janiecbros/iStock via Getty Images

Energy Transfer (NYSE:ET) has long been a favorite, despite the market’s consistent dislike of the company. Despite the company’s position near 52-week highs, we still see the company as having significant potential to continue driving market beating shareholder rewards. This helps highlight how the company is a valuable investment.

Energy Transfer 2021 Performance

Energy Transfer wrapped up 2021 with incredibly strong performance.

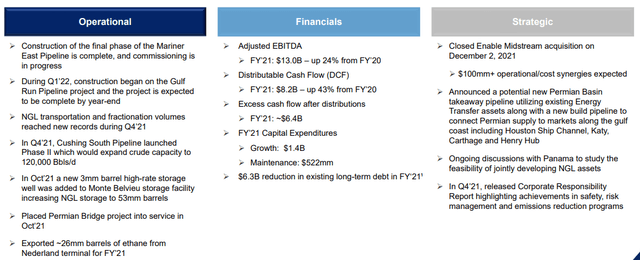

Energy Transfer has completed significant construction work through 2021. The company finished the Mariner East Pipeline, a massive $2.5 billion project, and has continued to improve NGL transportation and fractionation volumes. The company has also expanded storage and worked on other integration and bolt-on projects. Those efforts will continue into 2022.

The company earned $13 billion in EBITDA (supported by the short-term blip of Winter Storm Uri) along with a massive $8.2 billion in FCF. The company spent a substantial $1.4 billion in growth capital while reducing long-term debt by a massive $6.3 billion. The company had $6.4 billion in cash after its >6% dividend that mostly went into capital reductions.

Lastly the company acquired Enable Midstream. It paid a fairly lofty price in our view by utilizing an all-stock acquisition, diluting existing shareholders. This is disappointing when the company still hasn’t utilized share buybacks and pays a lofty dividend. We would have liked to see it use an all-cash transaction or at least something mixed.

Energy Transfer 2022 Forecast

Energy Transfer 2022 forecast is for reasonably strong cash flow driving respectable shareholder returns.

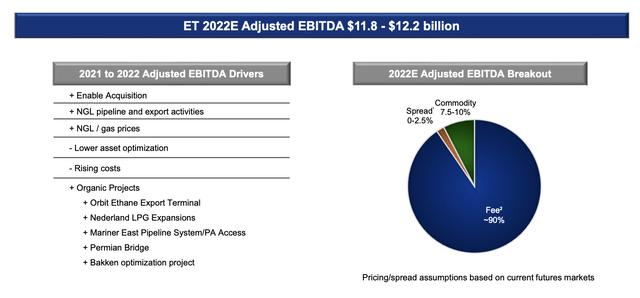

The company sees roughly $12 billion in adjusted EBITDA which should translate to roughly $7.5 billion in DCF. The company’s dividend obligations are roughly $2.1 billion, which would imply $5.4 billion in post dividend cash flow for shareholders. That’s substantial for a company with a market cap of just under $35 billion and just under $45 billion long-term debt.

The company’s cash flow is expected to be primarily fee-based (90%) worth with some minimal commodity exposure that’s benefiting from current high commodity prices.

Energy Transfer and an Excitable Management

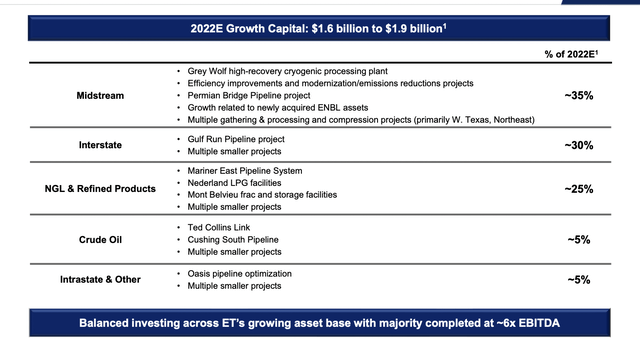

Energy Transfer is spending an estimated $1.75 billion on 2022E growth capital across a variety of projects, although primarily in the midstream.

The company is spending $1.75 billion on growth capital at roughly ~6x EBITDA meaning roughly $300 million in new EBITDA (~3-4% EBITDA growth). However, the company does have an excitable management when it comes to capital spending, and it’s rapidly ramped up capital spending in good times before.

There’s nothing wrong with that. However, it took the company’s debt load to an unsustainable level when the black swan event of the COVID-19 crash came in. And companies should always expect the unexpected. We think management could be making better decisions.

Our View On Debt

Energy Transfer has $44 billion in long-term debt. That’s gone down significantly from $50 billion at the start of 2021. We don’t hate debt and the company has used it effectively to build a midstream empire. However, there’s no denying it’s also been significantly punished by that market for having that amount of debt.

The company’s annual interest expenditures are almost $2.5 billion annually. That’s comfortably affordable, but paying off the debt could result in a 33% increase in DCF. However, we would like to see management opportunistically focus on growth. In our view share buybacks could generate much stronger returns from saving the dividend.

Versus diluting existing shareholders, the company can continue increasing its dividends with lower cost, and support overall shareholder rewards. The company’s debt is near its target so spending additional cash all on growth wouldn’t reward shareholders as well for the long run in our opinion.

Energy Transfer Shareholder Return Potential

Energy Transfer has the ability to drive substantial shareholder returns. The company, post dividends, in 2022 will earn $5.4 billion in DCF per our estimates. The company’s debt is already in its $40-45 billion target, and the company hasn’t provided an indication on how it’s going to spend money going forward.

The company is spending roughly $1.85 billion on growth capital, which implies $3.6 billion leftover. The company could pay-down debt, but it has yet to provide guidance on how it’s going to use the cash. We’d like to see share buybacks on top of the dividend. Regardless of how the company spends the money it should generate double-digit shareholder returns.

Overall, Energy Transfer can generate strong double-digit shareholder returns.

Thesis Risk

In our view the thesis has two substantial risks.

The first is management. Management has put the company in its debt load predicament, and it’s consistently gone with the chase growth at all costs mindset. In our view the mindset should be about maximizing shareholder returns for the long-term, and growth should be a part of that only if it makes sense.

The second risk is the company’s adjustment to a changing market. The company is spending less capital on climate alternative projects and low emission projects than its competitors which means as the environment changes for energy demands the company could struggle to remain competitive.

Conclusion

Energy Transfer has an impressive portfolio of assets. The company has continued to utilize bolt-on growth, and it has significant abilities to continue increasing its EBITDA from these projects at a 6x multiple. The company had an incredibly strong 2021 and moved its debt into its target range, with a manageable interest rate.

We’re not an enormous fan of management and we think they’ve been bad at generating long-term shareholder rewards. We think the company should be aggressively buying back shares before other investments given its current valuation and we think it shouldn’t have diluted shareholders with the Enable Midstream acquisition.

The path might be rocky, but whatever the company spends DCF on we expect it should generate strong double-digit shareholder rewards.

Be the first to comment