burhan oral gudu/iStock via Getty Images

Enovis (NYSE:ENOV) is likely better known as the surviving entity, which once was Colfax. After the company has spun off its ESAB (ESAB) welding business, Enovis is the surviving entity which comprises the medical segment of the company, acquired through the $3.1 billion purchase of DJO Global back in 2018.

That deal was driven by synergy estimates, but over time it became apparent that there were few synergies between (welding) fabrication and a medtech business.

Colfax Take

At the start of this year, I last looked at Colfax which ironically itself was a spin-off from Danaher (DHR), another conglomerate which has created great value through active portfolio management.

Shares of Colfax peaked in their $70s in 2014 as shale natural gas and oil production in North America thrived, and so did Colfax, given its large exposure to this industry. Shares sold off to a $20-$40 range ever since, as Colfax announced the $3.1 billion purchase of DJO Global in 2018, adding $1.2 billion in orthopedic revenues with EBITDA margin reported in the low twenties, while selling its Air & Gas business soon thereafter to address elevated leverage.

The new Colfax generated $3.3 billion in sales in 2019 on which it posted EBITDA just shy of half a billion, much heeded with net debt still topping $2 billion, as adjusted earnings came in around $2 per share. The results took a beating in 2020 amidst the pandemic, as the company guided for 2021 results to largely mimic the 2019 results.

In January of this year the company had 161 million shares outstanding, trading at $45 per share, and if we include roughly $1.4 billion in net debt, the company was valued at $8.6 billion. Just having analyzed ESAB, that business now supports a roughly $4.0 billion valuation, as we are now focusing on the medtech business Enovis which remains of the original Colfax.

Enovis On Its Own

In March of this year, Enovis presented itself as a standalone business to the market just ahead of the official spin-off early in April. With this business largely comprised out of the original DJO business, Enovis generated $1.52 billion in pro forma sales, on which it posted $216 million in adjusted EBITDA.

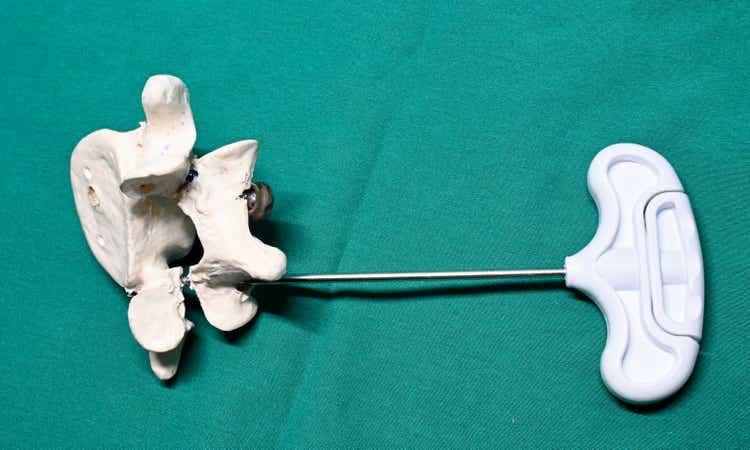

The business generates two thirds of sales in North America, with a similar two-thirds of sales generated from prevention and recovery activities. With a more than $50 billion addressable ortho market, divided across knee, hip, extremities, trauma, sports medicine, spine and biologics.

Of course, the company is up against some formidable competitors which includes the likes of Globus Medical (GMED), Smith & Nephew (SNN), Zimmer (ZBH), Stryker (SYK) and DePuy, among others. While the business has grown sales some 20% since the 2018 purchase, actual EBITDA has been flattish, revealing some margin pressure, as this is far from an automatic play here.

The company has outlined a solid guidance for 2022, guiding for 10-14% sales growth on the back of 6-9% organic revenue growth, with EBITDA seen at a midpoint of $255 million, implying margin recovery. The company believes that corporate cost allocation will drop by $15 million following the separation of ESAB, with adjusted earnings seen between $2.20 and $2.40 per share this year.

The company guided for a 1.5 times leverage ratio. This suggests pro forma net debt, based on the 2021 performance, at roughly $324 million. With some 6 million shares still held in ESAB, now trading at $47 per share, the $282 million valuation of these shares makes for a flattish net cash position.

Solid Start

Shares of Enovis now trade at $65 per share, and in May, the company reported it first quarter results. First quarter sales rose 21% to $375 million with EBITDA up a quarter to $48 million, as this is a seasonally softer first quarter, with the company reiterating the full year guidance in terms of sales and earnings for the year.

The company reports a share count of around 55 million shares which works down to a $3.6 billion equity valuation, or $3.8 billion enterprise valuation if we account for the modest net debt load, while excluding the value of the shares held in ESAB. Incorporating the latter, I end up with a roughly $3.5 billion valuation. This reveals that the medtech ortho business is valued at just around 2.2 times around 14-15 times EBITDA and at roughly 28 times adjusted earnings, as margins is really what this deal is about.

Following the separation, the big driver should be to bolster margins, now coming in around 15%, while many peers post margin (well) in excess of 20%, as such achievements are likely priced in to some extent and could drive growth in shareholder value from here.

Preferring ESAB

While the long-term positioning of Enovis is likely better than that of ESAB, the valuation of ESAB looks a bit more interesting here. While Enovis trades at 28 times earnings, potential margin gains, but more so potential to incur leverage is very large with a flattish net cash position if we account for the remaining shares held in ESAB by the company.

I was not too interested in Colfax as a combination, yet I generally like spin-offs as we have incentivized management teams having the potential to create great shareholder value as the spin-off has been quite interesting as well. I consider Enovis a show-me story amidst demanding valuations and lower margins, yet I am happy to go initiate a small position here in ESAB now.

Be the first to comment