Sundry Photography

Thesis

Enphase Energy, Inc. (NASDAQ:ENPH) stock has significantly outperformed the SPDR S&P 500 ETF (SPY) since our previous update in July. However, we highlighted that investors shouldn’t follow the pre-earnings buying surge.

Notwithstanding, ENPH reported robust earnings for Q2, which saw it breach its previous all-time highs. The passing of the Inflation Reduction Act spurred further buying upside in August. However, the recent pullback has seen most of its August gains digested.

It appears that ENPH has outmaneuvered our previous Sell rating comprehensively with its recent outperformance. However, we urge investors not to get caught up with the rapid buying surge, as our thesis on its unsustainable momentum has not shifted.

Notwithstanding, we must give credit to Enphase for demonstrating robust execution in Q2 despite facing ongoing supply chain headwinds. It has benefited tremendously from the current energy crisis in Europe, spurring more consumers to switch to Enphase’s comprehensive solutions.

While we have upgraded our fair value estimates, it remains far below its current valuation. Consequently, we postulate that the reward-to-risk profile at the current levels is unattractive.

As such, we reiterate our Sell rating on ENPH and urge investors to use the opportunity to rotate out.

Enphase’s Massive Q2, But Upside Likely Reflected

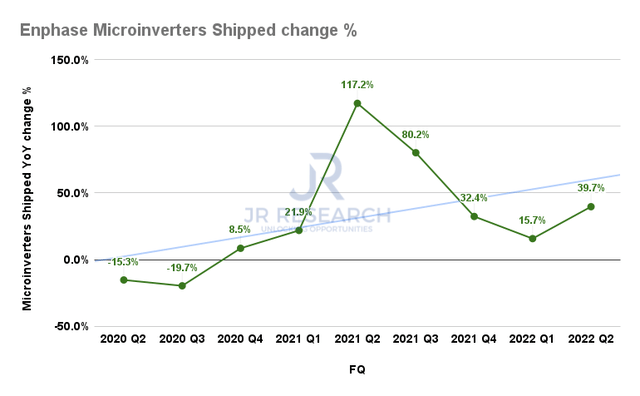

Enphase microinverters shipped change % (Company filings)

Enphase posted a 39.7% growth in microinverters shipments in FQ2, up significantly from FQ1’s 15.7% increase. Therefore, the company demonstrated its ability to navigate its supply chain disruptions as Enphase looks to recover its rapid growth cadence. CEO Badri Kothandaraman accentuated:

Our supply chain situation is quite stable due to diligent supplier management as well as [the] qualification of alternate suppliers. Our quarterly capacity across all contract manufacturing facilities is around 5 million microinverters today. We are on track to begin manufacturing in Romania starting in Q1’23. This will enable a capacity of 6 million microinverters per quarter for us globally. So [in the] Netherlands, we are quite strong there. We service the long tail of installers. They like us because of our quality. And many of the other suppliers have been unable to ship products in these times. (Enphase FQ2’22 earnings call)

Therefore, we posit that Enphase’s microinverter growth trajectory should normalize from here as its supply chain complexities improve over time. Also, Enphase’s growth has been lifted significantly from its IQ8 battery adoption, coupled with its developing segment in EV charging. As a result, the secular trend and Europe’s energy crisis have likely accelerated Enphase’s growth, lifting investors’ sentiments over its medium-term outlook.

However, given the rapid surge seen in ENPH since its July lows, we postulate that the near- to medium-term upside has already been reflected. Therefore, we believe investors should temper their expectations of further outperformance momentum unless Enphase is expected to accelerate its overall growth cadence.

