xavierarnau

Enphase Energy (NASDAQ:ENPH) has been an incredible stock performer over the past few years, but that might prove to be its downfall. Unlike the tech sector which has seen a reckoning in valuations, ENPH (and much of the renewable energy sector) has seemingly escaped that wrath. While ENPH has proven itself to be a top tier energy management company, valuation typically makes itself meaningful over the long term. In the current environment, ENPH is a very dangerous stock to own.

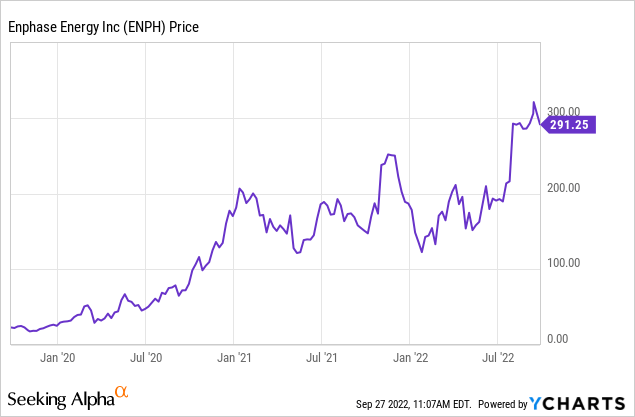

ENPH Stock Price

ENPH is down only 13% from all time highs and has delivered an incredible 242% return over the last two years and insane 12x return over the last three years.

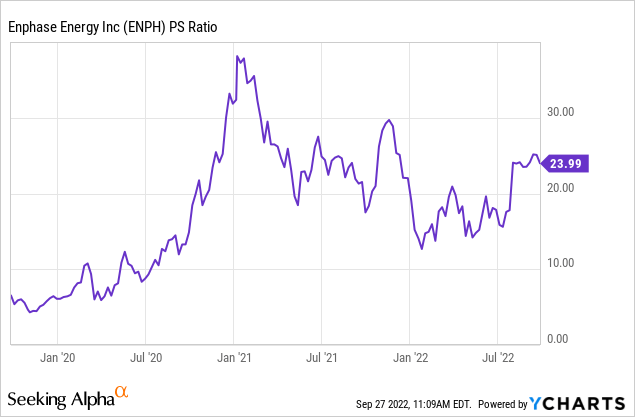

While some of those returns were driven by stellar growth, most of it was driven by multiple expansion – the rich multiple that the stock presently trades at suggests that this catalyst will not repeat itself in the future.

