Sunlight19/iStock via Getty Images

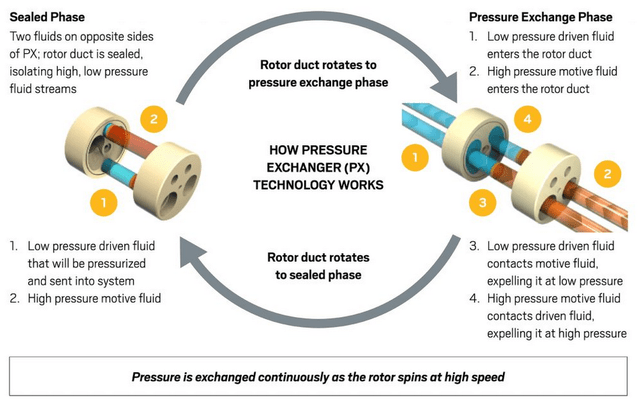

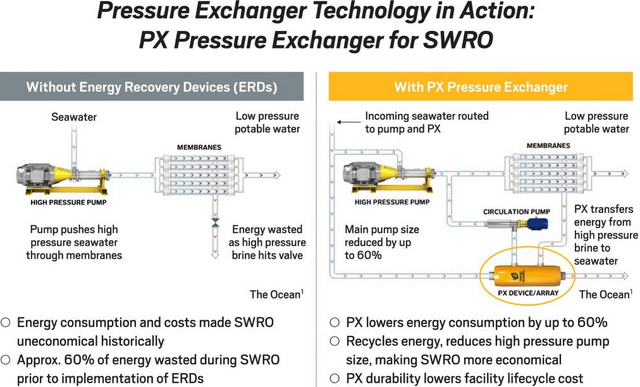

Energy Recovery (NASDAQ:ERII) makes a patent-protected line of PX pressure exchangers for the global desalinization market, which it dominates. PX devices are “ERDs”, or “energy recovery devices”. During the SWRO process, salt water is driven through filtering membranes while the PX devices recover energy (from the fluid pressure differential) that would otherwise be lost during the process (see graphics below). PX devices used in a typical SWRO process application can lower energy consumption by as much as 60% – and that lowers emissions. Energy Recovery is the global leader in the SWRO ERD market, and given the fundamental need for more potable water, combined with the ESG mandate to lower emissions, the company is ideally positioned for the coming decades of increased water scarcity.

Investment Thesis

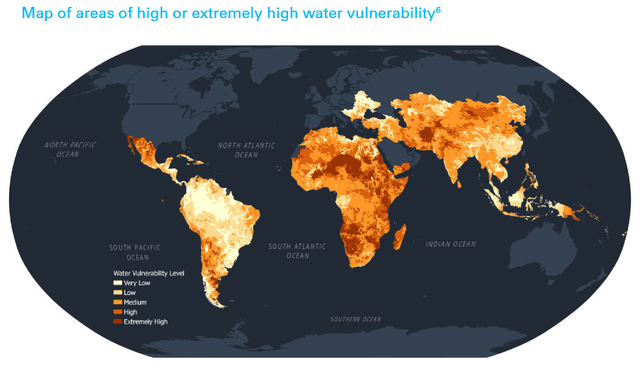

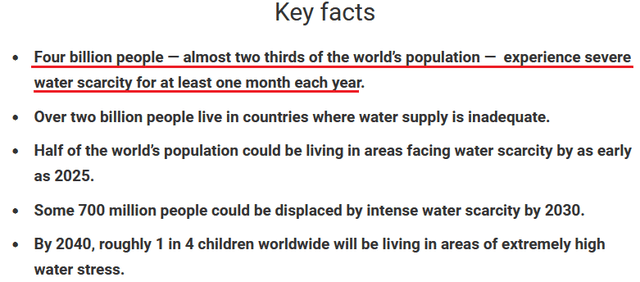

UNICEF reports that a large portion of the planet currently suffers from severe water scarcity:

Indeed, as can be seen by the graphic above, a whopping two-thirds of the world’s population experiences severe water scarcity for a last one month each year. And with the rising temperatures as a result of global warming, water scarcity is becoming a bigger problem with each passing year.

As a result, Research and Markets reports that the global SWRO membrane market is estimated to grow at a CAGR of 7.6% between 2020-2030 to reach $19+ billion. Note that ERII doesn’t make the actual membranes, but the growth of the membrane market infers strong growth in the SWRO ERD market because practically all SWRO facilities being built today use ERII’s ERDs to save on energy costs.

In the meantime, the global ESG mandate means governments are highly focused on reducing emissions. This is where Energy Recovery and its patented PX devices shine for SWRO processes. The graphic below shows how the PX devices save energy – and therefore reduce emissions – by recovering energy that would otherwise be lost (right side of graphic):

ERII’s PX devices are also known throughout the industry for their excellent reliability: PX devices have a 25-year design cycle.

In my last Seeking Alpha article on Energy Recovery, I reported how the company finally pulled the plug on the ill-fated attempt to diversify into the shale fracking market with its Vor-Teq commercialization effort (see ERII: Investors Cheer IRA Bill and Vor-Teq’s Exit). I also covered the company’s Q2 earnings results and reported that:

- The company ended Q2 with no debt and cash & investments of $86.5 million ($1.53/share).

