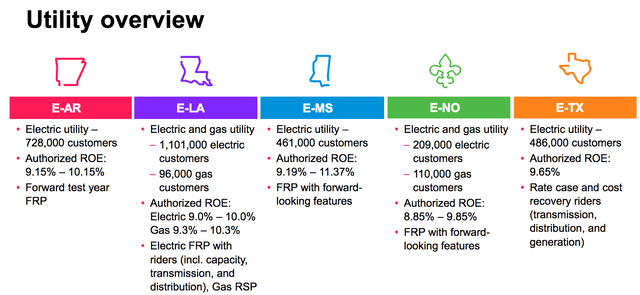

As stated in the introduction, Entergy Corporation is a regulated electric utility that operates in four states in America’s Deep South region. These four states are Louisiana, Mississippi, Texas, and Arkansas:

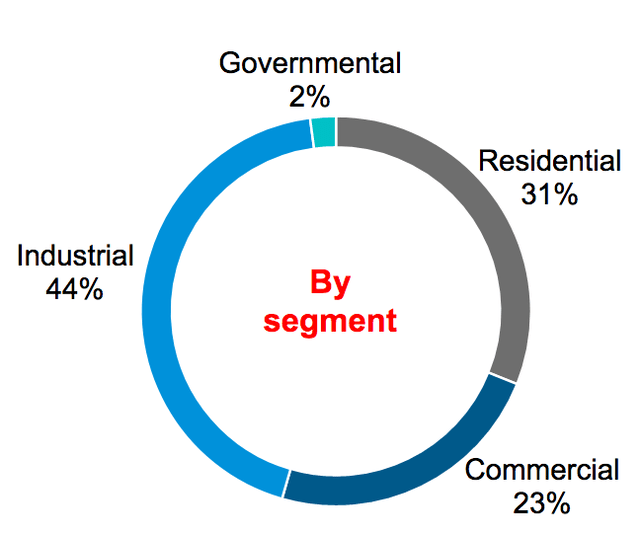

This is one of the interesting areas of the country due to the development that it has seen over the past few decades. As all of my regular readers likely know, Texas and to a lesser extent Louisiana has been the focal point of the nation’s energy boom for about ten years. However, the region has seen much more economic and industrial development than just this as various new factories building a variety of products have been set up in Entergy’s footprint. It thus may not be surprising that industrial and commercial users consume the majority of Entergy’s electrical production, although residential users still account for a not insignificant portion:

This is a very attractive business mix that provides Entergy with a substantial amount of diversification. This is because commercial and especially industrial users consume substantially more electricity than residential ones do. This should be fairly obvious. However, residential users tend to be considerably more stable customers over the long term. After all, businesses typically cut back on their operations during times of economic weakness, such as what we might see during a recession. However, residential users tend to not change their energy use much regardless of broader economic conditions. Indeed, residential users tend to prioritize paying their utility bills during times when money gets tight since maintaining electricity in a home is far more important to most people than any form of discretionary spending.

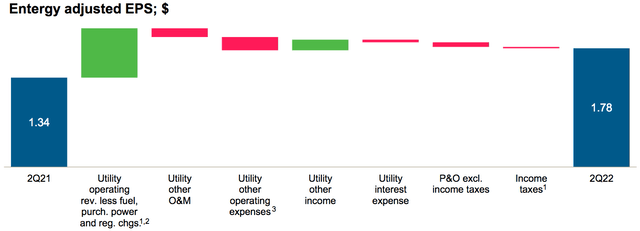

As investors, stability is not nearly enough to satisfy us. We like to see growth, which Entergy certainly delivered during the second quarter of 2022. During the period, Entergy reported revenues of $3.3952 billion, representing a 20.31% increase over the $2.8221 billion that it reported in the prior-year quarter. However, we are generally concerned more with earnings than we are with revenues. Entergy managed to deliver here as well. During the quarter, Entergy reported an adjusted net income of $1.78 per share compared to $1.34 per share in the year-ago quarter:

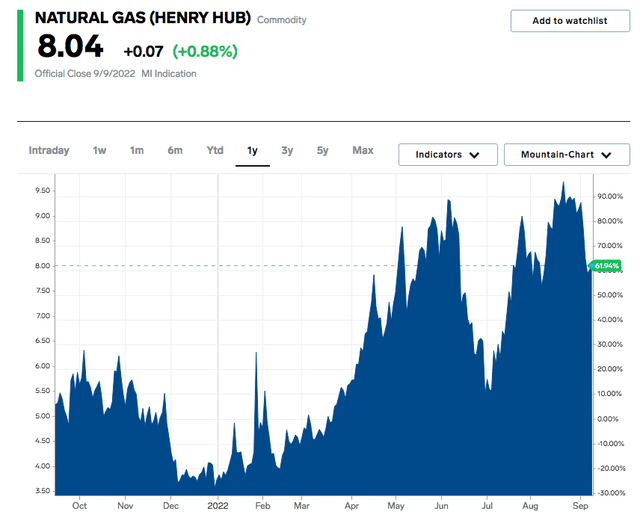

The only real downside here is that Entergy’s operating cash flow declined substantially year-over-year. This metric went from $796 million a year ago to $278 million in the most recent quarter. This is not exactly surprising. One of the biggest expenses that an electrical utility has is purchasing natural gas for use in its generating plants. As I have pointed out in many previous articles, natural gas prices are currently substantially higher than they were last year. Indeed, the price of natural gas at Henry Hub has risen an enormous 61.94% over the past year, despite some recent declines:

The cost of purchasing natural gas weighed heavily on the company’s operating cash flows. Fortunately, it was still able to increase its net income. The company is likely to be able to continue to do this going forward. This is because Entergy is continuing to grow its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the company’s rate base allows it to increase the prices that it charges its customers in order to earn that specified rate of return. Thus, the company needs to increase its rate base in order to grow. This is typically accomplished by investing money into upgrading, modernizing, or even expanding its utility-grade infrastructure. Entergy is planning to do exactly this. As I discussed in my last article on Entergy, the company is planning to invest $11.7 billion into this task over the 2022 to 2024 period. The company did not provide an updated figure during the second quarter conference call, so presumably, this number is still accurate. I will confess, though, that I would like to see a bit more visibility from management here as the majority of the company’s peers have outlined capital spending plans until at least 2026 so it would be nice if this company were to do that as well.

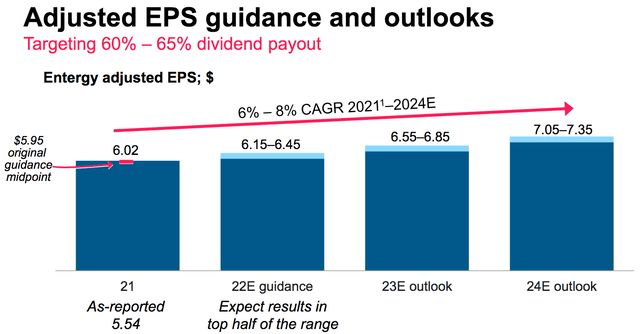

Entergy did increase its earnings per share growth rate guidance as a result of its performance during the second quarter, however. As you may recall, I stated in my last article that the company’s projected rate base growth positioned it to grow its earnings per share at a 5% to 7% compound annual growth rate over the 2021 to 2024 period. It now appears that this estimate was too low. Entergy is now projected to grow its earnings per share at a 6% to 8% compound annual growth rate over the same period:

When we combine this with Entergy’s current 3.37% dividend yield, investors should be looking at a 9% to 11% total return over the next two years by purchasing the company’s stock today. This is roughly in line with the total return that the company was offering back in May due to the fact that the stock price has increased somewhat in response to these improved guidance numbers. It is still a very attractive total return for a utility, however.

Financial Considerations

It is important to look at the way that a company finances itself before making an investment in it. This is because debt is a risker way to finance a business than equity because debt must be repaid at maturity. As this is usually accomplished by issuing new debt to replace the maturing debt, a company may see its interest costs increase following such an event, depending on the conditions in the market. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flows to decline could push it into insolvency if it has too much debt. Although utilities tend to enjoy remarkably stable cash flows, bankruptcies are certainly not unheard of in the sector. Indeed, we have already seen that Entergy’s operating cash flows declined substantially during the most recent quarter so this is certainly a risk that we should not ignore.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important. As of June 30, 2022, Entergy Corporation had $26.2709 billion of net debt compared to $12.0380 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 2.18. this is an improvement over the figure that the company had back in May, which is nice because the company’s high leverage has long been one of my biggest concerns about it. With that said though, here is how Entergy compares to some of its peers:

| Company | Net Debt-to-Equity |

| Entergy Corporation | 2.18 |

| DTE Energy (DTE) | 2.23 |

| Eversource Energy (ES) | 1.41 |

| Exelon Corporation (EXC) | 1.60 |

| Fortis Inc. (FTS) | 1.22 |

As we can see here, with the exception of DTE Energy, Entergy still has substantially higher leverage than many of its peers. Although the company is certainly boasting a stronger balance sheet than it did at the end of the first quarter, this is still a very real concern as it indicates that the company may be carrying too much debt. As we saw earlier in this article, Entergy’s cash flows declined substantially due to rising natural gas prices. This high debt load could thus create problems for the company if the price of natural gas rises much above the level that it had in the second quarter. This is a very real possibility long-term so we should keep an eye on Entergy’s debt load to see if the company continues to make strides in reducing it.

