spooh

Energy Transfer LP (NYSE:ET) is one of the largest midstream partnerships in the United States, boasting operations spanning much of the eastern part of the country. The company has not exactly been a favorite of investors, though, due to various mistakes that have been made by its management over the past few years. This has not stopped the company from delivering a very respectable return, though, as the partnership units are up 22.24% over the past year. This compares quite favorably to many of its peers.

Despite this strong performance, the units still appear to have room to run, as Energy Transfer continues to boast reasonably strong growth prospects. Of course, the primary reason why many people invest in this company is the 7.61% distribution yield that it possesses. Energy Transfer has long been a favorite of income-focused investors, although it is not as popular as it once was due to the aforementioned management problems. Nevertheless, there may still be some reasons for any investor to consider taking a position in the partnership today.

About Energy Transfer

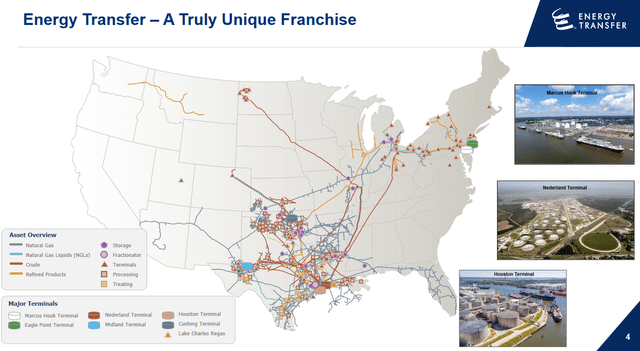

As stated in the introduction, Energy Transfer is one of the largest midstream companies in the United States, owning various infrastructure assets spanning much of the central and eastern regions of the nation:

One thing that we note here is that Energy Transfer’s infrastructure network includes almost every major basin in which hydrocarbons are produced. This is nice because each of these different basins has somewhat different fundamentals. For example, energy producers in the Marcellus Shale are typically looking to produce natural gas whereas producers operating in the Permian Basin are more often attempting to produce crude oil. The fact that Energy Transfer has operations in both of these regions, among others, thus gives it a great deal of diversification.

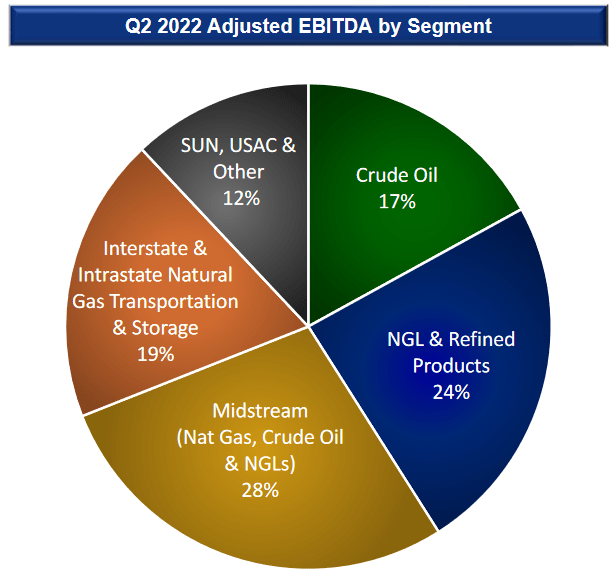

This differs from peers like NuStar Energy (NS), which are dependent solely upon one specific resource for their profits. Indeed, as we can see here, Energy Transfer’s cash flows are very well diversified, with no individual resource accounting for more than 30% of its cash flows in the second quarter of 2022:

Energy Transfer

This is nice because the fundamentals of these resources are somewhat different. Notably, natural gas demand is likely to grow much more than crude oil demand going forward. The demand for any given resource is quite important to Energy Transfer because of the business model that the company uses. In short, Energy Transfer enters into long-term (typically five to ten years in length) contracts with its customers. Under these contracts, Energy Transfer transports the customer’s oil, natural gas, and derivative products through its infrastructure and is compensated by the customer based on the volume of products that are transported, not on their value. We can generally assume that the overall volumes will likely go up along with demand for the products because upstream producers will want to take advantage of the rising demand in order to make more money. As Energy Transfer bills its customers based on volumes, it should see rising cash flows in such a scenario.

