Kesu01/iStock via Getty Images

Entegris (NASDAQ:ENTG) finalized its plans to acquire CMC Materials (CCMP) on July 6, 2022. The parties announced their agreement for Entegris to acquire CMC Materials in a cash and stock transaction on December 15, 2021.

Bertrand Loy, president and chief executive officer of Entegris, noted in the post-merger press release:

“It is an exciting day at Entegris. With the closing of the acquisition of CMC Materials, we are creating the global leader in electronic materials.”

The acquisition itself and its timing were ill-conceived for a variety of reasons which are now coming to bear based in its recent disastrous November 2, 2022, earnings call. Its Q3 Non-GAAP EPS of $0.85 missed by $0.15. Revenue of $993.83M (+71.5% Y/Y) missed by $16.17M.

Q4 Outlook: Revenue in the range of $930M-$970M vs consensus of $1.02B, non GAAP EPS $0.75-$0.80 vs consensus of $1.04.

Problems Stem from CMC Materials Acquisition of KMG Electronic Materials in 2018

To expand on this statement, I refer readers to my August 20, 2018 Seeking Alpha article entitled “Some Caveats About Cabot Microelectronics’ Acquisition Of KMG Chemicals.”

The acquisition of KMG was problematic when I wrote this article, noting:

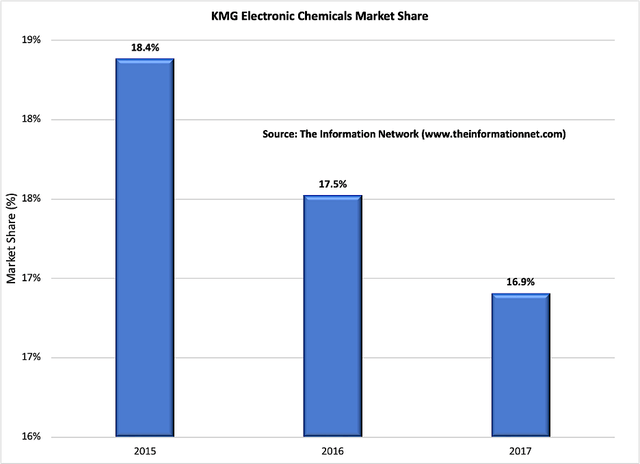

“… KMG was in third place in the global electronic materials market in CY2017. Chart 2 shows that KMG’s market share dropped from 18.4% in CY2015 to 17.5% in CY2016 to 16.9% in CY2017. Importantly, KMG had been in first place in 2014 with a 19.9% share.”

In Chart 1, I re-print that chart illustrating the market share performance of KMG as a supplier of electronic chemicals for the semiconductor industry.

The Information Network

Chart 1

As a background to KMG, which Entegris now owns, I noted:

“The electronic chemicals business was acquired initially in December 2007 from Air Products and Chemicals, Inc. and expanded with purchases in March 2010 and in May 2013 of similar businesses from General Chemical Performance Products LLP and OM Group, Inc, respectively. On April 4, 2016, KMG completed the acquisition of Nagase Finechem Singapore (PTE) Ltd., a Singapore-based manufacturer of electronic chemicals.”

CMC Materials (then Cabot Microelectronics was not doing as well either. I noted in the article:

“Cabot Microelectronics is a leader in CMP slurry. The company has maintained that lead for more than 20 years of organic growth. However, market share, while flat for the past year, has dropped from 34.2% in 2008 to 28.1% in 2017.”

According to our current update of its “CMP Technology: Competition, Products, Markets” report, CMC’s market share had been moving in a small range between 28.1% and 29.3%, thanks to a strong dominance in oxide and metal slurries, but has lost share in the copper slurry sector, primarily to Fujifilm and Versum, recently acquired by Merck.

At least one of the positive notes from Entegris was its decision to dump the Pipeline and Industrial Materials business acquired from CMC for $240 million, selling it to privately held Infineum. I was shocked that CMC didn’t divest the division after its KMG acquisition, and it has been an albatross for CMC.

Problems Already Surfacing at Entegris

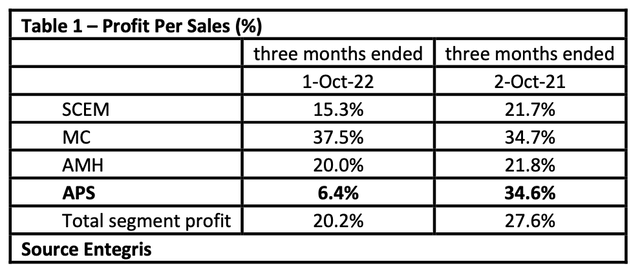

Table 1 shows Profit/Sales for the four segments of Entegris for the recent Q3 2022 which is after the CMC acquisition, and Q3 2021 before the acquisition.

Entegris

I refer readers to definitions of each segment in Entegris’ earnings call press release of November 2, 2022, and Table 1 was derived from its Quarterly Financial Results Summary detailed in the release.

The important takeaway is that with the CMC acquisition, Entegris now sells CMP (Chemical Mechanical Planarization) materials (slurries and pads), which impacted its Advanced Planarization Solutions (“APS”) segment. The stagnant CMP business at CMC, which I briefly mentioned above, shows a significant drop in profits compared to results before the acquisition, as shown in Table 1, dropping to 6.4% from 34.6% YoY.

The other segment from the CMC acquisition is Specialty Chemicals and Engineered Materials (“SCEM”), from the KMG segment of CMC Materials, and discussed briefly above. While revenues increased 45% based on increased products to sell, profits increased just 2%, and profits/sales decreased 30% to 15.3% after the acquisition.

What Caused the Drop in the APS Sector?

According to Entegris CEO Bertrand Loy in the earnings call:

“And that did impact both APS and certain product lines of our SCEM division as well. And we expect to see a repeat of that in Q4. The two things that I would want to highlight is that, first, we saw a significant contraction in HDD business. And I know it’s – and that’s actually a series of applications that APS has great exposure to, and that’s one of the reasons we’ve seen maybe a more pronounced contraction in APS as compared to SCEM.”

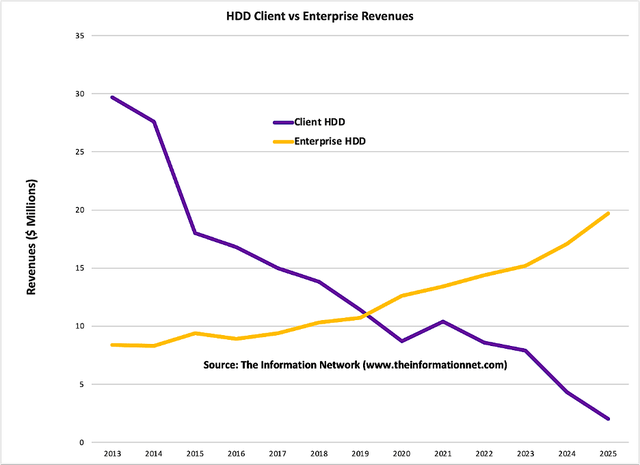

The important fact that HDD business is dropping is not recent. According to our report entitled “The Hard Disk Drive (HDD) and Solid State Drive (“SSD”) Industries: Market Analysis And Processing Trends,” HDDs have been dropping for the past decade as SSDs have increased, as show in Chart 2.

The Information Network

Chart 2

CMP slurry from Entegris is used in the HDD business for

- Planarizing thin film heads

- Glass platens that store the data in a thin film media

Glass platens are planarized with ceria slurry and used primarily in client applications (mobile) as shown in Chart 2. These are being replaced by SSDs.

The only bright spot in HDDs is in enterprise servers in data centers because of the large capacity of these HDDs. More details are in my latest article on HDDs in my August 9, 2022, Seeking Alpha article entitled “Seagate: Outperforming Western Digital On Major Fronts,” where I note more than 90% of exabytes in cloud data centers are stored on HDDs, and the remaining 10% are stored on SSDs.

Why this comes as a surprise to Entegris is because of the lack of proper due diligence by management.

More Problems with the Memory Chip Crash

A “double whammy” for Entegris is that SSDs are replacing HDDS, and that SSDs are made with NAND memory chips, which are in freefall. I have written extensively on the problems, and readers can learn from my most recent Seeking Alpha article on memory dated November 14, 2022, entitled “Micron: Even The Best Technology Won’t Help Until 2024.”

Entegris CFO Greg Graves commented during the earnings call:

“The biggest driver of the sequential sales decline in APS was CMP consumable products, which are particularly exposed to the memory market.”

Investor Takeaway

Entegris is facing significant headwinds, many of which are due to its own lack of proper due diligence in the acquisition of CMC Materials. The company is impacted by a drop in HDD, which has been going on for 10 years from competition with SSDs, which are made from memory chips.

The memory chip market is now in freefall and will remain so through 2023 due to reductions in sales of consumer products such as PCs and smartphones, which were heightened by PC pull-ins during the COVID pandemic. These negative impacts came before the date of the CMC acquisition, and I first reported them in a July 18, 2022 Seeking Alpha article entitled “Post-Micron Earnings Call: What Samsung’s Pre-Announcement Tells Us.”

Entegris also is impacted by U.S. sanctions imposed on China, which according to the company’s earnings call, will reduce its sales by approximately $40 million to $50 million in Q4, and this is reflected in its guidance for Q4 and for the year.

Finally, the total acquisition of CMC Materials is questionable. Entegris was interested in buying CMP materials competitor Versum in 2019 and had made an offer to merge with the company in early 2019 for an all-cash deal. In April 2019, Versum went with Merck KGaA for $53 per share.

CMC and Versum, a spinoff of Air Products (APD), had slightly over $1 billion in revenues, but CMC has a CMP slurry share of more that 2X that of Versum.

Entergis Metrics

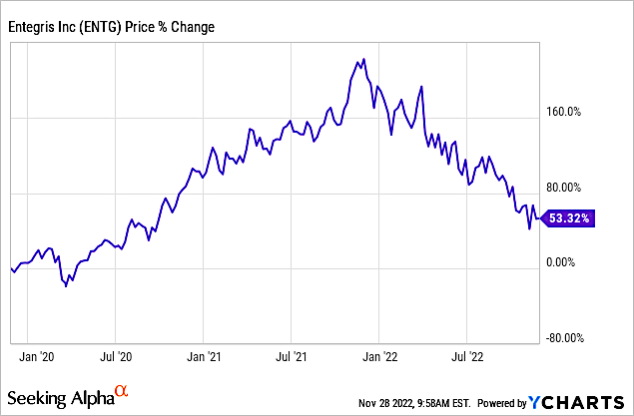

Chart 3 shows Entegris stock price performance for a three-year period. But YTD, Entegris stock is down 46.8%, with nearly the entire drop coming since the beginning of 2022, right after the acquisition was announced on Deccember 15, 2021. Share price has continued to drop even after the acquisition was finalized on July 6.

YCharts

Chart 3

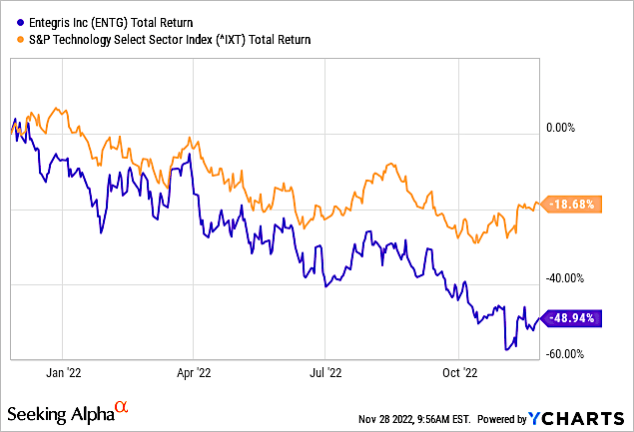

However, in a comparison of share performance with the S&P Technology Select Sector Index (IXT), performance at the end of the one-year period shows Entegris significantly underperformed the S&P as shown in Chart 4.

YCharts

Chart 4

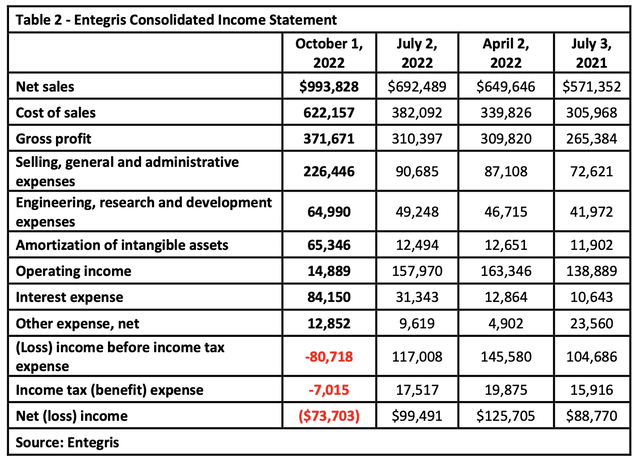

Prior to the acquisition, Entegris’ net income was positive although dropping QoQ, as shown in Table 2. The acquisition of CMC in the last quarter threw net income to a loss.

Entegris

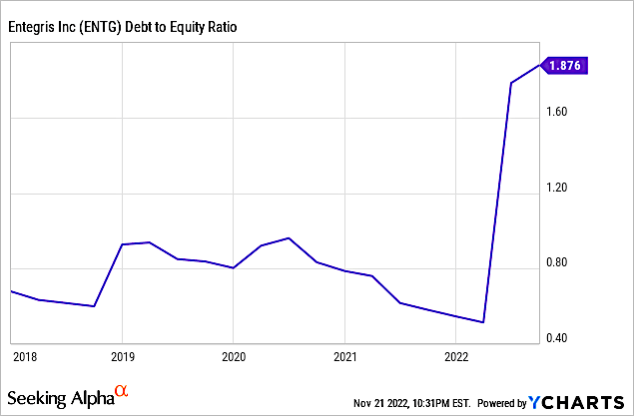

Chart 5 shows that the debt generated by the acquisition created a debt to equity ratio of 1.876 or 187.6%. Entegris’ debt to equity ratio has increased from 50.6% to 187.6% over the past five years.

YCharts

Chart 5

With a total purchase price of $5.74, Entegris paid $3.84 billion in cash and $1.27 billion in stock, and through various transactions added $5.27 billion in debt (a new term loan facility in the aggregate principal amount of $2,495.0 million, senior secured notes due 2029 in an aggregate principal amount of $$1,600.0 million, senior unsecured notes due 2030 in an aggregate principal amount of $895.0 million, and a 364-Day Bridge Credit Facility in the aggregate principal amount of $275.0 million).

As an aside to this article but I think ties to management’s approach to this acquisition, back in mid-November 2021 I contacted the company to discuss issues with supply chain, primarily with Applied Materials (AMAT) which is a customer. The response I got by email was “Thank you for your Other submission. We will review your inquiry and respond as soon as possible.”

When I heard rumors about the acquisition, I didn’t bother to contact management to discuss it. Readers can see from this article that I had sufficient background to converse, but couldn’t waste my time.

The headwinds that Entegris, as indicated in its earnings call, came primarily from poor due diligence by management. Many of the headwinds have been in play before the acquisition and have either been amplified or created in that period of time.

The problem was initiated by CMC Materials in 2018 with its acquisition of KMG Electronic Materials. Competition in CMC’s CMP slurry by Japan’s Fujifilm and Versum of the U.S. added to weak financials of the company.

Now Entegris is facing a memory slowdown, sanctions against China, and competition from Asian slurry companies which combined have a 50% share of the market. I have a Strong Sell on the company.

Be the first to comment