Jean-Luc Ichard/iStock Editorial via Getty Images

Today, we are taking another look at French utility provider Engie (OTCPK:ENGIY) which we previously looked at in February before the global financial landscape changed considerably. Last time out, we were focussing primarily on restructuring whilst this time we are taking a look at the performance so far this year and the potential political headwinds as European governments attempt to tackle energy bills spiralling out of control for its citizens.

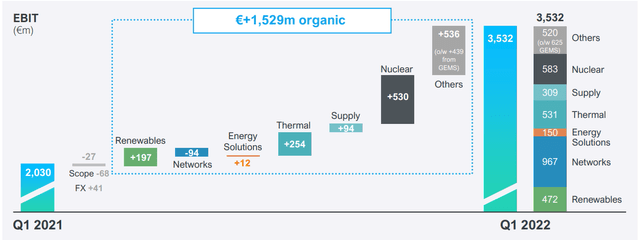

Starting off by looking at the performance, in its Q1 report published last month, Engie posted 76% growth in group EBIT with a lot of this exceptional performance coming from the Group’s nuclear division and energy management division. The French utility giant benefitted from higher energy prices in the nuclear division and in Energy management the Group had a long net gas position as well as selling volatility in the market. We also saw a €254 million increase thanks to thermal generation which benefitted from higher thermal spreads.

Engie

These results led the group to increase their 2022 guidance to €3.8–4.4 billion in net income, up from the previous €3.1–3.3 billion.

Nuclear phase out

One key issue for Engie has been the proposed phase out of the nuclear power plants in Belgium. The Belgian government had planned to phase out all 7 of Engie’s nuclear reactors in the country by 2025. However, recent developments have led the Belgian government to consider extending the useful life of two of the 7 reactors. Engie is happy to enter the agreement to extend the life of the reactors as long as there is a balanced risk-sharing approach. A decision is expected to be reached by September, in any case though, Engie maintains that the necessary works to extend the life of the two reactors will take 5 years, meaning that the reactors will not come back online until at least 2027.

The political game

The French government hasn’t announced any windfall taxes yet on energy profits but has regulated the wholesale price, as well as introducing measures for the consumer such as cutting VAT. However, this is a constantly evolving landscape and any new measures could add to Engie’s potential headwinds. Due to this, the management is not ready to set new targets for 2023-24. The European Commission has proposed to introduce an 80% gas storage level obligation for this winter which could be set to rise to 90% the following year. CEO Catherine MacGregor has mentioned very good levels of gas storage and, barring any disruption during the summer months, they could enter the winter with full storage.

Other news

Engie is continuing to deliver on its strategic plan, completing the acquisition of Eolia, a leading renewable player in Spain, adding 0.9 GW of operating assets to its renewable network and 1.2 GW pipeline to the Group Iberian Peninsula platform. Also, the disposal of EQUANS, the group’s services subsidiary, to Bouygues remains on track.

Conclusion

While we find the valuation of Engie attractive, especially considering a slight discount vs. peer average (EV/EBITDA 23E 7.4x vs. 9x for integrated peers), we are not so keen on the sector which is currently in the political crosshairs and requiring high levels of investment as they transition into a changing energy sector. Despite the raised guidance, we follow the management’s suit and assign a hold rating.

Be the first to comment