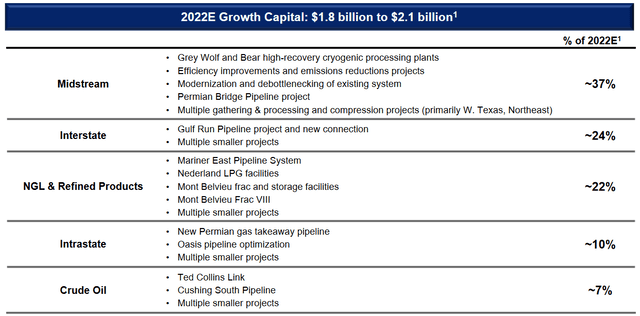

Energy Transfer is already positioning itself to take advantage of this. We can see this in the fact that the company is working to expand its infrastructure. This is necessary because a given pipeline or storage facility is only capable of carrying a finite quantity of resources, so the only way for the company to grow is by expanding its infrastructure so that it can increase its volumes. The company expects to spend $1.8 billion to $2.2 billion in 2022 alone on various projects that are expected to expand its infrastructure and overall capacity:

The nice thing about these projects is that Energy Transfer has already secured contracts from its customers for the use of this new capacity. This is nice for a few reasons. The first is that we can be certain that Energy Transfer is not spending an enormous amount of money on new infrastructure that nobody wants to use. In fact, each of these projects should begin generating money and positive cash flow for Energy Transfer as soon as they begin operation. In addition, Energy Transfer knows in advance how profitable each project will be in advance so the company knows that it will generate a sufficiently high return to justify the investment.

Although Energy Transfer has not provided numbers for any specific project, it has stated that in aggregate the projects listed above will pay for themselves in about six years. This is a reasonable payback period that is comparable to what peers such as The Williams Companies (WMB) typically obtain from their own growth projects. We should not really be disappointed here.

One of the most significant of these projects is the Lake Charles LNG Export Terminal. This is a brownfield liquefied natural gas terminal being constructed on a 240-acre site currently occupied by the Lake Charles LNG import and regasification facility. As that facility is not currently being properly utilized, Energy Transfer is reconfiguring the import site to an export site. There are some advantages to this, including the fact that the company can use much of the infrastructure that is already present at the location for a new purpose. This includes four liquefied natural gas storage tanks capable of holding 425,000 cubic meters of liquid natural gas and two deepwater docks capable of accommodating ships up to a 215,000 cubic meter capacity. This is nowhere near enough infrastructure to construct the export terminal but it is a decent start. Energy Transfer will need to invest a lot of money to get the facility operational by its planned date of 2026. When complete, this could give Energy Transfer the ability to export approximately 16.5 million tonnes of liquefied natural gas.

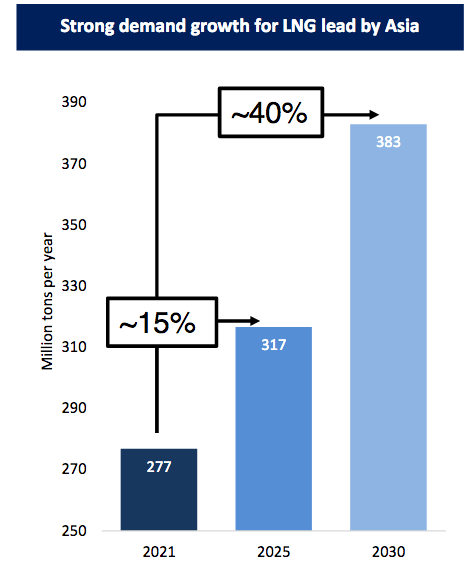

The fact that Energy Transfer is getting into the emerging liquefied natural gas market is interesting, but it is not unique. In fact, a number of midstream companies have expressed interest in entering into this market. There is a good reason for this. As I pointed out in a previous article, the global demand for liquefied natural gas is expected to grow dramatically over the coming years. In fact, Asia alone is expected to increase its demand by 40% by 2030:

Golar LNG

This is mostly because various countries in Asia see natural gas as a possible solution to the smog problems that they are currently experiencing. This is because natural gas burns much cleaner than coal or any other hydrocarbon. These countries do not have the ability to produce all the natural gas that they need to meet the demands of their industrial users so they have no choice but to import it. The only way to ship natural gas over the ocean is by converting it into a liquid so liquefied natural gas is pretty much the only solution. Recently, we have also begun to see countries outside of Asia attempting to increase their own imports of liquefied natural gas. Most notably, many European markets are seeing that as a possibility to reduce their own dependence on Russia, which has been curtailing natural gas exports in response to the sanctions that various Western powers have put on it.