Dividend Analysis

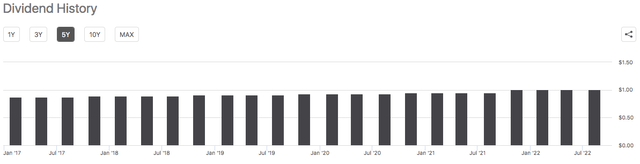

One of the biggest reasons that investors purchase utilities is because they have historically been one of the highest-yielding sectors in the market. This makes a great deal of sense since the sector is characterized by generally low growth so many of these companies deliver a greater proportion of their total return to investors via their dividends than a company in a high-growth sector would. Entergy is certainly no exception to this as the stock currently yields 3.37%, which is substantially above the 1.48% yield of the S&P 500 index (SPY). Perhaps even better, Entergy has a long history of increasing its dividend on an annual basis:

The history of growing dividend payouts is quite nice during inflationary times, such as the one that we are currently in. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. As a result, an investor that is depending on the dividend to support their lifestyle may feel as if they are getting poorer and poorer over time. The fact that the company increases the amount of money that it pays out every year thus helps to offset this effect and allows us to continue to purchase the same things with the dividend that we always could. As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want to find ourselves the victims of a dividend cut since such an event would both reduce our incomes and probably cause the stock price to decline.

The usual way that we analyze a company’s ability to pay its dividend is by looking at its free cash flow. The free cash flow is the money that is generated by the company’s ordinary operations that is left over after it pays all of its bills and makes all capital expenses. This is the money that it can use for things such as reducing debt, buying back stock, or paying a dividend. In the second quarter of 2022, Entergy had a negative levered free cash flow of $1.8839 billion. This is obviously not enough to pay any dividend, let alone the $205.4 million that the company pays out every quarter.

However, it is typical for utilities to finance their capital expenditures through the issuance of equity and especially debt. This is due to the incredibly high costs involved in building and maintaining utility-grade infrastructure over a wide geographic area. The utility will then use its operating cash flow to cover the dividend. In the second quarter of 2022, Entergy had an operating cash flow of $278.0 million, which was enough to cover the $205.4 million that it paid out in dividends with some money left over for other things. Admittedly, the coverage ratio here is a bit tighter than I would really like to see but it does appear that Entergy is able to afford and maintain its dividend. Overall, the payout is probably pretty safe.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like Entergy, one metric that we can use to value it is the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward growth numbers and vice versa. However, very few stocks in today’s overheated market have a ratio that low. This is particularly true in the low-growth utility sector. Thus, the best option is to compare Entergy’s ratio against that of its peers in order to determine what company offers the best relative valuation.

According to Zacks Investment Research, Entergy will grow its earnings per share at a 6.72% rate over the next three to five years. This is right in line with the figure that we discussed earlier when calculating the stock’s potential total return, so it seems pretty solid. It gives the stock a price-to-earnings growth ratio of 2.80 at the current price. Here is how that compares to the company’s peer group:

| Company | PEG Ratio |

| Entergy Corporation | 2.80 |

| DTE Energy | 3.75 |

| Eversource Energy | 3.56 |

| Exelon Corporation | 2.84 |

| Fortis Inc. | 3.86 |

As we can see, Entergy offers by far the most attractive valuation out of this peer group. This is something that is very nice to see as it could be a sign that the stock is somewhat undervalued today. This could be due to the risk associated with the company’s debt, but DTE Energy is both more heavily levered and substantially more expensive. Thus, we can see that it may make a lot of sense for an income-seeking value investor to purchase Entergy.

Conclusion

In conclusion, Entergy appears to be offering investors a very attractive proposition right now. The company boasts a remarkably high dividend year, attractive overall total return potential, and a very low valuation. The only real downside is that high natural gas prices have taken a toll on its cash flows, but as natural gas prices have retreated during the third quarter, this may not be a problem for very long. Overall, the company looks like a very good investment for anyone seeking a combination of growth and income.

Be the first to comment