grandriver

Enerplus Corporation (NYSE:ERF) is a Canadian independent exploration and production company that boasts operations in three different resource basins throughout North America. Investors in the company have certainly benefited from the tremendous surge in energy prices that has occurred over the past year as the stock is up 90.91% over the trailing twelve-month period. Although there has been a bit of a correction as energy prices have declined over the past few weeks, there may be reasons to believe that the stock still boasts some upside potential as Enerplus Corporation is positioned for some long-term production growth and the fundamentals for energy prices are quite strong. The stock remains undervalued, however, despite all of the potential that it has and the rewards that the company’s investors have already received. Thus, there may still be some reasons to consider it as an investment today.

About Enerplus Corporation

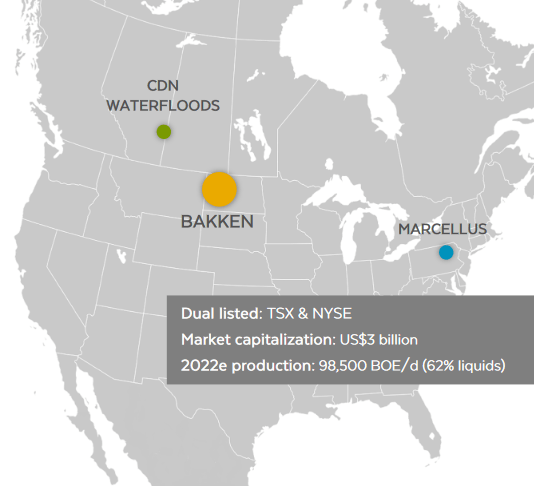

As stated in the introduction, Enerplus Corporation is a Canadian independent exploration and production company that produces crude oil and natural gas in three separate basins throughout North America. These three basins are the Canadian Waterfloods, the Bakken Shale, and the Marcellus Shale:

Enerplus Corporation

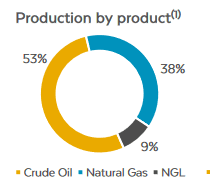

This makes Enerplus Corporation one of the few Canadian producers to have operations in the United States. In fact, the company produces more resources in the Bakken Shale than in any other region. Approximately 64% of the company’s projected 2022 production is expected to come from this area with the remainder coming mostly from the Marcellus Shale. This is certainly unusual for a Canadian company and as such, we can almost think of Enerplus Corporation as an American shale energy producer. The fact that the company operates in these three particular basins is fairly attractive though due largely to the differences between them. The Marcellus Shale, for example, is almost exclusively thought of as a natural gas and natural gas liquids production center, while the Bakken Shale and Canadian Waterfloods are normally targeted by producers looking for crude oil. With that said though, both natural gas and natural gas liquids are produced in the Bakken Shale and Canadian Waterfloods. As such then, we might expect Enerplus Corporation to produce a mixture of crude oil, natural gas, and natural gas liquids. This is indeed the case, although Enerplus’s production is slightly more weighted towards crude oil:

Enerplus Corporation

The fact that the company has a reasonably balanced production mix is something that is nice to see. This is because both crude oil and natural gas have strong fundamentals, which is a major shift from a few years ago when natural gas was frequently flared off by producers as a waste product. In fact, from some perspectives, natural gas might be a better product to focus on today. Over the past year, natural gas at Henry Hub is up 75.00% while West Texas Intermediate crude oil is up a more moderate 42.29%. As is the case with many other exploration and production firms, this surge in commodity prices had a very positive impact on the company’s revenues as Enerplus brought in $477.7 million during the first quarter of 2022 compared to $215.9 million a year ago. The company’s operating cash flow also surged from $29.6 million to $196.0 million over the same period:

| Q1 2022 | Q1 2021 | |

| Total Revenue | $477.7 | $215.9 |

| Operating Cash Flow | $196.0 | $29.6 |

(all figures in millions of U.S. dollars)

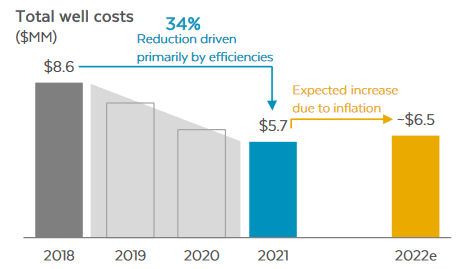

Enerplus has been taking steps beyond simply relying on rising energy prices to drive revenue and cash flow growth. As I pointed out in a few previous articles, most notably this one, one of the biggest problems with shale oil and gas production is the incredibly high decline rate of the wells. This forces companies to continually drill new wells simply to maintain, let alone grow, their production. This is an expensive proposition that is one of the major reasons why the shale industry has been one of the largest issuers of high-yield bonds over the past decade. Fortunately for its investors, Enerplus has been taking steps to reduce its costs of operations. Over the 2018 to 2021 period, Enerplus managed to reduce its costs of drilling a well by 34%:

Enerplus Corporation

This is something that any investor should be able to appreciate because lower costs mean that more money is available to make its way down to the company’s cash flows and profits, all else being equal. It also tends to have a positive effect on the company’s free cash flow, which is ultimately the money that is available to reward the stockholders. Unfortunately, we can also see that the company’s well completion costs started to increase this year. While this is certainly disappointing, it is nothing that we actually need to worry about. This is because this cost increase is being driven by rising costs for diesel fuel and steel and both of these expenses are completely out of Enerplus’s control. Fortunately, it is at least able to offset the diesel fuel costs by the fact that the company is able to get higher prices for the crude oil that it sells in order to make the diesel fuel. The slightly higher drilling costs this year have not really had a negative impact on the company’s free cash flow. As we can clearly see here, the overall trend for the firm’s free cash flow has been quite positive over time:

| Q1 2022 | Q4 2021 | Q3 2021 | Q2 2021 | Q1 2021 | Q4 2020 | Q3 2020 | Q2 2020 | Q1 2020 | |

| Levered Free Cash Flow | $138.9 | $149.4 | $74.1 | $94.4 | $42.6 | $35.7 | $55.5 | ($42.3) | ($6.9) |

(all figures in millions of U.S. dollars)

The growing free cash flow allows Enerplus to reward its shareholders, which is exactly what the company is doing. In fact, it has committed to return at least 50% of its free cash flow to the shareholders this year through a combination of dividends and stock buybacks. Unlike some other energy companies though, Enerplus has not instituted a variable dividend program, which means that it currently has a lower annualized yield than a company like Pioneer Natural Resources (PXD). This may make the company somewhat less appealing to those investors that would like to receive a fat check to help offset the high prices that they are paying at the pump, although the company did recently increase its quarterly dividend by 30%. The majority of the money that Enerplus will be returning to its shareholders this year will be in the form of stock buybacks. This could prove attractive to anyone investing with a taxable account as share repurchases do tend to be a more tax-efficient way to return money to the stockholders than dividends. I will admit though that I would be happier if the company paid a much larger dividend as the current one is only a very small fraction of the $350 million minimum that Enerplus will pay out this year.

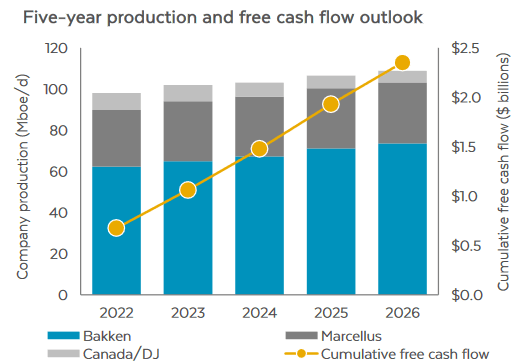

Another method that Enerplus Corporation is using to grow its free cash flow going forward is increasing its production. This is particularly true in the Bakken Shale, which as we have already seen is the center of the company’s operations. This is a marked difference from the strategy being used by some of the company’s peers like Diamondback Energy (FANG) that are planning to hold production steady despite the surge in energy prices. Enerplus Corporation plans to dedicate 80% of its growth capital spending over the next five years towards its Bakken Shale operations. This should cause the company’s production in the basin to grow at a 3% to 5% compound annual growth rate over the period:

Enerplus Corporation

It should be fairly obvious how this program should result in cash flow growth for the company. In fact, increasing production is one of the only ways for an oil and gas company to generate growth that is actually within its control. This is because it gives the company more products that it can sell and generate revenue from. If the company is actually able to produce these hydrocarbon products profitably, as Enerplus Corporation can, then this production growth should result in cash flow growth. Enerplus Corporation has projected that this growth program will generate a cumulative free cash flow of approximately $2.3 billion if West Texas Intermediate crude oil averages $70 per barrel over the period, which seems realistic. This is certainly not a bad return on $400 million to $450 million of planned capital expenditures. As Enerplus returns at least half of its free cash flow to the shareholders, we can quickly see how rewarding this can be.

