Urupong/iStock via Getty Images

Enghouse’s (OTCPK:EGHSF) track record of compounding capital through acquisitions remains intact. While investor sentiment has dampened following a period of slower M&A and organic growth, the company’s recent acquisitions (Competella and NTW Software) signal a momentum rebound ahead. Enghouse is also equipped with a strong balance sheet to accelerate its M&A strategy as well as reinvest in driving organic growth, so I see ample upside to the current earnings growth trajectory. The stock currently trades at ~10x fwd EBITDA, well below its peers in the Canadian enterprise software space (e.g., Constellation Software (OTCPK:CNSWF) and Descartes (DSGX)), as well as its historical trading average. As buying into Enghouse at the low end of its historical valuation range or when M&A rebounds have typically been an attractive entry point, I think investors could make a nice return from the stock at these levels.

Kicking Off a New M&A Cycle with Competella

Enghouse recently announced the acquisition of Competella AB – its first acquisition since Nebu BV and Momindum back in 3Q21. For context, Competella, founded in 2009 and based in Sweden, provides cloud and on-premise contact center software. As Competella is a Microsoft (MSFT) partner, and its contact center solutions are built on Microsoft Teams (Enghouse is currently one of the largest providers of contact center software for Microsoft Teams), bringing the asset under the Enghouse banner is a logical fit. The Competella acquisition also adds an operator console that can be expanded into contact centers and, by extension, helps Enghouse better address the Teams opportunity in Europe (note Competella primarily serves the Scandinavian and Swiss markets).

Based on Zoominfo estimates, its annual revenue run-rate is ~C$6.5m (or $5m), which implies Enghouse likely paid an 0.9x P/Sales multiple based on the ~C$6m price tag. Given this is in line with Enghouse’s average takeout multiple, I view the Competella acquisition terms as financially favorable. To be clear, this is a small acquisition – Competella only has 30 employees even though it serves >700 companies. That said, the addition of Competella, while not overly meaningful from a P&L perspective, presents an early signal that assets are becoming increasingly available at very reasonable takeout multiples.

Following Up with NTW Software Acquisition

Enghouse subsequently announced the acquisition of Austria/Germany-based NTW Software, which provides communications software across contact center and attendant consoles. Compared to the acquisition of Competella (for an estimated ~C$6m), NTW is a smaller asset at >C$2m of revenue generation per year (based on Enghouse’s revenue per employee spread over NTW’s ten employees). In turn, an in-line takeout multiple assumption of 0.9x would imply a purchase price of $1.8m for the asset – well covered by its net cash balance. Strategically, the deal expands Enghouse’s contact center portfolio, this time in the Cisco (CSCO) market, where NTW focuses on. Key products include phone services, intelligent routing, and recording capabilities. While both acquisitions will have limited financial impact going forward, they represent positive signs that the M&A environment is improving and that Enghouse’s M&A appetite has returned.

Vidyo Acquisition Paid Off; Still Early Days for Cloud Migration

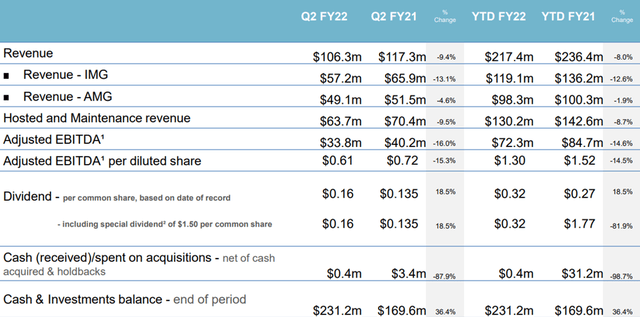

If the 2Q22 numbers were anything to go by, the M&A contribution is badly needed – in constant currency terms, organic growth was -7.1% on further declines in Enghouse’s Vidyo business. For context, much of the shareholder value creation on Vidyo occurred in the early stages, where the low purchase price at ~0.7x EV/Sales helped the company realize attractive returns despite a challenging backdrop. Even excluding Vidyo, though, the Interactive Management (IMG) business’ organic growth has been downbeat and warrants watching, particularly given the ongoing transition to the cloud as well as competitive headwinds. On the flip side, Enghouse has seen strong demand for its burgeoning cloud solutions business. With the company also recently appointing a new global head of demand generation and making further progress on its direct go-to-market sales efforts, its sales pipeline for its contact center software has risen ~65% Q/Q, with ~40% of that in the cloud. Given the cloud migration remains in its early stages and ample room for M&A-driven growth, the runway is extensive, in my view.

Record Net Cash Position Boosts the M&A Pipeline

Enghouse’s recent quarterly commentary on its M&A pipeline was positive, indicating more deals ahead amid higher interest rates and declining public valuations, as more target valuations are falling within its acquisition criteria. With the company also benefiting from a strong balance sheet and beefing up its acquisitions team to capitalize on more opportunities over the coming years, I see a clear path to M&A activity accelerating from here. As of 2Q22, Enghouse had a record ~$231m of cash and no debt, as well as >$100m of FCF generation guided for the full year. For context, this is the second highest quarterly net cash level for the company after 4Q20, when it held ~$209m just prior to the Altitude Software acquisition. With capital deployed on acquisitions likely to be accretive to annual EPS in the double-digit % range (in line with its M&A track record), execution on the deal pipeline will be key to unlocking more earnings upside in the coming years.

Enterprise Software Rollup Embarking on a New M&A Cycle

Enghouse’s track record of compounding capital through acquisitions should give investors optimism ahead of a new M&A cycle. While the company has undergone a period of slower acquisitions and organic growth, its momentum looks set to rebound in the coming quarters as Enghouse deploys its net cash balance amid the prevailing asset price weakness. Plus, Enghouse has also not bought back any stock this year, despite valuations moving to multi-year lows, signaling management’s intent on the acquisition front. The company’s slowing organic growth rate (ex-acquisitions) warrants concern, but I am optimistic about its acquired growth opportunities picking up the slack and taking the stock price higher. At ~10x fwd EV/EBITDA – a discount to peers and its historical trading range – the stock is cheap, and more accretive M&A should catalyze a re-rating from here.

Be the first to comment