But, Even The Bullish Street Analysts Think Enphase’s Growth Could Slow

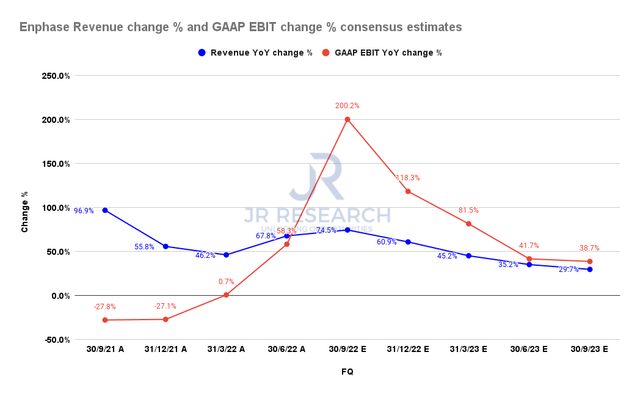

Enphase revenue change % and GAAP EBIT change % consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates (bullish) suggest that Enphase’s revenue growth should moderate through FY23 as it laps challenging comps. Also, its operating leverage gains are projected to normalize further, corroborating the deceleration in its topline growth. Hence, we postulate that it would be unreasonable for investors to expect ENPH to continue outperforming the market at its current valuation, given slowing growth dynamics.

ENPH’s Valuation Needs To Come Down Further

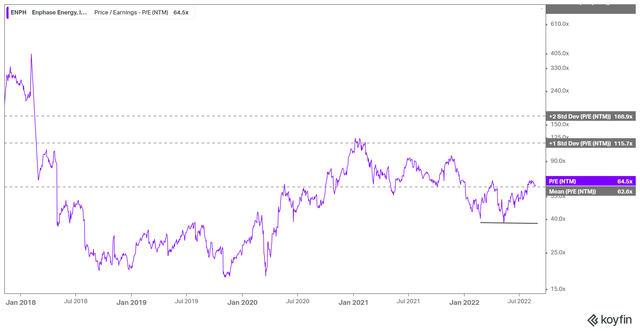

ENPH NTM normalized P/E valuation trend (koyfin)

As seen above, ENPH last traded at an NTM normalized P/E of 64.46x, close to its 5Y mean. However, investors should note that ENPH remains far from being undervalued, at levels closer to its March 2020 levels. While it saw robust buying support at around the 40x P/E levels in July, it appears that the market has de-rated ENPH, as it has seen robust resistance at its current valuation.

ENPH TTM P/FCF valuation trend (koyfin)

Furthermore, our analysis of its TTM free cash flow (FCF) multiples suggests that ENPH continues to face significant resistance at its current levels, as seen above. Therefore, we posit that further buying momentum above its 5Y mean is unlikely. Coupled with our earlier analysis that ENPH’s growth momentum could slow through FY23, we posit that investors could underperform moving forward.

Is ENPH Stock A Buy, Sell, Or Hold?

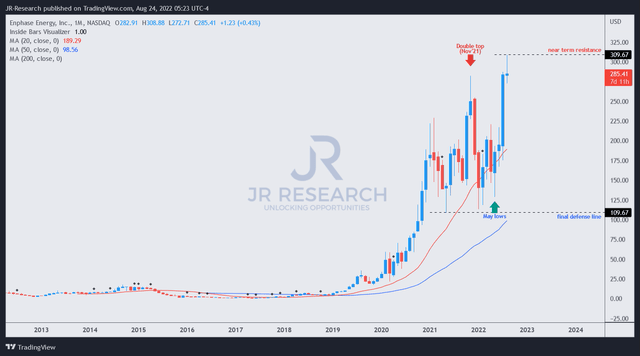

ENPH price chart (monthly) (TradingView)

We observed that ENPH had a rapid surge from its July lows as investors cheered its robust Q2 earnings performance. However, the buying upside from the passing of the Inflation Reduction Act has been digested, as ENPH gave back most of its August gains.

We posit that ENPH’s price structure looks ominously configured for a much deeper pullback, even though we have upgraded our fair value estimates to around $150.

Therefore, we urge investors to use the sharp momentum spike to layer out and cut exposure. Accordingly, we reiterate our Sell rating on ENPH.

Be the first to comment