This all is resulting in a very rapidly growing market for liquefied natural gas, so it makes sense for Energy Transfer to attempt to get into this market, especially since it already has the transportation infrastructure in place to move the natural gas to the liquefaction plant that it intends to build. Unfortunately, Energy Transfer has not received contracts from buyers to purchase the entire output from this facility at this time, although it has received some. Most of the contracts that it has received so far are for twenty years, which would provide a steady source of cash flow for this facility until 2046. It does still have a lot of work to do to obtain buyers for the rest of the facility’s production though, but given the expected demand growth this will probably not be a problem.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a business than equity because debt must be repaid at maturity. As most companies pay off their maturing debt by issuing new debt, this can cause a firm’s interest costs to increase following the rollover. A company also must make regular payments on its debt if it wishes to remain solvent. Thus, an event that causes a company’s cash flow to decline may push it into financial distress if it has too much debt. Midstream companies like Energy Transfer tend to enjoy remarkable cash flow stability due to their contract-driven volume-based business model but bankruptcies are still possible so we should not ignore this risk.

One metric that we can use to analyze a company’s ability to carry its debt is the leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio tells us how many years it would take a company to completely pay off its debt if it were to devote all its pre-tax cash flow to that task. Energy Transfer had an adjusted EBITDA of $11.958 billion over the last twelve months:

|

Q2 2022 |

Q1 2022 |

Q4 2021 |

Q3 2021 |

|

|

Adjusted EBITDA |

3,228 |

3,340 |

2,811 |

2,579 |

(all figures in millions of U.S. dollars)

As of June 30, 2022, the company has a net debt of $48.598 billion. This gives it a leverage ratio of 4.06 based on its trailing twelve-month adjusted EBITDA. This is a reasonable ratio, albeit slightly higher than some of its peers. Analysts generally consider anything below 5.0x to be an acceptable ratio. I am much more conservative though and like to see this ratio below 4.0x in order to add a margin of safety to the position. As we can see, then, Energy Transfer is currently slightly more leveraged than I really want to see, but overall its ratio is certainly not horrible. Nevertheless, it would be nice to see the company fix this by the end of the year as it historically has been under the 4.0x level.

Distribution Analysis

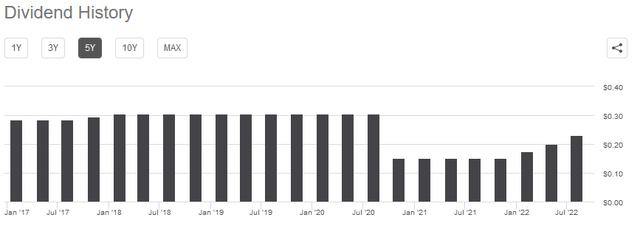

As stated in the introduction, one of the reasons why investors buy partnership units of Energy Transfer is because of the high yield that it has typically possessed. This continues to be the case today as the company yields 7.61% as of the time of writing. This is substantially higher than the 1.65% yield of the S&P 500 Index (SPY). Unfortunately, Energy Transfer has not been nearly as consistent with its distribution over the years as some of its peers like Enterprise Products Partners (EPD). Energy Transfer was one of the companies that cut its distribution back in 2020 in response to the uncertain conditions that were surrounding the industry around that time:

This was admittedly somewhat disappointing, as Energy Transfer’s cash flow in 2020 was more than sufficient for it to cover the distribution without the cut. I pointed this out in a few articles that I published on the company during that year. This was one of the management decisions that turned people off from the company, which I alluded to earlier. With that said, anyone buying the partnership today will receive the current distribution at the current yield and so does not need to particularly worry about the company’s past actions. The important thing for anyone buying today is that the company can afford to maintain its distribution going forward.

The usual way that we analyze a midstream company’s ability to cover its distribution is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP metric that theoretically tells us the amount of cash that was generated by the company’s ordinary operations that is available for distribution to the limited partners. During the second quarter of 2022, Energy Transfer reported a distributable cash flow of $1.869 billion, which was enough to cover the distribution 2.63 times over. Generally, analysts consider anything over 1.20x to be reasonable and sustainable. As usual, though, I am more conservative than analysts and like to see this metric at over 1.30x to add a margin of safety to the position.

Energy Transfer clearly beats both of these requirements handily. We thus should have no real concerns about the company’s ability to maintain its distribution, as it is generating much more cash flow than it needs for that purpose. Overall, this distribution should be quite safe.

Conclusion

In conclusion, Energy Transfer continues to have a lot to like and it remains recommended despite the general market dislike for it. The company offers a great deal of product diversity and remarkably stable cash flows. It also boasts some strong growth prospects, including in the rapidly emerging liquefied natural gas space. When we combine this with a reasonably strong balance sheet and a highly sustainable distribution yield, we continue to see a company that has a great deal to offer any investor that is searching for income. Overall, Energy Transfer could deserve a place in anyone’s portfolio.

Be the first to comment