Macro-Economic Fundamentals

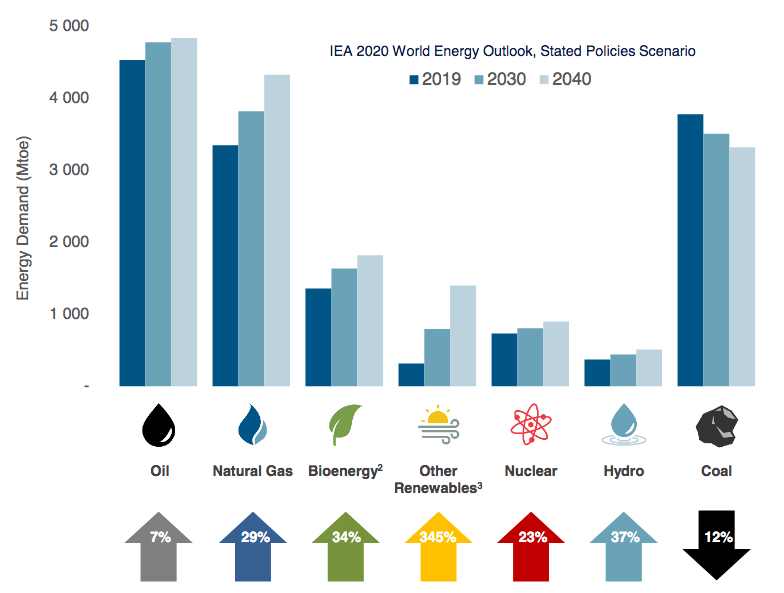

As Enerplus Corporation makes its money from the production and sale of crude oil and natural gas, it would be prudent to take a look at the fundamentals of these products. Fortunately, the fundamentals for both products are quite strong and point towards high energy prices going forward. As I mentioned earlier, the fundamentals for natural gas are quite a bit stronger than those for crude oil, which is somewhat unfortunate for Enerplus considering that its production is mostly crude oil, although Enerplus does enjoy a reasonable balance between the two products. The fact that the fundamentals for the two products are strong may be surprising considering the efforts that many developed countries have been engaging in to reduce carbon emissions and combat global warming. However, natural gas is actually likely to benefit from these efforts. This is something that has been pointed out by both the United States Energy Information Administration and the International Energy Agency. Indeed, the International Energy Agency projects that the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

As just stated, the demand growth for natural gas is actually being helped along by the efforts to convert to a “green” economy. One of the common moves being made in this direction is to retire old coal-fired power plants, which are then replaced with renewable sources of electricity. However, renewables have a fairly big problem with reliability. After all, wind power does not work when the air is still and solar panels do not generate electricity when the sun is not shining. A common solution then is to supplement renewable generation with natural gas turbines. This is because natural gas burns much cleaner than other fossil fuels and enjoys the reliability needed to support a modern grid. This is why natural gas is often called a “transitional fuel” as it provides a method to support the grid while reducing carbon emissions, allowing society to continue to enjoy a modern lifestyle until renewable technologies are sufficient to accomplish this task on their own.

As mentioned earlier, the fundamentals also point towards high energy prices going forward, which will benefit Enerplus. This is because the production of these fuels is unlikely to grow as much as the demand for them. For example, I pointed out in a previous article that we have been seeing some companies be content to not grow production at all and simply hold static in order to maximize free cash flow. Enerplus itself is only planning to grow its production at a 3% to 5% rate, which is likewise not enough to keep up with the demand growth. This is an industry-wide condition, which prompted Moody’s to recently state that the energy industry must increase upstream spending by $542 billion annually in order to avoid a supply shock. There is no reason for the industry to do this. After all, many of these companies are under tremendous pressure from politicians and activists to improve the sustainability of their operations as well as from investors to improve returns. This points to a strong likelihood of demand growth exceeding supply growth. According to economic law, that leads to rising prices. Thus, my earlier statement that West Texas Intermediate crude oil could average at least $70 per barrel going forward seems realistic. This thus means that Enerplus’s growth strategy could very easily play out in the way that was outlined earlier.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of an exploration and production company like Enerplus Corporation, one metric that we can use to value it is the forward price-to-earnings ratio. This tells us how much an investor is paying today for each dollar of earnings that the company will generate over the next year. As a general rule, a lower number indicates a more attractive valuation as long as there is no general problem with the company. As there does not appear to be any real problem with Enerplus or the industry in which it operates, we do not need to worry too much about that.

According to Zacks Investment Research, Enerplus will earn $3.31 per share in 2022 and $4.00 per share in 2023. This gives the stock a forward price-to-earnings ratio of 3.91 at the current stock price, which is remarkably cheap in today’s market. As I have pointed out before though, pretty much the entire traditional energy industry appears to be quite cheap so let us see how this value compares to some of the company’s peers:

| Company | Forward P/E |

| Enerplus Corporation | 3.91 |

| Diamondback Energy | 4.48 |

| Pioneer Natural Resources | 6.39 |

| Continental Resources (CLR) | 5.31 |

| Devon Energy (DVN) | 5.90 |

As we can clearly see, all of these companies appear to boast very attractive valuations compared to most things in the broader market. However, Enerplus Corporation is by far the most attractively valued of any of them. This is a positive sign and clearly indicates that the company is worth considering at the current price.

Conclusion

In conclusion, Enerplus Corporation is one of the few Canadian independent exploration and production companies with significant operations in the United States but that has certainly not made it unattractive from an investment standpoint. Indeed, there appears to be a great deal to like here including the fact that this is one of the few energy companies that is actually planning any significant amount of production growth. The fact that it does not have a variable dividend may reduce the appeal somewhat for an income investor but there are admittedly people that will like the fact that it is opting to use share buybacks instead as a method to return free cash flow to shareholders. The company is well-positioned to grow its free cash flow going forward as well, which could result in a growing dividend or even larger buybacks that drive the price up. The fact that Enerplus boasts a very attractive valuation is just icing on the cake. Overall, there may be a reason for any investor to consider this company today.

Be the first to comment