- As of July 1, 2022 the company completed its March 2021 share repurchase authorization by purchasing 1 million shares during the quarter for $18.6 million (an average of $18.6/share). At pixel time, the stock is currently trading at $24.93.

- ERRI reiterated its full-year FY22 revenue guidance of $130 million – that would be a record high and up 25% on a yoy basis.

Since then, the company has landed more wins: an aggregate of $12.6 million in SWRO related contracts in North Africa. The company said:

“Energy Recovery estimates that across the four largest facilities in this group, the PX will prevent more than 130,000 metric tons of carbon emissions each year, the equivalent of removing over 28,000 passenger cars from the road.” ERII reported it now as a cumulative installed capacity in North Africa exceeding 4 million cubic meters per day.

ESG

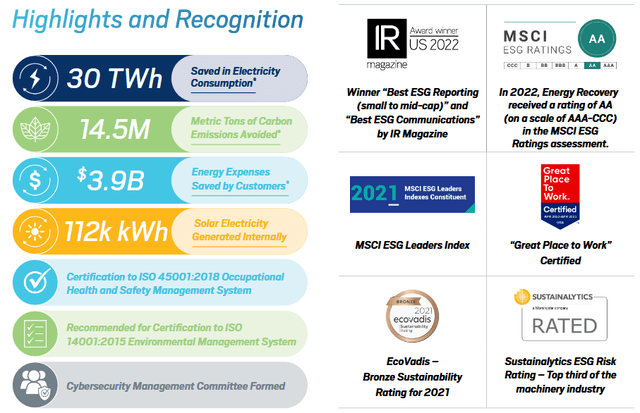

Last month, ERII released its latest ESG report. Highlights included:

- Nearly $4 billion energy costs savings.

- 14.5 million metric tons of emissions avoided annually for its customers.

Energy Recovery has been a very visible and highly rated ESG company for years now:

Going Forward

As I reported in my last article, ERII has switched its diversification focus from Vor-Teq to CO2 refrigeration. Investors should pay close attention to any related management commentary in both the Q4 earnings report and on the accompanying conference call (both are scheduled for November 2nd) as CO2 refrigeration could be a significant growth market for ERII. Indeed, ERII projects that CO2 refrigeration will be a $1 billion annual TAM by 2030 due to many governments adopting regulation to enforce reductions in hydro-fluorocarbon (“HFC”) emissions.

In the meantime, ERII has continued to improve its bread-n-butter PX device offerings with the announcement of the new PX-Q400 a couple weeks ago (see video here):

ERII

The PX Q400 will be Energy Recovery’s highest-performing and highest-capacity PX device for SWRO desalination and industrial wastewater facilities. Key advantages of the PX Q400 include:

- The highest average efficiency rating as compared to other PX products

- At 400 gallons per minute (“GPM”), the Q400 is the highest capacity PX device to date and can result in up to a 25% reduction in the number of required devices as compared to the PX Q300 (depending on the overall size of the SWRO facility)

- The Q400 offers the lowest projected life cycle cost of any ERD for the SWRO desalination market.

In the meantime, investors should keep an eye on gross margin (typically ~65%) in the Q3 report considering the challenging inflationary macro-environment and the fact that ERII has a global business and is therefore subjected to the negative foreign-currency related impact of the strong U.S. dollar.

Summary & Conclusion

ERII is the dominant supplier of ERDs for the global SWRO desalination market. As of the end of Q2, the company had no debt and $86.5 million in cash ($1.53/share). The shares currently trade with TTM P/E of a whopping 111x. However, most of that is due to the fact that the company posted a loss in Q2 primarily due to mega-project timing and a one-time $1.3 million charge related to the cessation of the Vor-Teq commercialization efforts. The mega-project shipments were likely moved into the current quarter, which will also not suffer from Vor-Teq related expenses any more. As a result, I expect ERII to release strong Q3 results. Yet, in my opinion, the most interesting aspect of the upcoming Q3 report is: will ERII report significant progress (i.e. sales) into the wastewater and CO2 refrigeration markets? If so, this stock could be off to the races.

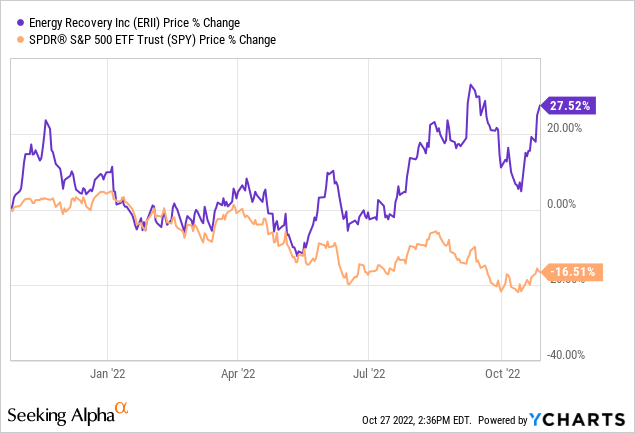

In the meantime, I’ll end with a stock price chart of ERII and note – over the past year – it has outperformed the broad S&P 500 market as represented by the SPY ETF. That is likely due, in part, to the strong order flow Energy Recovery has announced as reported in this article as well as my previous article (which, at the time, summarized year-to-date contract wins):

Be the first to comment