fatido/iStock via Getty Images

Energous (NASDAQ:WATT) is seeing some progress in growing its revenues but probably will still end up with 2022 revenues that are below 2017 levels. I am modeling its 2022 revenues at approximately $1 million. It appears to have no sightline into delivering meaningful revenue from product sales, and I am skeptical that it can ever start generating meaningful product sales revenue.

I had previously looked at Energous after it did an equity raise in Q4 2021 and had concluded that it would likely need to do another equity raise by late 2022 to early 2023.

Energous’s cash burn has been reduced a bit (with its Q4 2021 net cash used in operating activities and investing activities adding up to $6.3 million). Thus, with it having $49.1 million in cash on hand at the end of 2021, I now expect its next equity raise to occur around early-to-mid 2023.

Despite the modest reduction in cash burn, there appears to be no end in sight to its need for further equity raises. Thus, I’d value Energous at a discount to its current cash balance.

There is also a risk that Energous will need to do a reverse split with its stock trading at only a bit above $1 per share for much of 2022 so far.

Notes On Revenue

Energous reported $0.225 million in revenue in Q4 2021, up sequentially from $0.201 million in revenue in Q3 2021. This brought its total revenue for 2021 up to $0.757 million.

While Energous is forecasting year-over-year revenue growth for 2022, it was unable to provide clearer guidance about how much revenue growth it expected. Given that lack of guidance, I’d expect Energous’s revenue growth in 2022 to be fairly modest and I am assuming that it will end up around $1 million in revenue for 2022.

|

$ Million |

2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Revenue | $2.50 | $1.45 | $1.15 | $0.52 | $0.20 | $0.33 | $0.76 |

Getting to $1 million in revenue for 2022 would be better than what it did in any year from 2018 to 2021 but would still be below its annual revenues from 2015 to 2017.

Lack Of Consumer Product Sales

Energous’s revenues are currently 100% from product development projects revenues, which it recognizes when various performance obligations are met. It has no history of delivering meaningful revenue from product sales and appears to have no sightline to delivering meaningful revenue from product sales in the future either.

I have kept track of consumer-oriented products such as the American Equus EQx VitalsSensor, which was originally supposed to be available in Q1 2021. The most recent update suggests availability in early 2022 now, although there is no way to actually purchase it yet, just the ability to get on a waiting list. I expect sales to be relatively limited if and when the product actually becomes available.

One positive is that the revamped senior management team appears to be more realistic about future prospects. This compares to a late 2017 interview where the former CEO talked about 2019 being a major break-out year for consumer product revenues. Instead, in 2019, it reported $0.2 million in revenues, its worst results for any year since it went public.

Cash Situation

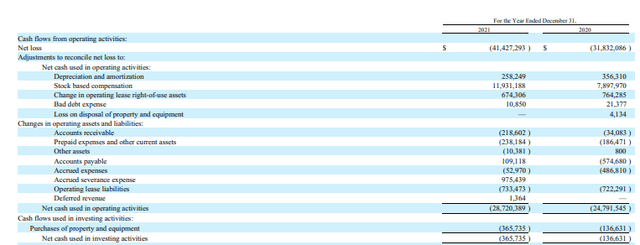

Energous reported $49.1 million in cash on hand at the end of 2021, having raised $27 million in 2021 through an at-the-market equity offering. This should give it enough cash to get through 2022 at least, with its combined net cash used in operating activities and investing activities adding up to approximately $29 million in 2021 and approximately $25 million in 2020.

2020 and 2021 Cash Flows (energous.com)

Energous looks to have trimmed its cash burn rate a bit, so I’d now expect around $25 million in cash burn in 2022. This would put it at around $24 million in cash at the end of 2022.

I’d expect Energous to raise more funds in early-to-mid 2023 since it may raise funds once its cash balance gets down to the $15 million to $20 million level.

Valuation

Due to its inability to generate more than minimal revenues (with 2022 revenues likely coming in lower than 2015 revenues) and continuing cash burn, I’d value Energous at a discount to its current cash balance.

At a valuation of $36 million (which would be Energous’s year-end 2021 cash balance less two quarters of cash burn), it would be worth around $0.47 per share based on 77 million shares outstanding.

For my opinion about Energous to change, it would need to start generating meaningful product revenues. Getting to several million per year in product revenues would still leave it with a large amount ($20+ million) of cash burn per year, but would at least be much more progress than it has made since it was founded in 2012. Energous is also at risk of needing to do a reverse split sometime in the future as its share price has been hovering at a bit above $1 for much of 2022 so far.

Conclusion

Energous’s revamped management team appears to be more realistic about future expectations, with its 2022 revenues expected to be more than 2021 (but no further guidance about how much revenue growth it expects). This contrasts with some of the talk from several years ago where Energous was supposedly on the cusp of greatly ramping up consumer product sales.

I am expecting Energous to generate around $1 million in revenues in 2022, although with no meaningful product sales revenues. It appears to have enough cash on hand to avoid another equity raise until early-to-mid 2023, but its stock is a sell unless it can somehow generate substantial product sales in the future. Energous has appeared to trim its cash burn rate a bit, and I am now expecting around $25 million in cash burn in 2022 compared to my prior expectations of $28 million in cash burn. This reduction is due to cost trimming rather than revenue growth though, and it will need to generate substantial amounts of product sales revenues if it wants to approach positive free cash flow.

Be the first to comment