ENPH Stock Key Metrics

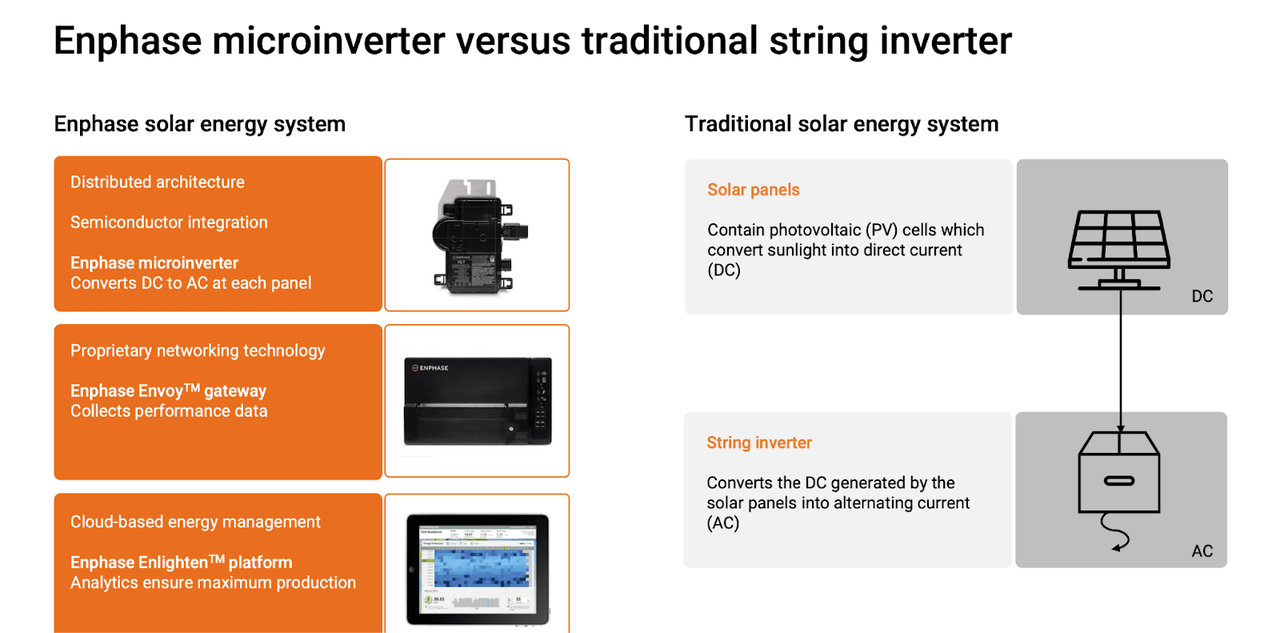

ENPH has established itself as a next-gen operator in energy management. Its microinverter technologies give customers greater control over their renewable energy platforms.

2022 Investor Presentation

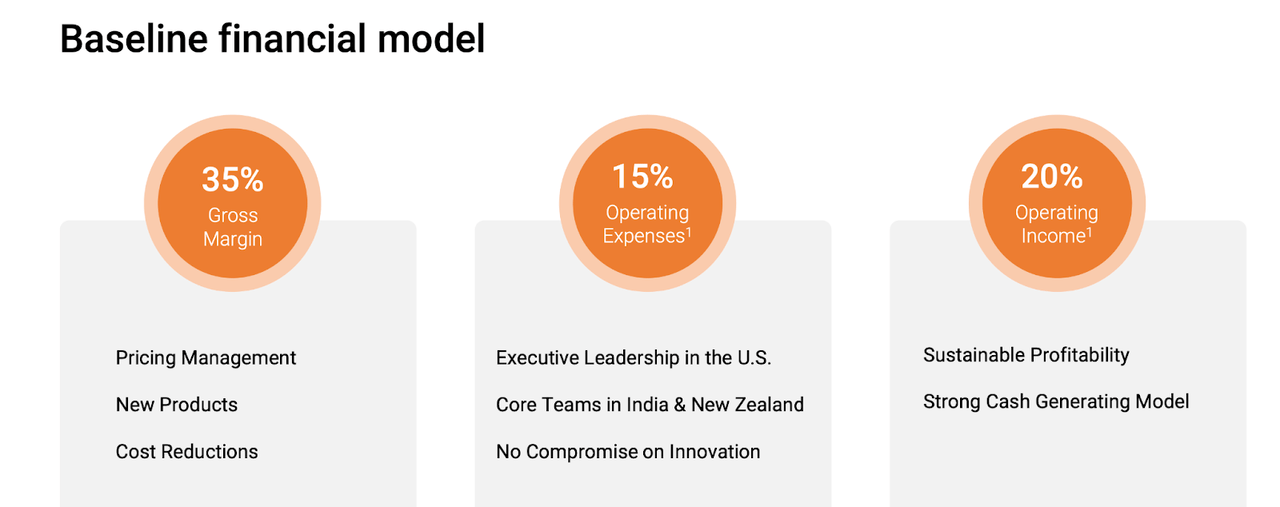

Due to how much its products are ahead of legacy providers, ENPH is able to sustain strong profit margins in what is commonly thought of as a commoditized solar landscape. ENPH has guided for 35% gross margins and 20% operating margins over the long term.

2022 Investor Presentation

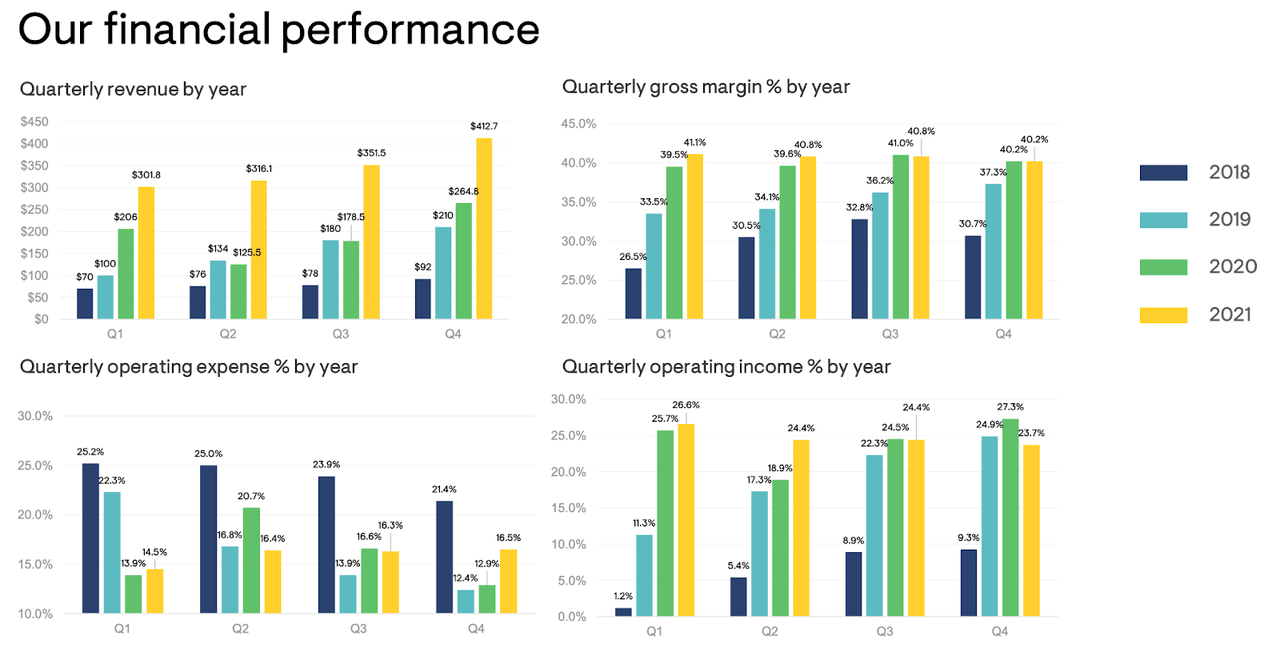

Its financial performance in recent years has exceeded that guidance, with gross margins hitting 40% and operating margin hitting over 24% in 2024.

2022 Investor Presentation

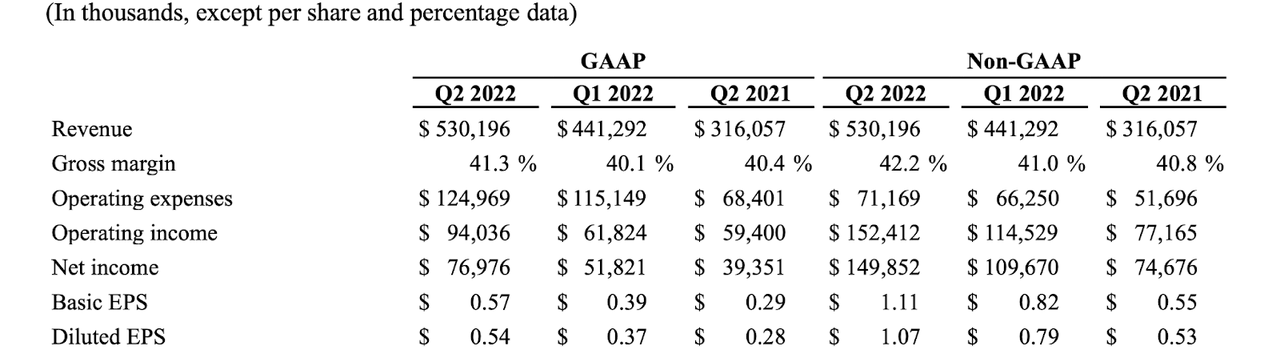

The latest quarter saw operating margins expand to nearly 29% as the company delivered 67.7% revenue growth.

2022 Q2 Press Release

This company is generating GAAP profits and has a solid balance sheet with $1.25 billion of cash versus $1.2 billion of debt.

Looking ahead, ENPH has guided for up to $630 million in revenue, representing 79% YOY growth, and up to $187.6 million in operating profits, representing a 30% non-GAAP operating margin.

Is ENPH Stock A Buy, Sell, or Hold?

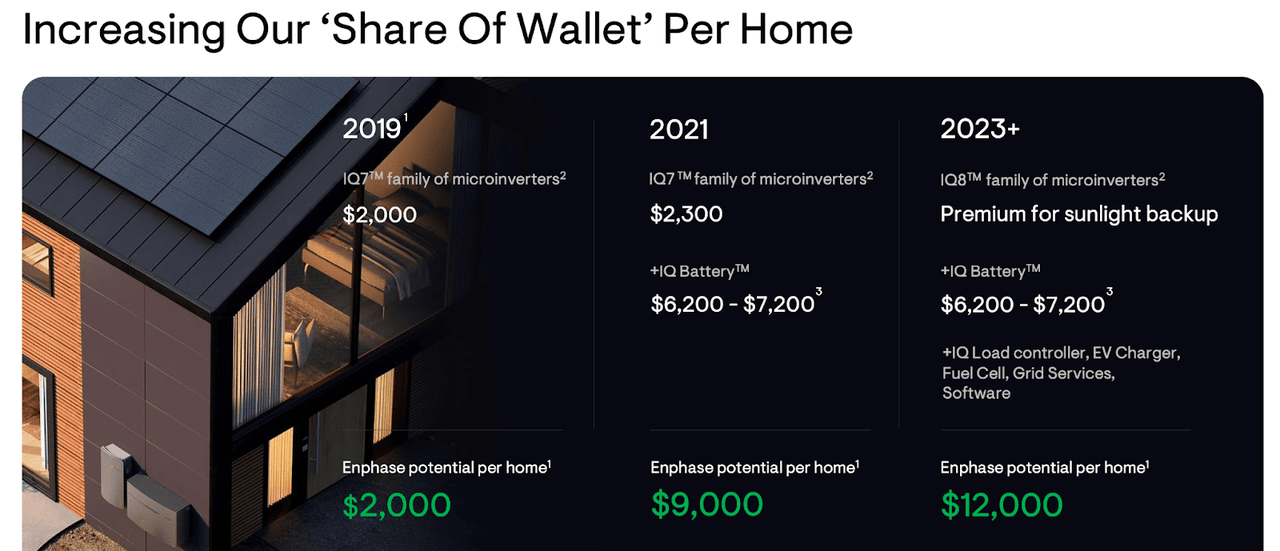

The long term growth prospects for ENPH remain promising as the company continues adding to its addressable market per home.

2022 Investor Presentation

But, as all value investors know, there is no growth story that is worth any price. There is always a price at which growth is priced in. That may be the case here, as ENPH has seen its multiple expand dramatically over the past few years alone.

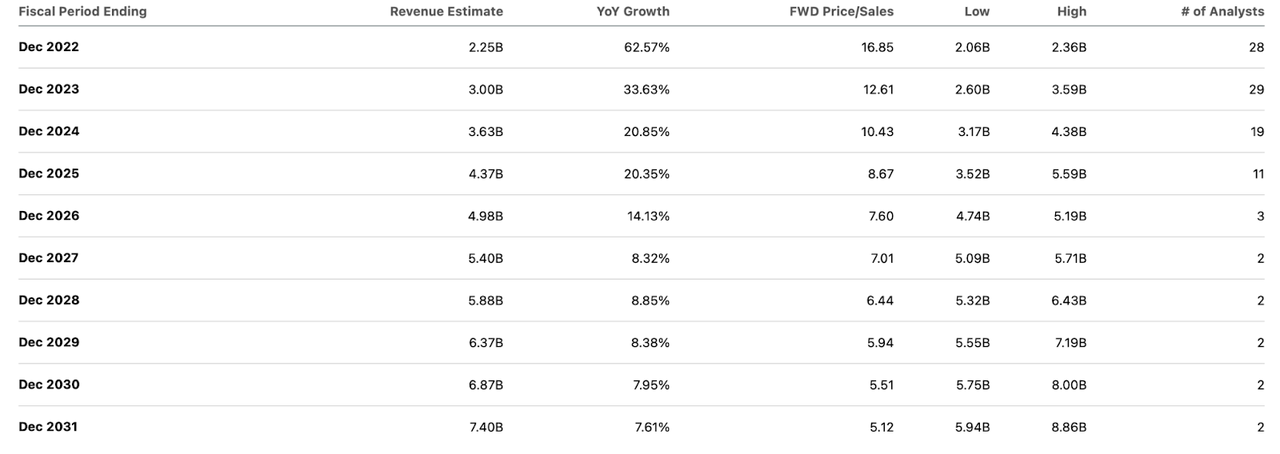

We can see consensus estimates below – it appears that Wall Street analysts expect a few more years of elevated growth before the law of large numbers kicks in.

Seeking Alpha

Is ENPH undervalued based on consensus estimates? Not based on my analysis. Let’s assume that ENPH ends up generating 25% GAAP net margins over the long term – far ahead of its guidance for 20% non-GAAP operating margins. If we assume a 1.5x price to earnings growth ratio (‘PEG ratio’), then ENPH might trade at 7.5x sales in 2024, representing a stock price of $198 per share – reflecting 32% potential downside over the next 2.5 years. ENPH would need to trade at a 2x PEG ratio in order to simply deliver 0% returns over the next two years. This is not the kind of market environment in which a 2x PEG ratio for a risky stock like ENPH makes sense as a base target.

Perhaps the reader thinks that consensus estimates are too low? Let’s instead assume 45% growth in 2023, 35% growth in 2024, and 30% growth in 2025. ENPH would be trading at 8.7x 2024e sales. I could see the stock trading at 11.3x sales, implying 29% total potential upside over the next 2.5 years. That would be a decent return ahead of historical averages, but arguably still not enough considering the elevated risk and aggressive underlying assumptions.

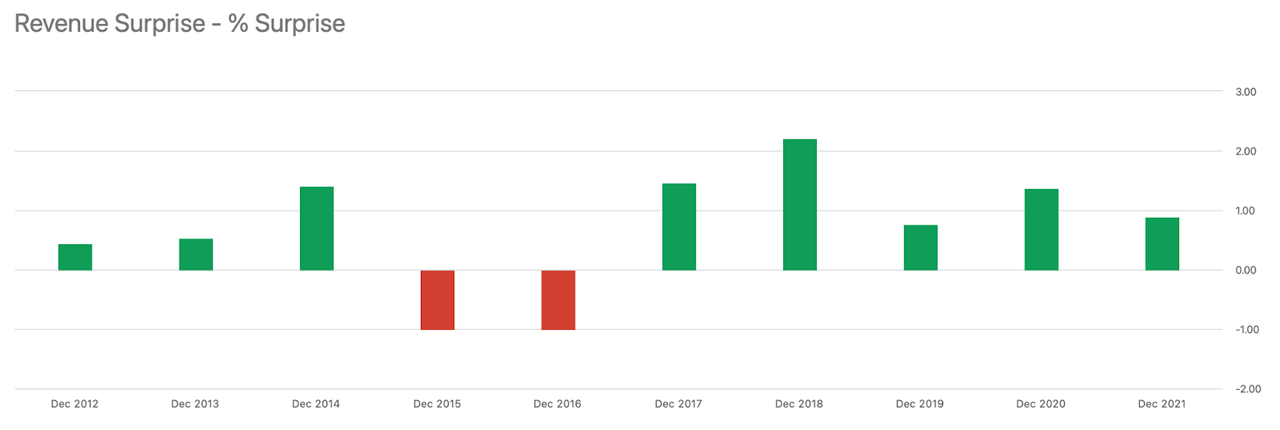

In the market environment of 2020 to 2021, my analysis might not matter so much, as renewable energy stocks were in vogue. But the valuation reset in the tech sector may imply that renewable energy stocks are the next shoe to drop – consider that QuantumScape (QS) is down nearly 80% since its November peak. Betting on upside from ENPH today requires optimistic multiples and huge beats to consensus estimates. While analysts often get a bad rap, their estimates for ENPH have historically been pretty close.

Seeking Alpha

It is also worth noting that in spite of the strong free cash flows, ENPH is not currently repurchasing stock – though that is ironically an example of strong capital allocation. While ENPH represents a compelling growth story, its stock trades at anything but compelling valuations. I rate the stock with an “avoid” or neutral rating.

Be the first to comment