Daniel Balakov

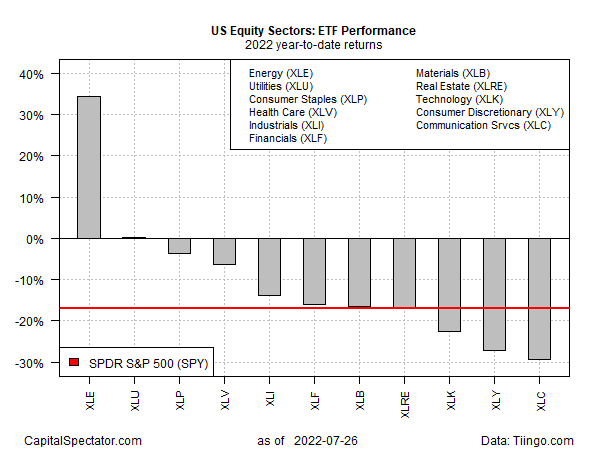

Energy stocks have stumbled in recent weeks, but this sector is showing signs of regaining its mojo. It could be noise or even a last gasp after an extraordinary bull run. But for the moment, shares in this corner remain the clear leader year-to-date, based on a set of sector ETFs through Tuesday’s close (July 26).

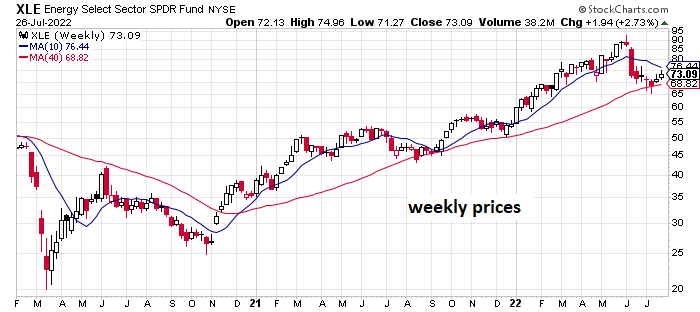

Most of this year’s rally in energy shares was posted during the first five months of the year. At one point in May, Energy Select Sector (XLE) was up more than 65% year-to-date. That surge has been nearly cut in half through yesterday’s close, but even after the haircut XLE remains the upside outlier by a wide margin.

A familiar mix of tight supply relative to demand, exacerbated by the ongoing Ukraine war, is an obvious factor – a factor that appears set to persist on the supply side for the foreseeable future. Russia is one the leading oil exporters and to the extent that those exports are diverted from the West, or reduced outright, it has an effect on global energy prices.

“Escalation [of the war], though incremental and thus far contained in Ukraine, is already underway,” write Samuel Charap (RAND Corp) and Jeremy Shapiro (European Council on Foreign Relations). “The West is providing more and more powerful weapons, and Russia is unleashing more and more death and destruction. For as long as both Russia and the West are determined to prevail over the other in Ukraine and prepared to devote their deep reserves of weapons to achieve that goal, further escalation seems almost preordained.”

The question is how slowing economic growth, and rising risk of recession, will counter supply issues and trim energy’s sails? There are increasing warning signs that a US recession may be lurking in the near future and Europe. Not surprisingly, the IMF advises: “The global economy, still reeling from the pandemic and Russia’s invasion of Ukraine, is facing an increasingly gloomy and uncertain outlook. Many of the downside risks flagged in our April World Economic Outlook have begun to materialize.”

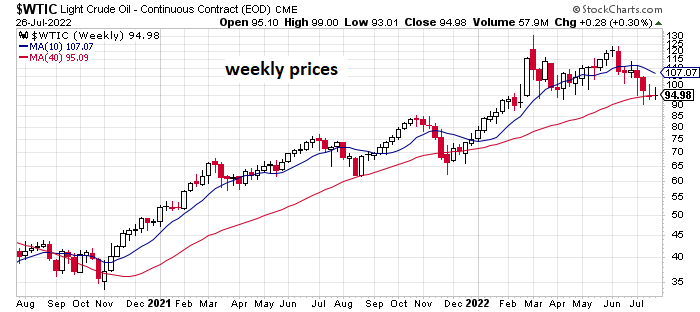

Energy markets have already started pricing in these headwinds. The US benchmark for crude oil, for example, has pulled back sharply in recent weeks and is again trading under $100 a barrel. Further evidence of slower economic growth and/or recession will keep downside pressure on oil and other commodities. Prices for natural gas in Europe are the exception, thanks to supply squeezes on gas flows from Russia related to the war in Ukraine. But outside of Europe, the case for flat or lower energy prices for the near term looks compelling.

Nonetheless, energy stocks still have no performance competition year-to-date. There are hints in recent weeks that some of the defensive sectors – utilities (XLU) and consumer staples (XLP) in particular – are mounting a challenge to energy’s leadership. But so far, those challenges remain thin and energy is still crushing the competition – and the market overall (SPY) – in 2022.

At some point, energy’s bull run, which started in late-2021, will run out of road. But the conditions that will trigger that shift, and when, remain wide open for debate.

An end to the Ukraine war and/or a recovery in economic growth are on the short list of possible factors. Convincing signs that inflation has peaked may be the most important catalyst that could breath new life in non-energy equity sectors. But for the moment, peak inflation is, at best, a speculative forecast.

Meanwhile, the Federal Reserve is set to raise interest rates at tomorrow’s policy meeting to extend its battle to break inflation’s back. In other words, headwinds remain strong for energy stocks and other sectors for the foreseeable future as the central bank promotes demand destruction.

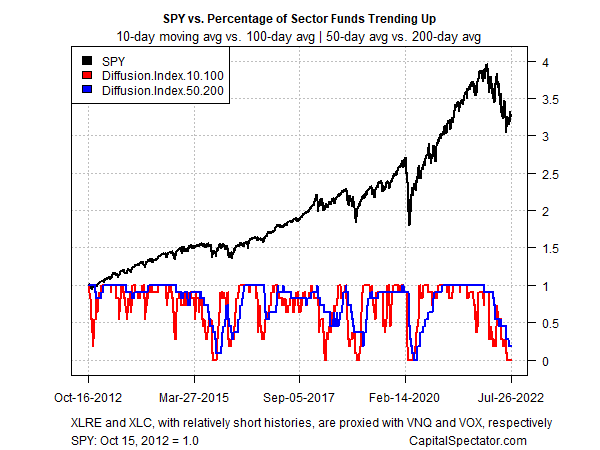

This much is clear: overall sector momentum remains bearish, based on a diffusion index (see below). The point of maximum bearishness on this basis is near. Technically, that implies the odds for a bounce look compelling. But with macro headwinds blowing strong, it’s probably premature to read too much into this technical signal as a contrarian signal in favor of the bulls.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment